Dual Indicator Slight Reversal Trading Strategy

Author: ChaoZhang, Date: 2023-10-17 15:45:09Tags:

Overview

The Dual Indicator Slight Reversal Trading Strategy combines momentum and trend-following indicators for short-term trading. The strategy first generates trading signals using a reversal indicator, then combines it with a trend-following indicator to produce more reliable signals. It aims to capture short-term price reversals within the context of medium-term trends.

Principle

The strategy consists of two sub-strategies.

The first is the 123 Reversal strategy. It monitors if a peak reversal pattern occurs. Specifically, it will generate a long signal if the closing price of the prior two days drops and the current closing price is higher than the previous closing price, with the Stochastic slow line below 50. It will generate a short signal if the closing prices of the prior two days rise and the current closing price is lower than the previous closing price, with the Stochastic fast line above 50.

The second is the Ergodic indicator, which is a trend-following indicator identifying the direction of medium to long term trends. It incorporates the ideas of moving averages and MACD, using single exponential smoothed moving averages and MACD’s fast and slow lines crossovers to generate trading signals.

The strategy combines the signals from the two sub-strategies. It will only open a position when the two sub-strategies generate consistent signals. That is, it only trades when there is a short-term slight reversal along with a strong medium to long term trend.

Advantages

Combining multiple indicators can effectively filter false signals and improve reliability.

Combining reversal and trend-following provides both short-term opportunities and avoids counter-trend trades.

The Stochastic parameter settings are quite robust to reduce whipsaws.

The smoothing parameters of the Ergodic indicator are reasonably set to better identify trends.

The trading frequency is appropriate, capturing adequate opportunities without overtrading.

Suitable for medium-term trading with flexible timeframes.

Risks

Reversal signals may produce false signals and need validation from trend indicators.

The low trading frequency may miss some short-term opportunities.

There could be reversals after reversals, requiring timely stop loss.

Inappropriate parameter settings may significantly impact results.

Relying too much on technical indicators risks overfitting.

Enhancement

Test different parameter settings to optimize sub-strategies.

Introduce more indicators to build multi-factor models.

Apply machine learning for dynamic parameter optimization.

Research different stop loss methods to control risks.

Study opportunity costs and adjust strategy trading frequency.

Test strategy robustness across different market regimes.

Conclusion

The Dual Indicator Slight Reversal Trading Strategy attempts to capture short-term reversal opportunities on medium-term timeframes using combinations of reversal and trend-following indicators. It can effectively filter false signals and control risks to some extent. However, issues like missing short-term opportunities, parameter sensitivity, and overfitting risks remain. Further enhancing stability and profitability can be achieved by incorporating more indicators, optimizing parameters, adjusting trading frequency, and testing across markets. Overall, the strategy represents a simple and practical quantitative approach worth exploring and applying.

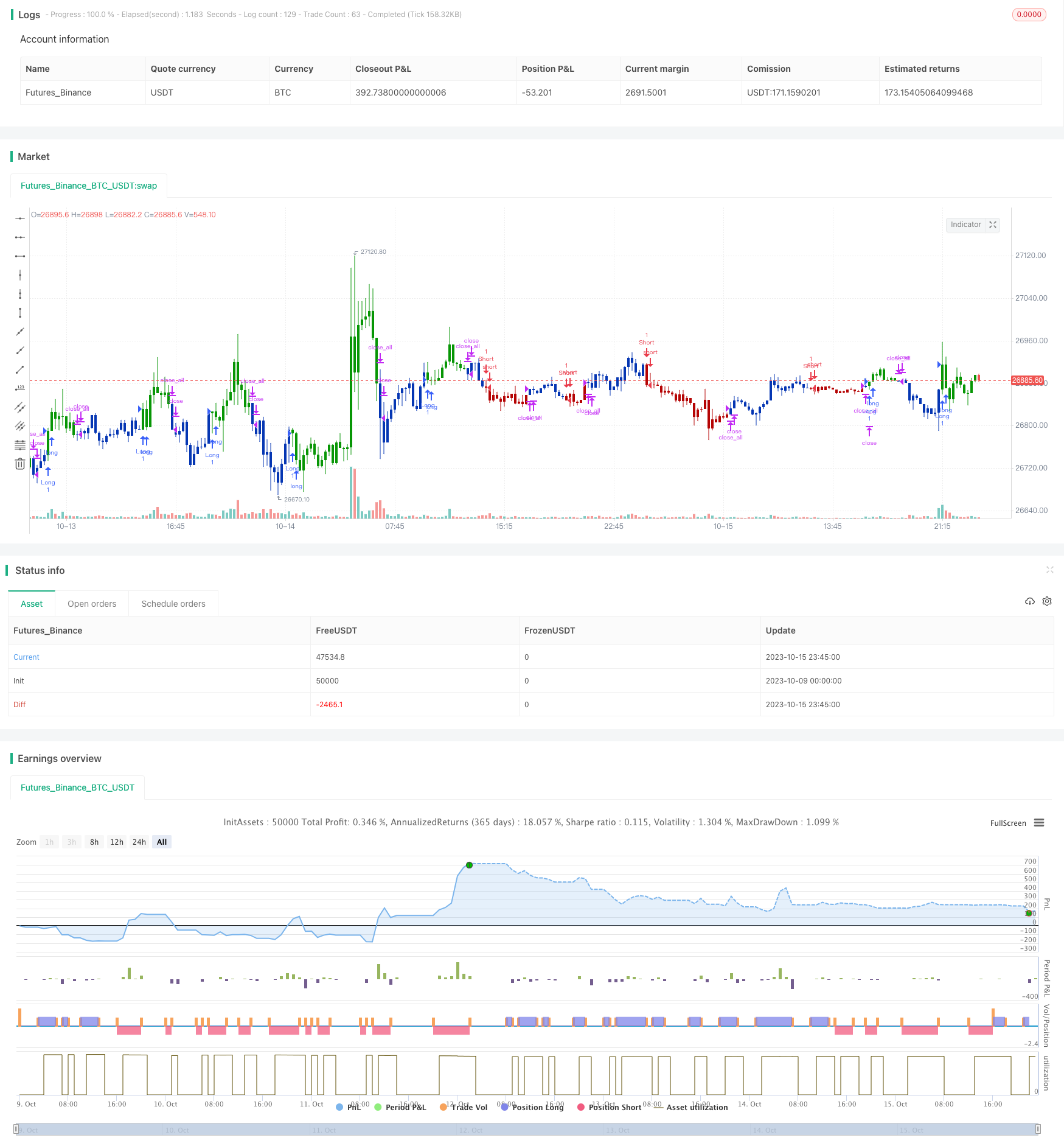

/*backtest

start: 2023-10-09 00:00:00

end: 2023-10-16 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 28/07/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This is one of the techniques described by William Blau in his book "Momentum,

// Direction and Divergence" (1995). If you like to learn more, we advise you to

// read this book. His book focuses on three key aspects of trading: momentum,

// direction and divergence. Blau, who was an electrical engineer before becoming

// a trader, thoroughly examines the relationship between price and momentum in

// step-by-step examples. From this grounding, he then looks at the deficiencies

// in other oscillators and introduces some innovative techniques, including a

// fresh twist on Stochastics. On directional issues, he analyzes the intricacies

// of ADX and offers a unique approach to help define trending and non-trending periods.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

EMDI(r,s,u,SmthLen) =>

pos = 0

xEMA = ema(close, r)

xEMA_S = close - xEMA

xEMA_U = ema(ema(xEMA_S, s), u)

xSignal = ema(xEMA_U, u)

pos := iff(xEMA_U > xSignal, 1,

iff(xEMA_U < xSignal, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Ergodic MDI", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

r = input(32, minval=1)

s = input(5, minval=1)

u = input(5, minval=1)

SmthLen = input(3, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posEMDI = EMDI(r,s,u,SmthLen)

pos = iff(posReversal123 == 1 and posEMDI == 1 , 1,

iff(posReversal123 == -1 and posEMDI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Moving Average Crossover Strategy

- Tracking Breakout Strategy

- Dual Moving Average Monitoring Model

- Mean Reversion Strategy Based on ATR

- Relative Volume Trend Following Trading Strategy

- MACD Trend Balancing Strategy

- EMA and Heikin Ashi Trading Strategy

- Trend Following Long Only Strategy

- Multi-model Candlestick Pattern Combination Strategy

- Channel Reversion Trading Strategy Analysis

- Surf Rider Strategy

- Momentum Tracking Strategy Based on Indicator Integration

- The Hulk Pullback Reversal Strategy

- Multifactor Dynamic Money Management Strategy

- Triple EMA With Trailing Stop Loss Strategy

- Adaptive Volatility Finite Volume Elements Strategy

- Trend Tracking Four Elements Strategy

- Double Moving Average Reversal Strategy

- STC MA ATR Integrated Trend Trading Strategy

- Bull Trend Riding Strategy Based on Stochastic RSI with Special Rules for Heavy Bullish Bias