Ehlers-Smoothed Stochastic RSI Strategy

Author: ChaoZhang, Date: 2024-01-26 15:58:48Tags:

Overview

The main idea of this strategy is to use the Ehlers SuperSmoother filter to process the Stochastic RSI indicator, filtering out many false signals and obtaining more reliable trading signals. The basic principle is to first calculate the Stochastic RSI indicator, then use the Ehlers SuperSmoother filter to smooth it, and finally go long or short based on the crossover between it and its own moving average line.

Strategy Logic

This strategy first calculates the RSI indicator of the logarithmic closing price, then calculates the Stochastic indicator based on the RSI indicator, which is a typical relative strength index indicator. To filter out false signals, the Ehlers SuperSmoother filter is used to process the Stochastic RSI. Finally, go long when the Stochastic RSI line has a golden cross with its own moving average line, and go short when there is a death cross. So the key points of this strategy are: 1) Calculate the Stochastic RSI indicator; 2) Use the Ehlers SuperSmoother filter; 3) Form trading signals with moving average crossover.

Advantage Analysis

The biggest advantage of this strategy is the use of the Ehlers SuperSmoother filter, which can effectively filter out many false signals and make trading signals more reliable. In addition, the Stochastic RSI indicator itself has very good breakthrough and trend tracking capabilities. Therefore, this strategy can correctly identify trends, establish positions at the right time, and close positions at the right time.

Risk Analysis

The main risk of this strategy is that it is prone to wrong signals when the market fluctuates sharply. When the price fluctuates sharply within a narrow range, the Stochastic RSI indicator will generate many false up and down signals. At this time, the effect of the Ehlers SuperSmoother filter will also be compromised. In addition, the lag of indicators may also bring some risks in some violent market conditions.

To reduce these risks, parameters can be adjusted appropriately, such as increasing the cycle of the Stochastic indicator, reducing the degree of smoothness, etc., to further filter out false signals. In addition, consider combining other indicators or patterns to form multiple filter conditions and avoid the risks of wrong signals.

Optimization Directions

The main optimization directions for this strategy are:

Optimize parameter settings. Optimize parameters like length and smoothing constants of Stochastic RSI through extensive backtesting.

Add stop loss mechanisms. Set trailing stop or pending orders to lock in profits and reduce drawdowns.

Combine with other indicators or patterns. Consider combining with volatility indicators, moving averages etc. to add multiple filter conditions and further reduce risks.

Adjust position sizing based on analysis of higher timeframes. Dynamically adjust the position size of each trade based on trend analysis results from higher timeframes.

Summary

This strategy first calculates the Stochastic RSI indicator, then processes it with the Ehlers SuperSmoother filter, and finally generates trading signals with the moving average crossover to determine the trend correctly. The advantage lies in the combination of indicator and filter, which can effectively filter out false signals and obtain high probability trading opportunities. The main risks come from inappropriate parameter settings and lack of stop loss mechanisms. Methods like parameter optimization, adding stop loss, and strategy optimization can further improve the stability and profitability.

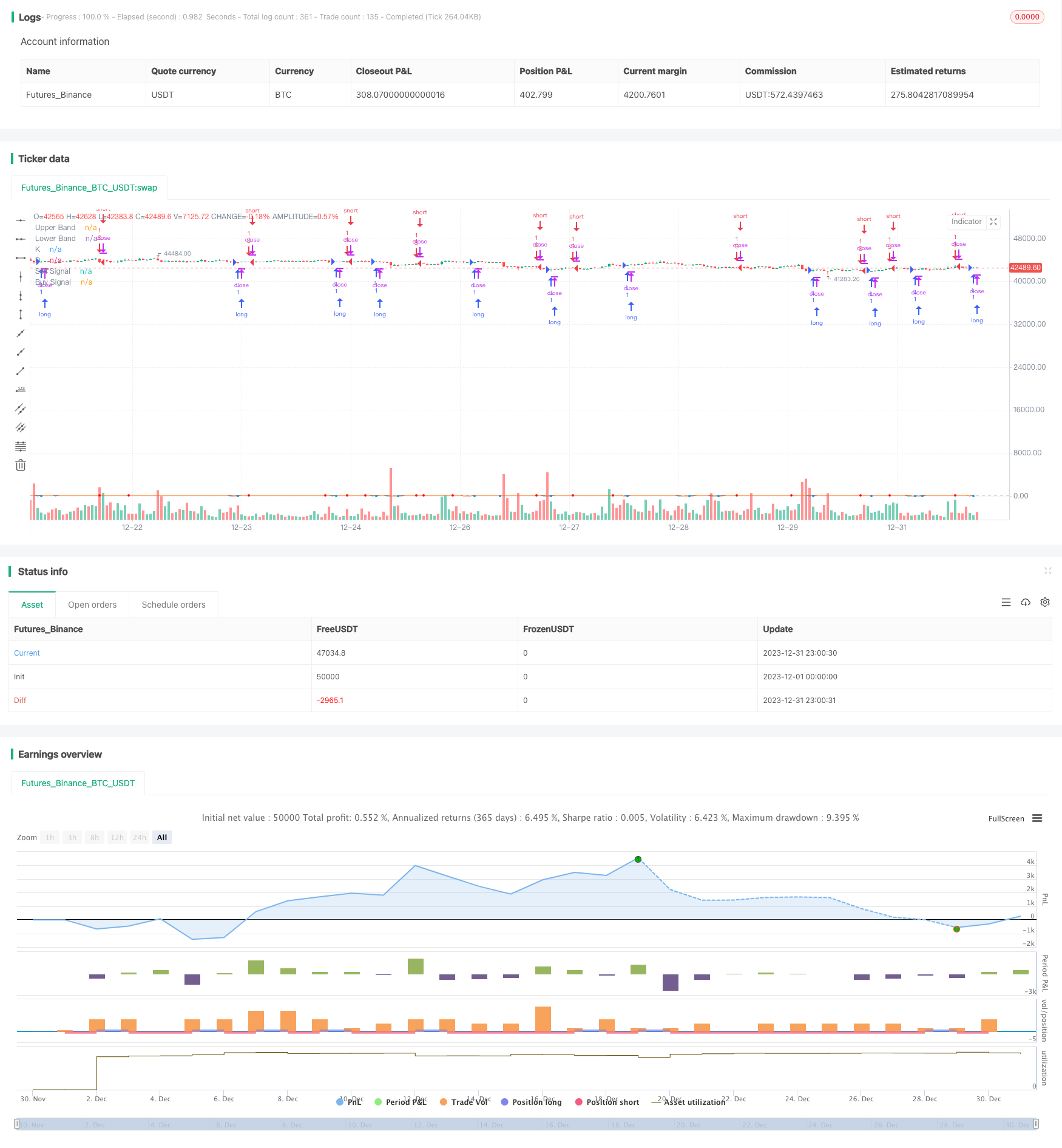

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("ES Stoch RSI Strategy [krypt]", overlay=true, calc_on_order_fills=true, calc_on_every_tick=true, initial_capital=10000, currency='USD')

//Backtest Range

FromMonth = input(defval = 06, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2018, title = "From Year", minval = 2014)

ToMonth = input(defval = 7, title = "To Month", minval = 1)

ToDay = input(defval = 30, title = "To Day", minval = 1)

ToYear = input(defval = 2018, title = "To Year", minval = 2014)

PI = 3.14159265359

drop1st(src) =>

x = na

x := na(src[1]) ? na : src

xlowest(src, len) =>

x = src

for i = 1 to len - 1

v = src[i]

if (na(v))

break

x := min(x, v)

x

xhighest(src, len) =>

x = src

for i = 1 to len - 1

v = src[i]

if (na(v))

break

x := max(x, v)

x

xstoch(c, h, l, len) =>

xlow = xlowest(l, len)

xhigh = xhighest(h, len)

100 * (c - xlow) / (xhigh - xlow)

Stochastic(c, h, l, length) =>

rawsig = xstoch(c, h, l, length)

min(max(rawsig, 0.0), 100.0)

xrma(src, len) =>

sum = na

sum := (src + (len - 1) * nz(sum[1], src)) / len

xrsi(src, len) =>

msig = nz(change(src, 1), 0.0)

up = xrma(max(msig, 0.0), len)

dn = xrma(max(-msig, 0.0), len)

rs = up / dn

100.0 - 100.0 / (1.0 + rs)

EhlersSuperSmoother(src, lower) =>

a1 = exp(-PI * sqrt(2) / lower)

coeff2 = 2 * a1 * cos(sqrt(2) * PI / lower)

coeff3 = -pow(a1, 2)

coeff1 = (1 - coeff2 - coeff3) / 2

filt = na

filt := nz(coeff1 * (src + nz(src[1], src)) + coeff2 * filt[1] + coeff3 * filt[2], src)

smoothK = input(7, minval=1, title="K")

smoothD = input(2, minval=1, title="D")

lengthRSI = input(10, minval=1, title="RSI Length")

lengthStoch = input(3, minval=1, title="Stochastic Length")

showsignals = input(true, title="Buy/Sell Signals")

src = input(close, title="Source")

ob = 80

os = 20

midpoint = 50

price = log(drop1st(src))

rsi1 = xrsi(price, lengthRSI)

rawsig = Stochastic(rsi1, rsi1, rsi1, lengthStoch)

sig = EhlersSuperSmoother(rawsig, smoothK)

ma = sma(sig, smoothD)

plot(sig, color=#0094ff, title="K", transp=0)

plot(ma, color=#ff6a00, title="D", transp=0)

lineOB = hline(ob, title="Upper Band", color=#c0c0c0)

lineOS = hline(os, title="Lower Band", color=#c0c0c0)

fill(lineOB, lineOS, color=purple, title="Background")

// Buy/Sell Signals

// use curvature information to filter out some false positives

mm1 = change(change(ma, 1), 1)

mm2 = change(change(ma, 2), 2)

ms1 = change(change(sig, 1), 1)

ms2 = change(change(sig, 2), 2)

sellsignals = showsignals and (mm1 + ms1 < 0 and mm2 + ms2 < 0) and crossunder(sig, ma) and sig[1] > ob

buysignals = showsignals and (mm1 + ms1 > 0 and mm2 + ms2 > 0) and crossover(sig, ma) and sig[1] < os

ploff = 4

plot(buysignals ? sig[1] - ploff : na, style=circles, color=#008fff, linewidth=3, title="Buy Signal", transp=0)

plot(sellsignals ? sig[1] + ploff : na, style=circles, color=#ff0000, linewidth=3, title="Sell Signal", transp=0)

longCondition = buysignals

if (longCondition)

strategy.entry("L", strategy.long, comment="Long", when=(buysignals))

shortCondition = sellsignals

if (shortCondition)

strategy.entry("S", strategy.short, comment="Short", when=(sellsignals))

- The relative momentum strategy

- Wave Trend and VWMA Based Trend Following Quant Strategy

- Dual Moving Average and Williams Average Combination Strategy

- Adaptive Triple Supertrend Strategy

- Moving Average Crossover Strategy

- Multiple Indicator Quantitative Trading Strategy

- Market Cypher Wave B Automated Trading Strategy

- Key Reversal Backtest Strategy

- Three EMA Stochastic RSI Crossover Golden Cross Strategy

- Reversal Candlestick Backtesting Strategy

- Swing High Low Price Channel Strategy V.1

- Momentum Reversal Trading Strategy

- Adaptive Linear Regression Channel Strategy

- Moving Average Difference Zero Cross Strategy

- Multiple Indicators Follow Strategy

- Solid Trend Following Strategy

- Price Crossing Moving Average Trend Following Strategy

- Dual EMA Golden Cross Breakout Strategy

- Gradual BB KC Trend Strategy

- Triple SMA Auto-Tracking Strategy