Trending systems - how to deal with 70% shocks

Author: Inventors quantify - small dreams, Created: 2017-05-23 10:23:25, Updated:How does the trend system cope with 70% shocks?

- ################ The importance of the system

After more than two years of experience, the old birds have both experienced, they started by feeling, but after losing the pain, they found out that inspiration is far less than the stability of the system, the feeling will infinitely magnify the weaknesses of people, and human nature is that we can not resist, only the system to rule. If you are a newbie you are still using inspiration in trading, now you must start building your own system!

What is a trading system, is the rules for the quantification of the performance of your own trading ideas. There is first a trading idea, then a trading system, this order cannot be disturbed. As your experience increases, your trading ideas must also be spiral upwards. And the trading system will also be constantly modified or even completely overturned by yourself.

I'm more inclined to build my own system than to use one that's universal (for example, the beach or the 10/20 cross, of course they can all be profitable). It's dangerous to think that financial transactions are primarily based on the first rule of the law, because I've tried to fight back and know that it's deadly.

The key is that you are the system, the system is you. There is no fighting or conflict. When your system can no longer fully reflect your trading ideas, it is necessary to improve. My system has had 10 versions from 3 years ago to now, and each time I think it is without a hit, but it can still be improved in the end, and I believe it will be.

- ##### 2. My original idea of building and trading systems

A few years ago, I made low-level mistakes like the newcomers of today. Then I started reading classic textbooks and went down the path of the long-running indicator scientist. But my cycle was relatively short, maybe only 2-3 months. Slowly discovering that this seemed to be a dead end, and then seeing many classic posts, what manipulated the three major stages of Go, 9 stages of Chess, 5 stages of Chess, I found my own direction after entering the seat.

After some fragmentary concepts, the idea gradually becomes clearer. It is not difficult to understand the two things. Objective rules, inhumanity are not difficult to do after being honed.

The question is, how do we define the concept of progression?

I couldn't find the answer. So the pain started.

Now on the forum everyone still hangs the trend on their mouths every day, as long as it is OK. If I tell you that these two words are specifically for putting the back of the horse, will you scold me, first think carefully about saying it again. What do you do?

I was aware of this problem at the time, and the breakthrough was very painful. The constant clash of ideas, the idea of being overthrown by itself (the framework of ideas was not yet formed).

- #### 3, classification and distinction of systems

When you encounter a bottleneck that you can't break through, you must go to a simple place to think, the simpler the better. More think about the nature of the trade, the nature of the market. The textbook says that the market has many shapes, shoulders, flags, cones, and double-top. At that time I was very painful, you told me whether the double-top is bullish or bearish.

After thinking for a while, I finally came back to the nature of the market. All markets have only two states: volatile and unilateral. All markets have only two states: volatile and unilateral. The only question is how to judge whether the market is volatile or not. BOLL, ADX, other indicators.

I asked myself if I had no talent to judge the shocks or one-sidedly, so I could only use one method of operation, either all low buy high sell, or all chase down. Its realization in view of chasing down is obviously to comply with the market, while low buy high sell is against the market, but at that time my own idea was a mess, plus experience is not enough.

If you can accurately judge the shocks or the one-sidedness, or your goals, the following words may have little reference value, because I did not take this shortcut but directly and the market is hard!

- ###############################################################################################################################################################################################################################################################

After a period of trading, the results of two different systems were gradually summarized. The shock method was a lower buy-and-sell method (KD): high success rate, but most of them were small. The KD indicator is very sensitive, once the reversal must immediately come out, and the inevitable stop loss will essentially wipe out the small gains, and this is only when the market has no obvious trend. Once the market has a very sharp rise or fall, the shock method only chases the high, the small, the higher, then the small, the higher.

I had a very scary idea at the time, and after summarizing my trading diary, I found that it was the constant small stop loss that smoothed my financial curve. So the first principle of the scripture was shaken.

Finally, after constant reflection, the spiral began to rise. Everyone has heard, losses are their own decision, profits are God's decision. Shock methods I can not optimize, are small losses, only increase the success rate, I do not have this talent.

As for whether the shock system will ultimately be profitable, I am not qualified to judge, because it is not in line with my personality and ideology.

- #####5 Optimization and refinement of the system

Finally, I succeeded in creating my own trading system, but if you think that as long as you create your own trading system, follow the basic trading discipline, profits are guaranteed, then I tell you that it is a big mistake. All the above steps, including the basic trading framework and the preparation of the trading concept, I basically completed in a year.

After building a trading system, the next job is to optimize and refine it. The initial system framework is just the soul of your trading idea, nothing substantial.

Of course, the soul is the most important, which is why I have repeatedly reiterated the importance of the system before.

System optimization is a very long and painful stage. Because your trading experience is slowing down compared to the beginning, and the process of improving your thinking is slowing down. In this process, you may have been able to make very few losses, but you are still slowly dying. For me, this stage is no longer a realization, there is only a slow realization of the water to maturity.

The above is basically my own journey, the writing is relatively simple. I believe that we all have experienced the things behind us (the old bird of more than 2 years holding hands, it is not easy). Lastly, the optimization and refinement of the system is endless, the spiral ascent will not stop, because our life experience and trading experience will not stop.

- #### How the trend trading platforms are coping with 70% shocks

Next is the focus of this topic, and my main objective: how to deal with 70% of shocks in trend trading! If you are using a trend system (the equator), if you are an old bird for more than 2 years, you will certainly have a considerable resonance.

My own system is a five-line, one-sided operating method. That is, all markets operate on one side, when the market is lucky, the market directly flies, when the market is bad luck, a lot of profits turn into losses, or directly stop the loss. Everyone knows, this method works when there is a clear trend, the market can go head to toe and still leave 70%, 80%.

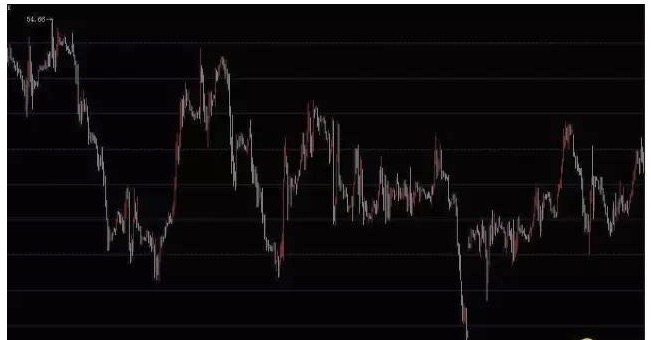

The black box is the shocks, the rest are the trend markets, we are all dead in these boxes. Many systems are on the chart to explain in detail what the entry and exit points are, all the horseshoes, the other chart is dead. First ask yourself, can my system make money in the obvious trend places on the chart?

If you ignore the shocks and your trend system still doesn't make a lot of money on one side, your system must have a problem. Very simple, because you are a trend system, now the market is trending, what reason do you have not to make money? If you can't get it when you grab it, why live? If you can capture more than 50% of the trend system on one side, it is basically a successful trend system.

The trend trading is actually one word: resistance to shocks. The next step, now we don't need to consider unilateral market movements, and there is a lot of hype. The textbook says: hold your losses, profits will take care of themselves. Now we are going to hold losses, how much you lost in the black box, flip! The chart at hand repeats itself.

- #### Trending trading 3 points:

(1) After a turn signal occurs in a higher-level cycle, the same signal operation is performed in a lower-level cycle, and the reverse is filtered out. This increases the win count. Stop loss continues to move in the trend direction along the higher-level cycle.

(2) If you want to capture a one-sided market, you must abandon the idea of trading frequently in short cycles. How can you avoid frequent trading? You can only choose to use signal placement with a higher level time cycle. However, entry must still be in small cycles, because the stop loss cost is small.

(3) After entering the short cycle, the stop loss should be moved to the open position as soon as (if appropriate) to ensure the security of the single trade.

The three points above are increasing in importance!!! especially the last one!

There are a lot of things on the 4th floor, newcomers may not feel much. Oh, this is the way everyone has to go, hide or not hide, maybe I've been twisted or not. But I believe that the old bird of more than two years must have a feeling. As long as you do a trend, there must be a turbulent period of profit vomit, even if you move out of what code, progress, ghost, Chloe, just hold the right position, etc., all vomit.

I chose the second black box in the diagram above as an example, which has the longest, largest and most lethal shaking time.4⁄29Below is a K line of the hour chart (the method is the same as the one used to see H4). The white chart is less clear, the black one, you may need to zoom in.

This wave is preceded by a unilateral uptrend, which is no doubt, after which each person's trend system may produce different trading signals. My system is a short-term median line system, more sensitive, and in this wave it produces a total of 10 shift signals (see K comparatively obvious). Only the last time there is a real uptrend behind the unilateral uptrend, what about the 9 earlights in the middle?

3⁄27-4/1: If the trend line shows a change, believe that the previous one-sided multiple order has been leveled. As for when to enter the blank order, see H1 chart ((or H4, different systems for each person). If H1 is up, then reverse the filter until the H1 rise ends and turns to a decline before entering the blank order ((my system is right-handed trading).

The entry of the blank is profitable, that's good luck. After entering H1/H4, the high point of the wave losses, the market opens and quickly goes down to the cost level, the next work will be to look at a level. The trend reversal signal of the day K does not come out, the blank does not move.

4⁄2- 4/3: The trend is shifting more, the empty order should have hit stop loss (stop loss) out.

4⁄6-4⁄8(First 2 days of the weekend): Trend reversal. The previous multi-single is basically not profitable, because the stop loss basically does not move in a favorable direction.

It is worth mentioning that during the 4-14-4/17 the 4 small K lines, it is necessary to follow this phrase to give up the thinking of operating in short cycles, otherwise the vibration of the ears is inevitable.

In summary, the operational idea is that: the big cycle determines the trend and the small cycle changes the trend.

My systemic idea is to do all the markets one-sidedly, not to initiate a stalemate and let it develop itself, but to constantly increase the stop loss. When you encounter an inevitable shock, the small cycle stop loss + moves as quickly as possible to the cost, the system will not come back.

- #### After all the discussion, I think there are some details that are not clear:

1, the big cycle determines the trend of penetration into multiple orders or empty orders.

2, small-cycle entry (quantitative scale not too big) filtering the small-cycle reverse wave, right-hand trade.

3, set the stop-loss curve according to the small cycle chart trading system.

4. Stop loss transfer to the cost-price cycle and then move to the short-term cycle after the appropriate profitability.

5 Enter the end of the job

6 ̊ If damage occurs, repeat 1 to 5 ̊.

7. If the big cycle shows a favorable trend, the stop loss continues to move in a favorable direction.

8, stop loss (stop win), operation above the loop.

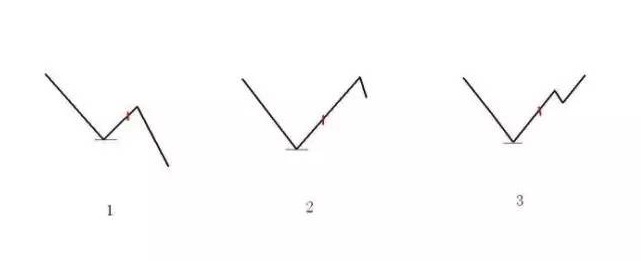

- #### The chart is more intuitive: assuming the EUR short cycle is longer (red point is the right hand side trading point), 30 points of the blue line stop loss.

1. Stop the damage immediately after entering the game, the worst case scenario is not mentioned. 2. Floating Profit 30 points + Profit and Stop Loss 1: 1 after entry, stop loss can be considered to cost. 3. The next adjustment continues upwards after entry, and consideration may be given to moving the stop loss to cost or new lows.

Sometimes the market doesn't go as smoothly as in the diagram. Different systems, different approaches, these are just some of my ideas.

I would like to emphasize: 1) Disorderly shocks can continuously put you out of business, the market doesn't respect us at all, so moving quickly to costs is very important. 2. Design and optimize the system must consider the worst case scenario, not always thinking about how to win more.

Trends trading, the big market has a lot of money. In the past, you think about the big market every day, the first breakdown feels like the price is going to double, the next breakdown feels like the market is going to collapse. In fact, the real market does not necessarily have a wave in one year. EUR has been trading for two months, May 2006 started trading for half a year.

Translated from the Tibetan Book of the Dead

- Fix your trading patterns, don't have to chase the Cup

- Inventors Quantify When did ETH start supporting ok and tokens?

- Now GetRecords can't use cycles?

- I took Python's decomposition is decomposition, and it took me a year.

- Custodian for OKCoin futures upgrade, please download again Deploy custodian

- The problem of multiple strategies

- Is Bitcoin supporting ETC and ETH transactions?

- python retrieves error reports in non-trading hours

- K-line date problem in python

- Is the age of the bit unusable?

- Vim remote programming is particularly useful, but note that VIM requires Python support.

- Can you tell us about the real-life meaning of increasing the volume, decreasing the volume, increasing the volume, decreasing the volume?

- Programmatic transactions, the top 10 things to look out for

- Is it possible to trade multiple pairs of trades in one strategy?

- What about the futures trading strategies of the little guy?

- The Black Swan Effect

- Three things to understand when making a long-term lease

- Statistics 7 - The average number of cheaters

- Why is the difference in the area a measure of the degree of dissociation?

- How to determine the failure of a procedural transaction model

The lonely motherGood article, learned