Mehrere Indikatoren folgen der Strategie

Schriftsteller:ChaoZhangTags:

Übersicht

Strategie Logik

Die Strategie besteht aus zwei Teilen:

- 123 Umkehrindikator

- Qstick-Anzeiger

Dieser Indikator beurteilt die Stärke von Bullen und Bären, indem er den einfachen gleitenden Durchschnitt der Differenz zwischen dem Eröffnungs- und dem Schlusskurs berechnet.

Wenn der Qstick über die Nulllinie geht, zeigt er eine zunehmende Aufwärtsdynamik an und erzeugt ein Kaufsignal.

Die Multiple Indicators Follow-Strategie berücksichtigt dann umfassend die Handelssignale sowohl des 123 Reversal-Indikators als auch des Qstick-Indikators.

Analyse der Vorteile

Die Multiple Indicators Follow-Strategie kombiniert die Signale von zwei verschiedenen Arten von Indikatoren, was die Genauigkeit der Handelssignale verbessern kann.

Risiken und Lösungen

Kann eine Mindesthaltedauer festlegen, um häufige Stornierungen und Bestellungen zu vermeiden.

Optimierungsrichtlinien

-

Prüfung von Konfigurationen des Stochastischen Oszillators mit unterschiedlichen Parametern

-

Hinzufügen einer Stop-Loss-Strategie

Schlussfolgerung

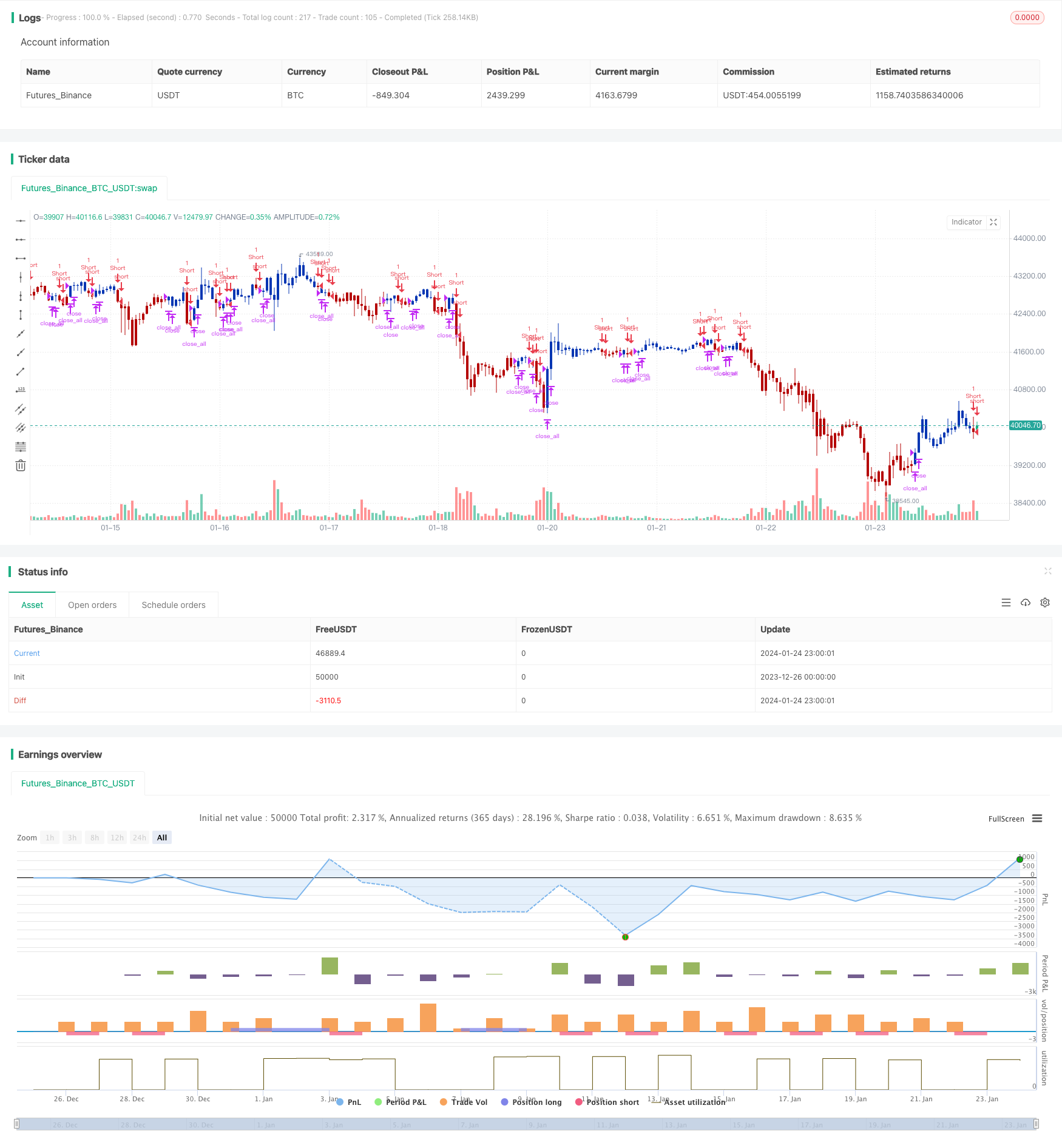

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 24/05/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// A technical indicator developed by Tushar Chande to numerically identify

// trends in candlestick charting. It is calculated by taking an 'n' period

// moving average of the difference between the open and closing prices. A

// Qstick value greater than zero means that the majority of the last 'n' days

// have been up, indicating that buying pressure has been increasing.

// Transaction signals come from when the Qstick indicator crosses through the

// zero line. Crossing above zero is used as the entry signal because it is indicating

// that buying pressure is increasing, while sell signals come from the indicator

// crossing down through zero. In addition, an 'n' period moving average of the Qstick

// values can be drawn to act as a signal line. Transaction signals are then generated

// when the Qstick value crosses through the trigger line.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Qstick(Length) =>

pos = 0.0

xR = close - open

xQstick = sma(xR, Length)

pos:= iff(xQstick > 0, 1,

iff(xQstick < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Qstick Indicator", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Qstick Indicator ----")

LengthQ = input(14, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posQstick = Qstick(LengthQ)

pos = iff(posReversal123 == 1 and posQstick == 1 , 1,

iff(posReversal123 == -1 and posQstick == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Mengenmäßige Handelsstrategie mit mehreren Indikatoren

- Market Cypher Welle B Automatische Handelsstrategie

- Wichtige Strategie zur Umkehrung von Backtests

- Die drei EMA Stochastic RSI Crossover Golden Cross-Strategie

- Strategie zur Umkehrung der Backtesting-Strategie

- Die RSI-Strategie wird von Ehlers-Smoothed angewendet.

- Swing-High-Low-Price-Channel-Strategie V.1

- Handelsstrategie zur Umkehrung der Dynamik

- Adaptive lineare Regressionskanalstrategie

- Strategie der gleitenden Durchschnittsdifferenz mit null Kreuz

- Solider Trend nach Strategie

- Preisüberschreitung des gleitenden Durchschnitts nach Strategie

- Zweifelhafte EMA-Golden Cross-Ausbruchstrategie

- Graduelle BB KC-Trendstrategie

- Dreifache SMA-Auto-Tracking-Strategie

- Strategie für den Handel mit Bitcoin-Futures

- Preis-EMA mit stochastischer Optimierung basierend auf maschinellem Lernen

- Dynamische Bollinger-Breakout-Strategie

- Zweijährige Strategie für einen neuen Höchstwert der rückläufigen Moving Average

- Handelsstrategie mit doppelten gleitenden Durchschnitten