RSI MTF Ob+Os

Author: Inventors quantified, Date: 2022-05-09 15:35:09Tags: RSI

Hello Traders,

This indicator use the same concept as my previous indicator “CCI MTF Ob+Os”.

It is a simple “Relative Strength Index” ( RSI ) indicator with multi-timeframe (MTF) overbought and oversold level.

It can detect overbought and oversold level up to 5 timeframes, which help traders spot potential reversal point more easily.

There are options to select 1-5 timeframes to detect overbought and oversold.

Aqua Background is “Oversold” , looking for “Long”. Orange Background is “Overbought” , looking for “Short”.

Have fun :)

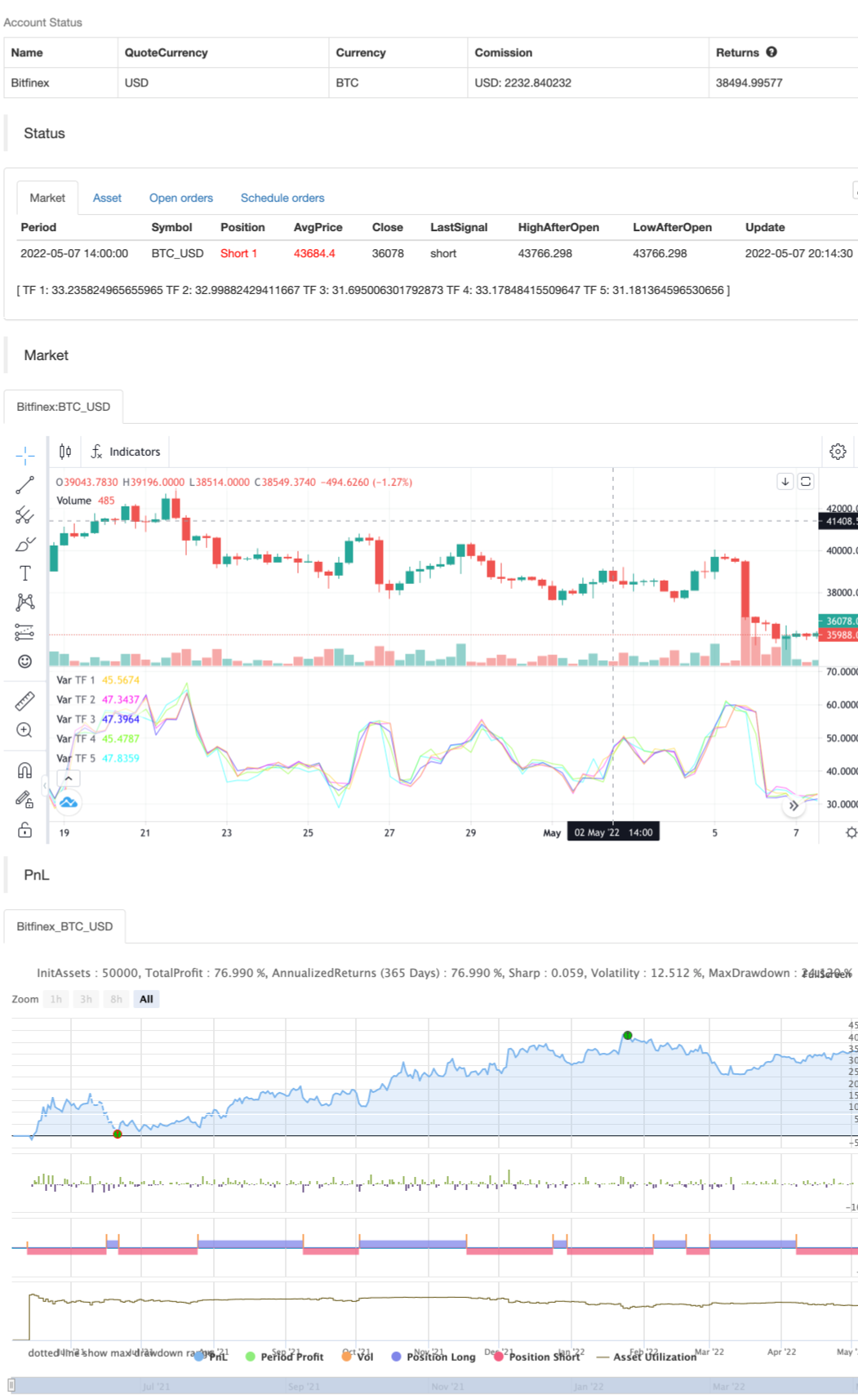

/*backtest

start: 2021-05-08 00:00:00

end: 2022-05-07 23:59:00

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © thakon33

// __ __ __ ____ ____

// / /_/ / ___ _/ /_____ ___ |_ /|_ /

// / __/ _ \/ _ `/ '_/ _ \/ _ \_/_ <_/_ <

// \__/_//_/\_,_/_/\_\\___/_//_/____/____/

//@version=5

indicator("RSI MTF Ob+Os")

//------------------------------------------------------------------------------

// Input

var g_rsi = "[ RSI SETTING ]"

rsiSrc = input (title="Source", defval=close, group=g_rsi)

rsiLength = input.int(title="Length", defval=14, minval=1, group=g_rsi)

rsiOverbought = input.int(title="Overbought", defval=65, minval=50, maxval=99, step=1, group=g_rsi)

rsiOversold = input.int(title="Oversold", defval=35, minval=1, maxval=50, step=1, group=g_rsi)

var g_tf = "[ SELECT TIMEFRAME ]"

rsiTf1 = input.timeframe(title="Timeframe 1", defval="15", group=g_tf, inline="tf1")

rsiTf2 = input.timeframe(title="Timeframe 2", defval="30", group=g_tf, inline="tf2")

rsiTf3 = input.timeframe(title="Timeframe 3", defval="60", group=g_tf, inline="tf3")

rsiTf4 = input.timeframe(title="Timeframe 4", defval="120", group=g_tf, inline="tf4")

rsiTf5 = input.timeframe(title="Timeframe 5", defval="240", group=g_tf, inline="tf5")

rsiTf1_E = input.bool(title="", defval=true, group=g_tf, inline="tf1")

rsiTf2_E = input.bool(title="", defval=true, group=g_tf, inline="tf2")

rsiTf3_E = input.bool(title="", defval=true, group=g_tf, inline="tf3")

rsiTf4_E = input.bool(title="", defval=true, group=g_tf, inline="tf4")

rsiTf5_E = input.bool(title="", defval=true, group=g_tf, inline="tf5")

//------------------------------------------------------------------------------

// Calculate RSI

Fsec(Sym, Tf, Exp) =>

request.security(Sym, Tf, Exp[barstate.isrealtime ? 1 : 0], barmerge.gaps_off, barmerge.lookahead_off) [barstate.isrealtime ? 0 : 1]

rsi1 = Fsec(syminfo.tickerid, rsiTf1, ta.rsi(rsiSrc, rsiLength))

rsi2 = Fsec(syminfo.tickerid, rsiTf2, ta.rsi(rsiSrc, rsiLength))

rsi3 = Fsec(syminfo.tickerid, rsiTf3, ta.rsi(rsiSrc, rsiLength))

rsi4 = Fsec(syminfo.tickerid, rsiTf4, ta.rsi(rsiSrc, rsiLength))

rsi5 = Fsec(syminfo.tickerid, rsiTf5, ta.rsi(rsiSrc, rsiLength))

//------------------------------------------------------------------------------

// RSI Overbought and Oversold detect

rsi1_Ob = not rsiTf1_E or rsi1 >= rsiOverbought

rsi2_Ob = not rsiTf2_E or rsi2 >= rsiOverbought

rsi3_Ob = not rsiTf3_E or rsi3 >= rsiOverbought

rsi4_Ob = not rsiTf4_E or rsi4 >= rsiOverbought

rsi5_Ob = not rsiTf5_E or rsi5 >= rsiOverbought

rsi1_Os = not rsiTf1_E or rsi1 <= rsiOversold

rsi2_Os = not rsiTf2_E or rsi2 <= rsiOversold

rsi3_Os = not rsiTf3_E or rsi3 <= rsiOversold

rsi4_Os = not rsiTf4_E or rsi4 <= rsiOversold

rsi5_Os = not rsiTf5_E or rsi5 <= rsiOversold

rsiOb = rsi1_Ob and rsi2_Ob and rsi3_Ob and rsi4_Ob and rsi5_Ob

rsiOs = rsi1_Os and rsi2_Os and rsi3_Os and rsi4_Os and rsi5_Os

//------------------------------------------------------------------------------

// Drawing on chart

plot (rsiTf1_E ? rsi1 : na, title="TF 1", color=color.rgb(255, 205, 22, 20), linewidth=1)

plot (rsiTf2_E ? rsi2 : na, title="TF 2", color=color.rgb(255, 22, 239, 20), linewidth=1)

plot (rsiTf3_E ? rsi3 : na, title="TF 3", color=color.rgb(38, 22, 255, 0), linewidth=1)

plot (rsiTf4_E ? rsi4 : na, title="TF 4", color=color.rgb(123, 253, 22, 20), linewidth=1)

plot (rsiTf5_E ? rsi5 : na, title="TF 5", color=color.rgb(0, 255, 255, 50), linewidth=1)

strategy.entry("BUY", strategy.long, when=rsiOb)

strategy.entry("SELL", strategy.short, when=rsiOs)

//==============================================================================

//==============================================================================

Related

- Dynamic Dual-Indicator Momentum Trend Quantitative Strategy System

- Dual Moving Average-RSI Multi-Signal Trend Trading Strategy

- Dynamic EMA System Combined with RSI Momentum Indicator for Optimized Intraday Trading Strategy

- Multi-Technical Indicator Crossover Momentum Trend Following Strategy

- Dynamic Stop-Loss Adjustment Elephant Bar Trend Following Strategy

- Dual-Period RSI Trend Momentum Strategy with Pyramiding Position Management System

- Dynamic RSI Quantitative Trading Strategy with Multiple Moving Average Crossover

- Dynamic Trend RSI Indicator Crossing Strategy

- Multi-Dimensional KNN Algorithm with Volume-Price Candlestick Pattern Trading Strategy

- Adaptive Multi-Strategy Dynamic Switching System: A Quantitative Trading Strategy Combining Trend Following and Range Oscillation

- Advanced Multi-Indicator Multi-Dimensional Trend Cross Quantitative Strategy

More

- EHMA Range Strategy

- Moving Average Buy-Sell

- Midas Mk. II - Ultimate Crypto Swing

- TMA-Legacy

- TV highs and lows

- Best TradingView Strategy

- Big Snapper Alerts R3.0 + Chaiking Volatility condition + TP RSI

- Chande Kroll Stop

- CCI + EMA with RSI Cross Strategy

- EMA bands + leledc + bollinger bands trend catching strategy

- MACD Willy Strategy

- RSI - Buy Sell Signals

- Heikin-Ashi Trend

- HA Market Bias

- Ichimoku Cloud Smooth Oscillator

- Williams %R - Smoothed

- QQE MOD + SSL Hybrid + Waddah Attar Explosion

- Buy/Sell Strat

- Triple Supertrend with EMA and ADX

- Tom DeMark Sequential Heat Map