Reversal Trading Strategy Based on Generalized Support/Resistance

Author: ChaoZhang, Date: 2023-10-30 11:23:25Tags:

Overview

This strategy adopts reversal trading based on bullish/bearish factors, with preset profit-taking levels. The core of the factors is the extended pattern “Generalized Support/Resistance” based on trading volume, suitable for stocks with high volume and volatility. The advantages lie in capturing larger reversal opportunities in medium-short terms and profiting quickly, while it bears the risk of being trapped.

Strategy Logic

Identifying bullish/bearish factors based on “Generalized Support/Resistance” with volume

Using candlestick patterns to identify classic S/R levels, filtered by significant volume

Generalized S/R has better coverage than classic patterns

Breaking generalized support signals long factor, breaking generalized resistance signals short factor

Reversal trading

Take reverse position when factor signal triggers

If already in position, reduce or add reverse position

Setting profit target levels

Set stop loss based on ATR

Set multiple profit levels like 1R, 2R, 3R

Partial profit taking when hitting different targets

Advantages

- Capture decent mid-term reversals

S/R breakouts represent strong reversal signals with some reliability, able to catch mid-term reversals

- Quick profit-taking, small drawdowns

By setting stop loss and multiple profit targets, can achieve quick gains and limit drawdowns

- Suitable for stocks with significant institutional money and volatility

The strategy relies on volume, requiring sizable institutional participation; also needs volatility to make profits

Risks

- Getting trapped in range-bound market

Frequent stop loss exit and re-entry in opposite direction can result in whipsaws

- Failure of support/resistance

Generalized S/R is not absolutely reliable, some failures exist

- One-sided holding risk

The pure reversal logic may miss large trending opportunities

Risk management:

Loosen factor conditions, not reverse on every breakout

Add other filters e.g. price/volume divergence

Optimize stop loss strategy to reduce traps

Enhancement Directions

- Optimize S/R parameters

Find more reliable factors by tweaking generalized S/R settings

- Optimize profit-taking

Add more profit levels, or use non-fixed targets

- Optimize stop loss

Adjust ATR parameters or use istics stop loss to reduce unnecessary stops

- Incorporate trend and other factors

Add trend filters like moving average to avoid big trend conflicts; also add other assisting factors

Summary

The core of the strategy is to capture decent mid-term swings via reversal trading. The logic is simple and direct, and can be practical with parameter tuning. But the aggressive nature of reversals leads to some drawdown and trapping risk. Further enhancements in stop loss, profit-taking and trend alignment will help reduce unnecessary losses.

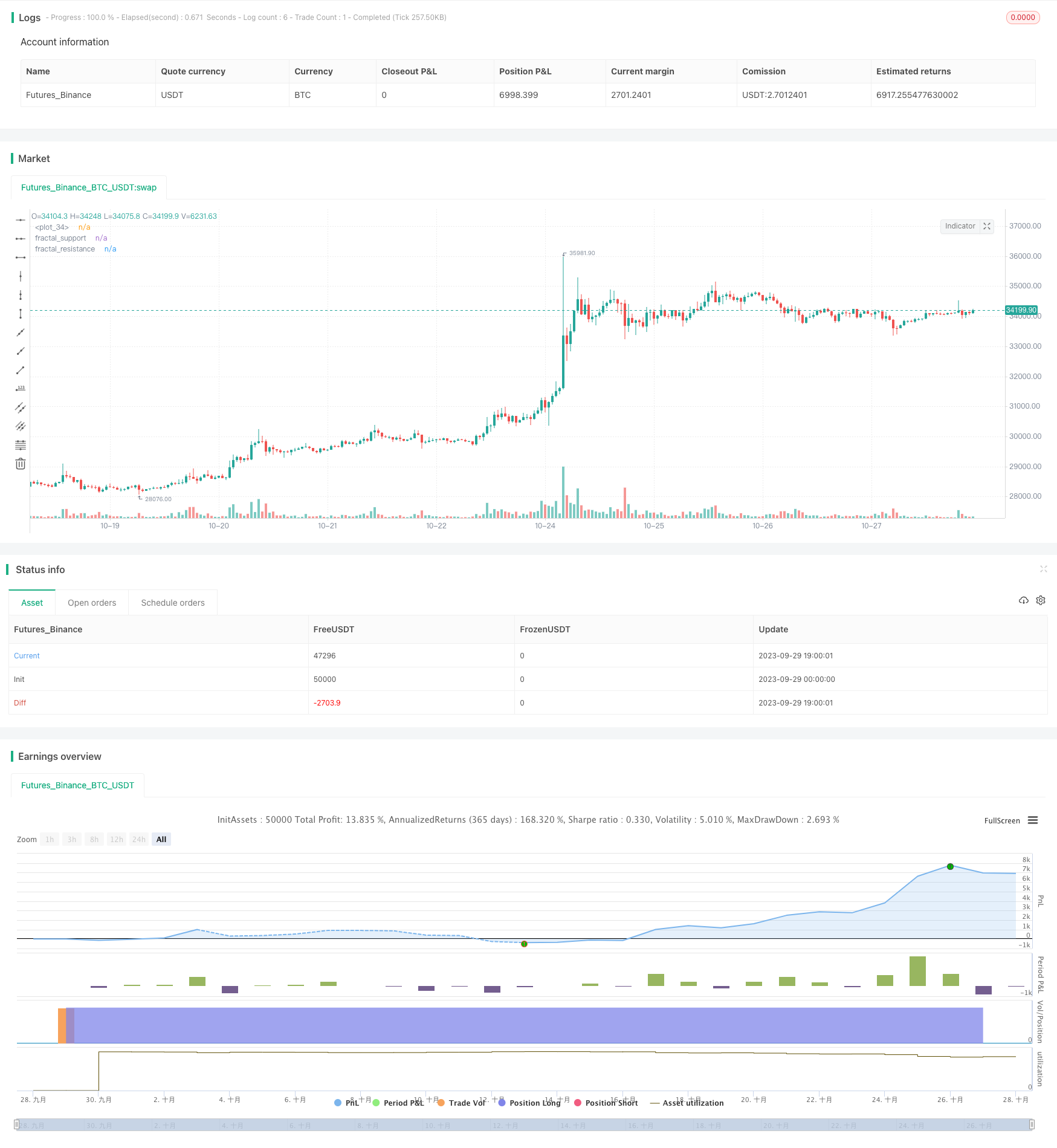

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DojiEmoji

//@version=5

strategy("Fractal Strat [KL] ", overlay=true, pyramiding=1, initial_capital=1000000000)

var string ENUM_LONG = "Long"

var string GROUP_ENTRY = "Entry"

var string GROUP_TSL = "Stop loss"

var string GROUP_TREND = "Trend prediction"

var string GROUP_ORDER = "Order size and Profit taking"

// backtest_timeframe_start = input.time(defval=timestamp("01 Apr 2000 13:30 +0000"), title="Backtest Start Time")

within_timeframe = true

// TSL: calculate the stop loss price. {

_multiple = input(2.0, title="ATR Multiplier for trailing stop loss", group=GROUP_TSL)

ATR_TSL = ta.atr(input(14, title="Length of ATR for trailing stop loss", group=GROUP_TSL, tooltip="Initial risk amount = atr(this length) x multiplier")) * _multiple

TSL_source = low

TSL_line_color = color.green

TSL_transp = 100

var stop_loss_price = float(0)

var float initial_entry_p = float(0)

var float risk_amt = float(0)

var float initial_order_size = float(0)

if strategy.position_size == 0 or not within_timeframe

TSL_line_color := color.black

stop_loss_price := TSL_source - ATR_TSL

else if strategy.position_size > 0

stop_loss_price := math.max(stop_loss_price, TSL_source - ATR_TSL)

TSL_transp := 0

plot(stop_loss_price, color=color.new(TSL_line_color, TSL_transp))

// } end of "TSL" block

// Order size and profit taking {

pcnt_alloc = input.int(5, title="Allocation (%) of portfolio into this security", tooltip="Size of positions is based on this % of undrawn capital. This is fixed throughout the backtest period.", minval=0, maxval=100, group=GROUP_ORDER) / 100

// Taking profits at user defined target levels relative to risked amount (i.e 1R, 2R, 3R)

var bool tp_mode = input(true, title="Take profit and different levels", group=GROUP_ORDER)

var float FIRST_LVL_PROFIT = input.float(1, title="First level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking first level profit at 1R means taking profits at $11", group=GROUP_ORDER)

var float SECOND_LVL_PROFIT = input.float(2, title="Second level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking second level profit at 2R means taking profits at $12", group=GROUP_ORDER)

var float THIRD_LVL_PROFIT = input.float(3, title="Third level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking third level profit at 3R means taking profits at $13", group=GROUP_ORDER)

// }

// Fractals {

// Modified from synapticEx's implementation: https://www.tradingview.com/script/cDCNneRP-Fractal-Support-Resistance-Fixed-Volume-2/

rel_vol_len = 6 // Relative volume is used; the middle candle has to have volume above the average (say sma over prior 6 bars)

rel_vol = ta.sma(volume, rel_vol_len)

_up = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>rel_vol[3]

_down = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>rel_vol[3]

fractal_resistance = high[3], fractal_support = low[3] // initialize

fractal_resistance := _up ? high[3] : fractal_resistance[1]

fractal_support := _down ? low[3] : fractal_support[1]

plot(fractal_resistance, "fractal_resistance", color=color.new(color.red,50), linewidth=2, style=plot.style_cross, offset =-3, join=false)

plot(fractal_support, "fractal_support", color=color.new(color.lime,50), linewidth=2, style=plot.style_cross, offset=-3, join=false)

// }

// ATR diversion test {

// Hypothesis testing (2-tailed):

//

// Null hypothesis (H0) and Alternative hypothesis (Ha):

// H0 : atr_fast equals atr_slow

// Ha : atr_fast not equals to atr_slow; implies atr_fast is either too low or too high

len_fast = input(5,title="Length of ATR (fast) for diversion test", group=GROUP_ENTRY)

atr_fast = ta.atr(len_fast)

atr_slow = ta.atr(input(50,title="Length of ATR (slow) for diversion test", group=GROUP_ENTRY, tooltip="This needs to be larger than Fast"))

// Calculate test statistic (test_stat)

std_error = ta.stdev(ta.tr, len_fast) / math.pow(len_fast, 0.5)

test_stat = (atr_fast - atr_slow) / std_error

// Compare test_stat against critical value defined by user in settings

//critical_value = input.float(1.645,title="Critical value", tooltip="Strategy uses 2-tailed test to compare atr_fast vs atr_slow. Null hypothesis (H0) is that both should equal. Based on the computed test statistic value, if absolute value of it is +/- this critical value, then H0 will be rejected.", group=GROUP_ENTRY)

conf_interval = input.string(title="Confidence Interval", defval="95%", options=["90%","95%","99%"], tooltip="Critical values of 1.645, 1.96, 2.58, for CI=90%/95%/99%, respectively; Under 2-tailed test to compare atr_fast vs atr_slow. Null hypothesis (H0) is that both should equal. Based on the computed test statistic value, if absolute value of it is +/- critical value, then H0 will be rejected.")

critical_value = conf_interval == "90%" ? 1.645 : conf_interval == "95%" ? 1.96 : 2.58

reject_H0_lefttail = test_stat < -critical_value

reject_H0_righttail = test_stat > critical_value

// } end of "ATR diversion test" block

// Entry Signals

entry_signal_long = close >= fractal_support and reject_H0_lefttail

// MAIN {

// Update the stop limit if strategy holds a position.

if strategy.position_size > 0

strategy.exit(ENUM_LONG, comment="SL", stop=stop_loss_price)

// Entry

if within_timeframe and entry_signal_long and strategy.position_size == 0

initial_entry_p := close

risk_amt := ATR_TSL

initial_order_size := math.floor(pcnt_alloc * strategy.equity / close)

strategy.entry(ENUM_LONG, strategy.long, qty=initial_order_size)

var int TP_taken_count = 0

if tp_mode and close > strategy.position_avg_price

if close >= initial_entry_p + THIRD_LVL_PROFIT * risk_amt and TP_taken_count == 2

strategy.close(ENUM_LONG, comment="TP Lvl3", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

else if close >= initial_entry_p + SECOND_LVL_PROFIT * risk_amt and TP_taken_count == 1

strategy.close(ENUM_LONG, comment="TP Lvl2", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

else if close >= initial_entry_p + FIRST_LVL_PROFIT * risk_amt and TP_taken_count == 0

strategy.close(ENUM_LONG, comment="TP Lvl1", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

// Alerts

_atr = ta.atr(14)

alert_helper(msg) =>

prefix = "[" + syminfo.root + "] "

suffix = "(P=" + str.tostring(close, "#.##") + "; atr=" + str.tostring(_atr, "#.##") + ")"

alert(str.tostring(prefix) + str.tostring(msg) + str.tostring(suffix), alert.freq_once_per_bar)

if strategy.position_size > 0 and ta.change(strategy.position_size)

if strategy.position_size > strategy.position_size[1]

alert_helper("BUY")

else if strategy.position_size < strategy.position_size[1]

alert_helper("SELL")

// Clean up - set the variables back to default values once no longer in use

if ta.change(strategy.position_size) and strategy.position_size == 0

TP_taken_count := 0

initial_entry_p := float(0)

risk_amt := float(0)

initial_order_size := float(0)

stop_loss_price := float(0)

// } end of MAIN block

- Dual EMA Crossover Strategy

- Trend-Following Strategy Based on Moving Average Breakout

- MACD Closing Turtle Hybrid Strategy

- Multi Timeframe Take Profit Strategy

- Low Point Rebound Strategy

- Momentum Reversal Combo Strategy

- Volume Difference Delta Cycle Oscillator Trading Strategy

- MA Trendline Breakthrough Strategy

- Momentum Trend Following Strategy

- RSI Box Grid Strategy

- Dual Moving Average Crossover Scalping Strategy

- Dormant Range Reversal Strategy

- Momentum Reversal Multi Timeframe Strategy

- Multi-Indicator Bitcoin Daily Trading Strategy

- Dual Balanced Bulls and Bears Strategy

- Gandalf Mean Reversion Quantitative Trading Strategy

- Momentum Breakout Reversal Trading Strategy

- Intraday Stochastic Oscillator with Double Moving Average Crossover Strategy

- Multi Timeframe Buy the Dip Strategy

- Bollinger Breakout Stop-loss Strategy