Simple Momentum Strategy Based on SMA, EMA and Volume

Author: ChaoZhang, Date: 2023-12-08 11:15:30Tags:

Overview

This is a simple intraday momentum strategy that only goes long and does not short. It utilizes SMA, EMA and volume indicators to attempt entering the market at the optimal timing when both price and momentum are trending up. Its advantage is being simple while having some trend recognition capability.

Strategy Principle

The entry signal logic is: when SMA is higher than EMA, and there is a consecutive 3-bar or 4-bar uptrend pattern, with the lowest price of the middle bars being higher than the open price of the starter uptrend bar, an entry signal is generated.

The exit signal logic is: when SMA crosses below EMA, an exit signal is generated.

This strategy only goes long and does not short. Its entry and exit logic has some capability in recognizing persistent uptrends.

Advantage Analysis

The advantages of this strategy:

-

The logic is simple and easy to understand and implement;

-

Utilizes common technical indicators like SMA, EMA and volume for flexibility in parameter tuning;

-

Has some capability in catching some opportunities during persistent uptrends.

Risk Analysis

The risks of this strategy:

-

Inability to detect downtrends or consolidation markets, leading to large drawdowns;

-

Inability to utilize shorting opportunities, unable to hedge against downtrends, missing good profit chances;

-

Volume indicator does not work well on high frequency data, parameters need adjustment;

-

Can use stop loss to control risks.

Optimization Directions

This strategy can be optimized in the following aspects:

-

Adding shorting capability for mean reversion opportunities;

-

Using more advanced indicators like MACD and RSI for better trend detection;

-

Optimizing stop loss logic to reduce drawdowns;

-

Tuning parameters and testing different timeframes to find optimal parameter sets.

Conclusion

In summary this is a very simple trend following strategy utilizing SMA, EMA and volume for entry timing. Its advantage is being simple and easy to implement, good for beginners to learn, but it cannot detect consolidation or downtrends and has risks. Improvements can be made by introducing shorting, optimizing indicators and stop loss etc.

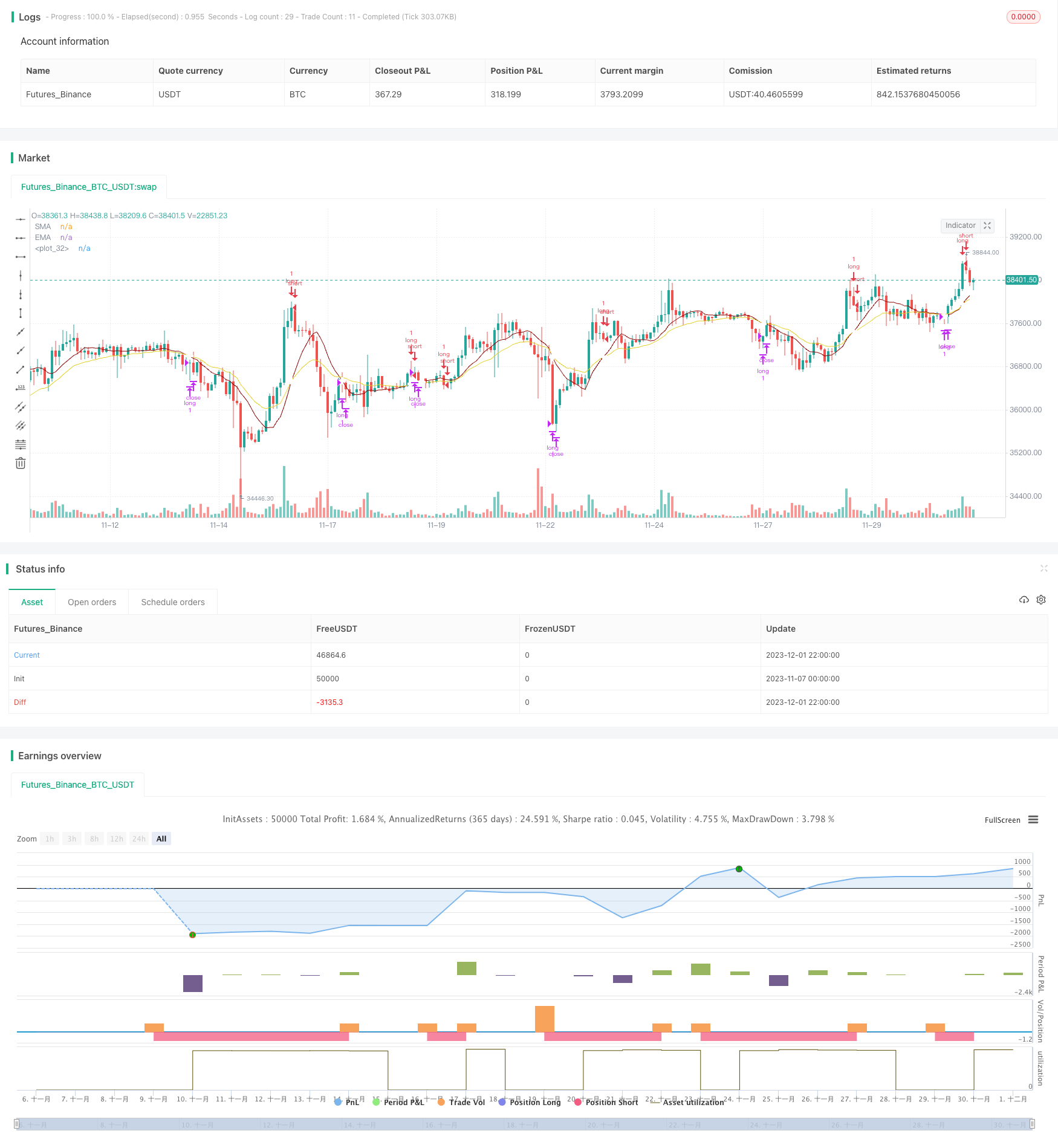

/*backtest

start: 2023-11-07 00:00:00

end: 2023-12-02 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © slip_stream

//@version=4

// Simple strategy for riding the momentum and optimising the timings of truer/longer price moves upwards for an long posistions on a daily basis (can be used, but with less effect

// on other time frames. Volume settings would have to be adjusted by the user accordingly. (short positions are not used).

// This strategy has default settings of a short(er) SMA of 10, a long(er) EMA of 20, and Volume trigger of 10 units and above. All these settings can be changed by the user

// using the GUI settings and not having to change the script.

// The strategy will only open a long position when there is a clear indication that price momentum is upwards through the SMA moving and remaining above the EMA (mandatory) and price period indicators

// of either 1) a standard 3 bar movement upwards, 2) a standard but "aggressive" 3 or 4 bar play where the low of the middle resting bars can be equal to or higher than (i.e. not

// the more standard low of about half) of the opening of the ignition bar. The "aggression" of the 3/4 bar play was done in order to counteract the conservatisme of having a mandatory

// SMA remaining higher than the EMA (this would have to be changed in the script by the user if they want to optimise to their own specifications. However, be warned, all programmatic

// settings for the maximum acceptable low of the middle resting bars runs a risk of ignoring good entry points due to the low being minutely e.g. 0.01%, lower than the user defined setting)

strategy(title = "Simple Momentum Strategy Based on SMA, EMA and Volume", overlay = true, pyramiding = 1, initial_capital = 100000, currency = currency.USD)

// Obtain inputs

sma_length = input(defval = 10, minval=1, type = input.integer, title = "SMA (small length)")

ema_length = input(defval = 20,minval=1, type = input.integer, title = "EMA (large length)")

volume_trigger = input(defval = 10, title = "Volume Trigger", type = input.integer)

sma_line = sma(close, sma_length)

ema_line = ema(close, ema_length)

// plot SMA and EMA lines with a cross for when they intersect

plot(sma_line, color = #8b0000, title = "SMA")

plot(ema_line, color = #e3d024, title = "EMA")

plot(cross(sma_line, ema_line) ? sma_line : na, style = plot.style_cross, linewidth = 4, color = color.white)

// Create variables

// variables to check if trade should be entered

//three consecutive bar bar moves upwards and volume of at least one bar is more than 10

enter_trade_3_bar_up = sma_line > ema_line and close[1] >= close [2] and close[3] >= close[4] and close[2] >= close[3] and (volume[1] >= volume_trigger or volume[2] >= volume_trigger or volume[3] >= volume_trigger)

// aggressive three bar play that ensures the low of the middle bar is equal to or greater than the open of the instigator bar. Volume is not taken into consideration (i.e. aggressive/risky)

enter_3_bar_play = sma_line > ema_line and close[1] > close[3] and low[2] >= open[3]

// aggressive four bar play similar to the 3 bar play above

enter_4_bar_play = sma_line > ema_line and close[1] > close[4] and low[2] >= open[4]

trade_entry_criteria = enter_trade_3_bar_up or enter_3_bar_play or enter_4_bar_play // has one of the trade entry criterias returned true?

// exit criteria for the trade: when the sma line goes under the ema line

trade_exit_criteria = crossunder (sma_line, ema_line)

if (year >= 2019)

strategy.entry(id = "long", long = true, qty = 1, when = trade_entry_criteria)

strategy.close(id = "long", when = trade_exit_criteria, qty = 1)

// for when you want to brute force close all open positions: strategy.close_all (when = trade_exit_criteria)

- Moving Average Crossover Strategy

- Trend and Moving Average Crossover Based Multi-Functional Algorithmic Trading Strategy

- Moving Average Bollinger Bands Breakout Strategy

- Trend Following Grid Strategy

- Quantitative Trading Strategy Integrating Reversal and Future Lines of Demarcation

- Crossing Strategy Between Bollinger Bands and Hull Indicator

- Turtle Breakout Drawdown Adaptive Trading Strategy

- RSI Trend Following Strategy with Trailing Stop Loss

- Reversal Dynamic Pivot Points Exponential Moving Average Strategy

- kNN-based Trend Following Strategy

- Donchian Channels Breakout Quantitative Trading Strategy

- N Consecutive Higher Closes Breakout Strategy

- Smart Quantitative Bottom Reversal Trading Strategy

- Bollinger + RSI Double Strategy (Long Only) v1.2

- CCI Zero Cross Trading Strategy

- Dual Moving Average Price Reversal Breakout Strategy

- Moving Average Pullback Trading Strategy

- Moving Average Aggregation Williams Commercial Bid-Ask Pressure Indicator Strategy

- Dual Moving Average Reversal Tracking Strategy

- Moving Average Aggregation MACD Strategy