Algorithm RSI Range Breakout Strategy

Author: ChaoZhang, Date: 2023-10-17 17:14:09Tags:

Overview

This strategy monitors the breakout of RSI indicator in different ranges to implement buying low and selling high. It goes long when RSI is in the low range and goes short when RSI is in the high range, thus reversing position when overbought or oversold conditions appear.

Strategy Logic

Set RSI period to 14

Set RSI buy signal ranges:

- Range 1: RSI <= 27

- Range 2: RSI <= 18

Set RSI sell signal ranges:

- Range 1: RSI >= 68

- Range 2: RSI >= 80

When RSI enters buy range, go long:

- If RSI enters range 1 (below 27), go long 1 lot

- If RSI enters range 2 (below 18), go additional long 1 lot

When RSI enters sell range, go short:

- If RSI enters range 1 (above 68), go short 1 lot

- If RSI enters range 2 (above 80), go additional short 1 lot

Set fixed take profit to 2500 pips and stop loss to 5000 pips

Close position when RSI exits signal range

Advantage Analysis

The double range setting helps better identify overbought and oversold conditions, avoiding missing reversal opportunities

Adopting fixed take profit and stop loss in pips prevents chasing trends too much

RSI is a mature oscillator in identifying overbought and oversold levels with advantages over other indicators

With proper parameter tuning, this strategy can effectively catch trend reversal points and generate excess returns

Risk Analysis

RSI divergence may happen leading to consecutive losses from sustained short position

Fixed take profit and stop loss may not match market volatility, unable to profit or stopping out prematurely

Improper range setting may lead to missing trades or frequent unprofitable trades

This strategy relies much on parameter optimization based on backtests. Careful walk-forward analysis is needed.

Optimization Directions

Test effectiveness of RSI with different period lengths

Optimize buy and sell range values to fit characteristics of different products

Research dynamic take profit and stop loss to improve profitability and reasonability

Consider combining other indicators for ensemble trading to improve robustness

Explore machine learning techniques to auto-optimize parameter ranges for robustness

Conclusion

This strategy is based on RSI’s overbought and oversold principles. By adopting double trading ranges, it utilizes RSI indicator effectively, capturing market extremes with decent stability. However, it has some parameter reliance and needs optimization across products. If tuned properly, this strategy can yield good excess returns. In summary, it is a simple yet effective trading strategy using a mature indicator, worth researching for improvements and providing insights for quantitative trading.

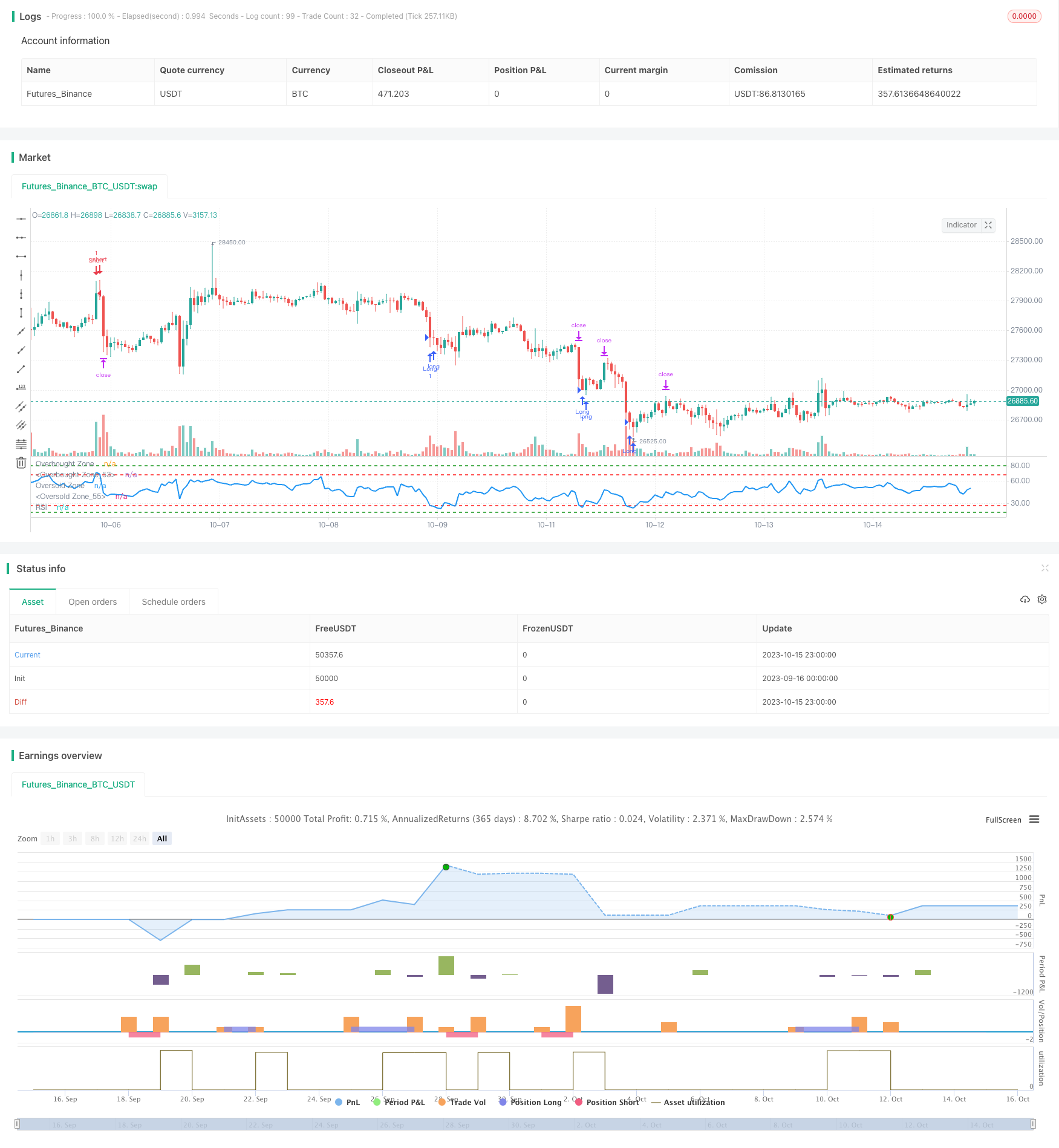

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Rawadabdo

// Ramy's Algorithm

//@version=5

strategy("BTC/USD - RSI", overlay=false, initial_capital = 5000)

// User input

length = input(title = "Length", defval=14, tooltip="RSI period")

first_buy_level = input(title = "Buy Level 1", defval=27, tooltip="Level where 1st buy triggers")

second_buy_level = input(title = "Buy Level 2", defval=18, tooltip="Level where 2nd buy triggers")

first_sell_level = input(title = "Sell Level 1", defval=68, tooltip="Level where 1st sell triggers")

second_sell_level = input(title = "Sell Level 2", defval=80, tooltip="Level where 2nd sell triggers")

takeProfit= input(title="target Pips", defval=2500, tooltip="Fixed pip stop loss distance")

stopLoss = input(title="Stop Pips", defval=5000, tooltip="Fixed pip stop loss distance")

lot = input(title = "Lot Size", defval = 1, tooltip="Trading Lot size")

// Get RSI

vrsi = ta.rsi(close, length)

// Entry Conditions

long1 = (vrsi <= first_buy_level and vrsi>second_buy_level)

long2 = (vrsi <= second_buy_level)

short1= (vrsi >= first_sell_level and vrsi<second_sell_level)

short2= (vrsi >= second_sell_level)

// Entry Orders

// Buy Orders

if (long1 and strategy.position_size == 0)

strategy.entry("Long", strategy.long, qty=lot, comment="Buy")

if (long2 and strategy.position_size == 0)

strategy.entry("Long", strategy.long, qty=lot, comment="Buy")

// Short Orders

if (short1 and strategy.position_size == 0)

strategy.entry("Short", strategy.short,qty=lot, comment="Sell")

if (short2 and strategy.position_size == 0)

strategy.entry("Short", strategy.short,qty=lot, comment="Sell")

// Exit our trade if our stop loss or take profit is hit

strategy.exit(id="Long Exit", from_entry="Long",qty = lot, profit=takeProfit, loss=stopLoss)

strategy.exit(id="Short Exit", from_entry="Short", qty = lot, profit=takeProfit, loss=stopLoss)

// plot data to the chart

hline(first_sell_level, "Overbought Zone", color=color.red, linestyle=hline.style_dashed, linewidth = 2)

hline(second_sell_level, "Overbought Zone", color=color.green, linestyle=hline.style_dashed, linewidth = 2)

hline(first_buy_level, "Oversold Zone", color=color.red, linestyle=hline.style_dashed, linewidth = 2)

hline(second_buy_level, "Oversold Zone", color=color.green, linestyle=hline.style_dashed, linewidth = 2)

plot (vrsi, title = "RSI", color = color.blue, linewidth=2)

- Multi-Indicator Buy and Sell Strategy

- Open-High Cross Over Trading Strategy

- Double K Crossbow Strategy

- Relative Body Index Crossover Strategy

- Multi-level Batch Take Profit BTC Robot Trading Strategy

- Dual Moving Average and RSI Reversal Trading Strategy

- Dual Moving Average Bollinger Band System Strategy

- Architecture Breakthrough Backtesting Strategy

- Breakout Strategy Based on Turtle Trading

- The DEMA Trend Following Strategy

- RSI Rising Crypto Trending Strategy

- EMA Slope Cross Trend Following Strategy

- TAM Intraday RSI Trading Strategy

- Exponential Moving Average Crossover Strategy

- Moving Average Crossover Strategy

- Tracking Breakout Strategy

- Dual Moving Average Monitoring Model

- Mean Reversion Strategy Based on ATR

- Relative Volume Trend Following Trading Strategy

- MACD Trend Balancing Strategy