This is probably the biggest lie in investing!

Author: Inventors quantify - small dreams, Created: 2017-03-01 10:31:13, Updated:This is probably the biggest lie in investing!

Timing, as the name implies, means choosing the time to buy and sell stocks and trying to profit from it. Today I will talk about this specifically.

- The temptation of time

Firstly, the temptation for investors to choose a time is very great. Because if you can correctly judge the highs and lows of the stock market, then by buying at the low and selling at the high, investors can get very rich returns.

Looking back over the past 20 years, the US stock market has had a total of about 5,000+ trading days. If all 20 years were held in the S&P 500, the investor's return would be about 9.8% per year. But if the five days of the biggest decline could be predicted and avoided (assuming selling the stock before each of these five days and buying it back after a day), the investor's return could increase to 12.2% per year.

Of course, 5 days is only 0.099% of the zone for 5,036 trading days. To achieve such an over-reward, investors need to have a very high degree of forecasting ability to predict that tomorrow will be a bullish day.

However...

- ### The risks of choosing ###

One danger of such a timing game is that if the investor's prediction goes wrong and he sells his holdings on the wrong day, he will suffer a devastating blow.

Similarly, in the past 20 years of the S&P 500 (as of December 31, 2015), the return on investment for holding a stable 20 years is about 8% per year. However, if an investor does not hold a stock for the five highest days on the stock market for various reasons, its return drops to 5.99% per year, which is 42% worse overall than the original stable.

In other words, if an investor misses five of the 5,000+ days (<0.1%) and the biggest five days of the year are without a stock, then he will have a hard time making up for those five days even if he sticks to the investment for 20 years.

- #### Is the domestic market the same?

A friend of mine asked me, "What you're talking about is the US stock market, but we have a different domestic stock market than the US stock market". The question is good, but the truth is that the above statement is also true for A shares, and even more so (because A shares are more volatile).

For example, the above graph shows two price lines. Blue is the return of the A stock index starting on January 1, 1997, and red is the return after the A stock index minus the 10 day maximum increase. You can see that over the 20 years, the investor's return for missing these 10 days is only about half of the return of the original A stock index strategy.

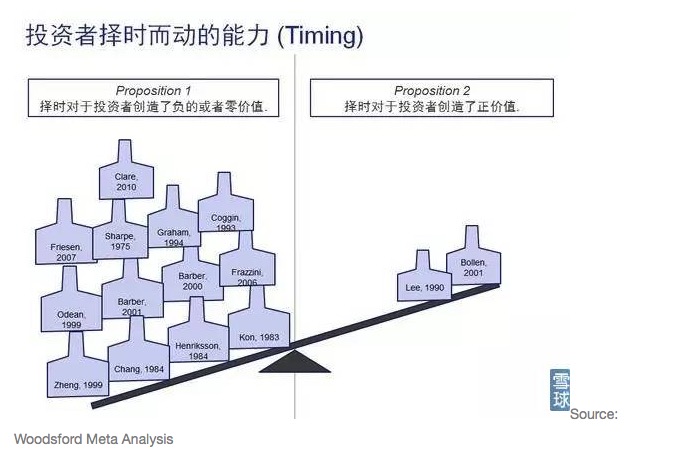

Investors lack the ability to time, not just an academic study or a scholar's conclusion. In the Woodsford Meta Analysis above, we examined all the mainstream academic journals aimed at answering this question and summarized their findings in the graph above. You can see that the vast majority of academic studies come to the same conclusion: investors do not have the ability to improve their returns by time.

Of course, even the most prominent investment experts can't guarantee that I'll be able to tell whether the stock market will go up or down tomorrow, let alone predict whether the stock market will go down in the next 20 years. So many of my readers and friends may ask: What is the minimum accuracy of my prediction that I need to guarantee if I want my timing strategy to be effective?

- #### What kind of success rate is cheap?

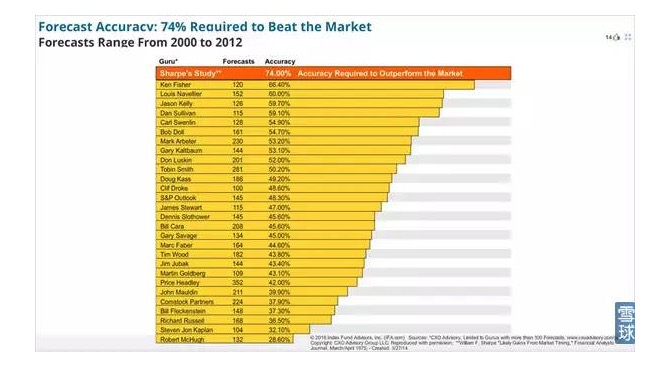

The famous American financial economist and Nobel Prize winner William Sharpe has studied this problem. In an academic paper, Sharpe proposed that predictors need to have 74% accuracy to be cheap in a timing game. If you can't get 70% accuracy, then you're better off buying an index fund/ETF and sitting still.

74%?! The egg lord says he has received a shock!

Sharpe looked at the records of some of the most prominent stock forecasters in the United States at the time and found that there was a huge amount of uncertainty in the market.

It's not like anyone can get 74% accuracy.

In the graph above, you can see that the best forecaster on record, Ken Fisher, has an accuracy of about 66%. This is pretty amazing, but it's not even close to the 74% accuracy that can help you make money.

- #### Why is it that some people still make firm choices?

In the market, there will never be a shortage of investors who try to profit by timing, and investors who believe they have the ability to beat the market by timing. Of course, they can't all be that good, which is why many people blindly believe that they are beyond their extraordinary ability to predict the market without evidence of their timing.

In fact, there has been a lot of research on this, such as studies on human behavioral biases. As mentioned in yesterday's article in The Public, the more common behavioral biases are overconfidence (overestimating one's own abilities) and selective recall (remembering only the part of one's transactional record that is profitable and selectively forgetting the part that is profitable).

Translated by Snowball Wurzchen

- Zero and negative markets

- High-frequency trading strategies talk - do the market versus the reverse option

- Becoming a probabilist - a random strolling idiot who reads books

- Positive expectations for probabilities, odds and long-term trades

- I'm going to ask the gods about my doubts about future functions!

- Money and credit in monetary banking

- Trading strategies of gamblers

- HttpQuery is not used in Python

- What does it mean to be a "dispossessed" hedge fund?

- Talking about the odds of winning and losing

- How to Survive in a Random World

- Discover trends and follow trends

- Disclosure of the Big Data Fund

- Why are retail investors buying and selling (Contrarian)?

- If you can't win, throw a coin and make a deal, can you still make money?

- The journey of machine learning algorithms

- When we predict probabilities, what do we predict?

- Programmatic transaction flow chart (an idea to the program)

- _C() Re-test the function

- _N() function, small number of decimal places, precision control