Multiple ATR strategies for digital currency futures (teachings)

Author: Inventors quantify - small dreams, Created: 2022-01-07 11:11:54, Updated: 2023-09-15 20:54:33

Multiple ATR strategies for digital currency futures (teachings)

Recently, platform users have been looking forward to the possibility of porting a Mac policy to a JavaScript policy, so that they can flexibly add a lot of optimization ideas; and even extend the policy to a wide variety of versions. Because Mac policies are usually trendy strategies, and many are executed with a closing price model. The strategy requests API interfaces of exchanges are not very frequent, if it is more suitable to port into multiple versions of the policy.

The strategy for transplanting the Ma language

TR:=MAX(MAX((H-L),ABS(REF(C,1)-H)),ABS(REF(C,1)-L));

ATR:=EMA(TR,LENGTH2);

MIDLINE^^EMA((H + L + C)/3,LENGTH1);

UPBAND^^MIDLINE + N*ATR;

DOWNBAND^^MIDLINE - N*ATR;

BKVOL=0 AND C>=UPBAND AND REF(C,1)<REF(UPBAND,1),BPK;

SKVOL=0 AND C<=DOWNBAND AND REF(C,1)>REF(DOWNBAND,1),SPK;

BKVOL>0 AND C<=MIDLINE,SP(BKVOL);

SKVOL>0 AND C>=MIDLINE,BP(SKVOL);

// 止损

// stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP;

C<=BKPRICE*(1-SLOSS*0.01),SP;

AUTOFILTER;

The trading logic of this strategy is simple: first calculate the ATR based on the parameters, then calculate the average of the highest, lowest, and closing prices of all K-line BARs, and find the EMA based on these average data. Finally, combine the coefficients N in the ATR parameters. Calculate the upBand, downBand.

Opening position, counterhand is based on the closing price breakdown of the downtrend. Breaking up the uptrend counterhand (when holding a hollow position) is more frequent, breaking down the downtrend counterhand open. When the closing price reaches the midline, it is flat, and the closing price until the stop loss price is also flat (according to SLOSS stop loss, SLOSS is 1 or 0.01, i.e. 1%)). The strategy is executed on a closing price model.

OK, now that we understand the strategic needs and ideas of Ma, we can start transplanting.

Transplantation, prototyping of design strategies

The strategy prototype code is no more than 1 to 200 lines, and to make it easier to learn how to write a strategy, the annotation is written directly in the strategy code.

// 解析params参数,从字符串解析为对象

var arrParam = JSON.parse(params)

// 该函数创建图表配置

function createChartConfig(symbol, atrPeriod, emaPeriod, index) { // symbol : 交易对, atrPeriod : ATR参数周期 , emaPeriod : EMA参数周期 , index 对应的交易所对象索引

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K线数据系列

name: symbol,

id: symbol + "-" + index,

data: []

}, {

type: 'line', // EMA

name: symbol + ',EMA:' + emaPeriod,

data: [],

}, {

type: 'line', // upBand

name: symbol + ',upBand' + atrPeriod,

data: []

}, {

type: 'line', // downBand

name: symbol + ',downBand' + atrPeriod,

data: []

}, {

type: 'flags',

onSeries: symbol + "-" + index,

data: [],

}

]

}

return chart

}

// 主要逻辑

function process(e, kIndex, c) { // e 即交易所对象,exchanges[0] ... , kIndex K线数据在图表中的数据系列, c 为图表对象

// 获取K线数据

var r = e.GetRecords(e.param.period)

if (!r || r.length < e.param.atrPeriod + 2 || r.length < e.param.emaPeriod + 2) {

// K线数据长度不足则返回

return

}

// 计算ATR指标

var atr = TA.ATR(r, e.param.atrPeriod)

var arrAvgPrice = []

_.each(r, function(bar) {

arrAvgPrice.push((bar.High + bar.Low + bar.Close) / 3)

})

// 计算EMA指标

var midLine = TA.EMA(arrAvgPrice, e.param.emaPeriod)

// 计算上下轨

var upBand = []

var downBand = []

_.each(midLine, function(mid, index) {

if (index < e.param.emaPeriod - 1 || index < e.param.atrPeriod - 1) {

upBand.push(NaN)

downBand.push(NaN)

return

}

upBand.push(mid + e.param.trackRatio * atr[index])

downBand.push(mid - e.param.trackRatio * atr[index])

})

// 画图

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == e.state.lastBarTime) {

// 更新

c.add(kIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

c.add(kIndex + 1, [r[i].Time, midLine[i]], -1)

c.add(kIndex + 2, [r[i].Time, upBand[i]], -1)

c.add(kIndex + 3, [r[i].Time, downBand[i]], -1)

} else if (r[i].Time > e.state.lastBarTime) {

// 添加

e.state.lastBarTime = r[i].Time

c.add(kIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

c.add(kIndex + 1, [r[i].Time, midLine[i]])

c.add(kIndex + 2, [r[i].Time, upBand[i]])

c.add(kIndex + 3, [r[i].Time, downBand[i]])

}

}

// 检测持仓

var pos = e.GetPosition()

if (!pos) {

return

}

var holdAmount = 0

var holdPrice = 0

if (pos.length > 1) {

throw "同时检测到多空持仓!"

} else if (pos.length != 0) {

holdAmount = pos[0].Type == PD_LONG ? pos[0].Amount : -pos[0].Amount

holdPrice = pos[0].Price

}

if (e.state.preBar == -1) {

e.state.preBar = r[r.length - 1].Time

}

// 检测信号

if (e.state.preBar != r[r.length - 1].Time) { // 收盘价模型

if (holdAmount <= 0 && r[r.length - 3].Close < upBand[upBand.length - 3] && r[r.length - 2].Close > upBand[upBand.length - 2]) { // 收盘价上穿上轨

if (holdAmount < 0) { // 持有空仓,平仓

Log(e.GetCurrency(), "平空仓", "#FF0000")

$.CoverShort(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: '平', text: "平空仓"})

}

// 开多

Log(e.GetCurrency(), "开多仓", "#FF0000")

$.OpenLong(e, e.param.symbol, 10)

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: '多', text: "开多仓"})

} else if (holdAmount >= 0 && r[r.length - 3].Close > downBand[downBand.length - 3] && r[r.length - 2].Close < downBand[downBand.length - 2]) { // 收盘价下穿下轨

if (holdAmount > 0) { // 持有多仓,平仓

Log(e.GetCurrency(), "平多仓", "#FF0000")

$.CoverLong(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: '平', text: "平多仓"})

}

// 开空

Log(e.GetCurrency(), "开空仓", "#FF0000")

$.OpenShort(e, e.param.symbol, 10)

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: '空', text: "开空仓"})

} else {

// 平仓

if (holdAmount > 0 && (r[r.length - 2].Close <= holdPrice * (1 - e.param.stopLoss) || r[r.length - 2].Close <= midLine[midLine.length - 2])) { // 持多仓,收盘价小于等于中线,按开仓价格止损

Log(e.GetCurrency(), "触发中线或止损,平多仓", "#FF0000")

$.CoverLong(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: '平', text: "平多仓"})

} else if (holdAmount < 0 && (r[r.length - 2].Close >= holdPrice * (1 + e.param.stopLoss) || r[r.length - 2].Close >= midLine[midLine.length - 2])) { // 持空仓,收盘价大于等于中线,按开仓价格止损

Log(e.GetCurrency(), "触发中线或止损,平空仓", "#FF0000")

$.CoverShort(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: '平', text: "平空仓"})

}

}

e.state.preBar = r[r.length - 1].Time

}

}

function main() {

var arrChartConfig = []

if (arrParam.length != exchanges.length) {

throw "参数和交易所对象不匹配!"

}

var arrState = _G("arrState")

_.each(exchanges, function(e, index) {

if (e.GetName() != "Futures_Binance") {

throw "不支持该交易所!"

}

e.param = arrParam[index]

e.state = {lastBarTime: 0, symbol: e.param.symbol, currency: e.GetCurrency()}

if (arrState) {

if (arrState[index].symbol == e.param.symbol && arrState[index].currency == e.GetCurrency()) {

Log("恢复:", e.state)

e.state = arrState[index]

} else {

throw "恢复的数据和当前设置不匹配!"

}

}

e.state.preBar = -1 // 初始设置-1

e.SetContractType(e.param.symbol)

Log(e.GetName(), e.GetLabel(), "设置合约:", e.param.symbol)

arrChartConfig.push(createChartConfig(e.GetCurrency(), e.param.atrPeriod, e.param.emaPeriod, index))

})

var chart = Chart(arrChartConfig)

chart.reset()

while (true) {

_.each(exchanges, function(e, index) {

process(e, index + index * 4, chart)

Sleep(500)

})

}

}

function onexit() {

// 记录 e.state

var arrState = []

_.each(exchanges, function(e) {

arrState.push(e.state)

})

Log("记录:", arrState)

_G("arrState", arrState)

}

The policy parameters:

var params = '[{

"symbol" : "swap", // 合约代码

"period" : 86400, // K线周期,86400秒即为一天

"stopLoss" : 0.07, // 止损系数,0.07即7%

"atrPeriod" : 10, // ATR指标参数

"emaPeriod" : 10, // EMA指标参数

"trackRatio" : 1, // 上下轨系数

"openRatio" : 0.1 // 预留的开仓百分比,暂时没支持

}, {

"symbol" : "swap",

"period" : 86400,

"stopLoss" : 0.07,

"atrPeriod" : 10,

"emaPeriod" : 10,

"trackRatio" : 1,

"openRatio" : 0.1

}]'

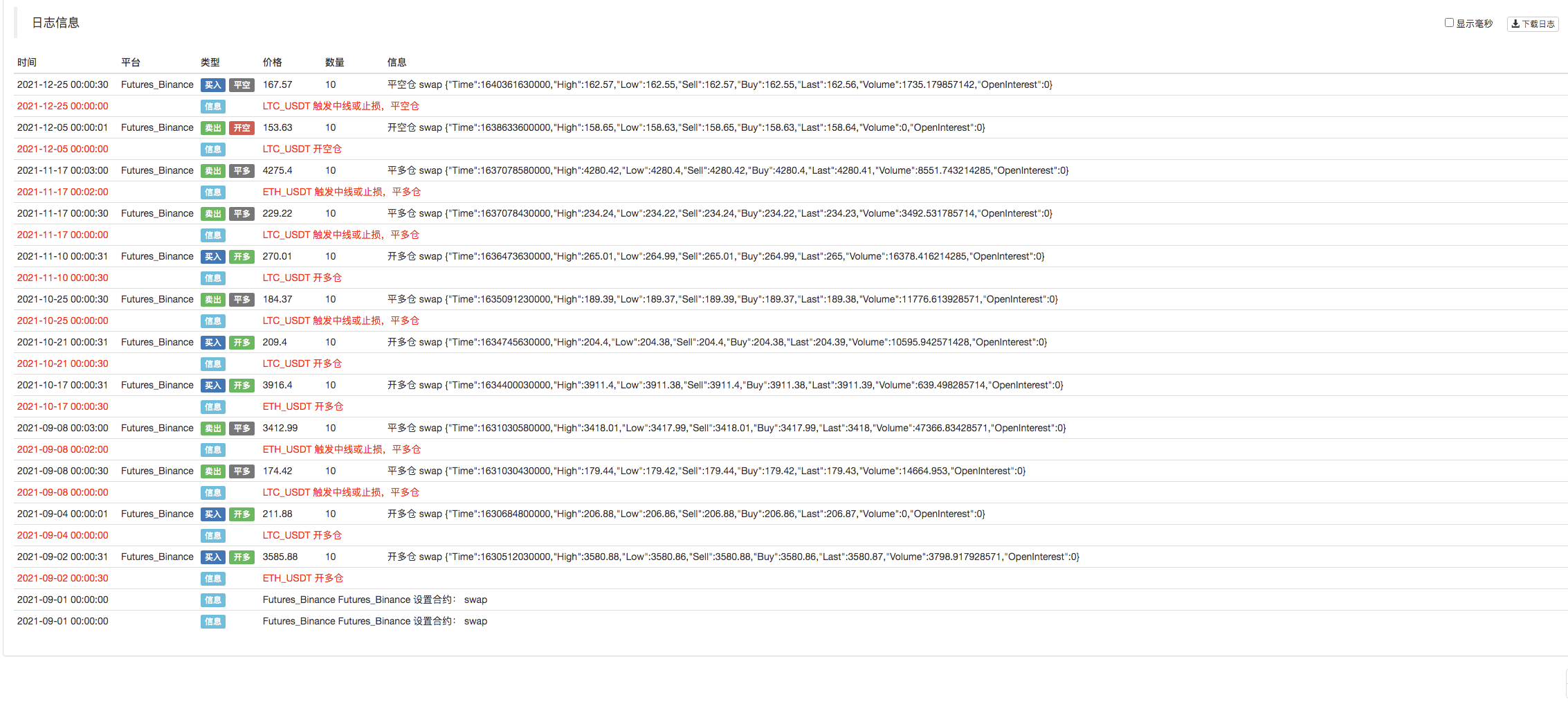

Re-tested

The source code of the strategy:https://www.fmz.com/strategy/339344

The policy is for review, study and research purposes only. Please modify, optimize, and reference it on your own.

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Strategy testing methods based on random market generators explored

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- If you haven't written a strategy yet with Pine, which is so easy to learn, then I...

- Detailed Explanation of Equilibrium & Grid Strategies

- It's about a beauty - how to design simple and effective strategies.

- The digital currency market has a new strategy for robbing coins (Teaching)

- Design a Multiple-Chart Plotting Library

- Designing a multigraph line library

- 60 lines of code to implement an idea -- the contract copying strategy.

- Design of an order synchronization system based on FMZ quantification (2)

- Design of an order synchronization system based on FMZ quantification (1)

- Upgrade! digital currency futures class Martin strategy

- Digital currency market review 2021 and the 10 simplest strategies to miss

- JavaScript implementation of the Fisher pointer and mapping on FMZ

- Digital currency cash multi-variety two-way strategy (teaching)

- Digital currency futures with double-equal turning point strategies (Teaching)

- Updates on the capital rate strategy and recommended actions

- Research on the design of hedging strategies for single-period loans

- FMZ platform Python replicator app for the first time - crawling Binance announcements

- dYdX strategy design paradigm - Randomized trading strategy

- Inventors quantify trading platforms with quick access app

- The exchange rate of the currency's futures contract is the return of the interest rate analysis