VWAP and RSI Combination Strategy

Author: ChaoZhang, Date: 2024-01-23 14:37:22Tags:

Overview

The strategy is named “Value Weighted Average Price and Relative Strength Index Combination Strategy”. It utilizes the Value Weighted Average Price (VWAP) and Relative Strength Index (RSI) indicators to implement a combination strategy of trend following entry and overbought oversold exit.

Strategy Principle

The main logic of this strategy is based on the following points:

- Use the 50-day exponential moving average crossing above the 200-day line as a signal that the market trend is up.

- When the closing price is higher than the VWAP price of the day, and the closing price is higher than the opening price, it is considered that the market is going stronger and can enter the market.

- If the RSI indicator on at least one of the previous 10 K-lines is lower than 10, it is regarded as an oversold formation and a strong entry signal.

- When the RSI indicator crosses down the overbought area of 90 again, exit the market.

- Set a 5% stop loss to avoid excessive losses.

The above is the basic trading logic of this strategy. EMA judges the big trend, VWAP judges the daily trend, RSI judges the overbought and oversold area to achieve effective combination of multiple indicators, which ensures the correct direction of the main trading while increasing entry and exit signals.

Advantage Analysis

The biggest advantage of this strategy is the combination use of indicators. The single VWAP cannot perfectly cope with all market conditions. At this time, with the help of RSI, some short-term oversold breakthrough opportunities can be identified. In addition, the application of EMA also ensures that only long-cycle upward trends are selected, avoiding being trapped by short-term reversals.

This way of using combined indicators also increases the stability of the strategy. In the case of one or two false breakouts of the RSI, there are still VWAP and EMA for backup, and it is unlikely to make wrong trades. Similarly, when VWAP has false breakouts, there is also confirmation from RSI indicators. Therefore, this combination usage greatly improves the success rate of strategy implementation.

Risk Analysis

The main risk of this strategy lies in the use of the VWAP indicator. VWAP represents the average transaction price of the day, but not every day’s price fluctuation fluctuates around VWAP. Therefore, VWAP breakout signals do not necessarily ensure that prices can continue to break through afterwards. Pseudo breakouts may cause losses in transactions.

In addition, RSI indicators are prone to have divergences. When the market is in a shock consolidation phase, the RSI may repeatedly touch the overbought and oversold zones multiple times, resulting in frequent output of trading signals. In this case, blindly following RSI signals for trading also faces certain risks.

To address this issue, we use the EMA exponential moving average as a large cycle judgment in the strategy, only considering trading when the large cycle is upward, which can alleviate the impact of the above two issues on the strategy to some extent. In addition, setting a stop loss can also keep a single loss within a certain range.

Optimization Direction

There is still room for further optimization of this strategy, mainly in the following aspects:

Introduce more indicators for combination. Such as Kalman lines, Bollinger bands, etc., to make trading signals clearer and more reliable.

Optimize transaction costs. The existing strategy does not consider the impact of fees and commissions. It can be combined with real trading accounts to optimize the size of the number of open positions.

Adjust the stop loss model. The existing stop loss method is relatively simple and cannot perfectly match market changes. Moving stop loss, tracking stop loss and other methods can be tested.

Test the application effects of different varieties. Currently only tested on the S&P 500 and Nasdaq indices. The sample range can be expanded to find the varieties that best match this strategy.

Summary

This strategy integrates the advantages of EMA, VWAP and RSI indicators to achieve effective combination of trend tracking and overbought oversold signals, which can find reasonable entry opportunities both in big cycle ups and short-term adjustments. At the same time, the strategy has considerable room for optimization, and it is promising to further improve the win rate and profit level of the strategy through introducing more indicators, adjusting stop loss methods, etc.

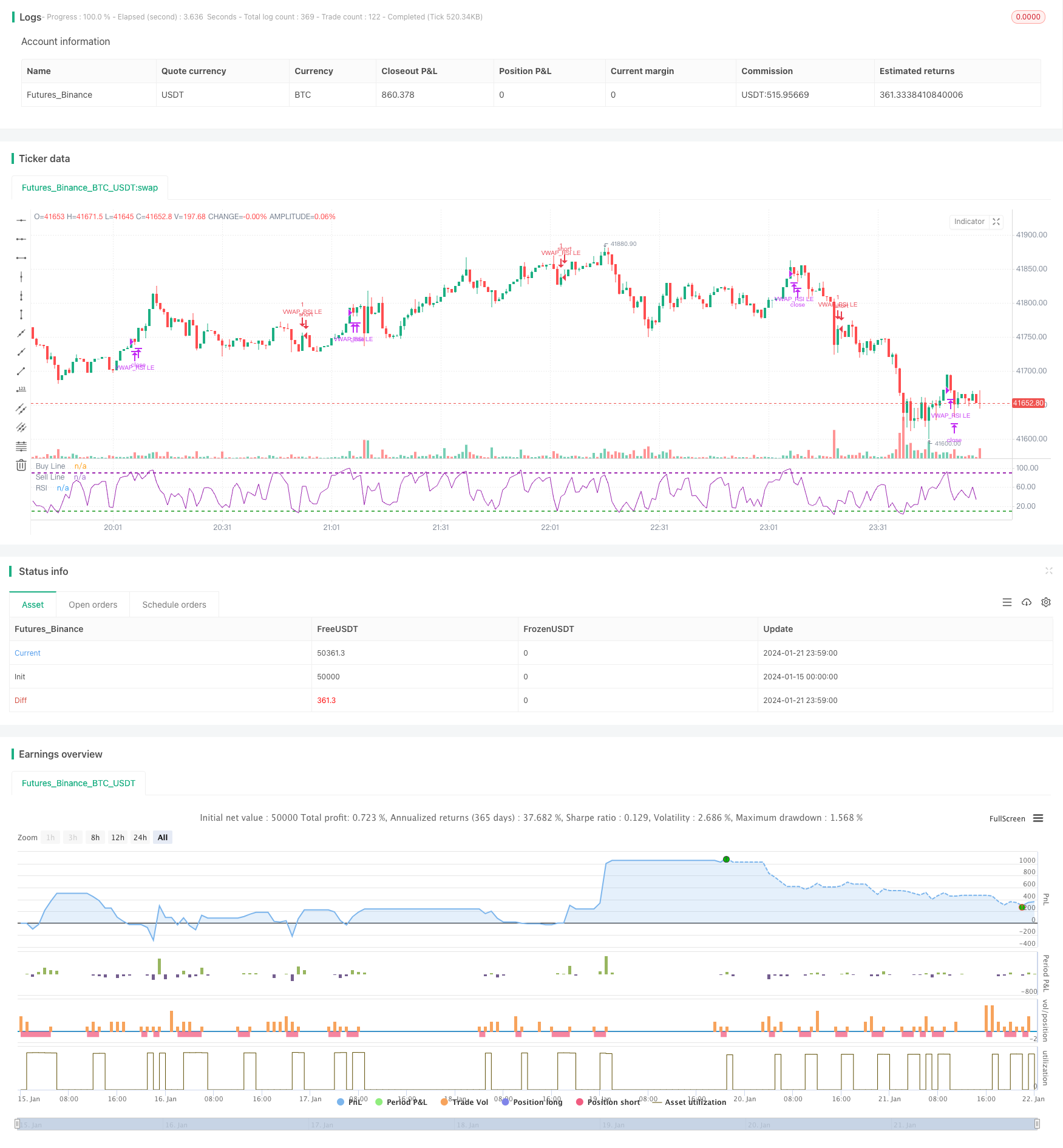

/*backtest

start: 2024-01-15 00:00:00

end: 2024-01-22 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

strategy(title="VWAP and RSI strategy [EEMANI]", overlay=false)

//This strategy combines VWAP and RSI indicators

//BUY RULE

//1. EMA50 > EMA 200

//2. if current close > vwap session value and close>open

//3. check if RSI3 is dipped below 10 for any of last 10 candles

//EXIT RULE

//1. RSI3 crossing down 90 level

//STOP LOSS EXIT

//1. As configured --- default is set to 5%

// variables BEGIN

longEMA = input(200, title="Long EMA", minval=1)

shortEMA = input(50, title="short EMA", minval=1)

rsi1 = input(3,title="RSI Period", minval=1)

rsi_buy_line = input(10,title="RSI Buy Line", minval=5)

rsi_sell_line = input(90,title="RSI Sell Line", minval=50)

stopLoss = input(title="Stop Loss%", defval=5, minval=1)

//variables END

longEMAval= ema(close, longEMA)

shortEMAval= ema(close, shortEMA)

rsiVal=rsi(close,rsi1)

vwapVal=vwap(hlc3)

// Drawings

plot_rsi = plot(rsiVal, title="RSI", color=color.purple, linewidth=1)

//plot_fill = plot(0, color=color.green, editable=false)

//fill(plot_rsi, plot_fill, title="Oscillator Fill", color=color.blue, transp=75)

hline(rsi_buy_line, color=color.green, title="Buy Line", linewidth=2, linestyle=hline.style_dashed)

hline(rsi_sell_line, color=color.purple, title="Sell Line", linewidth=2, linestyle=hline.style_dashed)

//plot(value_ma, title="MA", color=color_ma, linewidth=2)

longCondition= shortEMAval > longEMAval and close>open and close>vwapVal

rsiDipped = rsiVal[1]<rsi_buy_line or rsiVal[2]<rsi_buy_line or rsiVal[3]<rsi_buy_line or rsiVal[4]<rsi_buy_line or rsiVal[5]<rsi_buy_line or rsiVal[6]<rsi_buy_line or rsiVal[7]<rsi_buy_line or rsiVal[8]<rsi_buy_line or rsiVal[9]<rsi_buy_line or rsiVal[10]<rsi_buy_line

//Entry

strategy.entry(id="VWAP_RSI LE", comment="VR LE" , long=true, when= longCondition and rsiDipped )

//Take profit Exit

strategy.close(id="VWAP_RSI LE", comment="TP Exit", when=crossunder(rsiVal,90) )

//stoploss

stopLossVal = strategy.position_avg_price - (strategy.position_avg_price*stopLoss*0.01)

strategy.close(id="VWAP_RSI LE", comment="SL Exit", when= close < stopLossVal)

- Momentum Pullback Strategy

- Moving Average Crossover Strategy

- Profit Grid Strategy With Oscillation

- Oscillation Breakthrough Strategy Based on Moving Average

- ZigZag Pattern Recognition Short-term Trading Strategy

- Volatility and Trend Tracking Strategy Across Timeframes Based on Williams VIX and DEMA

- Momentum Breakout Strategy Based on Cycle Judgment with Moving Averages

- Money Flow Index 5 Minute Strategy Across Time and Space

- Dual EMA Cross Trend Trading Strategy

- Dynamic MACD Optimization Trading Strategy

- God's Bollinger Bands RSI Trading Strategy

- EMA Channel and MACD Based Short-term Trading Strategy

- Momentum and Fear Index Crossover Strategy

- Automatic Long/Short Trading Strategy Based on Daily Pivot Points

- Triple Moving Average Quantitative Trading Strategy

- A Momentum Crossover Strategy Based on Exponential Moving Average

- Adaptive Moving Average and Weighted Moving Average Crossover Trading Strategy

- Aggregated Multi-timeframe MACD RSI CCI StochRSI MA Linear Trading Strategy

- Multi-timeframe MACD Trend Following Strategy

- Trend Following Trading Strategy Based on MACD and RSI