Take out slow movers of high frequency trading strategy

Author: Zero, Created: 2015-06-07 07:53:19, Updated: 2015-06-09 11:24:21If there is more than one market maker in a market, some market makers' information devices/software/algorithms will be faster, while others will be slower.

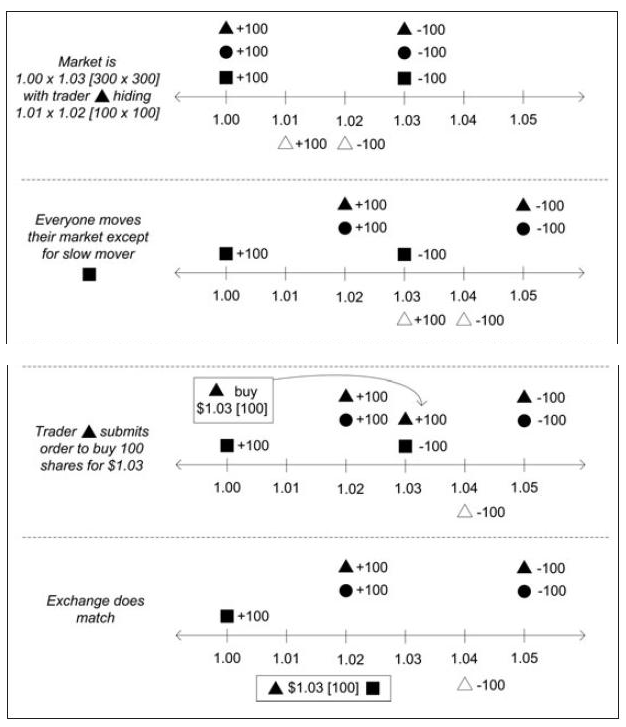

At certain points in time, market prices may change rapidly and dramatically, such as when economic data reports are published or when a company has a major profit/loss announcement. Then faster market makers can react quickly to such price changes, while slower market makers naturally become the lunch of faster market makers. For example, market maker A places orders in the market.\(1.00 x \)1.03 of the buy and sell order, at which time he placed a passive order, because he placed a passive order in the market, waiting to be eaten by others.

Market makers will usually set the spread of the buy and sell orders hanging in the market (the price difference between the inside and outside of the market) to be much larger than the buy and sell price they are actually willing to negotiate, this is because if someone is in a hurry to get out of the market with the market order, the market maker will usually put up a wider buy and sell order that will allow them to buy cheaper shares or sell for a higher price.\(1.01 Buy in,\)So 1.02 is sold, so he's going to have a\(1.01 x \)1.02 Acitve market, that is, market makers do not use the\(1.01 is the payoff and \)The 1.02 bill is hung on the market, but see if anyone is hanging on the market.\(1.01 is sold or \)If the buyer is willing to pay a 1.02 bill, if any, then buyer A will jump out and eat the bills.

Now suppose that the market suddenly announces a significant profit message, at which time all market makers will respond to this significant profit message and raise their bids upwards.\(1.02 x \)It's also a good way to increase their active market to 1.05.\(1.03 x \)1.04。

Now there's a market maker B who's slower to react than others, and he hasn't had time to react to this Lido message yet, so his\(1.00 x \)The 1.03 buy/sell order is still pending in the market, at which time the fastest seller A eats the entire $1.03 order of the slowest seller B, which means that seller A buys the cheapest item because of the speed, while seller B sells a stock because of the slower reaction; this strategy is called Take Out Slow Mover.

So this is why the speed of the network/computer/software/algorithm is so important for those who specialize in high-frequency trading, in a world of high-frequency trading, only the fastest can make money.

- Inventors quantify the path of automated trading

- The Law of Grid Trading

- I've created a forum, use it for a while.

- Join the Makers in high-frequency trading strategy

- Reserve orders and iceberg orders for high-frequency trading strategies

- Poke for bargain high-frequency trading strategy

- Improvements and advantages of multi-platform hedge stability swap V2.7

- About being sucked in

- Single-point sniper with high-frequency stacking automatic counter-hand unlocking algorithm

- Penny Jump for high-frequency trading strategy

- Push the Elephant in high-frequency trading strategy

- Scratch for the Rebate high frequency trading strategy