Why are retail investors buying and selling (Contrarian)?

Author: Inventors quantify - small dreams, Created: 2017-02-27 12:26:44, Updated:Why are retail investors buying and selling (Contrarian)?

Introduction: What are the typical "retail mindsets" in the stock market? How to avoid them? - In bh lin's answer, I mentioned the tendency of retail investors to buy and sell in general. This is also a relatively mainstream view in behavioral finance research.

Before discussing the reasons, as is common practice, let's first discuss whether retail investors are buying and selling.

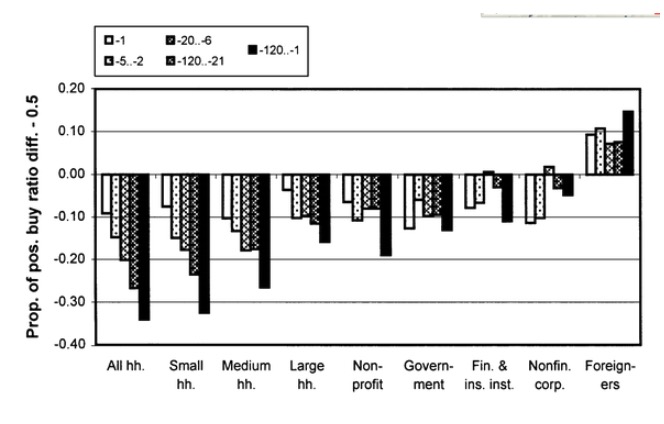

Academic comparisons are more commonly used to measure retail investor net buying/selling to measure their buying/selling propensity. The buying/selling propensity is expressed as: retail investor net buying after stock market decline; retail investor net selling after stock market rise. Based on similar metrics, researchers have found such trading propensities in retail investor investment data from several countries around the world (the United States, France, Sweden, Finland, Japan, South Korea, Australia, China, etc.).

Another interesting finding is that this tendency seems to be related to the level of financial sophistication of the investor.

The investment behavior and performance of various investor types: a study of Finland's unique data set:

Retail investors on the left of the graph have varying degrees of propensity to buy and sell, and tend to weaken as their assets grow in size. In the Finnish stock market, the group of foreign investors on the right of the graph is considered to be relatively more savvy investors, and they tend to buy and sell more.

Similarly, a study based on Chinese investor data, The Trading Behavior of Institutions and Individuals in Chinese Equity Markets, found that retail investors tend to be contrarian, while relatively more astute institutional investors tend to be momentum-driven.

The academic community, of course, has a different view. UC Davis professor Brad Baber and UC Berkeley professor Terrance Odean summarize the behavior of retail investors in a review article:http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1872211中认为散户投资者净买入/卖出上的卖涨买跌是因为散户投资者的购买出售行为受过去的回报影响程度不同。同时这样的倾向和净买入/卖出量,过去回报率的测量区间有关。

Back to the question of why retail investors tend to buy and sell. The academic view is that the behavior of retail investors tends to be linked to their beliefs about the market, the market structure/mechanism, and the psychological reasons of the investors.

- ##### 1. Investors' expectations for the market

An investor's investment behaviour should be related to his expectation of future changes in the market. If the investor thinks the future stock market is going up, he should buy or hold the stock. Conversely, if the investor thinks the future stock market is going down, he should sell the stock.

So, the expectation of a bullish trend should be when the stock market is up, where retail investors believe future earnings will decrease, while the stock market is down, where future earnings will increase. This back-feedback seems to be consistent with some rational expectation models.

And whether or not such a logic makes sense, is this what retail investors expect?

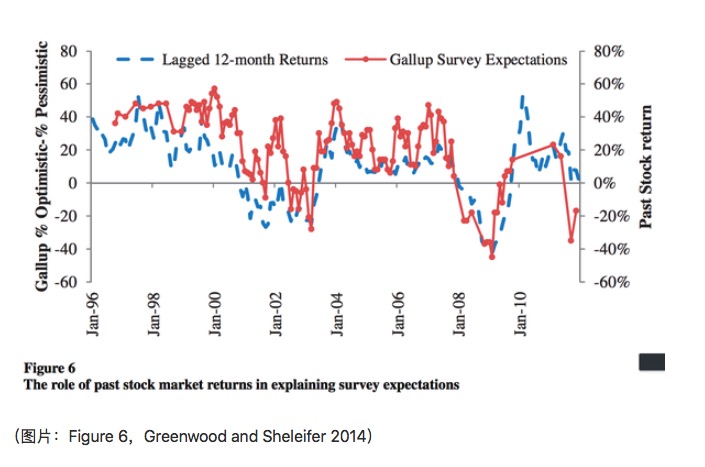

Evidence does not seem to support this view. Greenwood and Shleifer (2014) used data from six survey-based US investors to find that investors are more like extrapolators: they see future returns as a continuation of past returns.

As shown in the graph, the rate of return for the past December is positively correlated with expectations based on the Gallup Survey, and the regression analysis in the article also supports the view that investors' expectations of future returns are a continuation of past returns.

Cochrane, of course, mentioned in his 2011 speech as president-elect of the American Finance Association (AFA) that survey-based data does not accurately reflect investor expectations.

- #### 2. The trading mechanism of the market

The second possible reason is that this tendency is influenced by the trading mechanisms of the market. Retail investors tend to use cap-and-trade, whereas cap-and-trade mechanisms make retailers' investment behaviour more volatile.

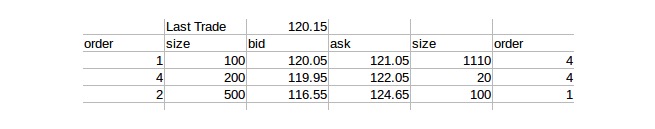

Usually, a buy at a fixed price is settled after the price has fallen, while a sell at a fixed price is settled after the price has risen. For example:

The ask order requires a price increase before the transaction, while the bid order requires a price decrease before the transaction.

Given that retail investors do not have specific order book data, the down-order strategy may be more conservative, such as a bid of 116.55 for which the order needs to be settled after a 3.6 decrease from the current price.

How significant is the effect of the trading mechanism on trading trends? Linnainmaa (2010) uses data from retail investors on the use of cap and market price lists. The most significant effect is the trend on the day of the trade. He also found that in stocks with a lower trading volume, the effect of the mechanism on the trend of buying and selling is obvious.

Such results are also intuitive, with lower-traded stocks and more conservative underwriting strategies significantly increasing the time to underwriting, thus reflecting the buy-and-sell propensity of investors over relatively long observation intervals. However, such an underwriting mechanism does not explain the findings in Grinblatt and Keloharju (2000): such a propensity is more pronounced over longer observation intervals in the past (see Figure 1), even when stocks such as Nokia account for one-third of the trading volume of the Finnish stock market.

- #### #3. Investor psychology

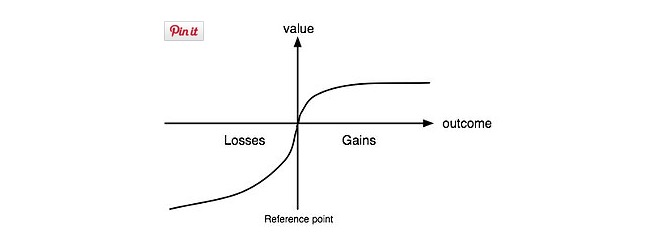

In behavioral finance, the disposition effect is directly related to the contrarian effect. The disposition effect refers to the tendency of investors to hold stocks that have fallen for too long, while selling early rising stocks. The disposition effect compares falling and rising stocks to selling and holding.

On the other hand, the buying and selling behavior should be related to another tendency of retail investors. Retail investors tend to buy lottery-type stocks. Lottery-type stocks are likely to have low returns over the past period of time, so they form a buying and selling phenomenon.

Of course, we should not simply use one behavior to explain another. Economists have returned to the analysis of utility functions and preferences. In 2002, Nobel laureate economist Kahneman and psychologist Tverskey proposed the prospect theory (Kahneman and Tverskey 1979).

This provides an explanation for why investors sometimes behave in a reluctant manner towards holding loss-making stocks. Risk seeking, which is the risk preference shown by decision makers in low-probability events, also provides a possible reason for investors to buy lottery-type stocks. Investors are eager to speculate on lottery-type stocks for huge returns.

- #### 4. Other reasons

Differences in the data set used and the measurement used may explain part of the reason for the other; it also explains why some studies have come to conflicting conclusions.

Different data sets

Empirical research on retail investor behavior requires analysis of the trading behavior of a certain number of retail investors over a period of time, the number of shares held. This requires a very detailed account-level data set. What interesting estimates would I have if I had all the stock entrustment, trading, holding data of all investors? - bh lin's answer cites several sources of data used by the academic community, including: data provided by intermediaries, data provided by exchanges, and data provided by central security depository.

Gallup survey

American Association of Individual Investor survey

Shiller survey

And so on and so forth.

The relevant transaction data, in addition to CSD data that can cover almost all investors, other data will inevitably have some deviations in the selection of the sample. For example, the user group that selects some intermediaries is likely to concentrate on an investor of a certain investment size, income level.

Questions about the survey data. Questions about the survey data, as mentioned earlier by Cochrane (2011), are influenced by many factors. First, the survey and the language used are related to respondents' understanding of the survey question.

- ### The difference between observation ranges

The observation intervals here involve calculating two measures; one is how long the past rate of return needs to cover the past; the second is how long the investor's behavioural tendencies need to be analyzed in the future. Of course, many empirical articles are based on the analysis of a sufficient number of different observation intervals. Going back to the investor's behavioural tendencies, should they correspond to the investor's investment cycle?

This is the first time I've seen it.

Grinblatt M, Keloharju M. The investment behavior and performance of various investor types: a study of Finland’s unique data set[J]. Journal of financial economics, 2000, 55(1): 43-67.

Ng L, Wu F. The trading behavior of institutions and individuals in Chinese equity markets[J]. Journal of Banking & Finance, 2007, 31(9): 2695-2710.

Cochrane J H. (2011) Presidential address: Discount rates. Journal of Finance 66:1047–108.

Greenwood, Robin, and Andrei Shleifer. 2014. “Expectations of Returns and Expected Returns,” Review of Financial Studies

Barber B M, Odean T. The behavior of individual investors[J]. Available at SSRN 1872211, 2011.

Linnainmaa, Juhani, 2010, Do limit orders alter inferences about investor performance and behavior? Journal of Finance 65(4), 1473-1506.

Kahneman, D.; Tversky, A. (1979). “Prospect theory: An analysis of decisions under risk”. Econometrica47 (2): 313–327. doi:10.2307⁄1914185.

Written by B. Lin Link to the video:https://zhuanlan.zhihu.com/p/20307618Source: known The copyright belongs to the author. For commercial reproductions, please contact the author for authorization. For non-commercial reproductions, please specify the source.

- I'm going to ask the gods about my doubts about future functions!

- Money and credit in monetary banking

- Trading strategies of gamblers

- HttpQuery is not used in Python

- What does it mean to be a "dispossessed" hedge fund?

- Talking about the odds of winning and losing

- This is probably the biggest lie in investing!

- How to Survive in a Random World

- Discover trends and follow trends

- Disclosure of the Big Data Fund

- If you can't win, throw a coin and make a deal, can you still make money?

- The journey of machine learning algorithms

- When we predict probabilities, what do we predict?

- Programmatic transaction flow chart (an idea to the program)

- _C() Re-test the function

- _N() function, small number of decimal places, precision control

- Adaptive learning in the first place

- Real and formal trading systems

- Three short stories about understanding real estate, stocks and money

- Six branches of Quant uncovered