Cross-Cycle Arbitrage Strategy Based on Multiple Indicators

Author: ChaoZhang, Date: 2024-01-29 11:10:33Tags:

Overview

This strategy uses a combination of three different technical indicators to build a cross-cycle arbitrage strategy that captures price trends across different time frames to achieve low-risk excess returns.

Strategy Logic

The three technical indicators used in this strategy are Keltner Channel (KC), Volatility Stop (Vstop), and Williams Alligator (WAE). The Keltner Channel is used to determine if prices are outside the channel range and thus generate trading signals. Volatility Stop is used to dynamically adjust stop loss positions to ensure stop loss while reducing unnecessary stop loss. The Williams Alligator indicator is used to determine if prices are in a strong trend. Specifically:

-

When the price is higher than the Keltner Channel upper rail, it is considered a bullish signal. When the price is lower than the Keltner Channel lower rail, it is considered a bearish signal.

-

Volatility Stop sets the stop loss position based on price volatility and channel width. It can adjust dynamically to ensure stop loss while avoiding excessively conservative stop loss positions.

-

The Williams Alligator indicator judges whether prices are in a strong uptrend or downtrend by calculating the MACD and Bollinger Band channel width.

By combining these three indicators, signals across different time frames are cross validated. This reduces the probability of misjudgment and builds an optimized strategy logic.

Advantage Analysis

The biggest advantage of this strategy is the precise trading signals brought by the combination of multiple indicators. The three indicators work in different time frames and cross validate each other, which can effectively reduce the probability of misjudgment and enhance the accuracy of signals. In addition, Volatility Stop setting is dynamic and can adjust the stop loss position according to real-time volatility to further control risks.

Compared with single indicator strategies, this combined strategy can provide more accurate and efficient trading signals. At the same time, the three indicators work together to form trading judgments within multiple time frames, which is a very scientific and reasonable logic design worth learning from.

Risk Analysis

The main risk of this strategy is that improper parameter settings may cause overfitting. The three indicators have 8 parameters in total. Improper settings may adversely affect the strategy. In addition, the weight relationship between indicators also needs to be properly configured, otherwise the signals may neutralize each other and become invalid.

To reduce these risks, the adaptability to different market environments should be fully considered during parameter setting, and the optimal parameter combination should be adjusted through backtesting analysis. In addition, appropriately adjust the weights between indicators to ensure that trading signals can be effectively triggered. When consecutive losses occur, consider reducing the position size to control losses.

Optimization Directions

The optimization space of this strategy mainly focuses on two aspects: parameter tuning and improvement of stop loss strategies. Specifically, the following aspects can be considered:

-

Choose indicator parameters more scientifically and optimize parameter combinations. Algorithms can be used to find the optimal parameters with the goals like return maximization and risk minimization.

-

Improve the stop loss strategy to further reduce unnecessary stop loss while ensuring stop loss, thereby improving win rate. For example, incorporate more indicators as stop loss signals, or set progressive pullback of stop loss positions.

-

Optimize weights between indicators and logic of trading signal judgments to reduce misjudgment rate. More price behavior features can be introduced to build more stable and reliable judgment rules.

-

Try to introduce machine learning models to achieve automatic parameter optimization. Or use deep reinforcement learning programming for strategy evaluation and improvement.

Summary

This strategy builds a cross-cycle arbitrage system through the combination of Keltner Channel, Volatility Stop and Williams Alligator. Multi-indicator combination improves signal accuracy and dynamic stop loss controls risks. But there is room for improvement in parameters setting and optimization. Overall, this strategy has strong scientificity and is worth further research and application.

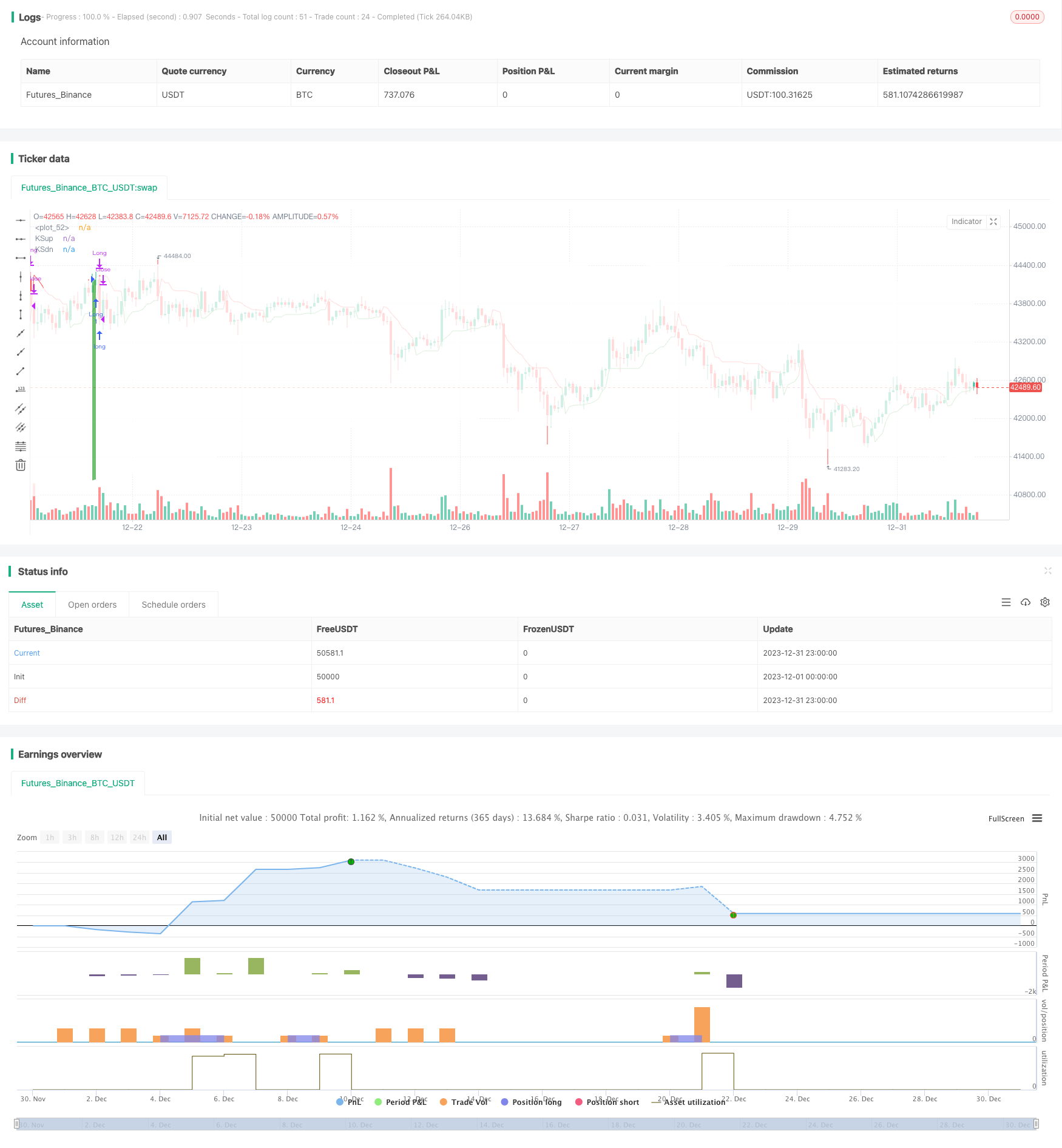

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("QuarryLake", overlay=true) ///Ultilized modified full kelly for this strategy = 36%

///Keltner channel///

nPeriod = input(title="Keltner Period", type=input.integer, defval=200, minval=1)

Mult = input(title="Keltner Mult", type=input.integer, defval=5, minval=1)

xPrice = ema(hlc3, nPeriod)

xMove = ema(high - low, nPeriod)

xMoveMult = xMove * Mult

xUpper = xPrice + xMoveMult

xLower = xPrice - xMoveMult

// plot(xPrice, color=red, title="KSmid")

p1 = plot(xUpper, color=color.white, title="KSup")

p2 = plot(xLower, color=color.white, title="KSdn")

fill(p1, p2, color=close > xUpper ? color.green : close < xLower ? color.red : color.white)

kclongcondition = close > xUpper

kcshortcondition = close < xLower

kccloselongcondition = crossunder(close, xUpper)

kccloseshortcondition = crossover(close, xLower)

///Volatility Stop///

length = input(title="Vstop length", type=input.integer, defval=3, minval=1)

mult1 = 1.5

atr_ = atr(length)

max1 = 0.0

min1 = 0.0

is_uptrend_prev = false

stop = 0.0

vstop_prev = 0.0

vstop1 = 0.0

is_uptrend = false

is_trend_changed = false

max_ = 0.0

min_ = 0.0

vstop = 0.0

max1 := max(nz(max_[1]), close)

min1 := min(nz(min_[1]), close)

is_uptrend_prev := nz(is_uptrend[1], true)

stop := is_uptrend_prev ? max1 - mult1 * atr_ : min1 + mult1 * atr_

vstop_prev := nz(vstop[1])

vstop1 := is_uptrend_prev ? max(vstop_prev, stop) : min(vstop_prev, stop)

is_uptrend := close - vstop1 >= 0

is_trend_changed := is_uptrend != is_uptrend_prev

max_ := is_trend_changed ? close : max1

min_ := is_trend_changed ? close : min1

vstop := is_trend_changed ? is_uptrend ? max_ - mult1 * atr_ : min_ + mult1 * atr_ :

vstop1

plot(vstop, color=is_uptrend ? color.green : color.red, style=plot.style_line, linewidth=1)

vstoplongcondition = close > vstop

vstoplongclosecondition = crossunder(close, vstop)

vstopshortcondition = close < vstop

vstopshortclosecondition = crossover(close, vstop)

///Waddah Attar Explosion///

sensitivity = input(150, title="Sensitivity")

fastLength = input(20, title="FastEMA Length")

slowLength = input(40, title="SlowEMA Length")

channelLength = input(20, title="BB Channel Length")

mult = input(2.0, title="BB Stdev Multiplier")

DEAD_ZONE = nz(rma(tr(true), 100)) * 3.7

calc_macd(source, fastLength, slowLength) =>

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, mult) =>

basis = sma(source, length)

dev = mult * stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = sma(source, length)

dev = mult * stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) -

calc_macd(close[1], fastLength, slowLength)) * sensitivity

t2 = (calc_macd(close[2], fastLength, slowLength) -

calc_macd(close[3], fastLength, slowLength)) * sensitivity

e1 = calc_BBUpper(close, channelLength, mult) -

calc_BBLower(close, channelLength, mult)

trendUp = t1 >= 0 ? t1 : 0

trendDown = t1 < 0 ? -1 * t1 : 0

waelongcondition = trendUp and trendUp > DEAD_ZONE and trendUp > e1

waeshortcondition = trendDown and trendDown > DEAD_ZONE and trendDown > e1

///Long Entry///

longcondition = kclongcondition and vstoplongcondition and waelongcondition

if longcondition

strategy.entry("Long", strategy.long)

///Long exit///

closeconditionlong = kccloselongcondition or vstoplongclosecondition

if closeconditionlong

strategy.close("Long")

///Short Entry///

shortcondition = kcshortcondition and vstopshortcondition and waeshortcondition

if shortcondition

strategy.entry("Short", strategy.short)

///Short exit///

closeconditionshort = kccloseshortcondition or vstopshortclosecondition

if closeconditionshort

strategy.close("Short")

///Free Hong Kong, the revolution of our time///

- Donchian Channel Breakout Strategy

- Moving Average Trend Tracking Strategy

- RSI Indicator Grid Trading Strategy

- PPO Price Sensitivity Momentum Double Bottom Directional Trading Strategy

- Scalping Strategy with Volume and VWAP Confirmation

- ADX, MA and EMA Long Only Trend Tracking Strategy

- Momentum Breakthrough Golden Cross Strategy

- Triple Indicator Collision Strategy

- Out-of-the-box Machine Learning Trading Strategy

- Moving Average Turning Point Crossover Trading Strategy

- The Bollinger Band breakout strategy is a long-only momentum chasing strategy

- Flawless Victory Quantitative Trading Strategy Based on Double BB Indicators and RSI

- RSI-based Stop Loss and Take Profit Strategy

- Moving Average Channel Breakout Strategy

- Fixed Time Breakback Testing Strategy

- Time and Space Optimized Multi Timeframe MACD Strategy

- Quantitative Trading Strategy Based on Stoch RSI and MFI

- Multi-indicator Composite Trading Strategy

- Crossover EMA Short-term Trading Strategy

- Trend Following Strategy Based on Dynamic Stop Loss of Dual EMA Crossover