1-3-1 Red Green Candlestick Reversal Strategy

Author: ChaoZhang, Date: 2023-10-27 16:00:41Tags:

Overview

The 1-3-1 red green candlestick reversal strategy is a strategy that generates buy and sell signals based on candlestick patterns. It looks for buying opportunities when 1 red candlestick is reversed by 3 subsequent green candlesticks.

Principles

The core logic of this strategy is:

- Check if the current candlestick is a red candle, i.e. the close price is lower than the open price

- Check if the previous 3 candlesticks are green candles, i.e. close price is higher than open price

- Check if the last green candle’s close price is higher than the previous 2 green candles

- If the above conditions are met, go long at the close of the red candle

- Set stop loss at the lowest price of the red candle

- Set take profit at entry price plus the distance from entry to stop loss

With this strategy, we can buy when the red candle is reversed, because the subsequent trend is likely to be upwards. Stop loss and take profit are set to control risk and lock in profits.

Advantage Analysis

The 1-3-1 red green reversal strategy has the following advantages:

- Simple and clear logic, easy to understand and implement

- Utilizes candlestick pattern features without reliance on indicators, avoiding overoptimization problems

- Has clear entry and exit rules for objective execution

- Sets stop loss and take profit to control risk/reward of each trade

- Good backtest results, likely to translate well to live trading

Risk Analysis

Some risks to note for this strategy:

- Candlestick patterns cannot perfectly predict future moves, some uncertainty exists

- Only one entry, may have lower win rate due to stock specifics

- No consideration of market trend, risk holding during sustained downtrend

- Does not account for trading costs and slippage, actual performance may be worse

Solutions:

- Consider combining with MA etc to filter signals and improve entry success rate

- Adjust position sizing, scale in across multiple entries

- Dynamically adjust stop loss based on market conditions or pause trading

- Test different stop loss/take profit ratios

- Test actual performance including trading costs

Optimization Directions

Some ways this strategy can be optimized:

Market index filtering - filter signals based on short/medium term market trend, go long in uptrend and stop trading in downtrend

Volume confirmation - only go long if green candle volumes increase

Optimize stop loss/take profit ratios - test different ratios to find optimal parameters

Position sizing optimization - scale in across multiple entries to reduce single trade risk

Add more filters - e.g. MA, volatility etc to ensure high probability entry

Machine learning on big data - collect lots of historical data and train optimal parameter thresholds via ML

Conclusion

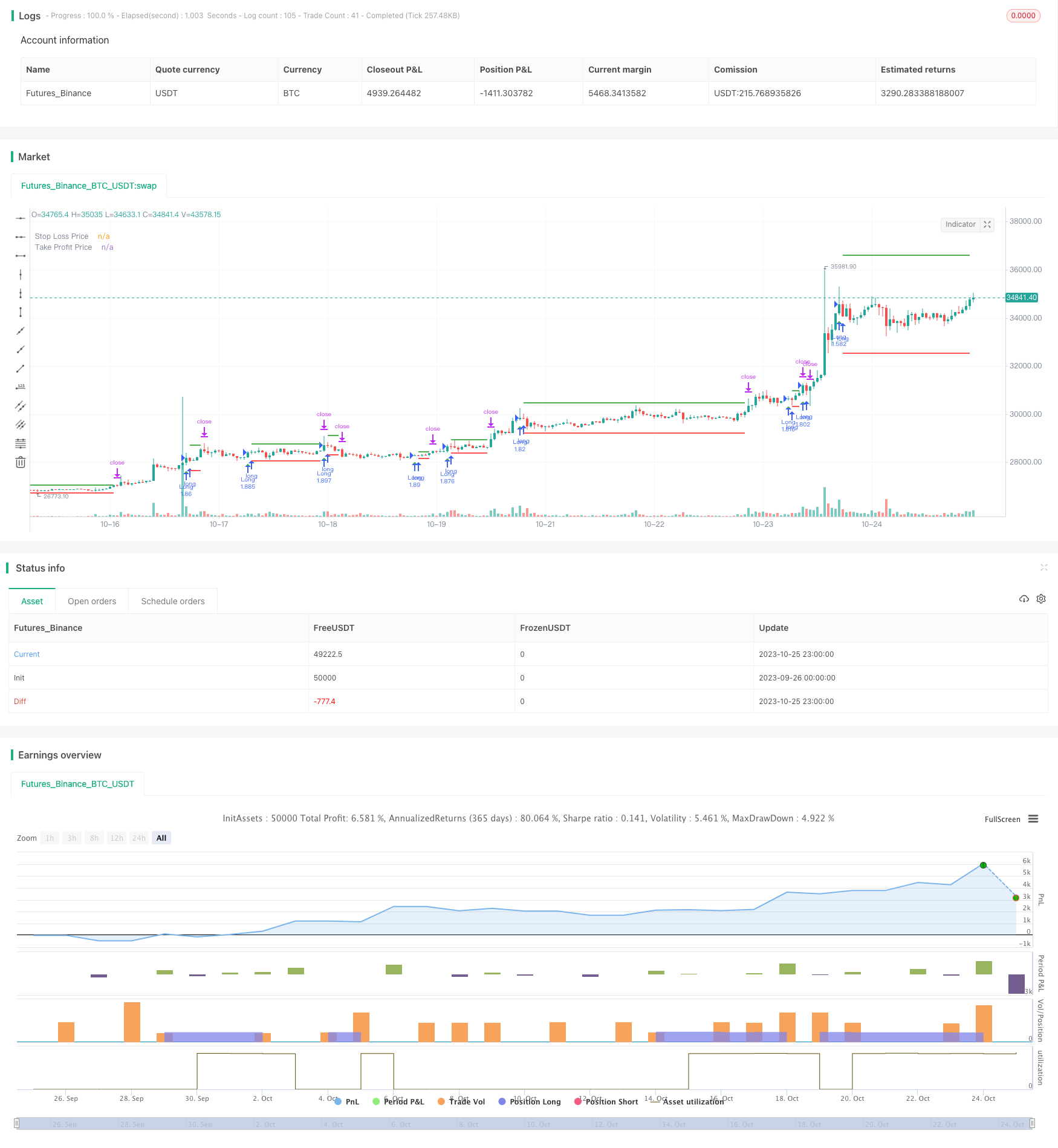

The 1-3-1 red green reversal strategy is overall a simple and practical short term trading strategy. It has clear entry and exit rules and good backtest results. With some optimization measures, it can become a reliable quant trading strategy. Risk management is also important to manage capital properly.

/*backtest

start: 2023-09-26 00:00:00

end: 2023-10-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//by Genma01

strategy("Stratégie tradosaure 1 Bougie Rouge suivi de 3 Bougies Vertes", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

// Définir les paramètres

var float stopLossPrice = na

var float takeProfitPrice = na

var float stopLossPriceD = na

var float takeProfitPriceD = na

// Vérifier les conditions

redCandle = close[3] < open[3] and low[3] < low[2] and low[3] < low[1] and low[3] < low[0]

greenCandles = close > open and close[1] > open[1] and close[2] > open[2]

higherClose = close > close[1] and close[1] > close[2]

// Calcul du stop-loss

if (redCandle and greenCandles and higherClose) and strategy.position_size == 0

stopLossPrice := low[3]

// Calcul du take-profit

if (not na(stopLossPrice)) and strategy.position_size == 0

takeProfitPrice := close + (close - stopLossPrice)

// Entrée en position long

if (redCandle and greenCandles and higherClose) and strategy.position_size == 0

strategy.entry("Long", strategy.long)

// Sortie de la position

if (not na(stopLossPrice)) and strategy.position_size > 0

strategy.exit("Take Profit/Stop Loss", stop=stopLossPrice, limit=takeProfitPrice)

if strategy.position_size == 0

stopLossPriceD := na

takeProfitPriceD := na

else

stopLossPriceD := stopLossPrice

takeProfitPriceD := takeProfitPrice

// Tracer le stop-loss et le take-profit sur le graphique

plotshape(series=redCandle and greenCandles and higherClose and strategy.position_size == 0, title="Conditions Remplies", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=redCandle and greenCandles and higherClose and strategy.position_size == 0, title="Conditions Remplies", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

// Afficher les prix du stop-loss et du take-profit

plot(stopLossPriceD, color=color.red, title="Stop Loss Price", linewidth=2, style = plot.style_linebr)

plot(takeProfitPriceD, color=color.green, title="Take Profit Price", linewidth=2, style = plot.style_linebr)

- Classic Dual Moving Average Crossover Strategy

- Fast Slow Dual Moving Average Trading Strategy

- ICHIMOKU KUMO TWIST STRATEGY

- Oscillation Breakthrough Strategy

- Breakout Swing Strategy

- A Powerful System Combining Reversal and Trend-Following Strategies

- Moving Average Crossover Strategy

- Reversal Breakout Strategy

- Multi-Period Dynamic Moving Average Strategy

- Seasonal Range Moving Average RSI Strategy

- Momentum Tracking Stop Loss Strategy

- Cumulative RSI Breakout Strategy

- High Frequency Hedging Strategy Based on MACD Bar Color and Linear Regression

- Momentum Stacking Strategy of Different Timeframes

- Cryptocurrency Momentum Breakout Strategy

- Dual Stochastics and Volume Weighted Moving Average Combination Indicator Strategy

- Trend Trading with Double EMA Crossover System

- Gradual Moving Average Trend Following Strategy

- RSI Momentum Long Short Strategy

- Combined Stochastic Oscillator and 123 Reversal Strategy