Channel strategy based on ATR

Author: The Baths of Archimedes, Date: 2018-11-30 09:19:56Tags: OKEXATRMyLanguage

-

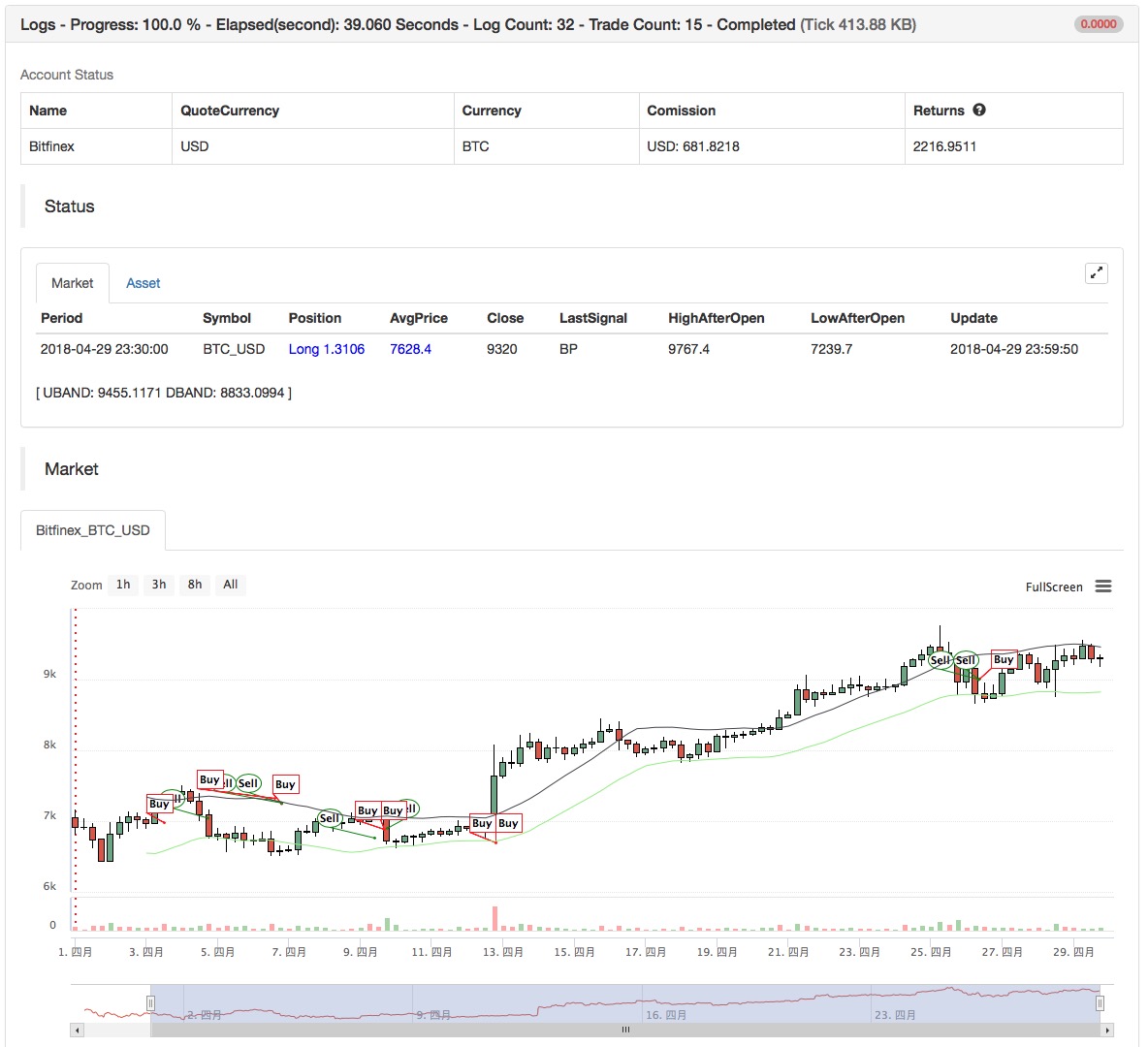

Strategy name: Channel strategy based on ATR volatility index

-

Strategy idea: Channel Adaptive Strategy, Fixed Stop + Floating Stop

-

Data Cycle: Multi-Cycle

-

Main chart: Draw UBAND, formula: UBAND ^^ MAC + MATR; Draw DBAND, formula: DBAND ^^ MAC-MATR;

-

Secondary chart: none

(*backtest

start: 2018-06-01 00:00:00

end: 2018-07-01 00:00:00

period: 1h

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

args: [["TradeAmount",10,126961],["ContractType","this_week",126961]]

*)

TR1:=MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW));

ATR:=MA(TR1,N);

MAC:=MA(C,N);

UBAND^^MAC+M*ATR;

DBAND^^MAC-M*ATR;

H>=HHV(H,N),BPK;

L<=LLV(L,N),SPK;

(H>=HHV(H,M*N) OR C<=UBAND) AND BKHIGH>=BKPRICE*(1+M*SLOSS*0.01),SP;

(L<=LLV(L,M*N) OR C>=DBAND) AND SKLOW<=SKPRICE*(1-M*SLOSS*0.01),BP;

// 止损

// stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP;

C<=BKPRICE*(1-SLOSS*0.01),SP;

AUTOFILTER;

Related

- Channel strategy based on ATR volatility indicator

- Break High and Low - Volume Index Weighting Strategy

- Dual Thrust (MyLanguage version)

- AlphaTrend use mfi

- Dynamic Trend Following Strategy

- SUPERTREND ATR WITH TRAILING STOP LOSS

- TURTLE-ATR Bollinger Bands Breakout Strategy

- baguette by multigrain

- MilleMachine

- SUPERTREND Trend-following Long Position with Stop-loss and Take-profit Strategy

More

- M Language “Turtle Trading strategy” implementations(V 1.0)

- OrdersDetail interface wrapped in Bithumb

- (Learning) API and code learning document in the tutorial

- Visualized futures ordering patterns

- Relative Strength Strategy Based on Price

- Dual Thrust (MyLanguage version)

- Bitmex position-change push(websocket)

- DMI and High-Low Strategy

- Combination of Double MA and RSI

- Trading Strategy of Traditional MA Index and KD Index

- Break High and Low - Volume Index Weighting Strategy

- Channel strategy based on ATR volatility indicator

- MACD+MA Indicator Combination Strategy

- The experience of the Malayalam beach strategy

- Drawing K-lines using the linear class library as well as the example of a straight line graph

- Multi-exchange pooling of markets/orders Strategies examples

- Push the price information to telegram

- Visualize using custom functions Test examples

- Transplanting OKCoin to the cabbage harvester

- BITMEX Strategy Tests for visualizing the strategy writing example