Multi-factor Momentum Rotation Strategy

Author: ChaoZhang, Date: 2023-10-25 11:52:19Tags:

Overview

This strategy combines RSI, MACD, Bollinger Bands and limit up/down factors to implement multi-factor momentum rotation trading. The strategy first judges if multiple technical indicators give buy or sell signals simultaneously. If so, corresponding buy or sell operations will be executed. Meanwhile, the strategy adopts moving stop profit and stop loss to lock in profits and control risks.

Strategy Logic

The main components of this strategy are:

Factor judgement

- RSI: Calculate 14-period RSI and judge if it is lower than the buy line or higher than the sell line

- TD Sequence: Calculate number of limit up/down days and judge if it meets buy/sell conditions

- MACD: Calculate MACD and MACD Histogram to judge buy/sell conditions

- Bollinger Bands: Calculate 20-period BBs and judge if price touches BBs’ upper or lower band

Entry and exit

- Buy condition: RSI, MACD, TD Sequence give buy signals together

- Sell condition: RSI, MACD, TD Sequence give sell signals together

- Stop profit: Use fixed points or percentage as trailing stop profit

- Stop loss: Set maximum tolerated loss points for stop loss

- Buy condition: RSI, MACD, TD Sequence give buy signals together

Strategy optimization

- Adjust RSI parameters: Optimize RSI period parameter

- Adjust MA period: Optimize period parameter of Moving Averages

- Adjust entry conditions: Add or reduce entry signals

- Add other factors: Incorporate more technical indicators and statistical factors

Advantage Analysis

- Multiple factors improve entry accuracy

The strategy considers multiple factors like RSI and MACD rather than just single indicator. This reduces false signals and improves entry accuracy.

- Momentum characteristic captures trends

Indicators like RSI and MACD have obvious momentum characteristic, which capture price trend changes. They are more sensitive than trend following indicators like MAs.

- Stop profit/loss mechanism controls risks

Moving stop profit can lock in profits dynamically following the market. Stop loss setting controls single trade loss.

- Simple and clear logic

The strategy combines common technical indicators and has certain universality. Its rules are relatively simple and clear.

Risk Analysis

- Poor performance in bull market

The strategy focuses on mean-reversion trading. It may trigger frequent stop loss in a bull market.

- Potentially too high trading frequency

If parameters are set too sensitively, trading frequency may be too high, increasing costs and slippage.

- Divergence risk across indicators

The strategy relies on consistent signals across indicators, but sometimes divergences may happen, resulting in wrong signals.

- Stop loss being penetrated

Fixed stop loss points may be penetrated. Dynamic stop loss or stock change may help avoid this risk.

Optimization Directions

- Optimize parameters to reduce trading frequency

Test RSI parameters and MA periods to find combinations with lower trading frequency.

- Add statistical factors to improve efficiency

Incorporate stock-specific stats like volatility and liquidity to set parameters and improve efficiency.

- Combine market-level indicators like VIX

Adjust strategy parameters based on market panic indicators like VIX to reduce trading frequency during market-wide crashes.

- Test different holding periods

Test long-term holding versus short-term rotation to see their impact on strategy performance.

- Optimize and test stop profit/loss

Research more advanced dynamic stop profit/loss techniques and backtest them.

Summary

This strategy combines multiple technical indicators and adopts moving stop profit/loss to lock in profits and control risks while ensuring high entry accuracy. The logic is simple and clear. Performance can be further improved through parameter optimization and indicator selection. But the strategy is more suitable for mean-reversion and range-bound markets. It may underperform in persistent uptrends. In summary, this is a typical multi-factor mean-reversion momentum strategy that provides ideas and reference for stock rotation trading.

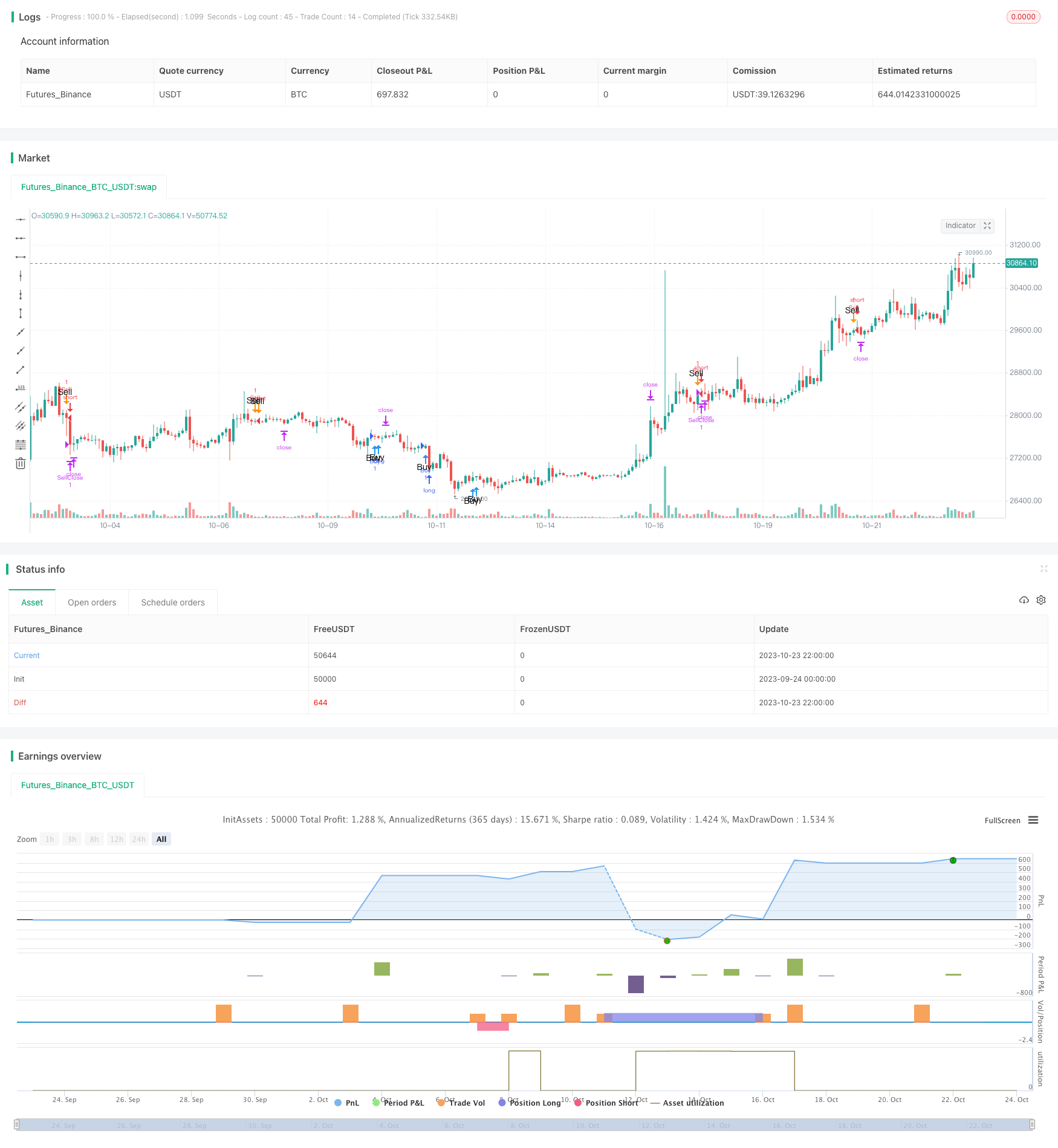

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("RSI, TD Seq, MACD, BB Strategy - Calculation Trailing Profit",overlay=true)

RSIDifference = input(-7, minval=-50, maxval=50, title="RSI Difference")

TD = close > close[4] ?nz(TD[1])+1:0

TS = close < close[4] ?nz(TS[1])+1:0

TDUp = TD - valuewhen(TD < TD[1], TD , 1 )

TDDn = TS - valuewhen(TS < TS[1], TS , 1 )

TDcheckUP = iff(TD == 2, true, false)

TDCheckDOWN = iff(TS == 2, true, false)

[_, _, histLine] = macd(close, 12, 26, 9)

MACDCheckDown = iff(histLine > 0 and histLine[1] > 0 and histLine[2] > 0 and histLine[3] > 0 and histLine[4] > 0, true, false)

MACDCheckUp = iff(histLine < 0 and histLine[1] < 0 and histLine[2] < 0 and histLine[3] < 0 and histLine[4] < 0, true, false)

RSICal = rsi(close, 14)

RSICalNewUp = 50 + RSIDifference

RSICalNewDown = 50 - RSIDifference

RSICheckUp = iff(RSICal <= RSICalNewUp, true, false)

RSICheckDown = iff(RSICal >= RSICalNewDown, true, false)

basis = sma(close, 20)

dev = 2 * stdev(close, 20)

upperBB = basis + dev

lowerBB = basis - dev

BBCheckUp = iff(close > upperBB, true, false)

BBCheckDown = iff(close < lowerBB, true, false)

//BBCheckUp = false

//BBCheckDown = false

BuyCheck = iff(TDcheckUP == true and MACDCheckUp == true and RSICheckUp == true and BBCheckUp == false, true, false)

SellCheck = iff(TDCheckDOWN == true and MACDCheckDown == true and RSICheckDown == true and BBCheckDown == false, true, false)

ProfitStratA = input(50, minval=0, maxval=10000, title="Profit", step=0.5)

ProfitTrailingA = input(10, minval=0, maxval=10000, title="Profit", step=0.5)

useStopLoss = input(false, title="Use Stop Loss?")

LossstratA = input(145, minval=0, maxval=10000, title="Stop Loss", step=0.5)

colB = input(100, minval=0, maxval=100, title="0-show / 100-hide Strategy", step=100)

ProfitStrat = ProfitStratA * 10

ProfitTrailing = ProfitTrailingA * 10

Lossstrat = useStopLoss ? LossstratA * 10 : 1000000

if (strategy.position_size > 0)

strategy.exit("BuyClose", "Buy", trail_points=ProfitStrat, trail_offset=ProfitTrailing, loss=Lossstrat)

if (strategy.position_size < 0)

strategy.exit("SellClose", "Sell", trail_points=ProfitStrat, trail_offset=ProfitTrailing, loss=Lossstrat)

if (BuyCheck == true and strategy.position_size == 0)

strategy.entry("Buy", strategy.long, comment="Long Entry")

if (SellCheck == true and strategy.position_size == 0)

strategy.entry("Sell", strategy.short, comment="Short Entry")

plotshape(BuyCheck, color=blue, transp=colB, style=shape.arrowup, text="Buy\n", location=location.belowbar)

plotshape(SellCheck, color=orange, transp=colB, style=shape.arrowdown, text="Sell\n", location=location.abovebar)

- ATR Adjustable Trailing Stop Loss Strategy

- Bollinger Band Width Scaling Double Moving Average Trend Filter Strategy

- Gradient Trailing Stop Loss Strategy

- Bollinger Bands and RSI indicators strategy

- short-term trading strategy

- Ichimoku Balance Line trend following Strategy

- Dual EMA Spread Breakout Strategy

- Contrarian Breakout Trading Strategy

- Williams VIX Fix Strategy

- RSI Dual-rail Oscillation Line Long and Short Bi-directional Trading Strategy

- RSI EMA Crossover Strategy

- Trend Following Dual Moving Average Strategy

- Glory Hole Breakout Strategy

- Heiken Ashi Moving Average Crossover Strategy with MACD Filter V3

- RSI Cross-Cycle Trading Strategy

- SuperTrend Enhanced Pivot Reversal Strategy

- Momentum Arbitrage Strategy Backtest Analysis

- Mean Reversion Bollinger Bands Strategy

- Linear Regression Moving Average Trading Strategy

- Dual Bandpass Filter Strategy