概述

该策略的主要思想是利用平滑移动平均线来计算平滑的启明均线,以发现价格趋势,并在价格与平滑启明均线发生金叉时做多,死叉时做空。

策略原理

该策略首先定义了一个计算平滑移动平均线的函数smoothedMovingAvg,该函数采用之前周期的移动平均线值和最新价,按一定权重计算出当前周期的平滑移动平均线。

然后定义了一个函数getHAClose,用于根据开盘价、最高价、最低价和收盘价计算出启明均线的收盘价。

在主策略逻辑中,首先获取不同周期的原始价格,然后利用smoothedMovingAvg函数计算出平滑移动平均线,再通过getHAClose函数计算出平滑启明收盘价。

最后,当价格上穿平滑启明收盘价时做多,下穿时平仓;当价格下穿平滑启明收盘价时做空,上穿时平仓。

优势分析

该策略最大的优势在于利用平滑移动平均线计算平滑启明均线,能更准确判断价格趋势,过滤掉部分噪音,避免在震荡中产生错误信号。此外,启明均线本身就具有突显趋势的优点,与价格结合使用,可以进一步提高判断准确率。

风险分析

该策略主要面临如下风险: 1. 平滑参数设置不当,可能导致策略错过价格反转机会或产生错误信号。需要通过反复回测和优化找到最佳参数。 2. 价格剧烈震荡时,平滑均线可能延迟跟随价格变化,从而导致止损或错过反转机会。此时需要降低仓位规避风险。

针对上述风险,我们可以通过调整平滑参数、引入止损机制、降低单笔交易仓位等方法来降低风险和提高策略稳定性。

优化方向

该策略还可以从以下几个方面进行优化: 1. 增加自适应平滑参数,当市场波动加剧时自动调整参数。 2. 结合其他指标作为过滤器,避免在价格震荡时发出错误信号。例如MACD,KD等。 3. 增加止损机制,以控制单笔亏损。可以设定百分比止损或振荡止损。 4. 对交易品种、时间段等进行优化,专攻最具优势的品种和交易段。

通过以上几点优化,可以进一步减少策略的曲线拟合风险,提高策略的适应性和稳定性。

总结

该策略整体思路清晰易懂,通过计算平滑启明均线判断价格趋势,并据此进行长短做法。最大优势在于可以过滤部分噪音,提高信号判断的准确度。但也存在一定的参数优化难度和可能错过快速反转的风险。通过引入自适应机制、拓宽指标组合等手段还可进一步优化,值得深入研究。

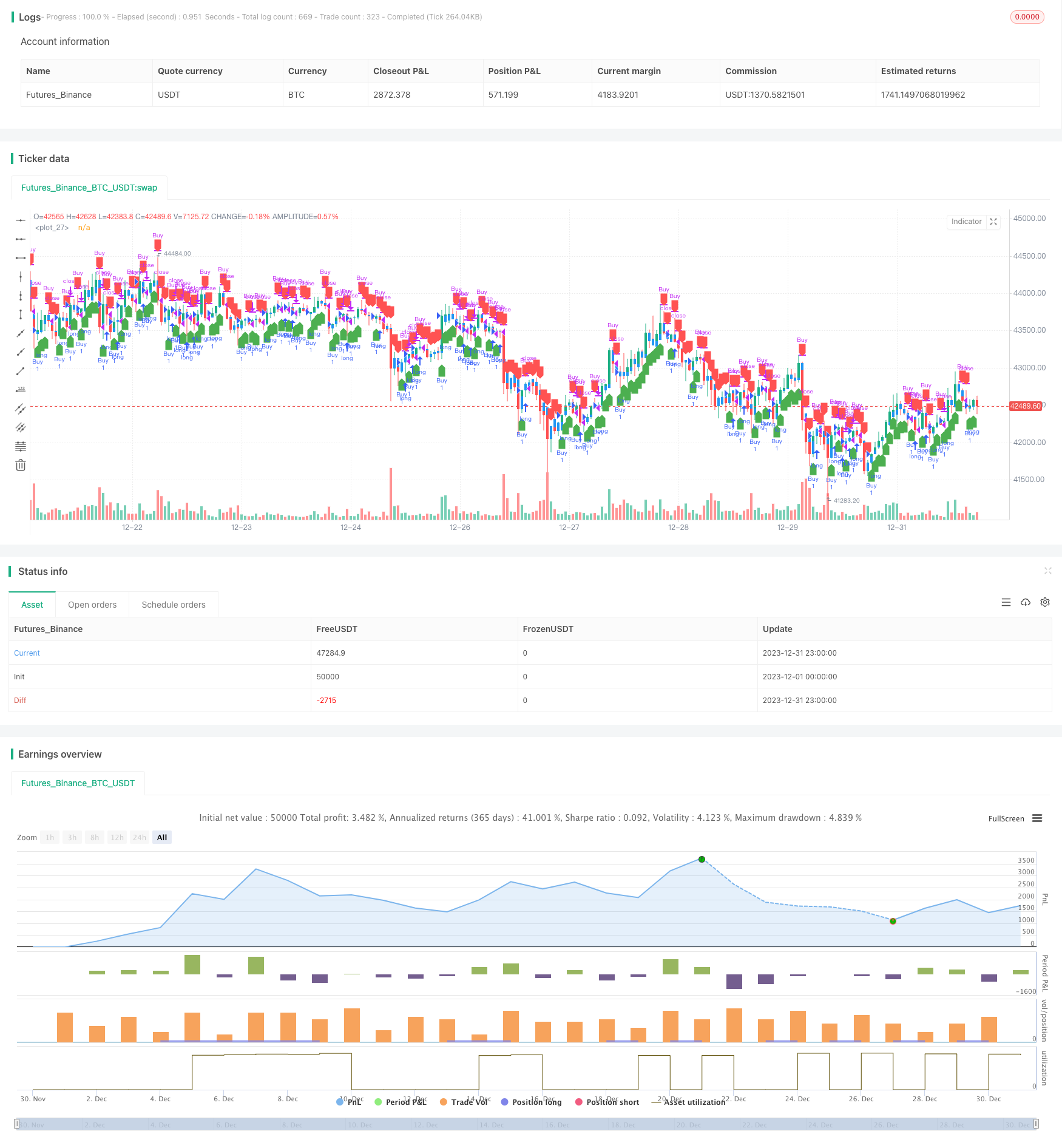

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Smoothed Heiken Ashi Strategy", overlay=true)

// Inputs

g_TimeframeSettings = 'Display & Timeframe Settings'

time_frame = input.timeframe(title='Timeframe for HA candle calculation', defval='', group=g_TimeframeSettings)

g_SmoothedHASettings = 'Smoothed HA Settings'

smoothedHALength = input.int(title='HA Price Input Smoothing Length', minval=1, maxval=500, step=1, defval=10, group=g_SmoothedHASettings)

// Define a function for calculating the smoothed moving average

smoothedMovingAvg(src, len) =>

smma = 0.0

smma := na(smma[1]) ? ta.sma(src, len) : (smma[1] * (len - 1) + src) / len

smma

// Function to get Heiken Ashi close

getHAClose(o, h, l, c) =>

((o + h + l + c) / 4)

// Calculate smoothed HA candles

smoothedHAOpen = request.security(syminfo.tickerid, time_frame, open)

smoothedMA1close = smoothedMovingAvg(request.security(syminfo.tickerid, time_frame, close), smoothedHALength)

smoothedHAClose = getHAClose(smoothedHAOpen, smoothedHAOpen, smoothedHAOpen, smoothedMA1close)

// Plot Smoothed Heiken Ashi candles

plotcandle(open=smoothedHAOpen, high=smoothedHAOpen, low=smoothedHAOpen, close=smoothedHAClose, color=color.new(color.blue, 0), wickcolor=color.new(color.blue, 0))

// Strategy logic

longCondition = close > smoothedHAClose

shortCondition = close < smoothedHAClose

strategy.entry("Buy", strategy.long, when=longCondition)

strategy.close("Buy", when=shortCondition)

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.labelup, location=location.belowbar)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.labeldown, location=location.abovebar)- 双K线预测闭合策略

- 基于CMO和WMA的双均线交易策略

- Stochastic Supertrend跟踪止损交易策略

- 双重反转震荡带趋势跟踪策略

- 基于DMI和RSI的趋势跟随策略

- 支撑阻力震荡交易策略

- 三EMA配合DMI和MACD的趋势跟踪策略

- 基于双重指标突破策略

- 皮特波浪交易系统策略

- 基于指数移动平均和成交量加权的多因子量化策略

- 双移动平均线与StochRSI交叉的趋势追踪策略

- 基于ADX指标的原油趋势跟踪策略

- 多时间轴协同交易策略

- 双因子反转与改良价格量趋势组合策略

- 趋势角度均线交叉策略

- 基于MACD指标的Histogram进行交易决策策略

- 动量张弛指标与123形态策略

- Fisher变换指标回测策略

- 震荡型广谱移动平均线交易策略

- 基于移动平均线跨度的反转交易策略