Dual Moving Average Counter Trend Strategy

Author: ChaoZhang, Date: 2024-01-08 11:01:11Tags:

Overview

The Dual Moving Average Counter Trend strategy is mainly designed for swing trading applied to the FOREX market. This strategy generates trading signals using two moving averages of different timeframes. When the fast moving average crosses above the slow moving average, a short position is taken to seek reversal; when the fast moving average crosses below the slow moving average, a long position is taken to seek reversal.

Strategy Principle

This strategy uses moving averages of 1 hour and 1 day timeframes. The 1 hour moving average reflects price changes more sensitively and can serve as the fast moving average; the 1 day moving average responds to price changes more slowly and can serve as the slow moving average. When the fast moving average crosses above the slow moving average, it is considered that the current market is bullish and a short signal will be generated; when the fast moving average crosses below the slow moving average, it is considered that the current market is bearish and a long signal will be generated.

The principle of entering long or short to seek reversal when the fast and slow moving averages have golden crosses or dead crosses is that when the fast and slow moving averages cross, it indicates that the market may have reversed, and the crosses of the fast line and slow line are the timing of generating reversal signals. According to reversal trading theory, prices usually do not rise or fall in one direction, and it is likely the time of price reversal when there is a breakthrough of important support and resistance levels. Therefore, this strategy uses dual moving average reversal signals to capture reversal opportunities.

This strategy also sets trading time and date screening conditions. It only trades within the set date range and trading hours to avoid trading during unsuitable periods.

Advantage Analysis

The Dual Moving Average Counter Trend Strategy has the following advantages:

-

Reversal strategies have the advantage of large profit space. Reversal trading can obtain higher profits in volatile market conditions by taking counter operations at key points.

-

Using double moving average combinations filters signals and avoids false signals. A single indicator is prone to false signals, while double indicator combinations can improve the reliability of signals by filtering out some false signals, making trading opportunities more reliable.

-

Setting trading hours and date conditions avoids inactive market periods and avoids being trapped. By trading only during the set trading hours and date range, it is possible to avoid periods of dramatic price fluctuations and avoid stalled trading.

-

Reversal strategies are suitable for medium-term trading. Compared with high frequency trading, medium-term trading strategies are more stable, avoiding excessive frequent buying and selling.

-

Maximum drawdown control is beneficial for capital management. Setting the maximum drawdown ratio can effectively control the overnight risk and avoid huge losses of funds.

Risk Analysis

The Dual Moving Average Counter Trend Strategy also has the following risks:

-

Reversal signals may fail leading to losses. Price reversal signals are not always reliable. There is a risk of loss when prices continue the trend without reversal. Losses can be controlled by setting stop loss.

-

Deviation of the trend leads to losses. When the two moving averages have separated significantly before reversal, there may be a risk of loss. The timing of reversal can be determined by observing the distance between the moving averages.

-

Improper trading hours settings may miss opportunities. If trading hours are set too strictly, some trading opportunities may be missed. Trading hours can be appropriately expanded.

-

Failure to stop loss promptly after reversal results in expanded losses. After reversal, losses must be stopped promptly when prices continue the original trend to control losses.

Optimization Directions

The Dual Moving Average Counter Trend Strategy can also be optimized in the following aspects:

-

Test combinations of more indicators to find better trading signals. Indicators like MACD, KDJ can be tested in combination with double moving averages to improve signal accuracy.

-

Optimize moving average cycle parameters to find optimal parameters. The best cycle numbers can be determined by backtesting moving averages of different lengths.

-

Expand or narrow trading hours to find the optimal trading hours. Test the effects of adjusting trading hours according to different product characteristics.

-

Add trend filtering conditions to avoid deviation. Indicators like ADX can be added to judge the strength of the trend and avoid reversal when there is no obvious trend.

-

Add machine learning models for signal verification. Models can be trained to judge the reliability of reversal signals and filter out some low quality signals.

Summary

The Dual Moving Average Counter Trend strategy is suitable for medium-term trading in the forex market. It uses golden crosses and dead crosses between fast and slow moving averages to generate reversal signals, making counter operations at key market points, which has the advantage of large profit space. At the same time, it also uses settings like trading hours and maximum drawdown to control risks. This is a relatively stable reversal system that can generate high returns while controlling risks. In the future, this strategy can be improved and optimized through methods like indicator and parameter optimization, and the application of machine learning models.

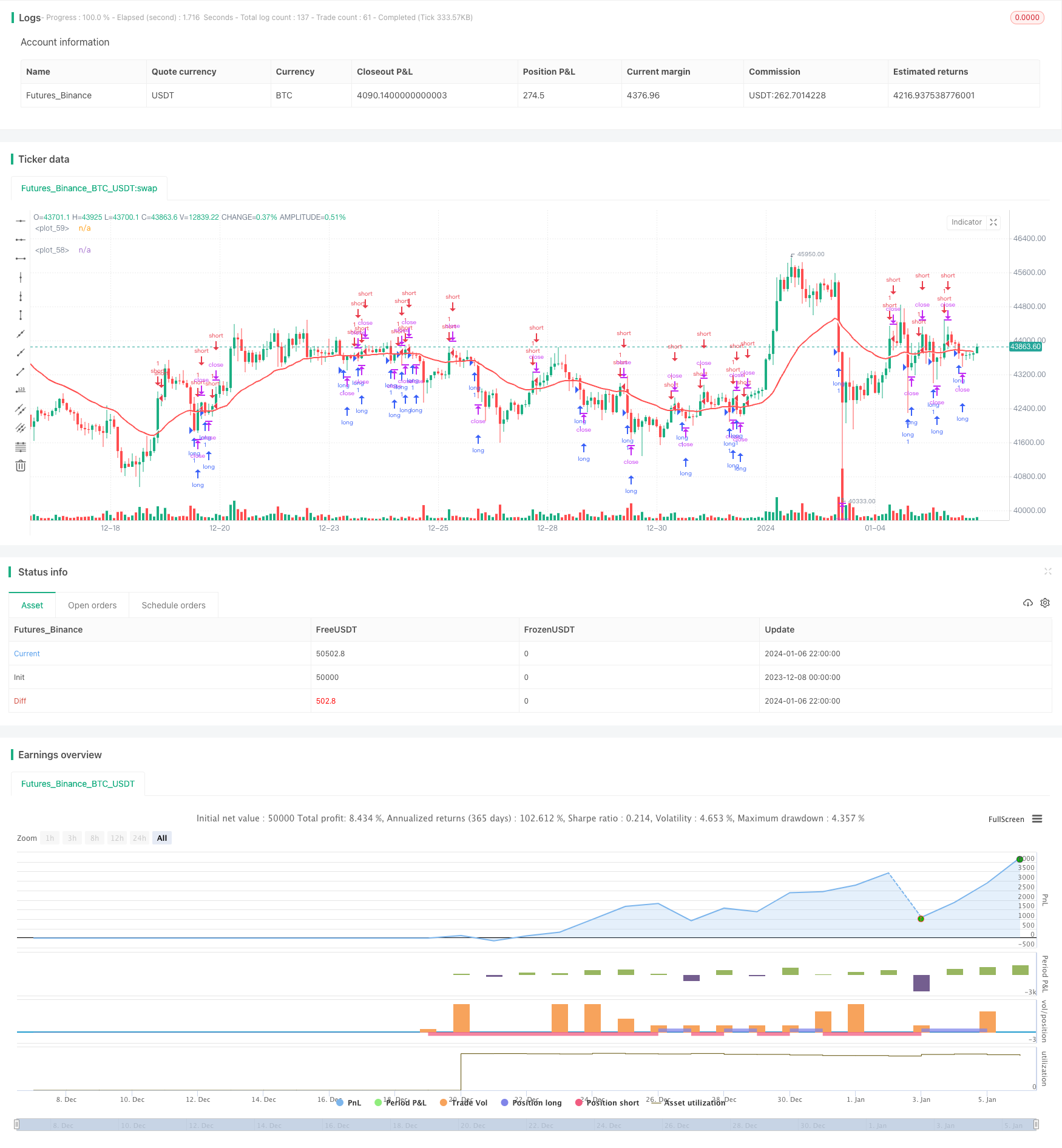

/*backtest

start: 2023-12-08 00:00:00

end: 2024-01-07 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("gbpnzd 1h", overlay=true)

src = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", type=input.resolution, defval="60")

len = input(28, title="Moving Average Length - LookBack Period")

//periodT3 = input(defval=7, title="Tilson T3 Period", minval=1)

factorT3 = input(defval=7, title="Tilson T3 Factor - *.10 - so 7 = .7 etc.", minval=0)

atype = input(2,minval=1,maxval=8,title="1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA, 8=Tilson T3")

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2000, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2020, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

res = useCurrentRes ? timeframe.period : resCustom

resCustom2 = input(title="plm", type=input.resolution, defval="D")

res2 = resCustom2

//hull ma definition

hullma = wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len)))

//TEMA definition

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

tema = 3 * (ema1 - ema2) + ema3

//Tilson T3

factor = factorT3 *.10

gd(src, len, factor) => ema(src, len) * (1 + factor) - ema(ema(src, len), len) * factor

t3(src, len, factor) => gd(gd(gd(src, len, factor), len, factor), len, factor)

tilT3 = t3(src, len, factor)

avg = atype == 1 ? sma(src,len) : atype == 2 ? ema(src,len) : atype == 3 ? wma(src,len) : atype == 4 ? hullma : atype == 5 ? vwma(src, len) : atype == 6 ? rma(src,len) : atype == 7 ? 3 * (ema1 - ema2) + ema3 : tilT3

out = avg

ema20 = security(syminfo.tickerid, res, out)

plot3 = security(syminfo.tickerid, res2, ema20)

plot33 = security(syminfo.tickerid, res, ema20)

plot(plot3,linewidth=2,color=color.red)

plot(plot33,linewidth=2,color=color.white)

// longC = crossover(close[2], plot3) and close[1] > close[2] and close > close[1]

// shortc = crossunder(close[2],plot3) and close[1] < close[2] and close < close[1]

volumeMA=input(24)

ema_1 = ema(volume, volumeMA)

timeinrange(res, sess) => time(res, sess) != 0

//entrytime = timeinrange(timeframe.period, "0900-0915")

myspecifictradingtimes = input('0900-2300', type=input.session, title="My Defined Hours")

entrytime = time(timeframe.period, myspecifictradingtimes) != 0

longC = crossover(plot33,plot3) and time_cond and entrytime

shortc = crossunder(plot33,plot3) and time_cond and entrytime

// exitlong = crossunder(plot33,plot3)

// exitshort = crossover(plot33,plot3)

distanta=input(1.0025)

exitshort = plot33/plot3 > distanta

exitlong = plot3/plot33 > distanta

inverse = input(true)

exit = input(false)

if(inverse==false)

strategy.entry("long",1,when=longC)

strategy.entry("short",0,when=shortc)

if(inverse)

strategy.entry("long",1,when=shortc)

strategy.entry("short",0,when=longC)

if(exit)

strategy.close("long",when=exitlong)

strategy.close("short",when=exitshort)

// if(dayofweek==dayofweek.friday)

// strategy.close_all()

// risk = input(25)

// strategy.risk.max_intraday_loss(risk, strategy.percent_of_equity)

- Fast Oscillating RSI Trading Strategy

- Single Exponential Smoothed Moving Average with Trailing Stop Loss Trend Following Strategy

- Buy Low Volatility VS Buy High Volatility Strategy

- Exponential Moving Average Crossover Strategy

- Multi-Timeframe Trailing Stop Loss Strategy

- Momentum Dual Moving Window TSI Indicator

- RSI and Bollinger Bands Profitable Strategy

- Buy/Sell on Candle Close Strategy

- Supertrend Take Profit Strategy

- Price Channel Trend Following Strategy

- Positive Bars Percentage Breakout Strategy

- RSI Dual-track Breakthrough Strategy

- Crude Oil Moving Average Crossover Strategy

- Vertical Horizontal Filter Backtest Strategy

- RSI and Bollinger Bands Quantitative Trading Strategy

- ZigZag Trend Following Strategy

- Supertrend Advance Strategy

- Midnight Candle Color Strategy with Stop Loss and Take Profit

- ATR Trend Following Strategy Based on Standard Deviation Channel

- ATR Based Trend Tracking Strategy