Schriftsteller:ChaoZhang, Datum: 2024-01-25 15:53:06

Tags:

Tags:

Übersicht

Strategieprinzip

Analyse der Vorteile

- Die Optimierung des RSI-Parameters bestimmt überkaufte und überverkaufte Bereiche genau, um falsche Trades zu vermeiden.

- Heikin-Ashi-Technologie wurde eingeführt, um die Richtungsänderung der Kerzen zu erkennen und genaue Handelssignale zu gewährleisten.

Risikoanalyse

- Ein größeres Risiko, wenn der Markt weiter sinkt.

- Der RSI neigt dazu, falsche Signale zu erzeugen und muss durch andere Indikatoren gefiltert werden.

Optimierung der Strategie

- Passen Sie die RSI-Parameter an, optimieren Sie das Überkauf-Überverkauf-Urteil.

- Anpassen der STO-Parameter, der Schlankheit und der Periode zur Verbesserung der Signalqualität.

- Mehr technische Indikatoren zur Verbesserung der Signalgenauigkeit.

- Optimierung der Stop-Loss-Ratio zur Verringerung des Einzelhandelsrisikos.

Schlussfolgerung

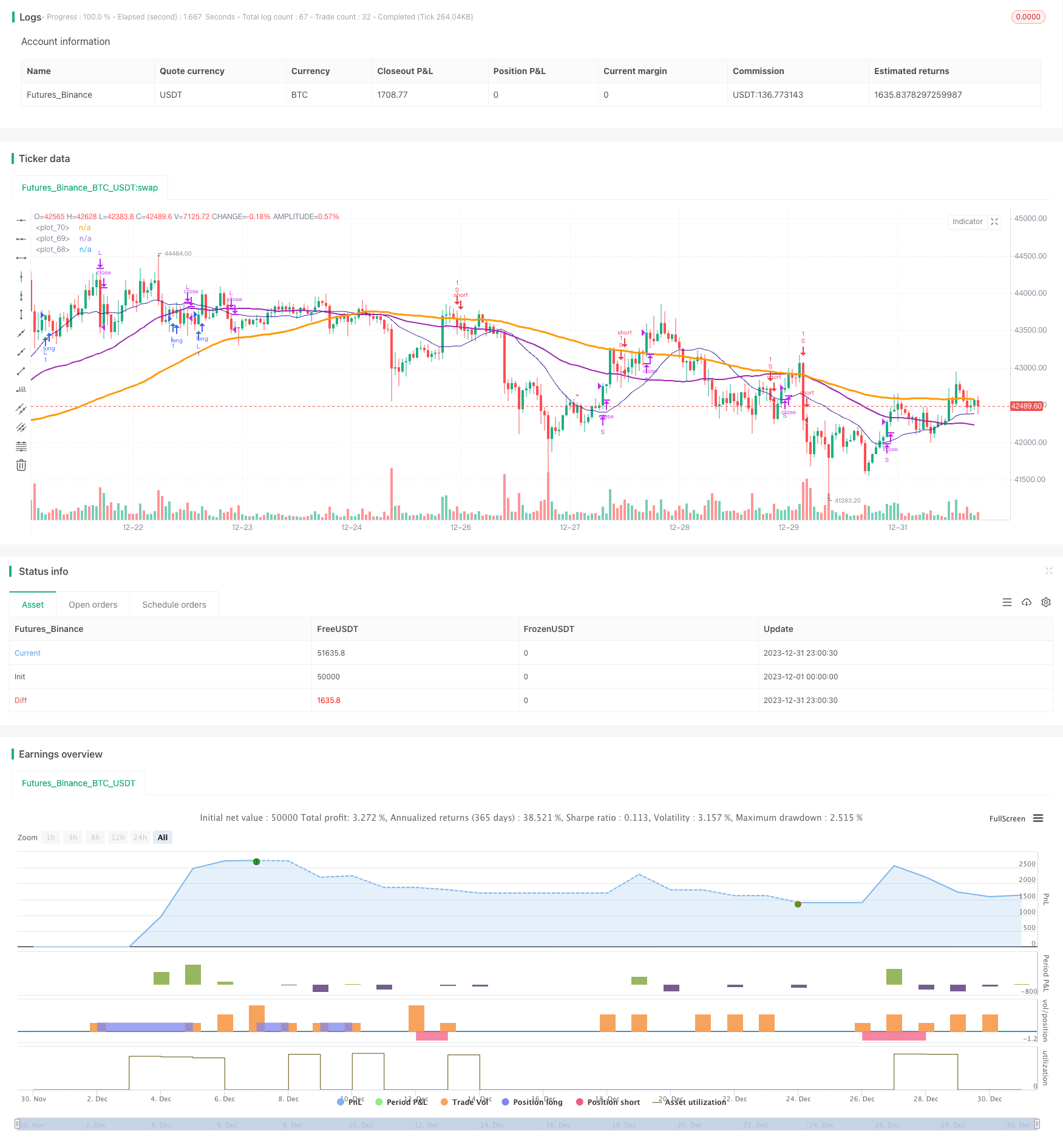

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//study(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true)

strategy(title="@sentenzal strategy", shorttitle="@sentenzal strategy", overlay=true )

smoothK = input(3, minval=1)

smoothD = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

overbought = input(80, minval=1)

oversold = input(20, minval=1)

smaLengh = input(100, minval=1)

smaLengh2 = input(50, minval=1)

smaLengh3 = input(20, minval=1)

src = input(close, title="RSI Source")

testStartYear = input(2017, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testPeriod() =>

time >= testPeriodStart ? true : false

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

crossBuy = crossover(k, d) and k < oversold

crossSell = crossunder(k, d) and k > overbought

dcLower = lowest(low, 10)

dcUpper = highest(high, 10)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashiPositive = heikinashi_close >= heikinashi_open

heikinashiBuy = heikinashiPositive == true and heikinashiPositive[1] == false and heikinashiPositive[2] == false

heikinashiSell = heikinashiPositive == false and heikinashiPositive[1] == true and heikinashiPositive[2] == true

//plotshape(heikinashiBuy, style=shape.arrowup, color=green, location=location.belowbar, size=size.tiny)

//plotshape(heikinashiSell, style=shape.arrowdown, color=red, location=location.abovebar, size=size.tiny)

buy = (crossBuy == true or crossBuy[1] == true or crossBuy[2] == true) and (heikinashiBuy == true or heikinashiBuy[1] == true or heikinashiBuy[2] == true)

sell = (crossSell == true or crossSell[1] == true or crossSell[2] == true) and (heikinashiSell == true or heikinashiSell[1] == true or heikinashiSell[2] == true)

mult = timeframe.period == '15' ? 4 : 1

mult2 = timeframe.period == '240' ? 0.25 : mult

movingAverage = sma(close, round(smaLengh))

movingAverage2 = sma(close, round(smaLengh2))

movingAverage3 = sma(close, round(smaLengh3))

uptrend = movingAverage < movingAverage2 and movingAverage2 < movingAverage3 and close > movingAverage

downtrend = movingAverage > movingAverage2 and movingAverage2 > movingAverage3 and close < movingAverage

signalBuy = (buy[1] == false and buy[2] == false and buy == true) and uptrend

signalSell = (sell[1] == false and sell[2] == false and sell == true) and downtrend

takeProfitSell = (buy[1] == false and buy[2] == false and buy == true) and uptrend == false

takeProfitBuy = (sell[1] == false and sell[2] == false and sell == true) and uptrend

plotshape(signalBuy, style=shape.triangleup, color=green, location=location.belowbar, size=size.tiny)

plotshape(signalSell, style=shape.triangledown, color=red, location=location.abovebar, size=size.tiny)

plot(movingAverage, linewidth=3, color=orange, transp=0)

plot(movingAverage2, linewidth=2, color=purple, transp=0)

plot(movingAverage3, linewidth=1, color=navy, transp=0)

alertcondition(signalBuy, title='Signal Buy', message='Signal Buy')

alertcondition(signalSell, title='Signal Sell', message='Signal Sell')

strategy.close("L", when=dcLower[1] > low)

strategy.close("S", when=dcUpper[1] < high)

strategy.entry("L", strategy.long, 1, when = signalBuy and testPeriod() and uptrend)

strategy.entry("S", strategy.short, 1, when = signalSell and testPeriod() and uptrend ==false)

//strategy.exit("Exit Long", from_entry = "L", loss = 25000000, profit=25000000)

//strategy.exit("Exit Short", from_entry = "S", loss = 25000000, profit=25000000)

Mehr

- Strategie für die Dynamikentwicklung

- Momentum Moving Average Crossover Quant Strategie

- Kombinationsstrategie der doppelten Umkehrung des gleitenden Durchschnitts und des ATR Trailing Stop

- Handelsstrategie mit Leveraged Martingale-Futures

- Momentum Pullback-Strategie

- Zweikandelsvorhersage Schließstrategie

- Stochastic Supertrend Tracking Stop Loss Handelsstrategie

- Trend der doppelten Umkehrung des Schwingungsbandes nach Strategie

- Trend-Nachfolge-Strategie auf Basis von DMI und RSI

- Trendfolgende Strategie mit 3 EMA, DMI und MACD

- Durchbruchsstrategie für Doppelindikatoren

- Pete Wave Handelssystem Strategie

- Quantitative Strategie auf der Grundlage eines exponentiellen gleitenden Durchschnitts und einer Volumengewichtung

- Origix Ashi-Strategie auf Basis eines glätteten gleitenden Durchschnitts

- BlackBit Trader XO Makrotrendenscanner-Strategie

- ADX-Trend für Rohöl nach Strategie

- MT-Koordinierungshandelsstrategie

- Kombinationsstrategie der Umkehrung der doppelten Faktoren und Verbesserung der Preisvolumenentwicklung

- Trendwinkel bewegliche Durchschnitts-Kreuzung