Moving Average Tracking Stop Loss Strategy

Author: ChaoZhang, Date: 2023-10-24 11:21:57Tags:

Overview

The core idea of this strategy is to design an automated trading system that can profit in trending markets while controlling drawdowns by using moving averages and a trailing stop loss mechanism.

Strategy Logic

The strategy allows users to choose from various types of moving averages, including simple moving average, exponential moving average, weighted moving average, etc. Users can select the moving average type based on their preferences.

Users need to set the period of the moving average. Generally the period is between 20-60 for medium-term trading.

Once the moving average is chosen, the strategy will calculate it in real-time. It will go long when price breaks above the moving average and go short when price breaks below the moving average.

The strategy uses a trailing stop loss mechanism. After opening a position, it will continuously monitor the relationship between the moving average and price, and dynamically adjust the stop loss level. Specifically, the stop loss is set at the moving average plus/minus a stop loss percentage set by the user.

Users can set the stop loss percentage. A larger percentage means a wider stop loss range and less sensitivity. A smaller percentage means a tighter stop loss and lower risk. The stop loss percentage is generally set between 2%-5%.

After opening a position, if price breaks back through the moving average, the position will be closed.

Advantages

- Can open positions along the trend and gain larger profits in trending markets

- Uses trailing stop loss to adjust stop level based on price action, avoiding stops being too tight

- Allows customization of moving averages and stop loss percentage according to risk appetite

- Supports various moving average types, enabling optimization through testing

- Simple and clear logic, easy to understand and modify

Risks

- Price may fluctuate around moving average in range-bound markets, causing excessive trading

- A stop loss percentage that’s too wide may lead to enlarged losses

- Optimal parameters for moving average and stop loss may differ across products and timeframes

- Avoid using this strategy near major news events

Risks can be optimized and controlled by:

- Using the strategy in products and timeframes with obvious trends

- Adjusting moving average period, using longer-term moving averages

- Appropriately reducing stop loss percentage for tighter risk control

- Testing separately on each product to find optimal parameters

- Stop trading before major news events

Enhancement Opportunities

The strategy can be further optimized in the following aspects:

Add other indicators for confirmation, avoiding excessive trades during range-bound markets. MACD, KD can be added, so that signals are only taken when they align.

Use a combination of moving averages. For example, a 5-day MA and 20-day MA can be used together, so that trades are taken only when both align in the same direction.

Test parameters separately on each product and set optimal parameters. Parameters differ across products and timeframes so separate testing is needed.

Add position sizing rules. For example, fixed quantity for initial position, then add to position based on stop loss distance.

Set maximum number of trades per day or minimum time between trades. This limits excessive trading.

Add machine learning algorithms to dynamically optimize parameters based on historical data, avoiding static parameter setting.

Incorporate deep learning models to forecast price trend, assisting with trend direction judgement.

Conclusion

Overall this is a very practical trend following strategy. It uses moving averages to determine trend direction and trailing stops to control risk. It can produce good returns in trending markets. Combining parameter optimization and integration with other indicators or models can further enhance the stability and profitability. Users need to note differences in parameter settings across products and timeframes, as well as the impact of major events. Overall this strategy suits mid-level hedge funds and retail investors with some experience.

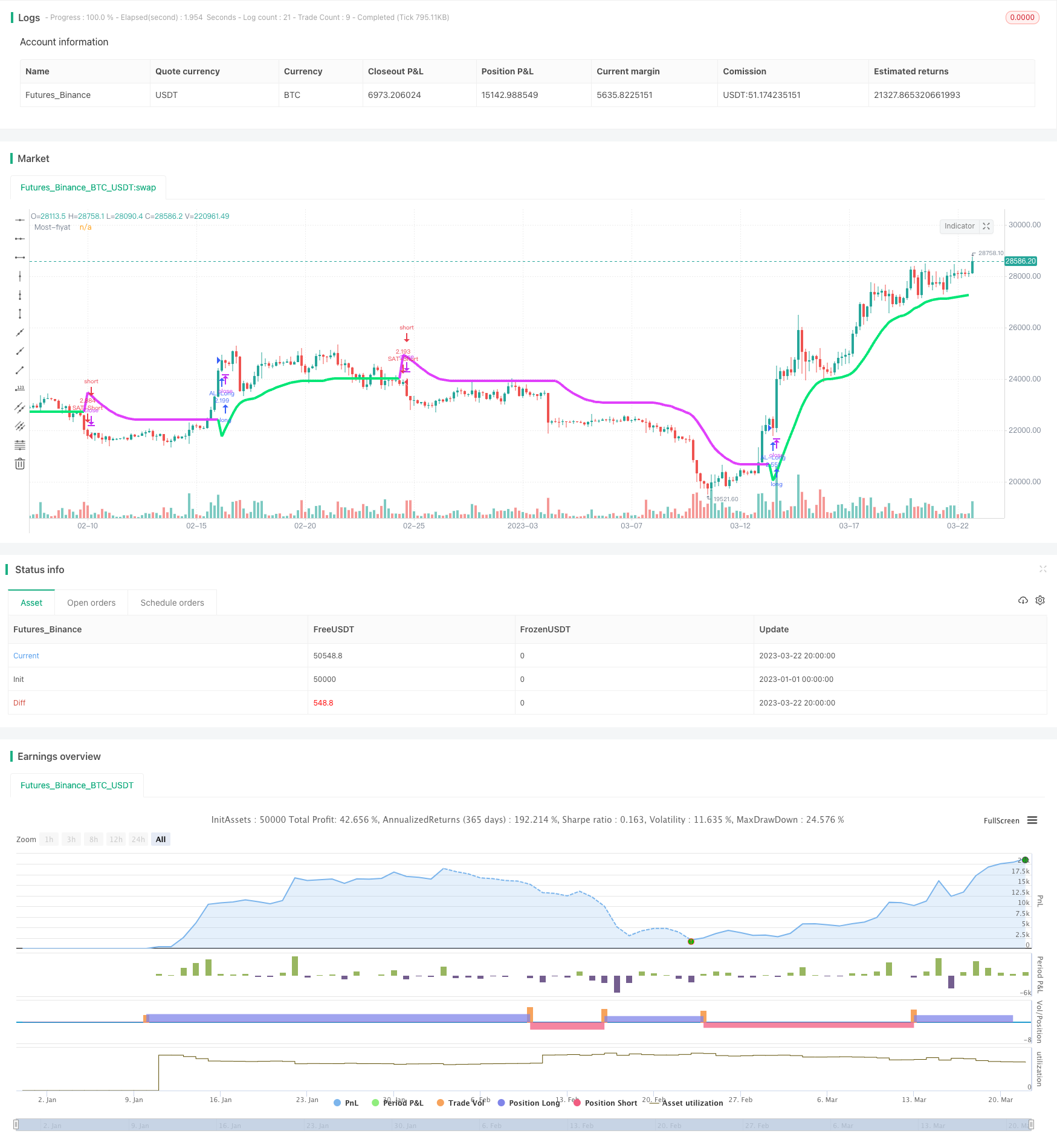

/*backtest

start: 2023-01-01 00:00:00

end: 2023-03-23 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//attoCryp, @HikmetSezen58

strategy("MOST Multi MAs", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

sx=input(defval = "close" ,title="Fiyat sec", options=[ "close", "high", "low", "open", "hl2", "hlc3", "hlco4", "hlcc4", "hlccc5"])

smox=input(defval = "HulleMA", title = "Hareketli Ortalama: ", options=["T3", "SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "EVWMA", "HullMA", "HulleMA", "LSMA", "ALMA", "TMA", "SSMA"])

timeFramemost = input(title="++++++++++++++++++++++++++++++++++++", defval="MOST Ayarlari:")

yuzde=input(defval=3.8, minval=0, step=0.1, title="Yuzde Oran")/100

ortalamauzunluk=input(defval=28, title="Periyot Uzunlugu", minval=1)

f=input(defval=0.4, step=0.1, title="T3 icin Factor", minval=0.01)

timeFrameadd=input(title="++++++++++++++++++++++++++++++++++++", defval="Diger Orta.Ayar:")

offsig=input(defval=4, title="LSMA icin Offset veya ALMA icin Sigma", minval=0)

offalma=input(defval=0.6, title="ALMA icin Offset", minval=0, step=0.01)

timeFramess=input(title="++++++++++++++++++++++++++++++++++++", defval="Baslangic-Bitis:")

gun_baslangic=input(defval=1, title="Baslangic Gunu", minval=1, maxval=31)

ay_baslangic=input(defval=1, title="Baslangic Ayi", minval=1, maxval=12)

yil_baslangic=input(defval=2017, title="Baslangic Yili", minval=2010)

gun_bitis=input(defval=1, title="Bitis Gunu", minval=1, maxval=31)

ay_bitis=input(defval=1, title="Bitis Ayi", minval=1, maxval=12)

yil_bitis = input(defval=2019, title="Bitis Yili", minval=2010)

// backtest icin baslangic ve bitis zamanlarini belirleme

baslangic=timestamp(yil_baslangic, ay_baslangic, gun_baslangic, 00, 00)

bitis=timestamp(yil_bitis, ay_bitis, gun_bitis, 23, 59)

zamanaraligi() => true

//guncel fiyatti belirleme

guncelfiyat=sx=="high"?high : sx=="close"?close : sx=="low"?low : sx=="open"?open : sx=="hl2"?(high+low)/2 : sx=="hlc3"?(high+low+close)/3 : sx=="hlco4"?(high+low+close+open)/4 : sx=="hlcc4"?(high+low+close+close)/4 : sx=="hlccc5"?(high+low+close+close+close)/5 : close

/////Ortalama Hesaplamalari/////

// Tillson T3

sm0(guncelfiyat,ortalamauzunluk,f) =>

t3e1=ema(guncelfiyat, ortalamauzunluk)

t3e2=ema(t3e1, ortalamauzunluk)

t3e3=ema(t3e2, ortalamauzunluk)

t3e4=ema(t3e3, ortalamauzunluk)

t3e5=ema(t3e4, ortalamauzunluk)

t3e6=ema(t3e5, ortalamauzunluk)

c1=-f*f*f

c2=3*f*f+3*f*f*f

c3=-6*f*f-3*f-3*f*f*f

c4=1+3*f+f*f*f+3*f*f

s0=c1 * t3e6 + c2 * t3e5 + c3 * t3e4 + c4 * t3e3

// Basit ortalama

sm1(guncelfiyat,ortalamauzunluk) =>

s1=sma(guncelfiyat, ortalamauzunluk)

// Ustel ortalama

sm2(guncelfiyat,ortalamauzunluk) =>

s2=ema(guncelfiyat, ortalamauzunluk)

// Cift Ustel ortalama

sm3(guncelfiyat,ortalamauzunluk) =>

s3=2*ema(guncelfiyat, ortalamauzunluk) - ema(ema(guncelfiyat, ortalamauzunluk), ortalamauzunluk)

// Uclu Ustel ortalama

sm4(guncelfiyat,ortalamauzunluk) =>

s4=3*(ema(guncelfiyat, ortalamauzunluk) - ema(ema(guncelfiyat, ortalamauzunluk), ortalamauzunluk)) + ema(ema(ema(guncelfiyat, ortalamauzunluk), ortalamauzunluk), ortalamauzunluk)

// Agirlikli Ortalama

sm5(guncelfiyat,ortalamauzunluk) =>

s5=wma(guncelfiyat, ortalamauzunluk)

// Hacim Agirlikli Ortalama

sm6(guncelfiyat,ortalamauzunluk) =>

s6=vwma(guncelfiyat, ortalamauzunluk)

// Smoothed

sm7(guncelfiyat,ortalamauzunluk) =>

s7=0.0

s7:=na(s7[1]) ? sma(guncelfiyat, ortalamauzunluk) : (s7[1] * (ortalamauzunluk - 1) + guncelfiyat) / ortalamauzunluk

// Hull Ortalama

sm8(guncelfiyat,ortalamauzunluk) =>

s8=wma(2 * wma(guncelfiyat, ortalamauzunluk / 2) - wma(guncelfiyat, ortalamauzunluk), round(sqrt(ortalamauzunluk)))

// Hull Ustel Ortalama

sm81(guncelfiyat,ortalamauzunluk) =>

s8=ema(2 * ema(guncelfiyat, ortalamauzunluk / 2) - ema(guncelfiyat, ortalamauzunluk), round(sqrt(ortalamauzunluk)))

// Least Square

sm9(guncelfiyat,ortalamauzunluk,offsig) =>

s9=linreg(guncelfiyat, ortalamauzunluk, offsig)

// Arnaud Legoux

sm10(guncelfiyat, ortalamauzunluk, offalma, offsig) =>

s10=alma(guncelfiyat, ortalamauzunluk, offalma, offsig)

// Triangular

sm11(guncelfiyat, ortalamauzunluk) =>

s11=sma(sma(guncelfiyat, ortalamauzunluk),ortalamauzunluk)

// SuperSmoother filter

sm12(guncelfiyat,ortalamauzunluk) =>

a1=exp(-1.414*3.14159 / ortalamauzunluk)

b1=2*a1*cos(1.414*3.14159 / ortalamauzunluk)

c2=b1

c3=(-a1)*a1

c1=1 - c2 - c3

s12=0.0

s12:=c1*(guncelfiyat + nz(guncelfiyat[1])) / 2 + c2*nz(s12[1]) + c3*nz(s12[2])

//Elastic Volume Weighted Moving Average

sm13(guncelfiyat,ortalamauzunluk) =>

hacimtoplam=sum(volume, ortalamauzunluk)

s13=0.0

s13:=(nz(s13[1]) * (hacimtoplam - volume)/hacimtoplam) + (volume*guncelfiyat/hacimtoplam)

ortalamafiyat=smox=="T3"?sm0(guncelfiyat,ortalamauzunluk,f) : smox=="SMA"?sm2(guncelfiyat,ortalamauzunluk) : smox=="EMA"?sm2(guncelfiyat,ortalamauzunluk) : smox=="DEMA"?sm3(guncelfiyat,ortalamauzunluk) : smox=="TEMA"?sm4(guncelfiyat,ortalamauzunluk) : smox=="WMA"?sm5(guncelfiyat,ortalamauzunluk) : smox=="VWMA"?sm6(guncelfiyat,ortalamauzunluk) : smox=="SMMA"?sm7(guncelfiyat,ortalamauzunluk) : smox=="HullMA"?sm8(guncelfiyat,ortalamauzunluk) : smox=="HulleMA"?sm81(guncelfiyat,ortalamauzunluk) : smox=="LSMA"?sm9(guncelfiyat,ortalamauzunluk,offsig) : smox=="ALMA"?sm10(guncelfiyat, ortalamauzunluk, offalma, offsig) : smox=="TMA"?sm11(guncelfiyat,ortalamauzunluk) : smox=="SSMA"?sm12(guncelfiyat,ortalamauzunluk) : smox=="EVWMA"?sm13(guncelfiyat,ortalamauzunluk) : guncelfiyat

/////MOST'u hesaplama/////

stopfiyat=ortalamafiyat*yuzde

mostfiyat=0.0

mostfiyat:=iff(ortalamafiyat>nz(mostfiyat[1],0) and ortalamafiyat[1]>nz(mostfiyat[1],0),max(nz(mostfiyat[1],0),ortalamafiyat-stopfiyat),iff(ortalamafiyat<nz(mostfiyat[1],0) and ortalamafiyat[1]<nz(mostfiyat[1],0),min(nz(mostfiyat[1],0),ortalamafiyat+stopfiyat),iff(ortalamafiyat>nz(mostfiyat[1],0),ortalamafiyat-stopfiyat,ortalamafiyat+stopfiyat)))

mostcolor=ortalamafiyat>mostfiyat?lime:fuchsia

plot(mostfiyat, color=mostcolor, linewidth=4, title="Most-fiyat")

/////AL-SAT LONG-SHORT girislerini belirleme/////

long=ortalamafiyat>mostfiyat and ortalamafiyat[1]<mostfiyat[1]

short=ortalamafiyat<mostfiyat and ortalamafiyat[1]>mostfiyat[1]

if (long)

strategy.entry("AL-Long", strategy.long, when = zamanaraligi())

if (short)

strategy.entry("SAT-Short", strategy.short, when = zamanaraligi())

- Following the Supertrend Strategy

- Trend Reversal Volatility Combination Strategy

- Progressive Take Profit Strategy

- Dual-position Breakthrough Strategy

- Trend Following Buy Dip Sell Peak Strategy

- Moving Average Crossover and MACD Combination Strategy

- Momentum Moving Average Crossover Trend Following Strategy

- Trend Following Strategy Based on Moving Average Crossover

- Dual Moving Average Turning Point Strategy

- Fast RSI Breakthrough Strategy

- Multi-factor Quantitative Trading Strategy

- Trend Following Strategy Based on Moving Average Crossover

- Noro's Price Channel Strategy v1.1

- Dual Moving Average Reversal Strategy

- Triple Pattern Oscillation Trading Strategy

- Trend Reversal System

- Channel Breakout SMA Strategy

- RSI Trend Reversal Strategy

- RSI MACD Crossover Double MA Tracking Strategy

- Multiple Timeframe Trend Strategy