FMZ heartbeat pathway - leap forward strategy included

Author: Quantification of district classes, Created: 2020-01-16 13:58:08, Updated: 2024-12-12 20:56:42

First, the preface

Before starting this article, the head of the section first made a self-introduction, the head of the section is a pen name, hoping to describe the blockchain in a phonic manner. The head of the section originally engaged in embedded development for 15 years, and in the last two years has more deeply understood the digital currency by researching the application of blockchain in the Internet of Things. At the same time, in the process of trading digital currency, the inventor quantitative platform was discovered. Although the head of the section heard about Bitcoin earlier, but it is really important, that is, this two-year thing, so it also perfectly missed the 17 and 18 years of the downturn.

The advantage of quantitative trading is that some operational ideas can be refined and executed through the program. This avoids the impact of people's moods when the market fluctuates sharply, and mismanagement or non-operation. Because the program monitoring, it is also easy to detect the market in time. At the same time, some trading ideas, whether they are reasonable, can also be retested through the inventor platform, and some bad strategies are removed in time.

Second, the real war.

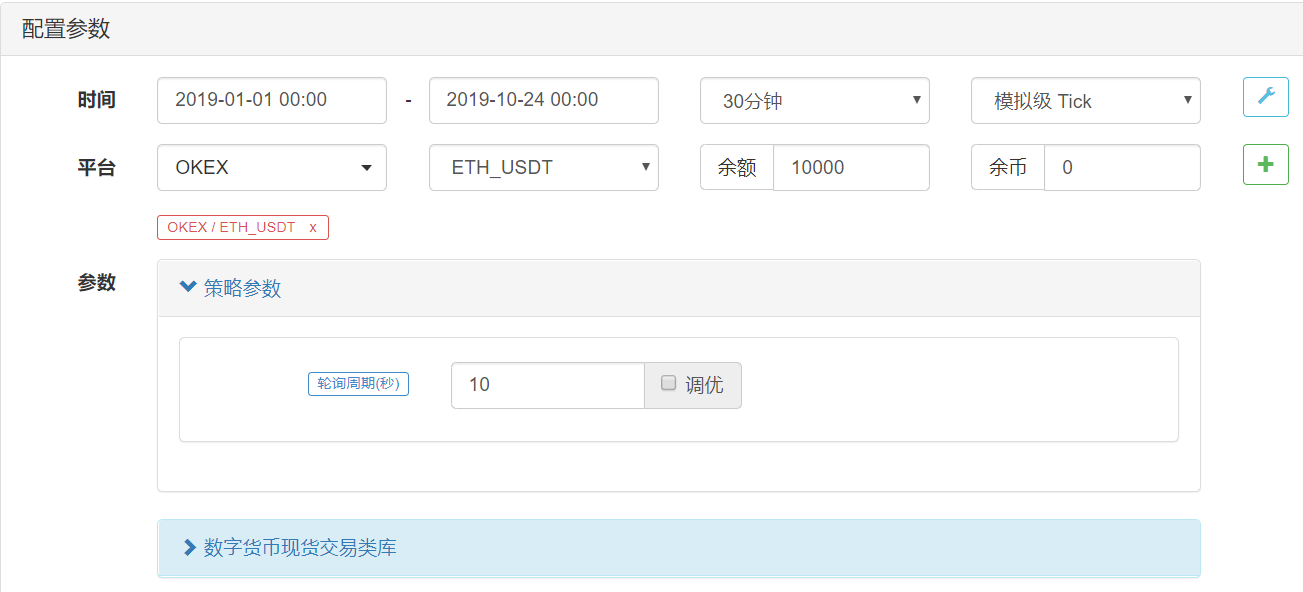

In order to accommodate a relatively large amount of funds, but also for better monitoring to be able to intervene manually, the zone master adopted day trading as the main currency. To avoid the sharp volatility of BTC, the zone master chose ETH as the main currency. In 2019, the review standard was made, because the first half of 2019 was basically a one-sided rise, the second half of the year was a one-sided fall, basically two scenarios can be considered in the bull market and the bear market.

We start our quantification journey with a strategy devised by the zone master himself: the big and small three-cycle leap strategies. In general, the big cycle indicates the direction of the market, the middle cycle is the current operating cycle, and the small cycle indicates the trend stop signal. When you enter, as long as you look at the state of the big and small three-cycle, you can, like Genghis Khan, adopt a varied strategy to cope with the complex market.

We then list the relationship between the K-line and the B-line of each cycle, for a total of 8 states, 8X8X8 = 512 states for three cycles, which 512 states are enough to handle all possible disks, and the technically competent programmer can design the best single-point low and stop loss point of each state in advance.The strategyIt was publicly announced.Click to seeI hope that you will be able to improve on this.

And then we go back and we can see the ageing is 29, the regression is slightly higher, it's 36%. We download the logs and analyze them for regression, which is the advantage of the inventor platform.

Three, improving

The main reasons for the analysis are:

-

The structure of the micro- and micro-cycles is relatively good, but the strategy of how the micro-cycles affect the medium-cycle is poorly conceived, and can be simplified first and then supplemented.

-

When the market is empty, one should definitely abandon the position.

-

The five-day average is important and not reflected in the strategy.

-

The rapid decline outside the Brin line should sell

-

If the reason for the rise falls, it should be stopped in time to stop the rise and stop the loss.

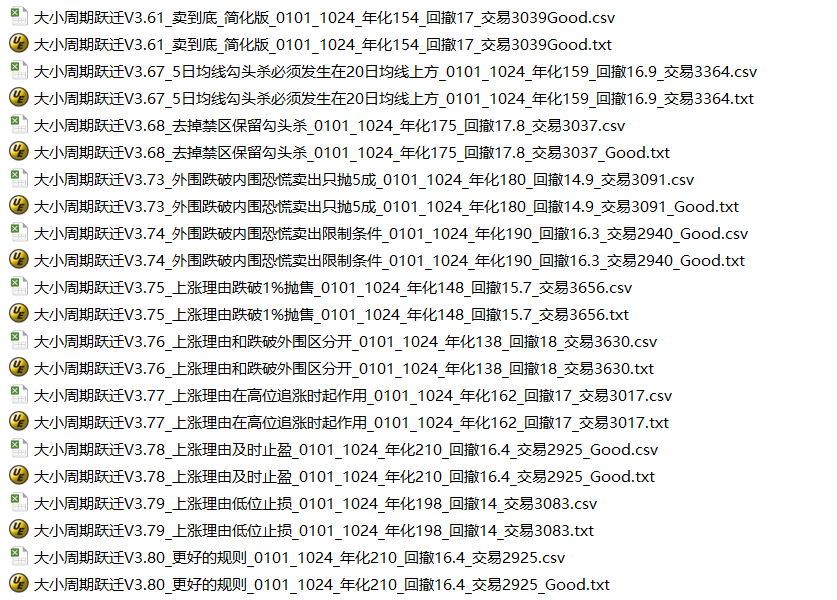

We put the reason for each iteration, run cycle, annualization, retraction, number of transactions into the filename and corresponding logs so that we can quickly find the previous version and make corrections. Good habits can lead us to better progress, visible quantification processes, but also the process of correcting the wrong strategies in our minds to make them more powerful.

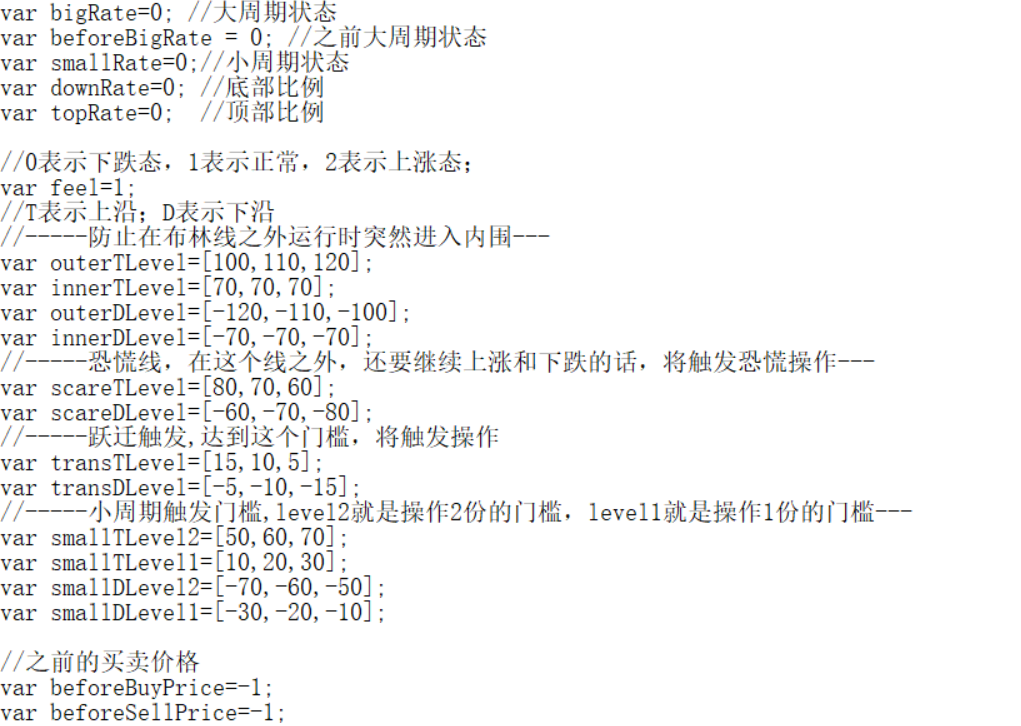

In order to deal with the various situations of holding losses, the zone master also added some variables. Considering the hot and cold conditions of the market, he also added a concept of FEEL. After the so-called hot is sold, the price jumps up again and has to buy; the cold situation is the opposite. When the cold temperature is different, the jump parameter is different.

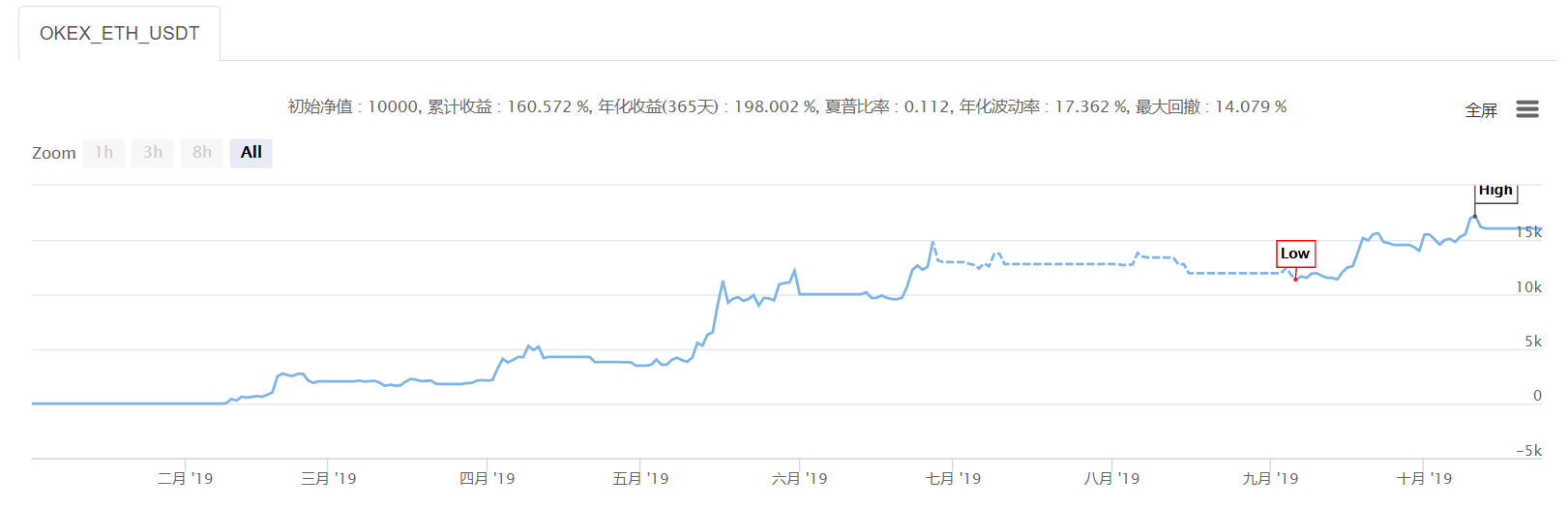

At the same time, we have also observed that as of June 27, we have made a profit of 14,872, and in the last 4 months only 2,3 thousand. The reason is because 2019 was exactly the first half of the upward market, up by more than 200%, and the second half of the downward market, down by 70%; This shows a good strategy, in the upward moment, it is necessary to absorb the force of the upward moment, in the downward moment to release the space position, as much as possible.

Four, the summary

The following strategies are optimized:

- Using a shorter cycle as a trading cycle, such as 1 hour, which requires repeated adjustment of optimization parameters

- It can be done by contract.

If you are also interested in quantification, come to the Inventor Platform and explore with the class leader.

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Strategy testing methods based on random market generators explored

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Python version of the MACD graph example

- The strategy of cross-currency arbitrage based on the Brin Belt

- Timing start or stop widgets for quantified trading robots using Python

- Corrupt Sisters Speak at the First Session of the General Assembly

- Quantitative fractional rate trading strategy

- The Python spreadsheet platform balancing strategy

- The old farmer's journey to the pit

- The story of a post-95 coin collector

- Hands-on teaches you how to convert a Python single-variety policy into a multi-variety policy.

- My automation loss and FMZ shore trip

- Python's chase and kill strategy

- Python version of simple grid policy

- Quantified trading tools for open-source digital currency options

- Handshake teaches you how to write a K-line syntax in Python

- Handshake teaches you how to add support for multiple charts to a policy

- Linear hang single-stream strategy based on data playback feature development

- Hands-on to teach you how to transplant a Macanese language strategy (progress)

- Q&A about how to get started with cryptocurrency

- Inventors Quantify FMex Mining Strategy and Use Guide

- Cross-currency hedging strategies in blockchain asset quantification

Quantification of district classesThe strategy is bull market is heavily positioned, bear market is determined to empty to avoid reassessment, is a good trend and is not a good one.

xunfeng91The money curve is very well controlled.