Overview

This strategy combines multiple strong indicators with different periods such as Aroon, MA, BB, Williams, %R, ADX to form a multi-dimensional powerful open position indicator system that can efficiently open positions when the trend is obvious.

Strategy Principle

The strategy mainly uses the combination of the following indicators to generate strong opening signals:

Aroon Indicator: Calculate the highest and lowest prices over a certain period to form an oscillating indicator. Judging the trend direction through the combination of Aroon indicators with multiple cycle lengths.

MA: Calculate the cross of short-period and long-period MA to determine turning points of the trend.

BB Band: When the price breaks through the upper rail of the BB band, it is a sell signal.

Williams %R Indicator: Forming divergence in overbought and oversold areas as opening signals.

ADX: Judging the strength of the trend. ADX above a certain position generates opening signals.

The above indicators, with different cycle length parameters, form a multi-dimensional judgment system that can generate strong opening signals when the trend is obvious.

Specifically, the buy conditions are:

- When Aroon_1 is lower than -85

- When the MA forms a golden cross

- When Williams %R is lower than -99

- When ADX is higher than 14

- When Aroon_2 is higher than -39

When 3 of the 5 buy conditions are met, a strong buy signal is generated.

The sell conditions are similar, with 5 sell conditions. When 3 of them are met, a sell signal is generated.

So this strategy can produce high certainty strong opening signals when the trend is obvious, through the combination of different indicators.

Advantage Analysis

The biggest advantage of this strategy is the multi-dimensional combination of indicator signals, which greatly reduces the probability of erroneous signals caused by a single indicator, thereby being able to generate high-quality opening signals when the trend is obvious. This is the biggest highlight of this strategy.

Other advantages include:

The parameters can be adjusted to adapt to different market characteristics

The parameter settings of the indicators are scientifically reasonable and highly robust

The combination of multiple time cycles is realized to improve the accuracy of judgment

The code structure is clear and easy to understand and secondary development

Risk Analysis

This strategy also has some risks:

Although the combination of multiple indicators can improve the quality of judgment, it also increases the complexity of the strategy and expands the risk of over-optimization.

The parameter settings are not 100% perfect and may fail under specific market conditions.

There is still room for optimization in the combination of indicator methods. The combination logic can be further refined.

Short-term adjustment opportunities may be missed.

Corresponding solutions:

Increase sample backtesting to test the robustness of parameters

Adjust some parameters to adapt to more markets

Optimize the integration method of indicators to improve judgment quality

Appropriately shorten some indicator parameters to increase capturing of short-term adjustments

Optimization Directions

The main optimization direction of this strategy is the optimization of the indicator integration method, which mainly includes:

Add more different types of indicators to form an indicator forest to further improve judgment accuracy

Optimize indicator parameter settings to automatically adapt to market changes

Use machine learning and other methods to automatically search for optimal indicator integration solutions

Increase stop-loss strategies to control risks

Combine sentiment indicators, judge market heat, and dynamically adjust parameters

There is still a lot of room for improvement in the judgment quality and robustness of this strategy by integrating more indicators, automatically optimizing parameters and integration schemes.

Summary

The biggest highlight of this strategy is the scientific integration of multiple indicators to form a powerful opening signal that performs significantly when the trend is obvious. There is a lot of room for optimization in the integration methods of this strategy. By introducing more indicators and intelligent optimization of parameters and integration methods, this strategy can become a very powerful quantitative trading strategy.

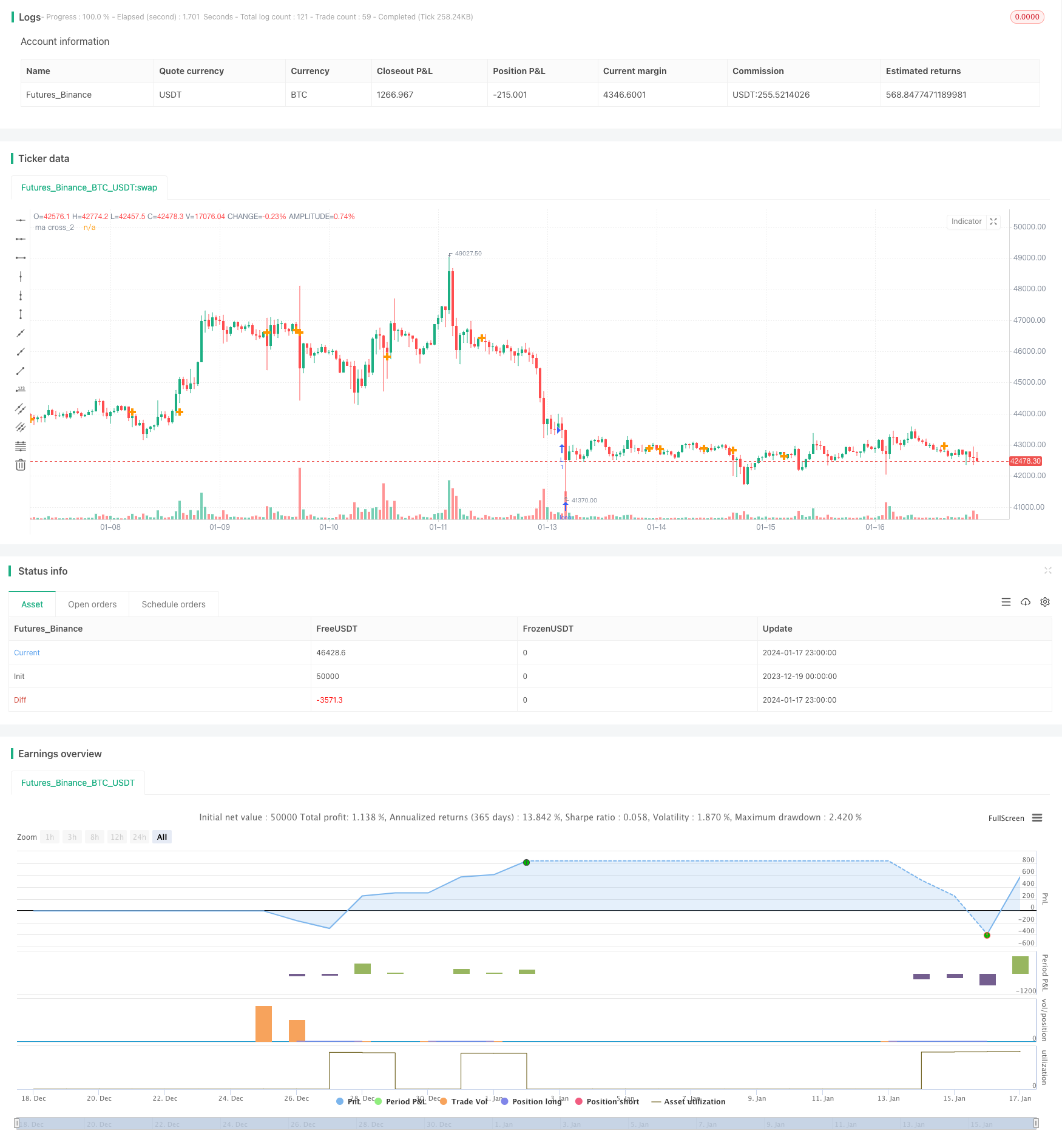

/*backtest

start: 2023-12-19 00:00:00

end: 2024-01-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="Aroon+Williams+MA2+ADX+Aroon Str.", shorttitle="Aroon+Williams+MA2+ADX+Aroon Str.", overlay=true)

//https://cafe.naver.com/watchbot/1945

//<<빙썸 매각 기념>> 바이낸스 이오스 복합지표

//Aroon_1

length_1 = input(264, minval=1, title="Length Aroon_1")

upper_1 = 100 * (highestbars(high, length_1+1) + length_1)/length_1

lower_1 = 100 * (lowestbars(low, length_1+1) + length_1)/length_1

midp_1 = 0

oscillator_1 = upper_1 - lower_1

//osc_1 = plot(oscillator_1, color=red)

//Aroon_2

length_2 = input(72, minval=1, title="Length Aroon_2")

upper_2 = 100 * (highestbars(high, length_2+1) + length_2)/length_2

lower_2 = 100 * (lowestbars(low, length_2+1) + length_2)/length_2

midp_2 = 0

oscillator_2 = upper_2 - lower_2

//osc_2 = plot(oscillator_2, color=red)

//Aroon_3

length_3 = input(137, minval=1, title="Length Aroon_3")

upper_3 = 100 * (highestbars(high, length_3+1) + length_3)/length_3

lower_3 = 100 * (lowestbars(low, length_3+1) + length_3)/length_3

midp_3 = 0

oscillator_3 = upper_3 - lower_3

//osc_3 = plot(oscillator_3, color=red)

//Aroon_4

length_4 = input(62, minval=1, title="Length Aroon_4")

upper_4 = 100 * (highestbars(high, length_4+1) + length_4)/length_4

lower_4 = 100 * (lowestbars(low, length_4+1) + length_4)/length_4

midp_4 = 0

oscillator_4 = upper_4 - lower_4

//osc_4 = plot(oscillator_4, color=red)

//Ma double

short_ma_1 = sma(close, 9)

long_ma_1 = sma(close, 21)

// plot(short_ma_1, color = red)

// plot(long_ma_1, color = green)

// plot(cross(short_ma_1, long_ma_1) ? short_ma_1 : na, style = cross, linewidth = 4)

short_ma_2 = sma(close, 9)

long_ma_2 = sma(close, 21)

// plot(short_ma_2, color = red)

// plot(long_ma_2, color = green)

plot(cross(short_ma_2, long_ma_2) ? short_ma_2 : na, transp= 100, title = "ma cross_2", style = cross, linewidth = 4)

//BB

length_bb = input(270, minval=1, title="BB length")

src_bb = input(close, title="Source")

mult_bb = input(2.0, minval=0.001, maxval=50, title="BB mult")

basis_bb = sma(src_bb, length_bb)

dev_bb = mult_bb * stdev(src_bb, length_bb)

upper_bb = basis_bb + dev_bb

lower_bb = basis_bb - dev_bb

// plot(basis_bb, color=red)

// p1 = plot(upper_bb, color=blue)

// p2 = plot(lower_bb, color=blue)

// fill(p1, p2)

//Williams

length_wil = input(130, minval=1, title="Length Williams %R")

upper_wil = highest(length_wil)

lower_wil = lowest(length_wil)

out_wil = 100 * (close - upper_wil) / (upper_wil - lower_wil)

// plot(out_wil)

// band1 = hline(-20)

// band0 = hline(-80)

// fill(band1, band0)

//ADX

adxlen = input(14, title="ADX Smoothing")

dilen = input(145, title="DI Length")

dirmov(len) =>

up_adx = change(high)

down_adx = -change(low)

plusDM = na(up_adx) ? na : (up_adx > down_adx and up_adx > 0 ? up_adx : 0)

minusDM = na(down_adx) ? na : (down_adx > up_adx and down_adx > 0 ? down_adx : 0)

truerange = rma(tr, len)

plus_adx = fixnan(100 * rma(plusDM, len) / truerange)

minus_adx = fixnan(100 * rma(minusDM, len) / truerange)

[plus_adx, minus_adx]

adx(dilen, adxlen) =>

[plus_adx, minus_adx] = dirmov(dilen)

sum_adx = plus_adx + minus_adx

adx = 100 * rma(abs(plus_adx - minus_adx) / (sum_adx == 0 ? 1 : sum_adx), adxlen)

sig_adx = adx(dilen, adxlen)

// plot(sig_adx, color=red, title="ADX")

//ADX 2

adxlen_2 = input(14, title="ADX Smoothing")

dilen_2 = input(150, title="DI Length")

dirmov_2(len) =>

up_adx_2 = change(high)

down_adx_2 = -change(low)

plusDM_2 = na(up_adx_2) ? na : (up_adx_2 > down_adx_2 and up_adx_2 > 0 ? up_adx_2 : 0)

minusDM_2 = na(down_adx_2) ? na : (down_adx_2 > up_adx_2 and down_adx_2 > 0 ? down_adx_2 : 0)

truerange_2 = rma(tr, len)

plus_adx_2 = fixnan(100 * rma(plusDM_2, len) / truerange_2)

minus_adx_2 = fixnan(100 * rma(minusDM_2, len) / truerange_2)

[plus_adx_2, minus_adx_2]

adx_2(dilen_2, adxlen_2) =>

[plus_adx_2, minus_adx_2] = dirmov_2(dilen_2)

sum_adx_2 = plus_adx_2 + minus_adx_2

adx_2 = 100 * rma(abs(plus_adx_2 - minus_adx_2) / (sum_adx_2 == 0 ? 1 : sum_adx_2), adxlen_2)

sig_adx_2 = adx(dilen_2, adxlen_2)

// plot(sig_adx_2, color=red, title="ADX_2")

//Input Position

//buy position

pos_aroon1 = input(-85, title="Aroon_1 Position Index_Down")

pos_madouble1_short = input(117, title="ma double_1 wma_Short")

pos_madouble1_long = input(86, title="ma double_1 sma_Long")

pos_wil = input(-99, title="Williams Position Index_Down")

pos_adx= input(14, title="ADX Position Index_Up")

pos_aroon2 = input(-39, title="Aroon_2 Position Index_Up")

//sell position

pos_bb = input(120, title="BB Position Index_Up")

pos_aroon_3 = input(99, title="Aroon_3 Position Index_Up")

pos_madouble2_short= input(88, title="ma double_2 ema_Short")

pos_madouble2_long= input(96, title="ma double_2 sma_Long")

pos_adx_2= input(9, title="ADX_2 Position Index_Up")

pos_aroon_4 = input(35, title="Aroon_4 Position Index_Down")

//Condition

longCondition_aroon_1 = (oscillator_1 <= pos_aroon1)

longCondition_ma2 = (pos_madouble1_short > pos_madouble1_long)

longCondition_wil = (out_wil <= pos_wil)

longCondition_adx = (sig_adx >= pos_adx)

longCondition_aroon_2 = (oscillator_2 >= pos_aroon2)

shortCondition_bb = (close > basis_bb)

shortCondition_aroon_3 = (oscillator_3 >= pos_aroon_3)

shortCondition_ma2 = (pos_madouble2_short < pos_madouble2_long)

shortCondition_adx = (sig_adx_2 >= pos_adx_2)

shortCondition_aroon_4 = (oscillator_4 <= pos_aroon_4)

vl_aroon_1 = 0

vl_ma2 = 0

vl_wil = 0

vl_adx = 0

vl_aroon_2 = 0

if longCondition_aroon_1

vl_aroon_1 := 1

if longCondition_ma2

vl_ma2 := 3

if longCondition_wil

vl_wil := 1

if longCondition_adx

vl_adx := -1

if longCondition_aroon_2

vl_aroon_2 := -1

vs_bb = 0

vs_aroon_3 = 0

vs_ma2 = 0

vs_adx = 0

vs_aroon_4 = 0

if shortCondition_bb

vs_bb := 1

if shortCondition_aroon_3

vs_aroon_3 := 1

if shortCondition_ma2

vs_ma2 := 3

if shortCondition_adx

vs_adx := -2

if shortCondition_aroon_4

vs_aroon_4 := -1

// plotshape(vl_aroon_1, title= "vl_aroon_1", location=location.belowbar, color=green, text="vl_aroon_1")

// plotshape(vl_ma2, title= "vl_ma2", location=location.belowbar, color=green, text="\nvl_ma2")

// plotshape(vl_wil, title= "vl_wil", location=location.belowbar, color=green, text="\n\nvl_wil")

// plotshape(vl_adx, title= "vl_adx", location=location.belowbar, color=green, text="\n\n\nvl_adx")

// plotshape(vl_aroon_2, title= "vl_aroon_2", location=location.belowbar, color=green, text="\n\n\n\nvl_aroon_2")

// plotshape(vs_bb, title= "vs_bb", location=location.abovebar, color=orange, text="vs_bb")

// plotshape(vs_aroon_3, title= "vs_aroon_3", location=location.abovebar, color=orange, text="vs_aroon_3\n")

// plotshape(vs_ma2, title= "vs_ma2", location=location.abovebar, color=orange, text="vs_ma2\n\n")

// plotshape(vs_adx, title= "vs_adx", location=location.abovebar, color=orange, text="vs_adx\n\n\n")

// plotshape(vs_aroon_4, title= "vs_aroon_4", location=location.abovebar, color=orange, text="vs_aroon_4\n\n\n\n")

longCondition = (vl_aroon_1 + vl_ma2 + vl_wil + vl_adx + vl_aroon_2) >= 3 ? true : na

shortCondition = (vs_bb + vs_aroon_3 + vs_ma2 + vs_adx + vs_aroon_4) >= 3 ? true : na

buy = longCondition == 1 ? longCondition : na

sell = shortCondition == 1? shortCondition : na

// plotshape(buy, title= "buy", location=location.bottom, color=green, text="buy")

// plotshape(sell, title= "sell", location=location.top, color=orange, text="sell")

// === BACKTEST RANGE ===

FromMonth = input(defval = 8, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2014)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2018, title = "To Year", minval = 2014)

strategy.entry("L", strategy.long, when=(buy))

strategy.close("L", when=(sell))

// strategy.entry("S", strategy.short, when=(sell and (time >= timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time <= timestamp(ToYear, ToMonth, ToDay, 23, 59))))

// strategy.close("S", when=(buy and (time <= timestamp(ToYear, ToMonth, ToDay, 23, 59))))