Inventors quantify the path of automated trading

Author: The grass, Created: 2015-07-01 12:13:27, Updated: 2019-08-01 10:55:26This article originally appeared on my blog.http://blog.sina.com.cn/s/articlelist_2389357153_0_1.htmlI've done some editing and published some articles. Each article has a date of publication marked. I've saved some because of the problems with the post.

One: Started on 2014-09-15

After a long summer without problems, with the help of the inventor's quantified platform, a little effort on automated trading, and even completing his own strategy, he gained some income, but after returning to school, he encountered a bottleneck. The reason: 1. I always hear about robot trading, it feels great. 2. The program can achieve no-man's-land and the market can react faster in virtual currencies with a lot of variables. 3. Serious operating losses. 4. Discover some advantageous spaces during the game. 5. I also want to learn programming. 6. The summer vacation is quite long. So my journey to automate virtual currency trading began, which was easier and harder than I thought. I'm not sure.

Two: Get ready for the 2014-09-16

I started to complicate the process quite a bit (it was complicated in the beginning) and with the help of the tech bull Zero platform, everything became simple. 1. I have learned about open-source machine learning (I haven't finished yet). 2. downloaded a Python learning video (actually didn't watch it) ‖ After reading the entire set of Intelligent Society's basic JS videos, it is useful to review the programming knowledge. But JS is for web development, and much of the talk is useless. 4. Start studying strategies that are shared on the platform, such as watering the roof, and get a good harvest. 5. Understand the basic automated trading strategies. I didn't really have much content, so I soon started trying to write my own strategy.

Three: The process started 2014-10-19

After a long summer break, I watched the jS teaching videos every day, commented on the code, and devised my own strategy, and soon I wrote my own initial strategy, and after changing countless low-level bugs, the strategy was finally working, watching the token orders bought and sold according to my own ideas, it felt amazing.

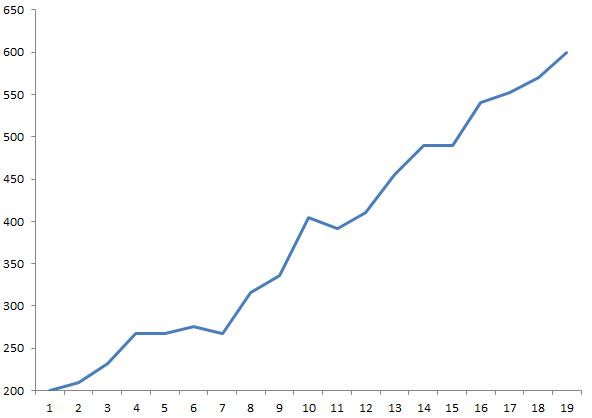

What is even more amazing is that the profitability of this short-term strategy is surprising. My initial capital was only 200 (why this number, I'll show you later) and I only bought seven or eight Litecoins, and over the next 20 days, plus the leverage of the tokens, my net capital grew as shown below: The result was quite good, the withdrawal was small, the average daily return was 5% above my planned day ((think about it now, the goal is too exaggerated) ‒ I watch my net worth increase every day, very quickly, and with this increase in earnings and profits, how long will it be before I get a promotion, and when... I'm on my way to the top of my life?

In retrospect, the rational view of this period of growth is that the strategy itself is effective for the following reasons:

In addition, the token's cash leverage increases earnings.

2, Light has rebounded to the bottom, and it's hard to lose money.

3rd, the market is more volatile, which suits my strategy.

4 and so on.

The result was quite good, the withdrawal was small, the average daily return was 5% above my planned day ((think about it now, the goal is too exaggerated) ‒ I watch my net worth increase every day, very quickly, and with this increase in earnings and profits, how long will it be before I get a promotion, and when... I'm on my way to the top of my life?

In retrospect, the rational view of this period of growth is that the strategy itself is effective for the following reasons:

In addition, the token's cash leverage increases earnings.

2, Light has rebounded to the bottom, and it's hard to lose money.

3rd, the market is more volatile, which suits my strategy.

4 and so on.

Four: Misguided 2014-10-23

The first 20 days of the strategy went smoothly, and I kept looking at the chart, summarizing the results, recording the daily net capital, minimum values, basic information on the day's chart in an Excel table. And in order to make the strategy more rapid entry and exit, two more parameters were added during this period. However, the bad effects gradually appeared, and every morning I woke up to see that the earnings began to appear negative, and for the next ten days, there was practically no profit, and the market did not fall. The holidays are coming to an end, the internet is down, and I'm not in the mood to study. On September 8, I went back to school and the problem was still unresolved, and the next time, despite the slump, the losses were still there. The situation did not begin to reverse until October.

Fifth: getting back on track 2014-10-24

The long period of unprofitability made me very depressed, and after everything settled down I started reflecting and learning. I found that it was probably because I had too many constraints in my strategy, that a good strategy does not require too many parameters, so I went back to improving the original strategy, removing a parameter that reflects short-term trends, and then started to make stable profits again, so simple.

The next day I was more focused, especially on the eleventh holiday. I was on my computer 24 hours a day, sleeping at 12 o'clock, getting up in the morning to see how much I had eaten, a maximum of one night (from morning to morning) added 130 pieces. The day was very happy. But the laptop was open every day and it was no problem, the noise was getting bigger, so I spent another 700 pieces in Taobao and bought an American electronic garbage Motion C5, the CPU is vintage, but good in low power consumption, practical use, no sound, fever is not obvious, has been started continuously for about ten days, no problem.

The previous losses soon returned, and net assets and the number of Litecoins in circulation steadily increased.

The following graph shows the growth curve of total capital (more than 1,260 loans): The most interesting of these was the October 14th Litecoin boom, and the strategy was perfect, because I found that Litecoin is always Okcoin up or down, so adding a token cap condition to the price of Okcoin, based on the current idea, is not necessary, but in this particular market just works.

In addition, the increase in the number of coins shows that the strategy has run out of steam, and when I finally decided to leave Litecoin, I was able to operate more than 120 (there are loans), which is not the same as when I started buying only 8 Litecoins.

The most interesting of these was the October 14th Litecoin boom, and the strategy was perfect, because I found that Litecoin is always Okcoin up or down, so adding a token cap condition to the price of Okcoin, based on the current idea, is not necessary, but in this particular market just works.

In addition, the increase in the number of coins shows that the strategy has run out of steam, and when I finally decided to leave Litecoin, I was able to operate more than 120 (there are loans), which is not the same as when I started buying only 8 Litecoins.

Sixth: Starting a Bitcoin trading strategy 2014-10-26

When I first came into contact with virtual currencies, my natural focus was Bitcoin, then I liked Litecoin again, and I never traded Bitcoin again until a few days ago. Trading Litecoin is natural because its price is lower and more volatile. But the behavior of Litecoin is more and more incomprehensible, it does not rise, it does not fall, it is said to be the worm that follows Bitcoin, but from time to time another explosion proves itself.

It was a slowdown after a slump before the October 23 crash. The result was very good, and the growth curve of the fund increased steadily: After a lifetime of Litecoin, it's time to go back to the Bitcoin cycle.

After a lifetime of Litecoin, it's time to go back to the Bitcoin cycle.

7 thoughts on 2014-10-28

From the beginning of my strategy, I always felt that short-term markets were trending, and that when the market was down, one should enter with caution or not enter, on the contrary, one should enter more aggressively. For this reason, my strategy was also specially adjusted. Later, I learned about the market effectiveness hypothesis, which states that the stock market is an efficient market, the stock price is statistically irregular, and investors cannot predict its future course based on historical prices. So, is the Bitcoin market effective? I have compiled and shared a retested strategy, which can be found in the www.fmz.com Strategy Square. Specifically, if 4 or 5 drops occur in 5 K lines, then the next one is more likely to fall, the strategy will calculate the frequency of the fall. I retested the 5 minute K line from October 23 to 28 and there were 244 such events, of which 125 drops accounted for a ratio of 51.2%; the chart below is the change in the frequency of the fall. Imagine, when the retesting cycle can be long enough, the probability is 0.5. What is the truth? I have observed many times that a downtrend strategy has helped me reduce my losses. Because essentially, this condition reduces my entry, it reduces the risk of my trade, but it also reduces the return on my trade. On October 23rd, Bitcoin experienced a longer period of decline, falling by about 10% overall, without a decent rebound, such a market in the spot market can only have positive returns. As mentioned earlier, my new strategy gained higher returns and also brought greater risks, which was perfectly verified in this fall. From the yield curve, it can be seen that the funds are decreasing, losing 136 blocks at the lowest point. In this round of decline, the maximum withdrawal of funds is less than 5%, which means that if there is no more severe decline, I can even leverage 20 times to maximize the use of funds, and my leverage is less than twice, which is actually a waste. Based on this, I took out some of the money in the tokens, the rest of the money was leveraged twice as much as the cash and transferred this part of the money to Okcoin. The reason I ended this series today is because it was a very special day: my net worth in tokens and OKcoin combined is over 3000 (of which 1000 were earned in the last 5 days), which is all the money I invested in Bitcoin and Litecoin, and today I finally realized the overall profit. Initially, I knew that Bitcoin was the Central Television reporting a big drop to $50 ((?), then for a long time I did not notice, but I do not know when I paid attention again, I silently observed for a long time, finally I rushed 1000 pieces on the token, on March 4, 14 I made the first transaction, to see if the price at that time was really unbeatable, just started to be careful, the target went away. During the period, I successively rushed 2000 pieces, then everyone was clear, the bit has been falling more than 2200, fortunately I cut the meat at more than 3900. March 20th, switched to Litecoin, when it coincided with the tokens on-line Litecoin shortly, once rushed to 128 yuan, then fell a hundred or so, I went into the game at that time, thinking it should not fall. Look at the price then look back now, more impressive: how did it fall so much? When trading Litecoin, began to borrow. In the continuous falling feeling hopeless, the bond is not moving, vacation home for a long time without internet, even more mindless to take care of, let God. Finally did not know that day still broke, with a mobile phone to look at the account balance, only 200 rupees left, mood is not unhappy. Although 3000 pieces are almost lost, but I don't know where the bottom of the heart, always feel like 3000 pieces are still. Later, the Da Da family network finally someone to repair, I brought back the school router on the safe, finally back to the arms of the network. I very early started the idea of automated trading, but not enough ability, everything has to start from scratch. One day, occasionally browsing the btc123 navigation website, found the btcrobot project, but it is not very clear, next to an inventor quantified programmatic transactions, click to see the introduction of the site, such as the discovery of the treasure, this is not what I was searching for? Going from 3000 to 200 and then from 200 to 3000 made me understand one thing: the world of Bitcoin is a playground for the high performers and a painful hell for the low performers. If ordinary people want to make money in this market, it is too difficult, there is only one way out, and automated trading is a good option.

- FMZ research platform Python introductory guide

- Some Bitcoin and digital currency quantification strategies worth learning

- Make Post-Only order and bulk orders on BitMEX through IO

- On how to list and order in bulk on BitMEX only passively (IO example)

- Inventor of the digital currency quantification platform websocket user guide (Details after the Dial function upgrade)

- Best ways to install and upgrade Linux hosts

- FMZ Quantify Platform features you know?

- Details of the BitMEX listing policy

- The CoinPark General Protocol Python 2 version

- BitMEX exchange API note

- X Minutes to Python

- How do robots communicate with each other?

- Pyramid schemes are better

- Why is the onexit function not executed?

- 亚当理论里的一个小故事.

- One of the newcomers to the K-line collection on the hard disk

- Some tips for re-testing the wrong packaging

- TypeError: Cannot access member 'GetRecords' of undefined at

:1:-1 Where is the problem? - On the strategy of single platform balancing

- Why choose to trade strategically on the FMZ Quantitative Trading Platform (BotVS)

- The strategy of making money could also be a coin.

- The Law of Grid Trading

- I've created a forum, use it for a while.

- Join the Makers in high-frequency trading strategy

- Reserve orders and iceberg orders for high-frequency trading strategies

- Poke for bargain high-frequency trading strategy

- Improvements and advantages of multi-platform hedge stability swap V2.7

- About being sucked in

- Single-point sniper with high-frequency stacking automatic counter-hand unlocking algorithm

- Penny Jump for high-frequency trading strategy

- Take out slow movers of high frequency trading strategy

jxhbtcWhat strategies have been shared?

IknownothingYou're too dumb, and, thank God for Zero, you have such a great platform.

botvs123456The small grass, well, it's what's in the bag, capable of making money in the market.

enzoThis little guy is stubborn and the money curve is pretty much irreversible...

ZeroShe hopes the platform will lead more people on the path to quantification!

The grassTyping is painful, the browser has been stuck lately

zhanwenfuI hope you can add my QQ 515001506.