Overview

This strategy uses multi-cycle adaptive moving averages and zigzag risk assessment indicators, combined with phasing points in market operation, to predict trends and output trading signals. The strategy name is “Multi-Cycle Adaptive Trend Forecast Strategy”.

Strategy Principle

The core logic of the strategy is divided into two main lines. The first main line utilizes adaptive moving averages nAMA with different parameters to construct a multi-cycle filtering judgment system. The second main line utilizes the zigzag risk assessment system out with different parameters to construct a multi-cycle risk assessment system. Finally, the two main lines are combined. When the short-cycle line exceeds the long-cycle line, a buy signal is generated. When the short-cycle line is below the long-cycle line, a sell signal is generated.

Specifically, the first main line sets adaptive moving averages of 10-cycle and 4, 24 parameters respectively. The second main line sets zigzag risk assessment lines of 7-cycle and 4, 300 parameters respectively. Finally, the 10-cycle line in the first main line is compared with the 31-cycle line in the second main line to form a trading signal. When the 10-cycle line rises above the 31-cycle line, a buy signal is generated. When the 10-cycle line falls below the 31-cycle line, a sell signal is generated.

In addition, the strategy also sets a volume-price confirmation module. Trading signals are only valid when the trading volume is greater than the 6-cycle average trading volume. This can filter out false signals to some extent. Finally, the strategy draws phasing points of different cycle levels as reference signals.

Analysis of Strategy Advantages

The biggest advantage of this strategy is the application of multi-cycle adaptive structures, which can adaptively adjust cycles according to market conditions to dynamically adjust cycles. Whether in trend sections or shock areas, appropriate cycle parameter combinations can be found to improve the strategy’s trend-following ability.

In addition, the strategy uses a multi-cycle joint filtering of zigzag risk assessment systems to effectively control trading risks and avoid establishing positions during high-risk phases. At the same time, the strategy also sets volume-price filtering conditions to avoid generating wrong signals when the volume-enabled is insufficient.

Analysis of Strategy Risks

The biggest risk of this strategy is that it requires the same directional judgment of multiple cycle lines, so the ability to capture short-term reversing markets is poor. When short-cycle lines and long-cycle lines change at the same time, unclear signals can be easily generated. Parameter cycles can be shortened for optimization.

In addition, the main cycle phase of the adaptive moving average and zigzag risk assessment system is relatively short compared to the broader market, and there is some lag under the drive of longer levels. The main cycle phase can be appropriately extended to reduce lag.

Strategy Optimization Directions

Shorten the main cycle parameters of the adaptive moving average and zigzag risk assessment line to 5-cycle and 20-cycle to increase capturing of short-term market reversing.

Increase main cycle parameters to 20-cycle and 50-cycle to reduce lag under longer level market drivers.

Optimize trading channel parameters to 0.5 times ATR channel to reduce the possibility of noisy trading.

Add results verification indicators such as MACD to improve signal reliability.

Summary

This strategy comprehensively uses multiple technical indicators such as adaptive moving averages, zigzag risk assessments, and volume-price analysis to construct a multi-cycle adaptive trading decision system. Through optimization and adjustment of parameters, it can be applied to different types of markets, automatically identifying trends and ranges. The strategy logic is clear and valuable to dig into, which is a recommended quant method.

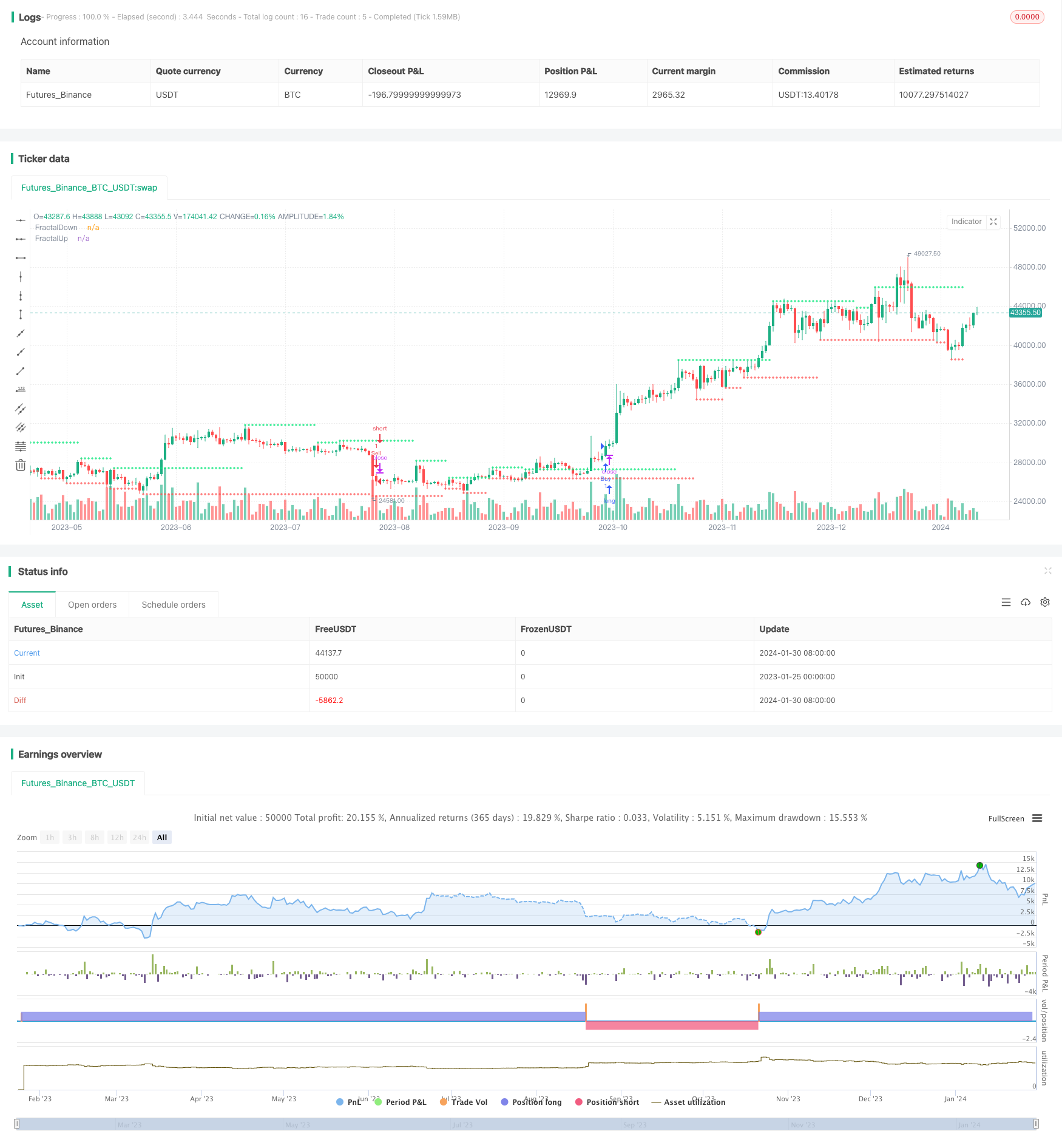

/*backtest

start: 2023-01-25 00:00:00

end: 2024-01-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Best Rabbit Strategy", shorttitle="Rabbit God",overlay=true)

Length = input(10, minval=1)

xPrice = close

xvnoise = abs(xPrice - xPrice[1])

Fastend = input(2)

Slowend = input(30)

nfastend = 2/(Fastend + 1)

nslowend = 2/(Slowend + 1)

nsignal = abs(xPrice - xPrice[Length])

nnoise = sum(xvnoise, Length)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = nz(nAMA[1]) + nsmooth * (xPrice - nz(nAMA[1]))

Length2 = input(10, minval=1)

xPrice2 = close

xvnoise2 = abs(xPrice2 - xPrice2[1])

Fastend2 = input(4)

Slowend2 = input(24)

nfastend2 = 2/(Fastend2 + 1)

nslowend2 = 2/(Slowend2 + 1)

nsignal2 = abs(xPrice2 - xPrice2[Length2])

nnoise2 = sum(xvnoise, Length2)

nefratio2 = iff(nnoise2 != 0, nsignal2 / nnoise2, 0)

nsmooth2 = pow(nefratio2 * (nfastend2 - nslowend2) + nslowend2, 2)

nAMA2 = nz(nAMA2[1]) + nsmooth2 * (xPrice2 - nz(nAMA2[1]))

price = input(hl2)

len = input(defval=7,minval=1)

FC = input(defval=4,minval=1)

SC = input(defval=300,minval=1)

len1 = len/2

w = log(2/(SC+1))

H1 = highest(high,len1)

L1 = lowest(low,len1)

N1 = (H1-L1)/len1

H2 = highest(high,len)[len1]

L2 = lowest(low,len)[len1]

N2 = (H2-L2)/len1

H3 = highest(high,len)

L3 = lowest(low,len)

N3 = (H3-L3)/len

dimen1 = (log(N1+N2)-log(N3))/log(2)

dimen = iff(N1>0 and N2>0 and N3>0,dimen1,nz(dimen1[1]))

alpha1 = exp(w*(dimen-1))

oldalpha = alpha1>1?1:(alpha1<0.01?0.01:alpha1)

oldN = (2-oldalpha)/oldalpha

N = (((SC-FC)*(oldN-1))/(SC-1))+FC

alpha_ = 2/(N+1)

alpha = alpha_<2/(SC+1)?2/(SC+1):(alpha_>1?1:alpha_)

out = (1-alpha)*nz(out[1]) + alpha*price

price2 = input(hl2)

len2 = input(defval=31,minval=1)

FC2 = input(defval=40,minval=1)

SC2 = input(defval=300,minval=1)

len12 = len2/2

w2 = log(2/(SC2+1))

H12 = highest(high,len12)

L12 = lowest(low,len12)

N12 = (H1-L1)/len12

H22 = highest(high,len2)[len12]

L22 = lowest(low,len2)[len12]

N22 = (H22-L22)/len12

H32 = highest(high,len2)

L32 = lowest(low,len2)

N32 = (H32-L32)/len2

dimen12 = (log(N12+N22)-log(N32))/log(2)

dimen2 = iff(N12>0 and N22>0 and N32>0,dimen12,nz(dimen12[1]))

alpha12 = exp(w*(dimen2-1))

oldalpha2 = alpha12>1?1:(alpha12<0.01?0.01:alpha12)

oldN2 = (2-oldalpha2)/oldalpha2

N4 = (((SC2-FC2)*(oldN2-1))/(SC2-1))+FC2

alpha_2 = 2/(N4+1)

alpha2 = alpha_2<2/(SC2+1)?2/(SC2+1):(alpha_2>1?1:alpha_2)

out2 = (1-alpha2)*nz(out2[1]) + alpha2*price2

tf = input(title="Resolution", defval = "current")

vamp = input(title="VolumeMA", defval=6)

vam = sma(volume, vamp)

up = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>vam[3]

down = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>vam[3]

fractalup = up ? high[3] : fractalup[1]

fractaldown = down ? low[3] : fractaldown[1]

fuptf = request.security(syminfo.tickerid,tf == "current" ? timeframe.period : tf, fractalup)

fdowntf = request.security(syminfo.tickerid,tf == "current" ? timeframe.period : tf, fractaldown)

plot(fuptf, "FractalUp", color=lime, linewidth=1, style=cross, transp=0, offset =-3, join=false)

plot(fdowntf, "FractalDown", color=red, linewidth=1, style=cross, transp=0, offset=-3, join=false)

buyEntry= nAMA[0]>nAMA2[0] and out[0]>out2[0]

sellEntry= nAMA[0]<nAMA2[0] and out[0]<out2[0]

if (buyEntry)

strategy.entry("Buy", strategy.long, comment="Long Position Entry")

if (sellEntry)

strategy.entry("Sell", strategy.short, comment="Short Position Entry")