How to profit from Bitcoin overnight trading?

Author: FMZ~Lydia, Created: 2024-11-19 14:07:22, Updated: 2024-11-19 14:08:51As interest in cryptocurrencies continues to skyrocket, fueled by each price rise, crypto assets have consolidated their position as one of the major asset classes in the global market. Unlike traditional assets that trade mainly during standard business hours, cryptocurrencies trade 24/7 and exhibit unique liquidity and volatility. This ongoing trading environment has led us to study the performance of the flagship cryptocurrency Bitcoin during daytime and overnight periods. As Bitcoin is increasingly traded through ETFs and other investment instruments by retail and institutional investors, we assume that these different time frames of trading activity may exhibit a pattern similar to that of traditional markets, in which returns are often affected by non-peak-hour dynamic fluctuations.

The Preface

The main objectives of this study are:

- Analyze daytime and overnight trading hours in the cryptocurrency space;

- To investigate whether, and to what extent, there is an overall overnight effect on the main uncrowned flagship asset Bitcoin (BTC);

- Analyze whether there is a potential for a crypto-currency (Bitcoin) to have a bullish weekend or bullish weekend effect.

- Using all of the above, build a seasonal strategy to capitalize on the seasonal effects of the BTC market.

The background

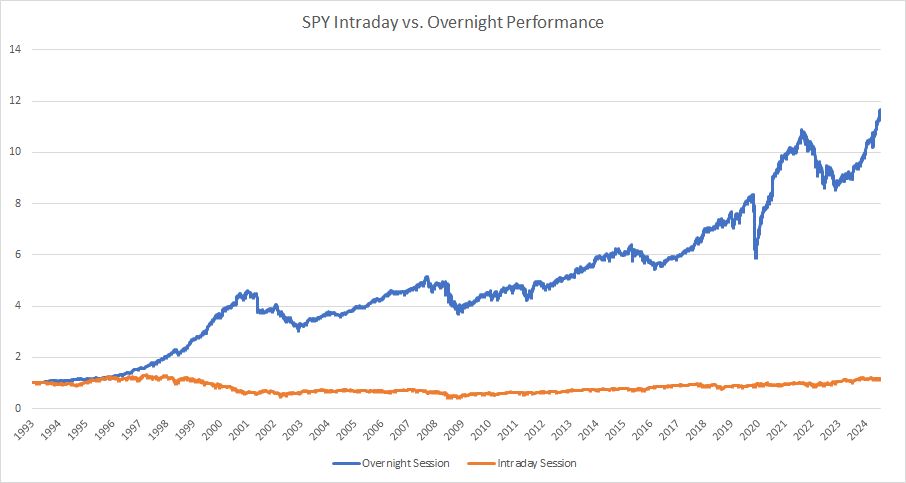

I'm referring to our previous post.Lunch effects of the S&P 500 and other major U.S. stock indexesIn the research chart, we observed that most SPY and QT index performance occurred mainly during night trading hours:

Source: Calculation by Quantpedia

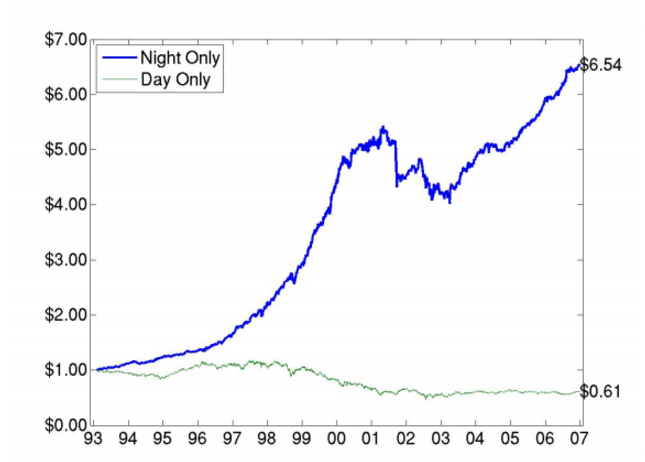

For ease of understanding, here is a short sample from a research paper published in 2008 (as we can see, not much has changed in the last 16 years):

Figure 1 The growth of overnight earnings (closing to opening price, rough blue line) and intraday earnings (closing to closing price, light green line) on a $1 investment in a Standard 500 Spider (SPY) exchange-traded fund from 1993 to 2006.

Cliff, Cooper, Gulen, and others have been asked to share their views.Abnormalities during the night: Difference in earnings between trading and non-trading hours: night and day.

Therefore, our aim is to understand the impact of day and night trading on Bitcoin's performance, especially in the context of the introduction of Bitcoin ETFs. This suggests a possible shift from day-to-day trading to a more structured trading environment similar to traditional exchanges (e.g. NYSE, NASDAQ, ASX, ARCA, etc.).

The motivation

We believe that as inflows and outflows of ETFs traded in these traditional financial domains are highly correlated with the trading hours of the exchanges, changes in Bitcoin trading are increasingly correlated with changes in traditional assets such as stocks and bonds.

Institutional traders typically open ("build") or close positions primarily at the opening and closing times of the main trading hours, when they have sufficient liquidity to satisfy their orders (not counting wholesale trading in intraday blinds or TWAP orders); thus, the first minute of trading and the last minute of trading in the daily trading hours are volatile and volatile in minute units (which intraday traders pursue, while ordinary investors do not); plus the interest traders need, the cumulative inventory on their accounts that they may clear, and the option trading for hedging capital flows. This is the best time for conflicts of interest, which often support the consensus view that price discovery and price pushing into the market often forms the trend of the remaining trading time of the day.

These things are largely unknown to Bitcoin, as it trades in many decentralized venues (cash or futures) that only allow immediate price arbitrage between them when liquidity constraints are favorable.

Bitcoin trades continuously, and is often the first high-risk asset to be liquidated when traditional financial exchanges close, due to expected upcoming volatility, such as geopolitical tensions or other unspecified extremes and unpredictable events. BeInCrypto revealed in late October that since Bitcoin has been recognized and approved by Wall Street and accepted by the ETF as a legal asset class, the SEC has also taken some small steps (such as approving the option trading of the above-mentioned ETF) to ease regulation.So, has Bitcoin's unique characteristic of distributing earnings at trading time been distorted, shifted, reversed, and is it now more like a proven asset like ETFs and stocks?

Methodology and approaches

The data

Our analysis is based onGemini DataThe page contains hourly BTC data from 2015-10-08 to 2024-10-15. We define the daily trading period as the performance between 10 a.m. and 4 p.m. eastern standard time on the opening day of the New York Stock Exchange. All hours outside this interval are defined as midnight.

We assume that the futures on the ETF BITO's token will be able to accurately track and predict the impact of the cryptocurrency hedge fund's make-up from the date of its inception on October 18, 2021. Therefore, for simplicity, we have divided the sample into a sample period (before October 2021, during which time the simple ETF trading instrument is not available for BTC trading) and a sample period (after October 2021).

We know that our definition of in-sample and out-sample cycles is very arbitrary. We cannot define Bitcoin (and other cryptocurrencies) as a traditional asset and no longer be considered as a foreign investment. The boundary between traditional and alternative assets is blurred. What we want to show is that over time, the behavior of Bitcoin changes during overnight and daytime trading hours.

Initial research

After collecting all the necessary data, we started processing the data and conducting preliminary investigations.

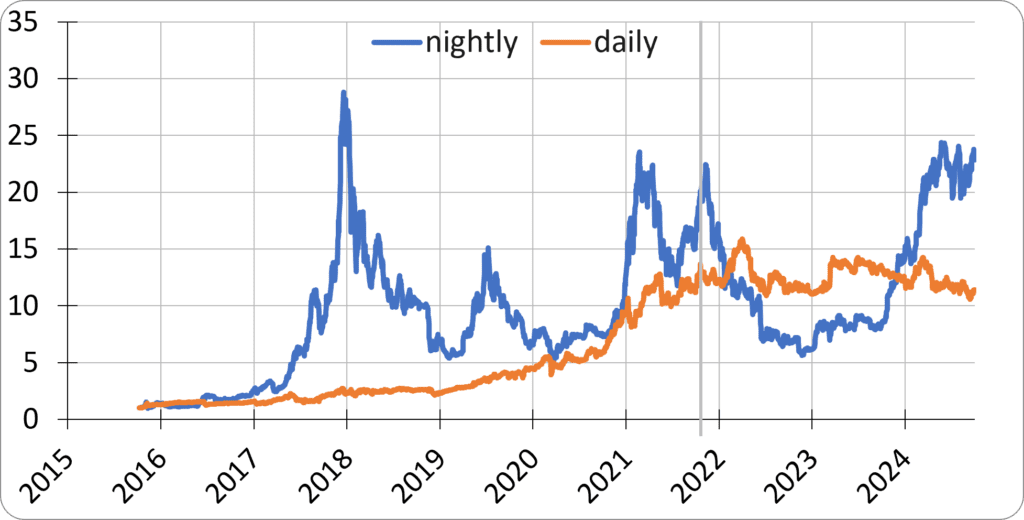

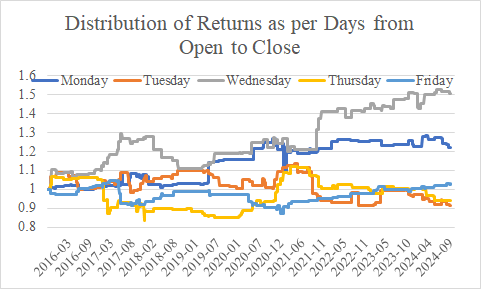

The following graph analysis illustrates the change in earnings over time between daytime and overnight trading hours:

We highlighted the milestones we are interested in and marked the launch of the first BTC ETF in the graph with a grey bold line.

As an overview, we found two key observations:

- A large part of BTC's strong movement (including uptrends and downtrends) tends to occur during night trading hours.

- The daily trading hours performed well before 2021, but have been stagnant for the past three years.

“ The Night After EffectsCurrency theory holds that most of the performance of risky assets such as stocks is achieved at night (i.e. from close to open; night currencies) to compensate for the associated risk. This period is usually not able to handle a large number of transactions, so when the asset is held overnight, it will compensate for its under-liquidity (or low liquidity) with a higher performance.

Our constructed Open and Closing Performance Chart confirms the theoretical hypothesis outlined above. Initially (until around 2021), BTC performed very positively during daytime trading hours, allowing BTC holders to increase assets with low risk (volatility and retracement). It performed better during night trading hours, but the risk (volatility and retracement) was also higher. As Bitcoin gradually became an asset class similar to other major asset classes, day trading earnings decreased, and most BTC earnings since 2021 were realized during night trading periods. This is exactly the same pattern as stocks or stock indices!

Deconstructing the structure of Bitcoin's daily earnings

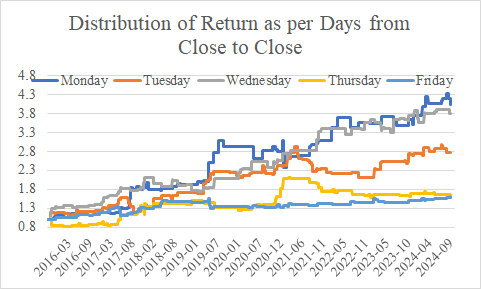

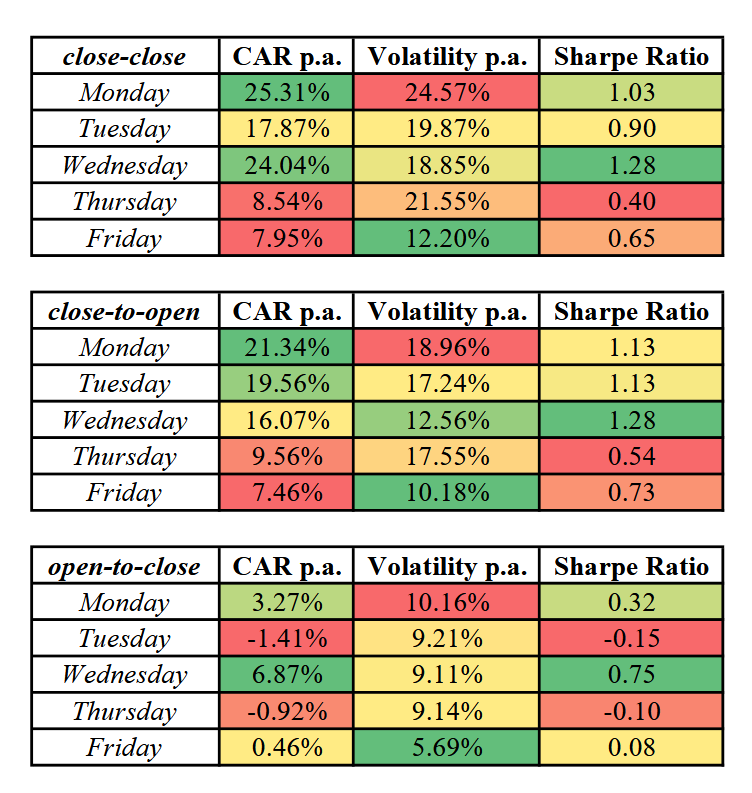

Let's continue to break down Bitcoin's performance by individual trading day (Monday, Tuesday, etc.) and analyze closing to opening, opening to closing, and closing to closing time. By our definition, Monday night's performance includes the time from Friday night's closing to Monday morning (traditional finance, whether it's securities or forex, exchanges are closed for the entire weekend). Tuesday night's performance includes the time from Monday night's closing (at 4pm EST) to Tuesday morning's opening (at 10am EST).

The results are presented in tabular and graphical formats, and the conclusion is that the main (maximum contribution) performance occurred during the closing trading hours of Monday, Tuesday and Wednesday.This performance is mainly driven by the night trading hours.So, Bitcoin is mainly used for this purpose.Between Friday closing and Monday opening (weekends), between Monday closing and Tuesday opening and between Tuesday closing and Wednesday openingThe price of Bitcoin has been falling since Friday, and it seems that the price of Bitcoin has been falling since Friday (both during the day and overnight).Bitcoin gains seem to be real in the weekend effects of the bubbleThe closure of traditional financial exchanges (such as the New York Stock Exchange) on Saturdays and Sundays will have a significant impact.

Trading strategies

Well, we know that BTC is sensitive to overnight/daytime price fluctuations, and also sensitive to weekend effects. The question now is, what can we do?

Replicating previous research methods

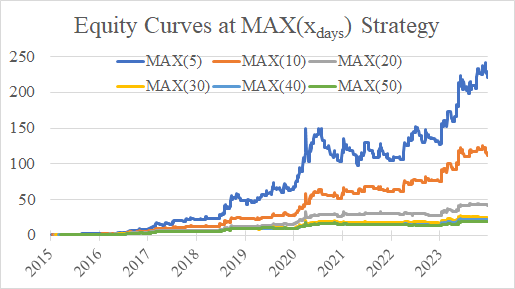

First, we used the old trend-tracking study and replicated the MAX strategy with 5, 10, and 50-day high parameters.

Rethinking Bitcoin's trend tracking and mean return strategy Major changes in the financial landscape over the past few years have reshaped the dynamics of global markets (including in the cryptocurrency space); the ongoing war in Ukraine, rising inflation, the soft landing of the US economy, and the recent halving of Bitcoin have all had profound effects on market sentiment and price trends. In light of these developments, we decided to re-examine and re-evaluate our trading strategies, in particular the trend tracking and even returns of Bitcoin released in 2022, which uses data from November 2015 to February 2022. This new study explores the performance of these strategies between November 2015 and August 2024, and takes into account recent changes.

Our study of trend tracking and mean value regression was retested on a daily column graph, with a time frame of 0.00 GMT, using the time scale of 0.00 GMT and 0.00 GMT.24⁄7The trading calendar (trades can be executed on Saturdays, Sundays and public holidays); therefore, our first step was to check how the trend-tracking strategy for buying into new local highs (5, 10, 20, 30, 40, or 50 days) would perform if we restricted trading decisions and could only trade in the ETF market at the close of trading on the NYSE opening day at 4 pm. We used Gemini Data and the NYSE calendar to create this data series and tested our strategies on it. Starting in 2021, MAX, this simple strategy adds cryptocurrencies, contracts, spread contracts or ETFs at the close of trading on the NYSE to make purchases in the form of ETFs, which are held on an easier trading day than when the ETF is at the high of trading on the X day. However, we did not actually study any ETFs before the ETF closed, but we were able to introduce this strategy to the ETF.

Here is a comprehensive chart showing the sum of all the versions from the closing to the closing of the trading cycle, as well as a detailed table:

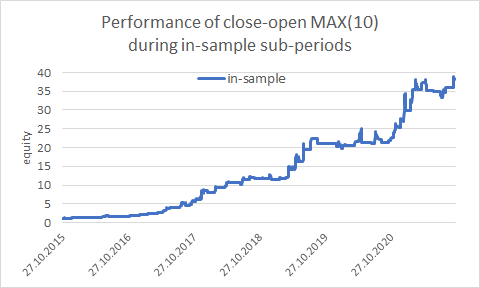

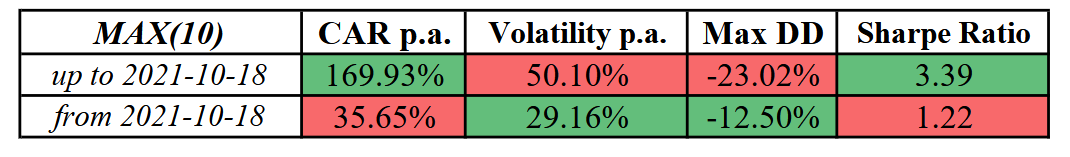

In order to be consistent with our previous publication, we ended up using the 10-day version, although it is not the best-performing version. For the purposes of this study, this version requires the provision of end-to-end and end-to-end performance charts, tables, and appropriate summaries, as described above:

We can see that the Bitcoin MAX strategy performs better in the first sub-cycle before the ETF is first introduced. The strategy still performs well above 35% during the off-sample period, with a minimum maximum drawdown of 12% (and significantly better than the benchmark Bitcoin market after risk adjustment), but as Bitcoin has become a widely accepted asset class, the simple trend-tracking strategy of buying new local highs no longer offers the same returns as before. What can we do?High-yield bond market reversed overnightThe technique is the same.

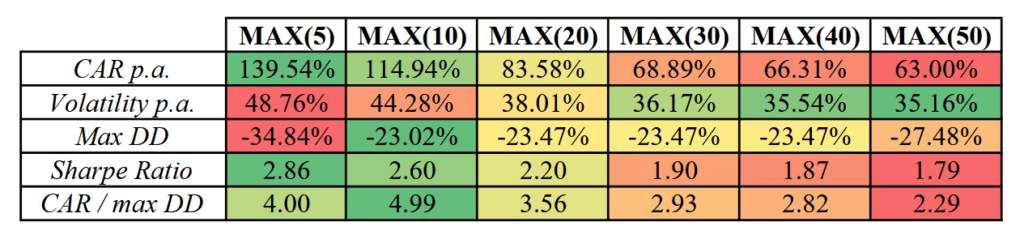

MAX ((10) policy performance during the subperiod

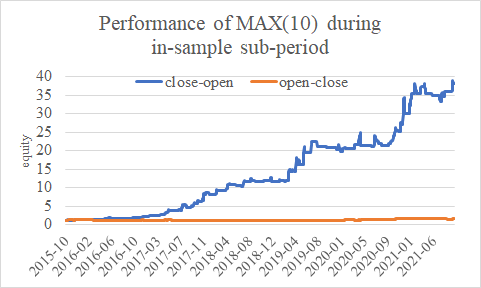

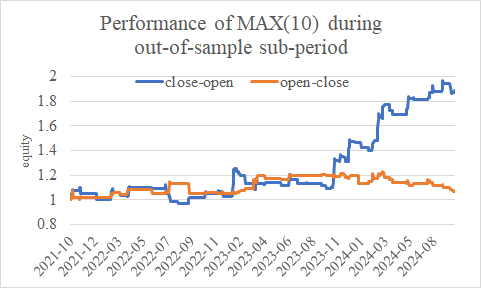

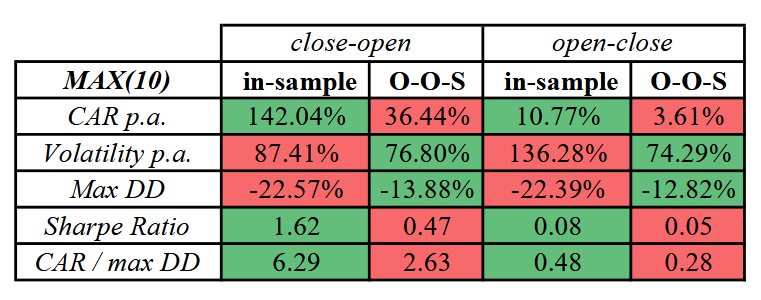

First, we can try to study the 10-day MAX strategy in the closing price-opening price and opening price-closing price sub-cycles ((just a reminder, in-sample as of October 2021, out-sample as of October 2021):

This section shows that most of the gains from the historical MAX (10) strategy (both in-sample and out-of-sample gains) were generated during the overnight trading period (from close to open).

Proposed final trade strategy

Well, our analysis is nearing completion. We learned that Bitcoin is sensitive to daytime and overnight splits, weekdays (or weekends), and that it is strongly trendy (once it reaches a local high, it usually continues to trend positively, eventually reaching higher prices). So we came up with a comprehensive MAX (10) strategy that operates only during Friday-Sunday nights, Monday-Tuesday nights, or Tuesday-Wednesday nights trading periods.

The ultimate rights and benefits curve

The ultimate rights and benefits curve

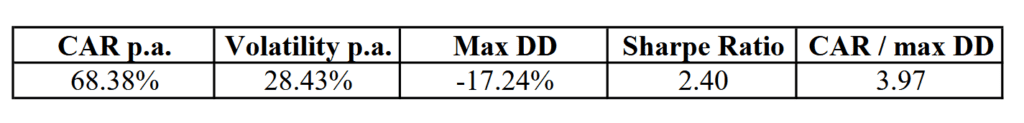

The whole sample

The whole sample

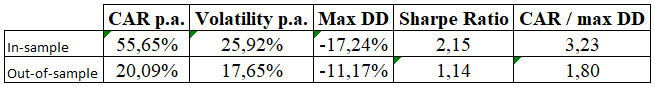

In and out of the sample

In and out of the sample

We have a great example of a combination of weekend and midnight effects, where if you are at the local 10-day maximum line, you can do more at the close of Friday, holding BTC until Monday morning (opening), and if Bitcoin remains at the local 10-day maximum line, you can do more again at the close of Monday and/or Tuesday. This strategy provides a strong attractive Sharpe ratio and low risk, and shows that Bitcoin is still a young asset, and its inefficiency problems are more serious compared to the traditional mature asset classes and their components in general.

Conclusions

Based on our analysis, a simple strategy focused on overnight trading hours provides substantial insights into the dynamics of Bitcoin's performance. The strategy operates only during Friday-Monday, Monday-Tuesday, and Tuesday-Wednesday night trading hours, suggesting that a large portion of Bitcoin's earnings are realized between overnight hours. This pattern is consistent with traditional asset classes, where overnight risk premia are recognized, suggesting that as Bitcoin becomes more integrated into traditional financial markets, its earnings distribution is similar to that of mature assets.

The results of this strategy show that despite Bitcoin's unique characteristics and all-weather trading environment, it behaves similarly to other financial instruments when constrained by institutional trading patterns. This suggests that the behavior of the Bitcoin market is gradually aligning with traditional market behavior, possibly due to the increasing involvement of institutional investors and the introduction of the Bitcoin ETF. These results highlight the importance of considering trading time dynamics when developing trading strategies and risk management frameworks for Bitcoin and other cryptocurrencies.

In summary, our research demonstrates once again that the overnight effect greatly drives Bitcoin's performance. The success of this strategy highlights the value of focusing on specific trading hours to optimize returns and manage risk effectively. As Bitcoin continues to gain legitimacy and integrate into the traditional financial system, ongoing research is critical to adjusting trading strategies and capitalizing on emerging trends to ensure investors stay ahead in this ever-changing market.

The original link:https://quantpedia.com/how-to-profitably-trade-bitcoins-overnight-sessions/?a=6080

- Pine language, retrieve selected disk data, return error after ordering

- When will the API for the Bitcoin Unified Securities Model be available?

- When retesting, the data selects a real disk-level error 5416072

- Is this error occurring when the minimum transaction volume is set to 0.01?

- Please teach me the problem of reporting the error in the Bitcoin balance sheet.

- Please teach me JS code problems.

- Metcalfe's law in Bitcoin

- Rethinking Bitcoin's trend tracking and mean return strategy

- How many bitcoins should we allocate to the portfolio?

- Why is the page always crashing?

- Building and implementing portfolio optimization using trading volume

- How do you update the parameters of a running disk?

- AI case studies: the strategy of multiple heads

- Strategy coding, professional quantification, former central company programmer, professional reliability.

- Simple versus advanced trading strategies - which is better?

- Python library for quantifying transactions

- Ornstein-Uhlenbeck simulation with Python

- Learn the PINE code, please ask what is the problem with the stop loss setting? Stop loss is not executed when retested, stop loss is executed when played, but subsequently does not open a straightforward, uninterrupted position according to the conditions.

- pine multi-cycle