RSI True Level Breakout Strategy

Author: ChaoZhang, Date: 2023-11-08 12:25:59Tags:

Overview

The RSI True Level breakout strategy combines the RSI indicator with adaptive True Level channels to implement breakout trading. It calculates True Level upper and lower bands and uses RSI overbought/oversold signals to generate breakout trades. In trending markets, it can early capture the trend direction. In range-bound markets, it can effectively filter out noise and catch significant directional opportunities.

Strategy Logic

The strategy first requires manually setting 14 True Level bands with different parameters. True Levels are calculated based on closing prices, standard deviation and linear regression over a certain period. The upper band is linear regression + n standard deviations. The lower band is linear regression - n standard deviations. The n can be adjusted through the input panel. This plots 14 True Level bands with different parameters.

Next, the strategy calculates the highest of the 14 bands as the True Level upper band, and the lowest as the lower band in each period. Combined with the RSI indicator values, it determines if RSI enters overbought or oversold zones. When RSI is overbought or price breaks below the upper band, it goes short. When RSI is oversold or price breaks above the lower band, it goes long.

Finally, entry and exit bands are set. The entry band is the lower True Level and the exit band is the upper True Level. After opening positions, prices touching the exit band again will close the trades.

In summary, the strategy utilizes both the trending strength of RSI and the adaptive ability of True Level channels to effectively determine trend direction, catch big opportunities in range-bound markets, and control risk with the exit bands.

Advantages

-

Uses adaptive True Level zones. The upper and lower bands change dynamically to adapt to market fluctuations.

-

Customizable True Level parameters. Users can optimize parameters for different market conditions.

-

Combines RSI overbought/oversold to avoid whipsaws in sideways markets.

-

Reasonable entry and exit line design controls risk.

Risks

-

RSI parameters need careful optimization. Wrong values may generate bad signals.

-

True Level parameters need testing and optimization. Unsuitable settings could undermine performance.

-

High whipsaw risk in choppy markets when prices hit exit bands frequently.

-

True Level bands need sufficient period to form. The strategy may fail with inadequate data.

Risks can be mitigated by optimizing RSI parameters, adjusting True Level settings, adding filters and using wise exits. Parameters should be tuned for different market environments.

Optimization Directions

-

Optimize RSI parameters to find best settings. Test different RSI periods.

-

Optimize True Level parameters for current markets.

-

Add other filters like MACD, KD to avoid bad trades in choppy markets.

-

Test different trading times or products to find optimal environment.

-

Optimize exits, like trailing stops or ATR-based stops.

-

Combine parameters and test for maximum stability.

-

Utilize machine learning and big data to auto optimize.

Conclusion

The RSI True Level breakout strategy combines the strengths of a trend indicator and adaptive channels. It can effectively determine trend direction and catch big opportunities in range-bound markets while controlling risk with stop loss. The high parameter customization allows tuning it for different market conditions. Overall, by integrating multiple indicators, it has advantages in trend determination and risk control. With further optimization, it is a recommended quantitative trading strategy.

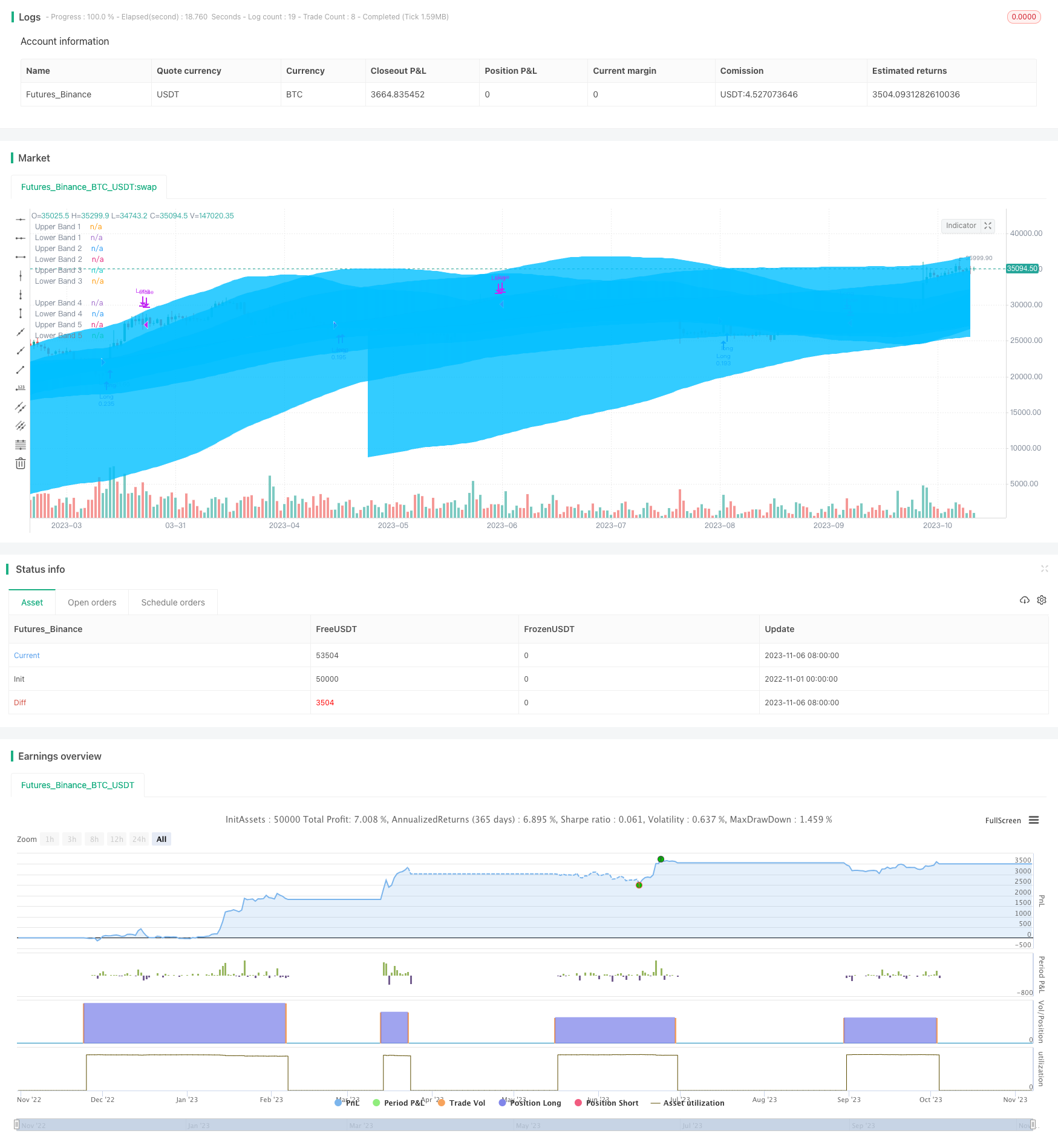

/*backtest

start: 2022-11-01 00:00:00

end: 2023-11-07 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Julien_Eche

//@version=4

strategy("RSI TrueLevel Strategy", shorttitle="RSI TL", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters for RSI

rsiPeriod = input(14, title="RSI Period", type=input.integer)

rsiOverbought = input(65, title="RSI Overbought Level", type=input.integer)

rsiOversold = input(40, title="RSI Oversold Level", type=input.integer)

// Inputs for selecting bands

entry_band = input(12, title="Entry TrueLevel Band", type=input.integer, minval=1, maxval=14)

exit_band = input(12, title="Exit TrueLevel Band", type=input.integer, minval=1, maxval=14)

// Input for long and short mode

long_and_short = input(false, title="Enable Long and Short", type=input.bool)

// Calculate the RSI

rsi = rsi(close, rsiPeriod)

// User inputs

len1 = input(title="Length 1", type=input.integer, defval=126)

len2 = input(title="Length 2", type=input.integer, defval=189)

len3 = input(title="Length 3", type=input.integer, defval=252)

len4 = input(title="Length 4", type=input.integer, defval=378)

len5 = input(title="Length 5", type=input.integer, defval=504)

len6 = input(title="Length 6", type=input.integer, defval=630)

len7 = input(title="Length 7", type=input.integer, defval=756)

len8 = input(title="Length 8", type=input.integer, defval=1008)

len9 = input(title="Length 9", type=input.integer, defval=1260)

len10 = input(title="Length 10", type=input.integer, defval=1638)

len11 = input(title="Length 11", type=input.integer, defval=2016)

len12 = input(title="Length 12", type=input.integer, defval=2646)

len13 = input(title="Length 13", type=input.integer, defval=3276)

len14 = input(title="Length 14", type=input.integer, defval=4284)

fill_color = input(title="Fill Color", type=input.color, defval=color.rgb(0, 191, 255, 95))

mult = input(title="Multiple", type=input.float, defval=1, step=0.2, options=[0.6, 0.8, 1, 1.2, 1.4])

src = input(title="Source", type=input.source, defval=close)

// Upper band calculation function

upperBand(length) =>

linreg = linreg(src, length, 0)

stddev = mult * stdev(src, length)

upperband = linreg + stddev

upperband

// Lower band calculation function

lowerBand(length) =>

linreg = linreg(src, length, 0)

stddev = mult * stdev(src, length)

lowerband = linreg - stddev

lowerband

// Calculate upper and lower bands for each length

upperband_1 = upperBand(len1)

upperband_2 = upperBand(len2)

upperband_3 = upperBand(len3)

upperband_4 = upperBand(len4)

upperband_5 = upperBand(len5)

upperband_6 = upperBand(len6)

upperband_7 = upperBand(len7)

upperband_8 = upperBand(len8)

upperband_9 = upperBand(len9)

upperband_10 = upperBand(len10)

upperband_11 = upperBand(len11)

upperband_12 = upperBand(len12)

upperband_13 = upperBand(len13)

upperband_14 = upperBand(len14)

lowerband_1 = lowerBand(len1)

lowerband_2 = lowerBand(len2)

lowerband_3 = lowerBand(len3)

lowerband_4 = lowerBand(len4)

lowerband_5 = lowerBand(len5)

lowerband_6 = lowerBand(len6)

lowerband_7 = lowerBand(len7)

lowerband_8 = lowerBand(len8)

lowerband_9 = lowerBand(len9)

lowerband_10 = lowerBand(len10)

lowerband_11 = lowerBand(len11)

lowerband_12 = lowerBand(len12)

lowerband_13 = lowerBand(len13)

lowerband_14 = lowerBand(len14)

// Plot envelope bands for each length

upperband_1_plot = plot(upperband_1, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 1")

lowerband_1_plot = plot(lowerband_1, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 1")

upperband_2_plot = plot(upperband_2, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 2")

lowerband_2_plot = plot(lowerband_2, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 2")

upperband_3_plot = plot(upperband_3, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 3")

lowerband_3_plot = plot(lowerband_3, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 3")

upperband_4_plot = plot(upperband_4, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 4")

lowerband_4_plot = plot(lowerband_4, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 4")

upperband_5_plot = plot(upperband_5, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 5")

lowerband_5_plot = plot(lowerband_5, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 5")

upperband_6_plot = plot(upperband_6, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 6")

lowerband_6_plot = plot(lowerband_6, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 6")

upperband_7_plot = plot(upperband_7, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 7")

lowerband_7_plot = plot(lowerband_7, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 7")

upperband_8_plot = plot(upperband_8, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 8")

lowerband_8_plot = plot(lowerband_8, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 8")

upperband_9_plot = plot(upperband_9, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 9")

lowerband_9_plot = plot(lowerband_9, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 9")

upperband_10_plot = plot(upperband_10, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 10")

lowerband_10_plot = plot(lowerband_10, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 10")

upperband_11_plot = plot(upperband_11, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 11")

lowerband_11_plot = plot(lowerband_11, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 11")

upperband_12_plot = plot(upperband_12, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 12")

lowerband_12_plot = plot(lowerband_12, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Lower Band 12")

upperband_13_plot = plot(upperband_13, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 13")

lowerband_13_plot = plot(lowerband_13, color=color.rgb(14, 139, 212, 95), linewidth=1, title="Lower Band 13")

upperband_14_plot = plot(upperband_14, color=color.rgb(14, 116, 212, 95), linewidth=1, title="Upper Band 14")

lowerband_14_plot = plot(lowerband_14, color=color.rgb(14, 139, 212, 95), linewidth=1, title="Lower Band 14")

// Plot fills for each length

fill(upperband_1_plot, lowerband_1_plot, color=fill_color, title="Fill 1")

fill(upperband_2_plot, lowerband_2_plot, color=fill_color, title="Fill 2")

fill(upperband_3_plot, lowerband_3_plot, color=fill_color, title="Fill 3")

fill(upperband_4_plot, lowerband_4_plot, color=fill_color, title="Fill 4")

fill(upperband_5_plot, lowerband_5_plot, color=fill_color, title="Fill 5")

fill(upperband_6_plot, lowerband_6_plot, color=fill_color, title="Fill 6")

fill(upperband_7_plot, lowerband_7_plot, color=fill_color, title="Fill 7")

fill(upperband_8_plot, lowerband_8_plot, color=fill_color, title="Fill 8")

fill(upperband_9_plot, lowerband_9_plot, color=fill_color, title="Fill 9")

fill(upperband_10_plot, lowerband_10_plot, color=fill_color, title="Fill 10")

fill(upperband_11_plot, lowerband_11_plot, color=fill_color, title="Fill 11")

fill(upperband_12_plot, lowerband_12_plot, color=fill_color, title="Fill 12")

fill(upperband_13_plot, lowerband_13_plot, color=fill_color, title="Fill 13")

fill(upperband_14_plot, lowerband_14_plot, color=fill_color, title="Fill 14")

// Add variables to store the highest upper band and lowest lower band values

var float highestUpperBand = na

var float lowestLowerBand = na

// Calculate the trueLevelUpperBand and trueLevelLowerBand

trueLevelUpperBand = max(upperband_1, max(upperband_2, max(upperband_3, max(upperband_4, max(upperband_5, max(upperband_6, max(upperband_7, max(upperband_8, max(upperband_9, max(upperband_10, max(upperband_11, max(upperband_12, max(upperband_13, upperband_14)))))))))))))

trueLevelLowerBand = min(lowerband_1, min(lowerband_2, min(lowerband_3, min(lowerband_4, min(lowerband_5, min(lowerband_6, min(lowerband_7, min(lowerband_8, min(lowerband_9, min(lowerband_10, min(lowerband_11, min(lowerband_12, min(lowerband_13, lowerband_14)))))))))))))

// Update the highest upper band and lowest lower band

highestUpperBand := highest(trueLevelUpperBand, 1)

lowestLowerBand := lowest(trueLevelLowerBand, 1)

// Store the upper and lower bands in an array for easy access

upperbands = array.new_float(14)

lowerbands = array.new_float(14)

array.set(upperbands, 0, upperband_1)

array.set(upperbands, 1, upperband_2)

array.set(upperbands, 2, upperband_3)

array.set(upperbands, 3, upperband_4)

array.set(upperbands, 4, upperband_5)

array.set(upperbands, 5, upperband_6)

array.set(upperbands, 6, upperband_7)

array.set(upperbands, 7, upperband_8)

array.set(upperbands, 8, upperband_9)

array.set(upperbands, 9, upperband_10)

array.set(upperbands, 10, upperband_11)

array.set(upperbands, 11, upperband_12)

array.set(upperbands, 12, upperband_13)

array.set(upperbands, 13, upperband_14)

array.set(lowerbands, 0, lowerband_1)

array.set(lowerbands, 1, lowerband_2)

array.set(lowerbands, 2, lowerband_3)

array.set(lowerbands, 3, lowerband_4)

array.set(lowerbands, 4, lowerband_5)

array.set(lowerbands, 5, lowerband_6)

array.set(lowerbands, 6, lowerband_7)

array.set(lowerbands, 7, lowerband_8)

array.set(lowerbands, 8, lowerband_9)

array.set(lowerbands, 9, lowerband_10)

array.set(lowerbands, 10, lowerband_11)

array.set(lowerbands, 11, lowerband_12)

array.set(lowerbands, 12, lowerband_13)

array.set(lowerbands, 13, lowerband_14)

// Get the selected bands for entry and exit

selected_entry_lowerband = array.get(lowerbands, entry_band - 1)

selected_exit_upperband = array.get(upperbands, exit_band - 1)

// Entry conditions

longCondition = crossover(rsi, rsiOversold) or crossover(close, selected_entry_lowerband)

shortCondition = crossunder(rsi, rsiOverbought) or crossunder(close, selected_exit_upperband)

if (longCondition)

strategy.entry("Long", strategy.long)

if (long_and_short and shortCondition)

strategy.entry("Short", strategy.short)

// Exit conditions

exitLongCondition = crossunder(rsi, rsiOverbought) or crossunder(close, selected_exit_upperband)

exitShortCondition = crossover(rsi, rsiOversold) or crossover(close, selected_entry_lowerband)

strategy.close("Long", when=exitLongCondition)

strategy.close("Short", when=long_and_short and exitShortCondition)

- Momentum Tracking Strategy

- ZVWAP Strategy Based on Z-Distance from VWAP

- Backtesting and Optimization of RSI Strategy

- Three EMA Trend Following Strategy

- Bullish Divergence Short-term Long Trade Finder Strategy

- An Indicator-Driven Stop Loss and Take Profit Strategy

- Dual Moving Average Reversal Trading Strategy

- High Low Breakout for Quantitative Trading

- Volatility Squeeze Breakout Strategy

- Donchian Channel Breakout Trading Strategy

- RSI Reversal Breakout Strategy

- Parabolic SAR Dynamic Breakout Triple SMMA Strategy

- SMA Crossover Strategy

- Volatility Adjusted Moving Average Trading Strategy

- Momentum Breakout Strategy

- Short Trading Strategy in Downtrend

- Volume Price Trend Reversal Forex Trading Strategy Based on Stairstep EMA

- Dual Shadow Reversal Strategy

- Double Fast RSI Breakthrough Strategy

- Cross Timeframe Hull Moving Average Buy Sell Strategy