Overview

The moving average crossover strategy is a quantitative trading strategy based on moving averages. By calculating the average price of securities over a period of time, it generates trading signals through the crossover of price moving averages to make profits.

Strategy Principle

This strategy mainly uses the crossover of fast and slow moving average lines to determine price trends and generate trading signals. Specifically, it employs two moving averages with different period lengths, such as 10-day and 20-day lines.

When the fast moving average line breaks through the slow moving average line upward, the market is considered to turn from decline to rise, generating a buy signal. When the fast moving average line breaks through the slow moving average line downward, the market is thought to turn from rise to decline, producing a sell signal.

By capturing the inflection points of price trends, this strategy can buy during an improving market and sell during a worsening market to make profits.

Advantage Analysis

This strategy has the following advantages:

- The concept is simple and easy to understand and implement

- Highly customizable by adjusting moving average periods etc.

- Good backtesting results, especially suitable for trending markets

- Can incorporate take profit and stop loss to control risks

Risk Analysis

This strategy also has the following risks:

- Prone to generating false signals and overtrading during range-bound markets

- Parameter tuning needed as different parameter sets lead to varied backtest results

- Ignores transaction costs and slippage, actual results likely weaker than backtest

- Time lag exists, may miss opportunities from fast price reversals

These risks can be alleviated through appropriate optimizations.

Optimization Directions

This strategy can be optimized in the following aspects:

- Add filters like volume and volatility indicators to avoid wrong trades during consolidations

- Employ adaptive moving averages to allow dynamic period changes for better trend following

- Optimize moving average periods to find best parameter sets

- Set re-entry conditions to prevent excessive trades

- Consider actual trading costs and slippage, adjust take profit and stop loss

The above optimizations can greatly improve the actual performance of the strategy.

Summary

In summary, the moving average crossover strategy is an easy to grasp and implement quantitative trading strategy. It judges market trends and generates trading signals through the intuitive principle of price average line crossovers. With parameter tuning and combinations with other technical indicators, it can strengthen the actual performance of this strategy and make it a reliable profit generator.

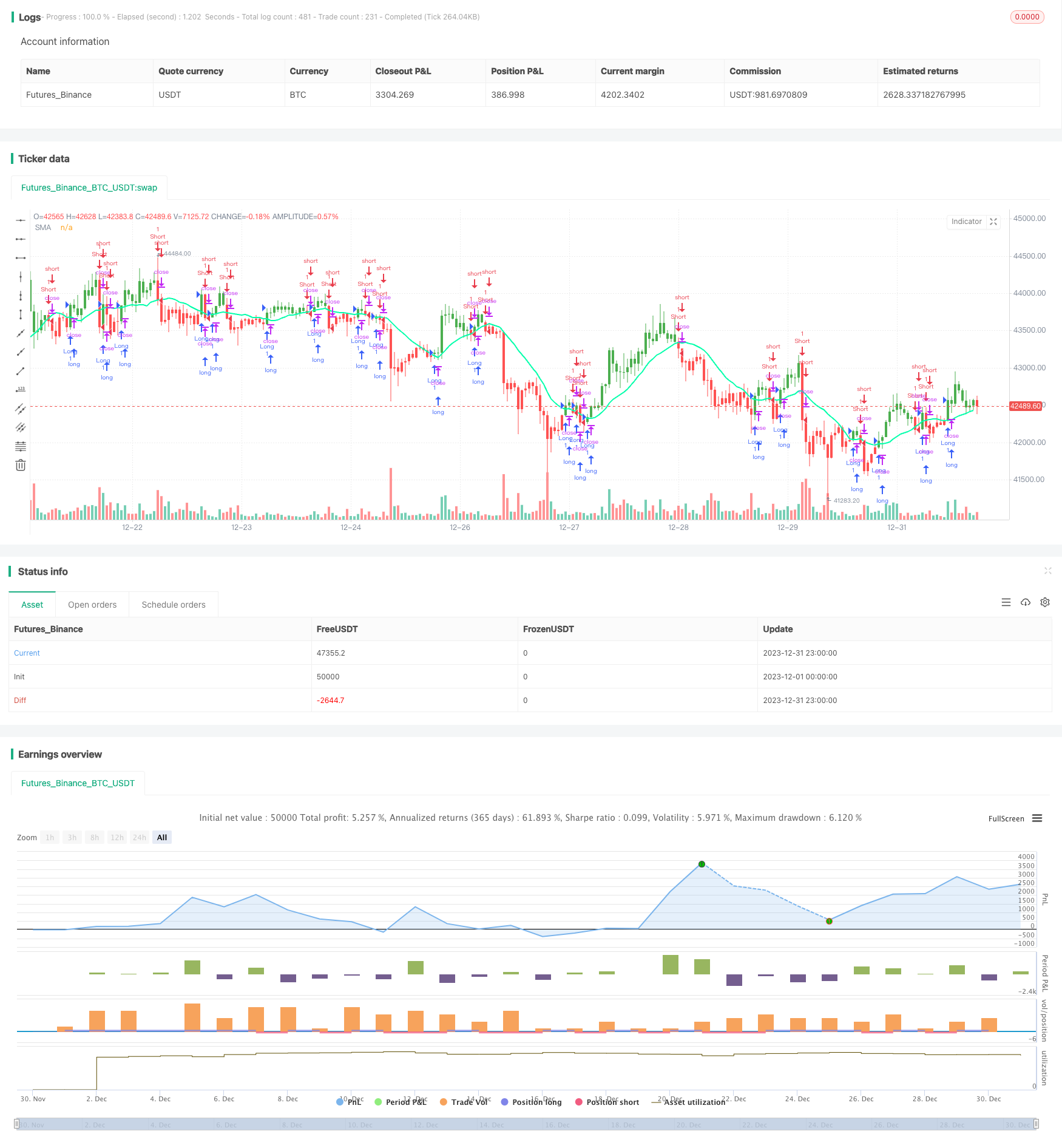

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HPotter

// Simple SMA strategy

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors

//@version=4

strategy(title="Simple SMA Strategy Backtest", shorttitle="SMA Backtest", precision=6, overlay=true)

Resolution = input(title="Resolution", type=input.resolution, defval="D")

Source = input(title="Source", type=input.source, defval=close)

xSeries = security(syminfo.tickerid, Resolution, Source)

Length = input(title="Length", type=input.integer, defval=14, minval=2)

TriggerPrice = input(title="Trigger Price", type=input.source, defval=close)

TakeProfit = input(50, title="Take Profit", step=0.01)

StopLoss = input(20, title="Stop Loss", step=0.01)

UseTPSL = input(title="Use Take\Stop", type=input.bool, defval=false)

BarColors = input(title="Painting bars", type=input.bool, defval=true)

ShowLine = input(title="Show Line", type=input.bool, defval=true)

UseAlerts = input(title="Use Alerts", type=input.bool, defval=false)

reverse = input(title="Trade Reverse", type=input.bool, defval=false)

pos = 0

xSMA = sma(xSeries, Length)

pos := iff(TriggerPrice > xSMA, 1,

iff(TriggerPrice < xSMA, -1, nz(pos[1], 0)))

nRes = ShowLine ? xSMA : na

alertcondition(UseAlerts == true and pos != pos[1] and pos == 1, title='Signal Buy', message='Strategy to change to BUY')

alertcondition(UseAlerts == true and pos != pos[1] and pos == -1, title='Signal Sell', message='Strategy to change to SELL')

alertcondition(UseAlerts == true and pos != pos[1] and pos == 0, title='FLAT', message='Strategy get out from position')

possig =iff(pos[1] != pos,

iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos)), 0)

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (UseTPSL)

strategy.close("Long", when = high > strategy.position_avg_price + TakeProfit, comment = "close buy take profit")

strategy.close("Long", when = low < strategy.position_avg_price - StopLoss, comment = "close buy stop loss")

strategy.close("Short", when = low < strategy.position_avg_price - TakeProfit, comment = "close buy take profit")

strategy.close("Short", when = high > strategy.position_avg_price + StopLoss, comment = "close buy stop loss")

nColor = BarColors ? strategy.position_avg_price != 0 and pos == 1 ? color.green :strategy.position_avg_price != 0 and pos == -1 ? color.red : color.blue : na

barcolor(nColor)

plot(nRes, title='SMA', color=#00ffaa, linewidth=2, style=plot.style_line)