Compound Stop Loss and Take Profit Strategy Based on Random Entry

Author: ChaoZhang, Date: 2024-01-24 15:38:49Tags:

Overview

The main idea of this strategy is to determine the entry point randomly and set three take profit points and one stop loss point to manage risks and control the profit and loss of each trade.

Strategy Logic

This strategy uses the random number rd_number_entry between 11 and 13 to determine the long entry point, and uses rd_number_exit between 20 and 22 to determine the closing of positions. After going long, the stop loss is set to the entry price minus atr(14)slx. At the same time, three take profit points are set. The first take profit point is the entry price plus atr(14)tpx, the second take profit point is the entry price plus 2tpx, and the third take profit point is the entry price plus 3tpx. The principle of going short is similar, except that the entry decision takes different rd_number_entry values, and the direction of take profit and stop loss is opposite.

The risk can be controlled by adjusting tpx (take profit coefficient) and slx (stop loss coefficient).

Advantage Analysis

The advantages of this strategy include:

- The use of random entry can reduce the probability of curve fitting

- Setting multiple stop loss and take profit points can control the risk of a single trade

- Using atr to set take profit and stop loss allows it to be based on market volatility

- The trading risk can be controlled by adjusting the coefficients

Risk Analysis

The risks of this strategy also include:

- Random entry may miss trends

- If the stop loss is too small, it may be stopped out easily

- If the profit taking space is too large, the profit may be insufficient

- Inappropriate parameters can lead to greater losses

The risks can be reduced by adjusting the take profit and stop loss coefficients and optimizing the random entry logic.

Optimization Directions

The strategy can be optimized in the following aspects:

- Improve the random entry logic and incorporate trend indicator judgments

- Optimize the take profit and stop loss coefficients to make the profit ratio more reasonable

- Increase position control to use different profit taking spaces at different stages

- Optimize parameters with machine learning algorithms

Conclusion

This strategy is based on random entry and sets multiple take profit and stop loss points to control the risk of a single trade. Due to the high randomness, the probability of curve fitting can be reduced. The trading risk can be reduced through parameter optimization. There is still much room for further optimization and research.

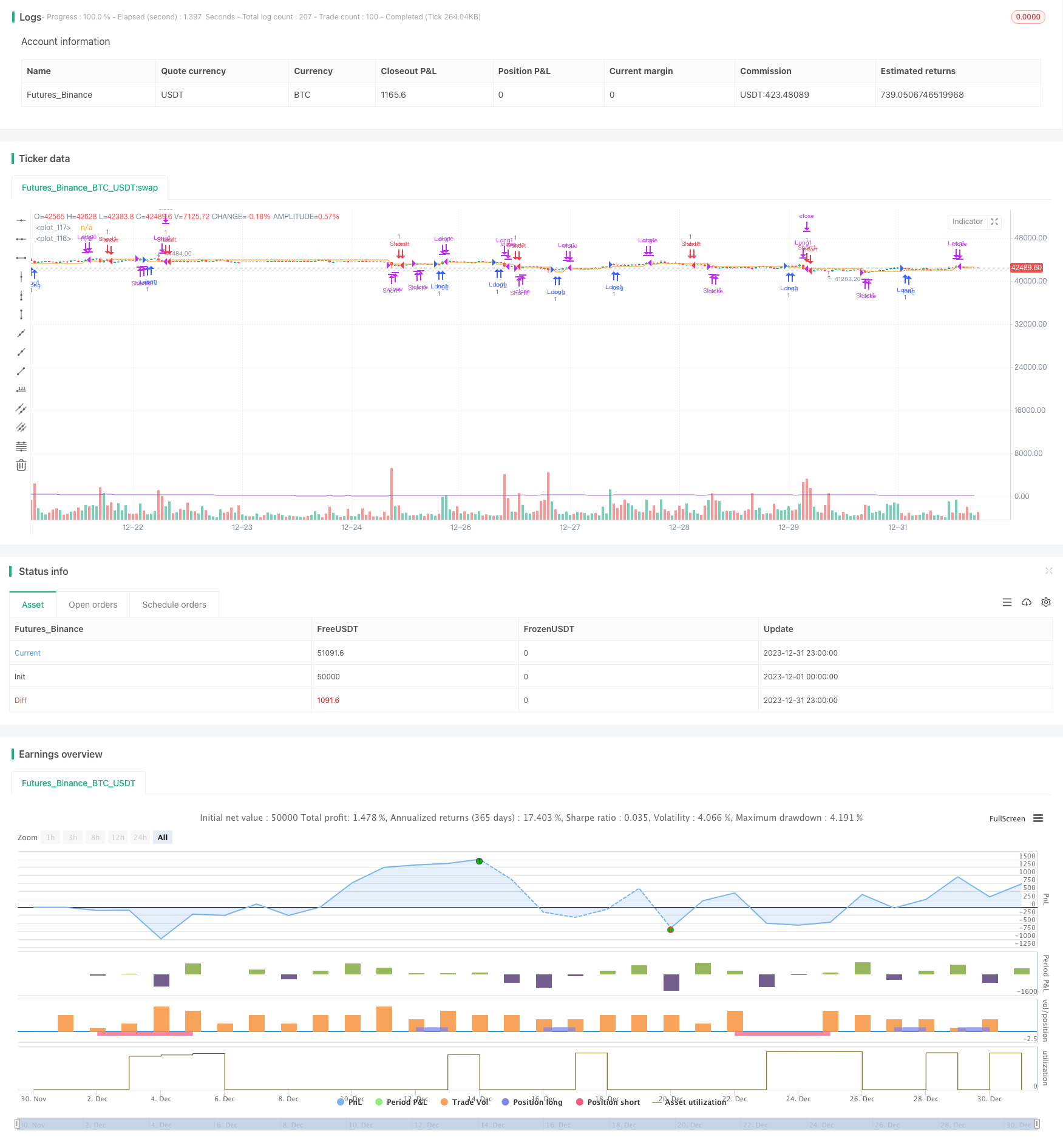

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Random Strategy with 3 TP levels and SL", overlay=true,max_bars_back = 50)

tpx = input(defval = 0.8, title = 'Atr multiplication for TPs?')

slx = input(defval = 1.2, title = 'Atr multiplication for SL?')

isLong = false

isLong := nz(isLong[1])

isShort = false

isShort := nz(isShort[1])

entryPrice = 0.0

entryPrice := nz(entryPrice[1])

tp1 = true

tp1 := nz(tp1[1])

tp2 = true

tp2 := nz(tp2[1])

sl_price = 3213.0

sl_price := nz(sl_price[1])

sl_atr = atr(14)*slx

tp_atr = atr(14)*tpx

rd_number_entry = 1.0

rd_number_entry := (16708 * nz(rd_number_entry[1], 1) % 2147483647)%17

rd_number_exit = 1.0

rd_number_exit := ((16708 * time % 2147483647) %17)

//plot(rd_number_entry)

shortCondition = (rd_number_entry == 13? true:false) and (year >= 2017) and not isLong and not isShort

longCondition = (rd_number_entry == 11 ? true:false) and (year >= 2017) and not isShort and not isShort

//Never exits a trade:

exitLong = (rd_number_exit == 22?true:false) and (year >= 2018) and not isShort

exitShort = (rd_number_exit == 22?true:false) and (year >= 2018) and not isLong

//shortCondition = crossunder(sma(close, 14), sma(close, 28)) and year >= 2017

//longCondition = crossover(sma(close, 14), sma(close, 28)) and year >= 2017

//exitLong = crossunder(ema(close, 14), ema(close, 28)) and year >= 2017

//exitShort = crossover(ema(close, 14), ema(close, 28)) and year >= 2017

if (longCondition and not isLong)

strategy.entry('Long1', strategy.long)

strategy.entry('Long2', strategy.long)

strategy.entry('Long3', strategy.long)

isLong := true

entryPrice := close

isShort := false

tp1 := false

tp2 := false

sl_price := close-sl_atr

if (shortCondition and not isShort)

strategy.entry('Short1', strategy.short)

strategy.entry('Short2', strategy.short)

strategy.entry('Short3', strategy.short)

isShort := true

entryPrice := close

isLong := false

tp1 := false

tp2 := false

sl_price := close+sl_atr

if (exitShort and isShort)

strategy.close('Short1')

strategy.close('Short2')

strategy.close('Short3')

isShort := false

if (exitLong and isLong)

strategy.close('Long1')

strategy.close('Long2')

strategy.close('Long3')

isLong := false

if isLong

if (close > entryPrice + tp_atr) and not tp1

strategy.close('Long1')

tp1 := true

sl_price := close - tp_atr

if (close > entryPrice + 2*tp_atr) and not tp2

strategy.close('Long2')

tp2 := true

sl_price := close - tp_atr

if (close > entryPrice + 3*tp_atr)

strategy.close('Long3')

isLong := false

if (close < sl_price)

strategy.close('Long1')

strategy.close('Long2')

strategy.close('Long3')

isLong := false

if isShort

if (close < entryPrice - tp_atr) and not tp1

strategy.close('Short1')

sl_price := close + tp_atr

tp1 := true

if (close < entryPrice - 2*tp_atr) and not tp2

strategy.close('Short2')

sl_price := close + tp_atr

tp2 := true

if (close < entryPrice - 3*tp_atr)

strategy.close('Short3')

isShort := false

if (close > sl_price)

strategy.close('Short1')

strategy.close('Short2')

strategy.close('Short3')

isShort := false

plot(atr(14)*slx)

plot(sl_price)

- Nifty Trading Strategy Based on RSI Indicator

- RSI and EMA Based Trend Following Strategy

- Trend Confirmation Tracking Strategy

- The RSI Divergence Indicator Strategy

- Momentum Moving Average Consolidation Strategy

- Fast QQE Crossover Trading Strategy Based on Trend Filter

- Adaptive Moving Average Tracking Strategy

- Scalping Strategy in Trend Reversal Market

- Bidirectional EMA Cross Quant Trading Strategy

- EMA Intraday Scalping Strategy

- Bandpass Filter Reversed Strategy

- Dual Moving Average Crossover Trading Strategy

- RSI Combined with Bollinger Bands and Dynamic Support/Resistance Quantitative Strategy

- Dynamic Dual EMA Trailing Stop Strategy

- Multi-indicator Combined Quantitative Trading Strategy

- Contrarian Donchian Channel Touch Entry Strategy with Post-Stop Loss Pause and Trailing Stop Loss

- Intraday Single Candle Indicator Combo Short Term Trading Strategy

- Moving Average Crossover Trading Strategy

- RSI Bollinger Bands Trading Strategy

- Trend Following Strategy Based on Dual EMA