Momentum Pullback Strategy

Author: ChaoZhang, Date: 2023-12-12 16:34:52Tags:

Overview

The Momentum Pullback Strategy identifies extreme RSI readings as momentum signals for a long/short strategy. Unlike most RSI strategies, it looks to buy or sell the first pullback in the direction of the extreme RSI reading.

It enters long/short on the first pullback to the 5-period EMA (low)/5-period EMA (high) and exits at the rolling 12-bar high/low. The rolling high/low feature means the profit target will begin to reduce with each new bar if the price enters prolonged consolidation. The best trades tend to work within 2-6 bars.

The suggested stop loss is X ATRs (adjustable in inputs) from the entry price.

The strategy is fairly robust across timeframes and markets with 60%-70% win rate and larger winning trades. Signals occurring from news volatility should be avoided.

Strategy Logic

-

Calculate 6-period RSI and identify values above 90 (overbought) and below 10 (oversold).

-

When RSI is overbought, go long on a pullback to the 5-period EMA (low) within 6 bars.

-

When RSI is oversold, go short on a pullback to the 5-period EMA (high) within 6 bars.

-

The exit strategy is a moving take profit, with the initial target being the highest high/lowest low of the past 12 bars, updating on each new bar for a rolling exit.

-

The stop loss is X ATRs from the entry price (customizable).

Advantage Analysis

The strategy combines RSI extremes as momentum signals and pullback entries to capture potential reversal points in trends, with a high win rate.

The moving take profit mechanism locks in partial profits according to actual price action, reducing drawdowns.

The ATR stop helps effectively control single-trade loss.

Good robustness to apply across different markets and parameter sets for easy real trading replication.

Risk Analysis

A too-wide stop loss if ATR multiplier set too high, increasing loss per trade.

Moving take profit mechanism may reduce profit margin if prolonged consolidation occurs.

Missing trades if pullback extends beyond 6 bars.

Potential slippage or false breakout if major news events occur.

Optimization Directions

Test shortening entry bar count from 6 to 4 to improve entry rate.

Test increasing ATR multiplier to further control loss per trade.

Incorporate volume indicators to avoid losses from divergence in consolidation.

Enter on pullback break of 60min mid-point to filter noise.

Conclusion

The Momentum Pullback Strategy is an overall very practical short-term mean reversion approach, incorporating elements of trend, reversal and risk management for easy real trading while still carrying alpha-generating potential. Further stability enhancements are possible through parameter tuning and combining additional indicators. It represents a great boon for quant trading and is well worth learning and applying.

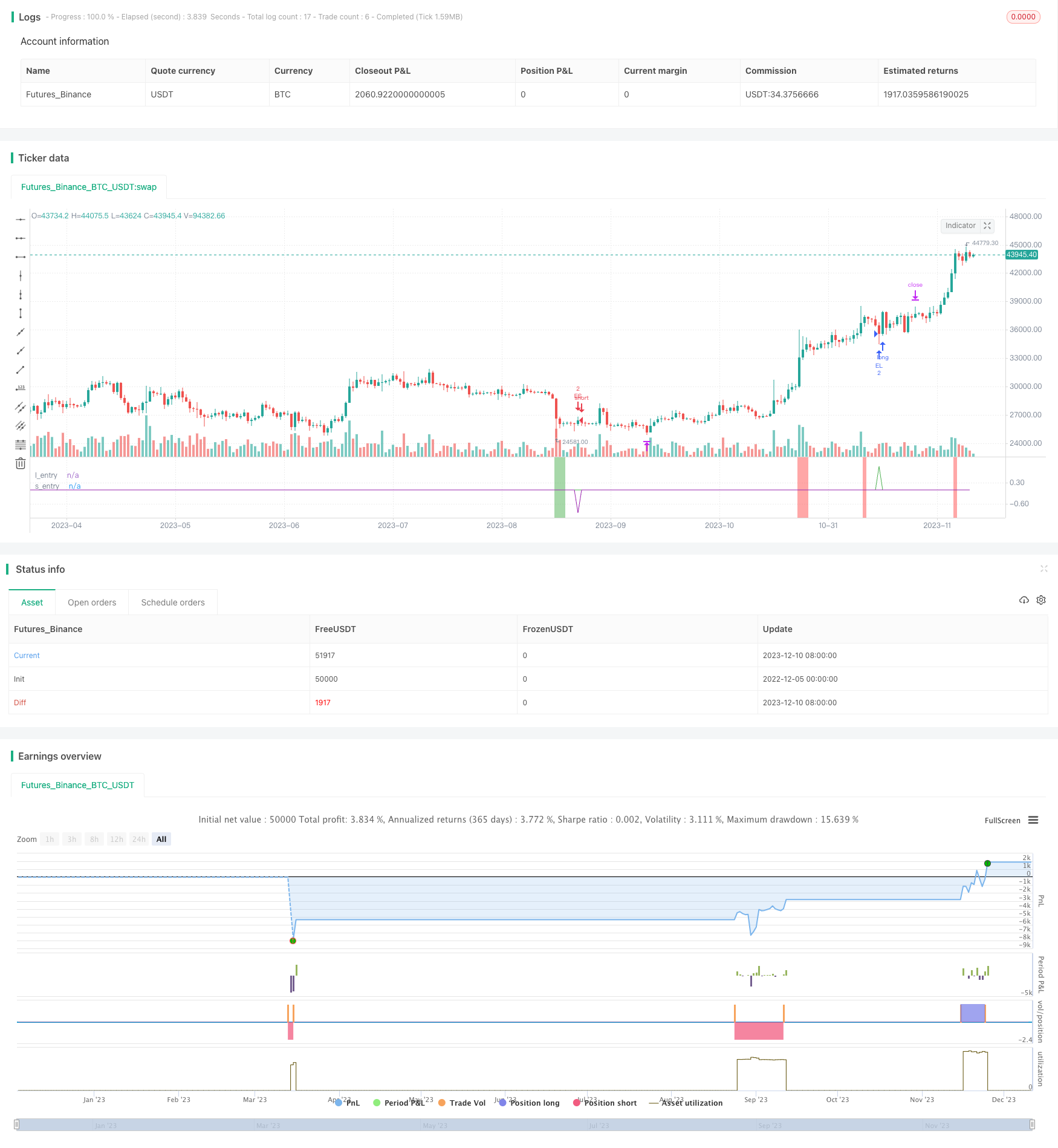

/*backtest

start: 2022-12-05 00:00:00

end: 2023-12-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Marcns_

//@version=5

strategy("M0PB", commission_value = 0.0004, slippage = 1, initial_capital=30000)

// commision is equal to approx $3.8 per round trip which is accurate for ES1! futures and slippage per trade is conservatively 1 tick in and 1 tick out.

// *momentum pull back* //

// long / short strategy that identifies extreme readings on the rsi as a *momentum signal*

//Strategy buys/ sells a pullback to the 5ema(low)/ 5ema(high) and exits at rolling 12 bar high/ low. The rolling high/ low feature means that

//if price enters into a pronlonged consolidation the profit target will begin to reduce with each new bar. The best trades tend to work within 2-6 bars

// hard stop is X atr's from postion average price. This can be adjusted in user inputs.

// built for use on 5 min & 1min intervals on: FX, Indexes, Crypto

// there is a lot of slack left in entries and exits but the overall strategy is fairly robust across timeframes and markets and has between 60%-70% winrate with larger winners.

// signals that occur from economic news volatility are best avoided.

// define rsi

r = ta.rsi(close,6)

// find rsi > 90

b = 0.0

if r >= 90

b := 1.0

else

na

// find rsi < 10

s = 0.0

if r <= 10

s := -1.0

else

na

// plot rsi extreme as painted background color

bgcolor(b ? color.rgb(255, 82, 82, 49): na)

bgcolor(s? color.rgb(76, 175, 79, 51): na)

// exponential moving averages for entries. note that source is high and low (normally close is def input) this creates entry bands

//entry short price using high as a source ta.ema(high,5)

es = ta.ema(high,5)

//entry long price using low as a source ta.ema(low,5)

el = ta.ema(low,5)

// long pullback entry trigger: last period above ema and current low below target ema entry

let = 0.0

if low[1] > el[1] and low <= el

let := 1.0

else

na

//short entry trigger ""

set = 0.0

if high[1] < es[1] and high >= es

set := -1.0

else

na

// create signal "trade_l" if RSI > 90 and price pulls back to 5ema(low) within 6 bars

trade_l = 0.0

if ta.barssince(b == 1.0) < 6 and let == 1.0

trade_l := 1.0

else

na

plot(trade_l, "l_entry", color.green)

//create short signal "trade_s" if rsi < 10 and prices pullback to 5em(high) wihthin 6 bars

trade_s = 0.0

if ta.barssince(s == -1.0) < 6 and set == -1.0

trade_s := -1.0

else

na

plot(trade_s, "s_entry", color.purple)

// define price at time of trade_l signal and input value into trade_p to use for stop parems later

trade_p = strategy.position_avg_price

//indentify previous 12 bar high as part of long exit strat

// this creates a rolling 12 bar high target... a quick move back up will exit at previous swing high but if a consolidation occurs system will exit on a new 12 bar high which may be below prev local high

ph = ta.highest(12)

// inverse of above for short exit strat - previous lowest low of 12 bars as exit (rolling)

pl = ta.lowest(12)

// 1.5 atr stop below entry price (trade_p defined earlier) as part of exit strat

atr_inp = input.float(2.75, "atr stop", minval = 0.1, maxval = 6.0)

atr = ta.atr(10)

stop_l = trade_p - (atr* atr_inp)

stop_s = trade_p + (atr* atr_inp)

//strat entry long

strategy.entry("EL", strategy.long, 2, when = trade_l == 1.0)

//strat entry short

strategy.entry("ES", strategy.short, 2, when = trade_s == -1.0)

//strat long exit

if strategy.position_size == 2

strategy.exit(id = "ph", from_entry = "EL", qty = 2, limit = ph)

if strategy.position_size == 2

strategy.close_all(when = low[1] > stop_l[1] and low <= stop_l)

// strat short exit

if strategy.position_size == -2

strategy.exit(id = "pl", from_entry = "ES", qty = 2, limit =pl)

if strategy.position_size == -2

strategy.close_all(when = high[1] < stop_s[1] and high >= stop_s)

// code below to trail remaining 50% of position //

//if strategy.position_size == 1

//strategy.exit(id ="trail", from_entry = "EL", qty = 1, stop = el)

- Schaff Trend Cycle with Double Moving Average Crossover Strategy

- Moving Average Channel Breakout Strategy

- Ichimoku Trading Strategy With Money Management

- Sustainable Trailing Stop Loss Trading Strategy

- Momentum Reversal Strategy

- Bollinger Band Awesome Oscillator Breakout Trading Strategy

- EMA Crossover Trading Strategy

- Divergence Matrix Trend Following Strategy

- Center of Gravity Backtesting Trading Strategy

- Pivot Points Breakout Strategy

- RSI Trend Following Crypto Strategy

- Trend Tracking Strategy Based on Dual Vortex Indicator Combined with True Strength Index

- Ichimoku Early Cloud Trend Following Strategy

- Multi-Timeframe Moving Average System Trading Strategy

- EVWMA Trend Following Strategy

- Rate of Change Quantitative Strategy

- EMA Tracking Trend Suppressing Oscillation Strategy

- Scalping Strategy based on RSI Indicator with Trailing Stop Loss

- Advanced Strategy with Volume and Price Pullback Multiple Take Profit

- Simple Pullback Strategy Tracking Long Term Trends