Keltner Channel Trend Based Strategy

Author: ChaoZhang, Date: 2023-11-03 16:59:39Tags:

Overview

This strategy is based on three main indicators: trend indicator, Keltner Channel and DM indicator.

The trend indicator consists of SMA and EMA. Keltner Channel is used to determine the open and close price of candles. DM indicator is for judging the direction of long and short.

The entry signal is triggered when:

- EMA crosses over SMA, confirming uptrend

- Candle opens above the upper band and closes inside the channel

- DM indicator is above the benchmark

The strategy has two take profit levels and one stop loss level. Trailing stop can be used for optimizing profits.

Strategy Principles

Trend Identification

SMA and EMA crossovers are used to determine the trend direction. EMA (46) crossing over SMA (46) indicates an upward trend.

Keltner Channel

The channel has three lines: middle, upper and lower. The middle line is SMA of close price with length of 81. The upper and lower bands are placed at a multiple of true range above and below the middle line. Here we use 2.5 times of true range.

Keltner Channel shows support and resistance levels. Price movements in relation to the channel are analyzed.

DM Indicator

DM indicator contains ADX, +DI and -DI. +DI measures uptrend strength while -DI measures downtrend strength. ADX shows the trend strength.

Here ADX (10), DI (19) are used. When +DI crosses above the benchmark (default 27), it signals strong uptrend and good for long entry.

Advantage Analysis

This strategy combines trend, channel and momentum indicators to effectively determine price actions and long/short direction. The advantages are:

-

Trend identification is relatively accurate to avoid counter trend trades.

-

Keltner Channel shows clear support and resistance levels.

-

DM indicator measures long/short momentum to ensure direction.

-

Strict entry rules help filter false breakouts.

-

Take profit and stop loss points allow capturing profits.

Risk Analysis

There are also some risks to consider:

-

Trend may reverse when EMA crosses below SMA, so exit timely.

-

Channel can fail in strong trends, not strict support/resistance.

-

DM may generate false signals, check price action.

-

False breakout may trigger entry but quickly fallback, use reasonable stop loss.

-

Take profit and stop loss need continuous optimization to adapt to changing market conditions.

Optimization Directions

Some ways to further optimize the strategy:

-

Adjust parameters and test different trend identification methods.

-

Optimize channel parameters to better fit true range.

-

Test different DM parameters and find the optimal combination.

-

Add more entry filters like volume.

-

Try trailing stop loss for getting more profits.

-

Test separately for different products to find best parameter sets.

Conclusion

The strategy integrates multiple indicators for determining trend, support/resistance and momentum, which allows effectively catching trends and controlling risks. But risks need to be noticed and parameters require optimization as market changes. Overall, this is a strategy with strong practicality.

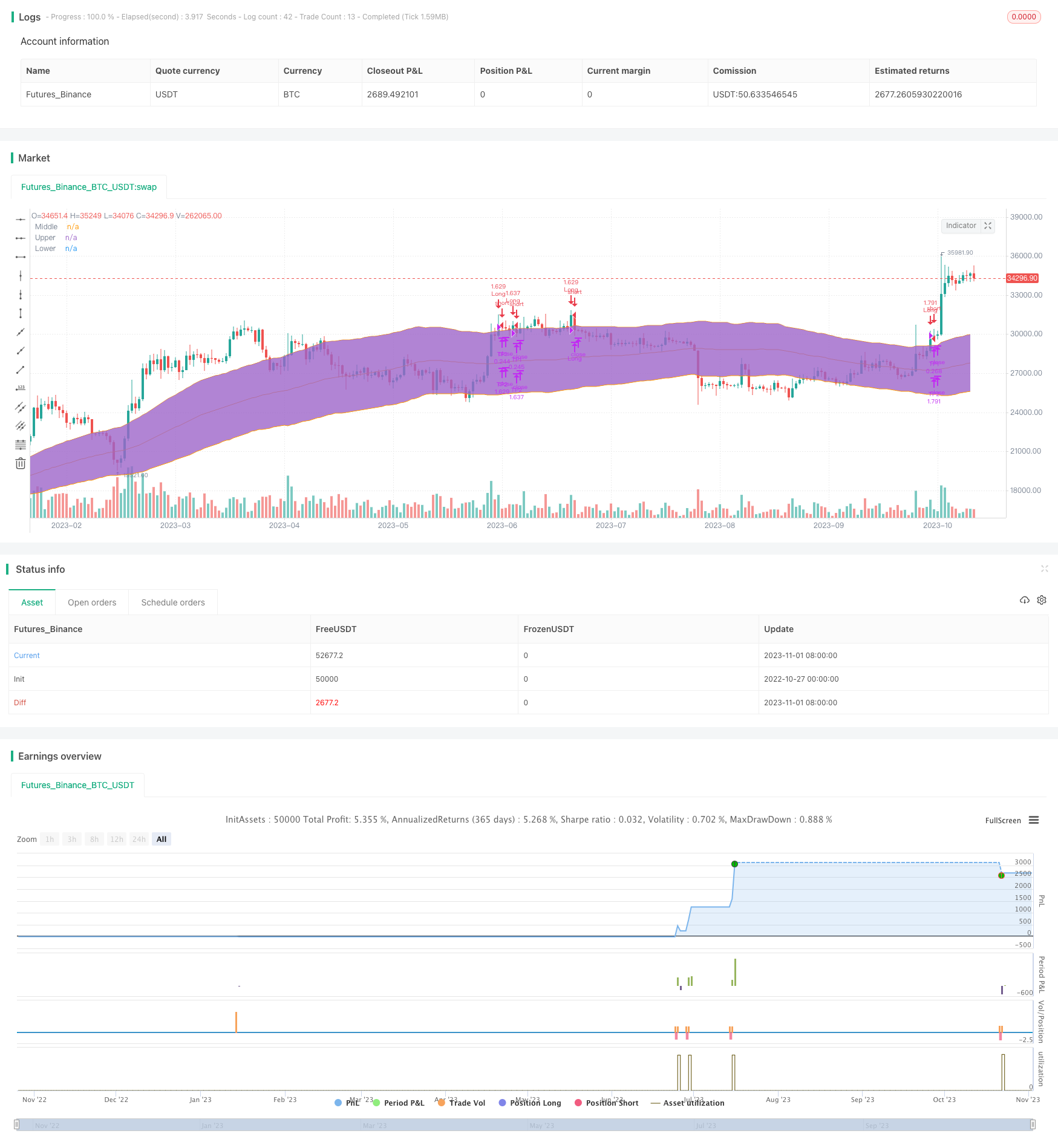

/*backtest

start: 2022-10-27 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Original Idea by: Wunderbit Trading

//@version=4

strategy("Keltner Channel ETH/USDT 1H", overlay=true, initial_capital=1000,pyramiding = 0, currency="USD", default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent,commission_value=0.07)

/// TREND

ribbon_period = input(46, "Period", step=1)

leadLine1 = ema(close, ribbon_period)

leadLine2 = sma(close, ribbon_period)

// p3 = plot(leadLine1, color= #53b987, title="EMA", transp = 50, linewidth = 1)

// p4 = plot(leadLine2, color= #eb4d5c, title="SMA", transp = 50, linewidth = 1)

// fill(p3, p4, transp = 60, color = leadLine1 > leadLine2 ? #53b987 : #eb4d5c)

//Upward Trend

UT=leadLine2 < leadLine1

DT=leadLine2>leadLine1

///////////////////////////////////////INDICATORS

// KELTNER //

source = close

useTrueRange = input(true)

length = input(81, step=1, minval=1)

mult = input(2.5, step=0.1)

// Calculate Keltner Channel

ma = sma(source, length)

range = useTrueRange ? tr : high - low

rangema = sma(range, length)

upper = ma + rangema * mult

lower = ma - rangema * mult

plot(ma, title="Middle", color=color.orange)

p1=plot(upper, title="Upper", color=color.orange)

p2=plot(lower, title="Lower", color=color.orange)

fill(p1,p2)

// DMI INDICATOR //

adxlen = 10 // input(10, title="ADX Smoothing")

dilen = input(19, title="DI Length")

keyLevel = 23// input(23, title="key level for ADX")

dirmov(len) =>

up = change(high)

down = -change(low)

truerange = rma(tr, len)

plus = fixnan(100 * rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

[adx, plus, minus]

[sig, up, down] = adx(dilen, adxlen)

benchmark=input(title="DMI Benchmark", defval=27, minval=1,step=1)

// plot(sig, color=color.red, title="ADX")

// plot(up, style=plot.style_histogram, color=color.green, title="+DI")

// plot(down, style=plot.style_histogram, color=color.red, title="-DI")

// plot(keyLevel, color=color.white, title="Key Level")

///////////////////////////////////////////////////////////

////////////////////////////////////////////////////Component Code Start

testStartYear = input(2019, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(9999, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

///// Component Code Stop //////////////////////////////////////////

//////////////// STRATEGY EXECUTION //////////////////////////

//LONG SET UP

// Take Profit / Stop Loss

long_tp1_inp = input(4.5, title='Long Take Profit 1 %', step=0.1)/100

long_tp1_qty = input(15, title="Long Take Profit 1 Qty", step=1)

long_tp2_inp = input(20, title='Long Take Profit 2%', step=0.1)/100

long_tp2_qty = input(100, title="Long Take Profit 2 Qty", step=1)

long_take_level_1 = strategy.position_avg_price * (1 + long_tp1_inp)

long_take_level_2 = strategy.position_avg_price * (1 + long_tp2_inp)

long_sl_inp = input(4, title='Long Stop Loss %', step=0.1)/100

long_stop_level = strategy.position_avg_price * (1 - long_sl_inp)

// STRATEGY CONDITION

// LONG

entry_long = ((open > lower and open < upper) and close > upper) and up > down and up > benchmark // and volume[0] > volume[1]

entry_price_long=valuewhen(entry_long,close,0)

SL_long = entry_price_long * (1 - long_sl_inp)

exit_long = (close < lower) or low < SL_long

// STRATEGY EXECUTION

if testPeriod()

// LONG

if UT

strategy.entry(id="Long", long=true, when=entry_long, comment = "INSERT ENTER LONG COMMAND")

strategy.exit("TP1","Long", qty_percent=long_tp1_qty, limit=long_take_level_1) // PLACE TAKE PROFIT IN WBT BOT SETTINGS

strategy.exit("TP2","Long", qty_percent=long_tp2_qty, limit=long_take_level_2) // PLACE TAKE PROFIT IN WBT BOT SETTINGS

strategy.close(id="Long", when=exit_long, comment= "INSERT EXIT LONG COMMAND")

//PLOT FIXED SLTP LINE

// LONG POSITION

plot(strategy.position_size > 0 ? long_take_level_1 : na, style=plot.style_linebr, color=color.green, linewidth=1, title="1st Long Take Profit")

plot(strategy.position_size > 0 ? long_take_level_2 : na, style=plot.style_linebr, color=color.green, linewidth=1, title="2nd Long Take Profit")

plot(strategy.position_size > 0 ? long_stop_level : na, style=plot.style_linebr, color=color.red, linewidth=1, title="Long Stop Loss")

- Triple Moving Average Crossover Strategy

- Trend Tracking Strategy Based on Momentum Breakout

- Random Oscillation Strategy

- Super Momentum Strategy

- Sizeblock Strategy

- Turnaround After Consolidation Strategy

- Moving Average Crossover Strategy

- Dual Breakout Strategy

- Cross Limit Order Cross Period Trading Strategy

- Ichimoku Stop Loss Strategy

- Scaled Normalized Vector Strategy with Karobein Mean Reversion

- Dual Moving Average Reversal Strategy

- Intraday Pivot Breakout Strategy

- Jupiter and Saturn Momentum MA Crossover Filtered Strategy

- Beyond The Clouds Strategy

- Shadow Trading Strategy

- Trend Breakout Moving Average Tracking Strategy

- Volume Oscillator Based Trend Tracking Strategy

- Trend Following Long Term Strategy Based on SuperTrend and Fisher Transform

- Dual Golden Cross Reversal Trading Strategy