Bollinger Band Momentum Breakout Trading Strategy

Author: ChaoZhang, Date: 2024-02-05 10:53:46Tags:

Overview

This strategy combines Bollinger Band indicator and volume indicators to identify strong momentum breakout opportunities above Bollinger upper band when trading volume is high, and enters long positions. It also uses moving average indicators to determine trend direction and reduce the risk of holding dead positions.

Strategy Logic

- Use Bollinger Band indicator to determine if price breaks out above the upper band.

- Use trading volume indicators to determine if current volume is significantly higher than past period average.

- Enter long position when trading volume is high and price breaks out above Bollinger upper band.

- Use moving average indicators to determine short term and medium term trend to cut loss in time.

This strategy mainly considers three factors: price level, momentum and trend. When price breaks out the Bollinger upper band into the buy zone, surge in trading volume indicates strong momentum and capital inflow. This is the right timing to enter long position. Then it uses moving averages to determine market trend to avoid holding dead positions. By combining price action, momentum and risk control, it aims to capture profits from strong trends.

Advantages

Accurate signals, avoids false breakout. Combining volume filter, it only buys on real strong momentum, reducing risk.

Able to cut loss in time via moving average trend determination, reducing holding loss.

Implemented quantitative strategy combining multiple indicators for decision making. Flexible parameters tuning for different products and timeframes.

Clear code structures, easy to read and maintain. Modular design of indicators calculation, signal generation and position management.

Risks

Bollinger Bands could fail during extreme price swings, missing signals or generating false signals.

No profits when overall trading volume is low. Buy signals may not be profitable without enough trading volume.

Moving averages trend determination could also fail, unable to fully ensure effective stop loss.

Improper parameter tuning also affects strategy profitability. For example, trading time window set too short may miss trend reversal.

Optimization Directions

Add more technical indicators for better trend and support/resistance analysis, improving stop loss, e.g. candlestick patterns, channels, key support levels.

Add machine learning models to judge real breakout possibilities, reducing false signals. e.g. LSTM deep learning models.

Optimize capital management strategies like dynamic position sizing, trailing stop loss to reduce single trade loss impact.

Test more products and timeframes, adjust parameters like Bollinger Bands, volume window to improve strategy robustness.

Conclusion

This strategy integrates Bollinger Band and trading volume indicators to identify strong momentum buying opportunities, with moving averages ensuring effective stop loss. Compared to single indicator strategies, it has higher accuracy and risk control capabilities. With modular design, trend filters and stop loss mechanisms, it forms an easy-to-optimize momentum breakout trading strategy.

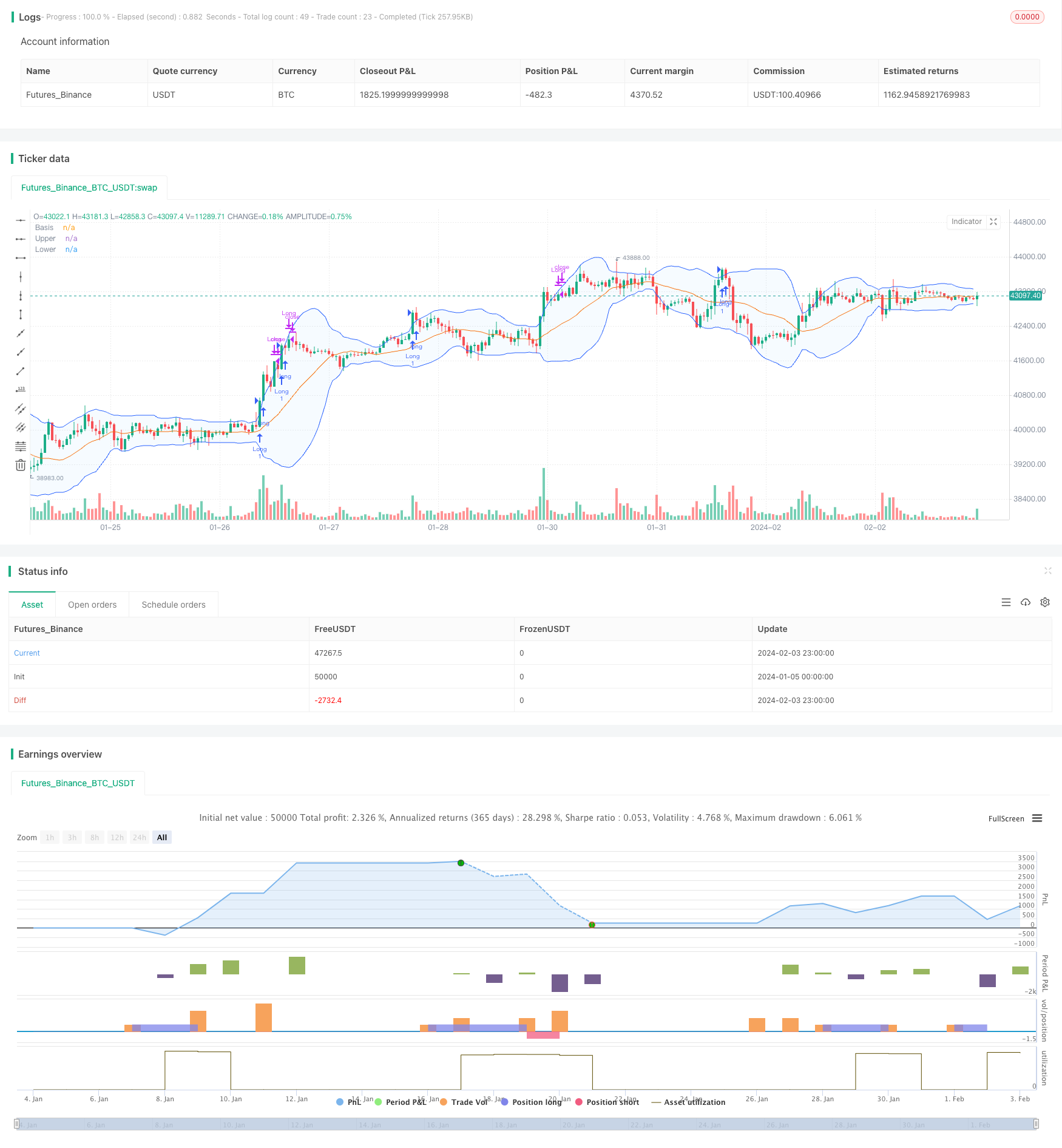

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KAIST291

//@version=4

initial_capital=1000

strategy("prototype", overlay=true)

length1=input(1)

length3=input(3)

length7=input(7)

length9=input(9)

length14=input(14)

length20=input(20)

length60=input(60)

length120=input(120)

ma1= sma(close,length1)

ma3= sma(close,length3)

ma7= sma(close,length7)

ma9= sma(close,length9)

ma14=sma(close,length14)

ma20=sma(close,length20)

ma60=sma(close,length60)

ma120=sma(close,length120)

rsi=rsi(close,14)

// BUYING VOLUME AND SELLING VOLUME //

BV = iff( (high==low), 0, volume*(close-low)/(high-low))

SV = iff( (high==low), 0, volume*(high-close)/(high-low))

vol = iff(volume > 0, volume, 1)

dailyLength = input(title = "Daily MA length", type = input.integer, defval = 50, minval = 1, maxval = 100)

weeklyLength = input(title = "Weekly MA length", type = input.integer, defval = 10, minval = 1, maxval = 100)

//-----------------------------------------------------------

Davgvol = sma(volume, dailyLength)

Wavgvol = sma(volume, weeklyLength)

//-----------------------------------------------------------

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

mult2= input(1.5, minval=0.001, maxval=50, title="exp")

mult3= input(1.0, minval=0.001, maxval=50, title="exp1")

mult4= input(2.5, minval=0.001, maxval=50, title="exp2")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

dev2= mult2 * stdev(src, length)

Supper= basis + dev2

Slower= basis - dev2

dev3= mult3 * stdev(src, length)

upper1= basis + dev3

lower1= basis - dev3

dev4= mult4 * stdev(src, length)

upper2=basis + dev4

lower2=basis - dev4

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

//----------------------------------------------------

exit=(close-strategy.position_avg_price / strategy.position_avg_price*100)

bull=( BV>SV and BV>Davgvol)

bull2=(BV>SV and BV>Davgvol)

bux =(close>Supper and close>Slower and volume<Davgvol)

bear=(SV>BV and SV>Davgvol)

con=(BV>Wavgvol and rsi>80)

imInATrade = strategy.position_size != 0

highestPriceAfterEntry = valuewhen(imInATrade, high, 0)

// STRATEGY LONG //

if (bull and close>upper1 and close>Supper and high>upper and rsi<80)

strategy.entry("Long",strategy.long)

if (strategy.position_avg_price*1.02<close)

strategy.close("Long")

else if (low<ma9 and strategy.position_avg_price<close)

strategy.close("Long")

else if (ma20>close and strategy.position_avg_price<close )

strategy.close("Long")

else if (rsi>80 and strategy.position_avg_price<close)

strategy.close("Long")

else if (strategy.openprofit < strategy.position_avg_price*0.9-close)

strategy.close("Long")

else if (high<upper and strategy.position_avg_price<close)

strategy.close("Long")

//////////////////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////////////

strategy.entry("Short",strategy.short,when=low<ma20 and low<lower1 and close<Slower and crossunder(ma60,ma120))

if (close<strategy.position_avg_price*0.98)

strategy.close("Short")

else if (rsi<20)

strategy.close("Short")

- Dynamic SMA Cross Trend Strategy

- Dual MA Indicator Oscillating Price Tracking Strategy

- Dual Moving Average Supertrend Quantitative Trading Strategy

- Trend Following Quant Strategy Based on Hull and LSMA Indicators

- Moving Average and RSI Crossover Strategy

- Dual Range Filter Trend Tracking Strategy

- Super Trend Following Strategy Based on Moving Averages

- Engulfing Candle RSI Trading Strategy

- A Bollinger Band and Trend Tracking Strategy Based on RSI

- Robust Dual Moving Average Trading Strategy

- Quantitative Trading Strategy Based on 5-day Moving Average Band and GBS Buy/Sell Signals

- Dual Moving Average Oscillator Stock Strategy

- Momentum Swing Trading Strategy

- Dynamic PSAR Stock Fluctuation Tracking Strategy

- Closing Price Comparison Dual Moving Average Crossover Strategy

- Ichimoku Cloud, MACD and Stochastic Based Multi-Timeframe Trend Tracking Strategy

- MACD Volume Reversal Trading Strategy

- Dynamic Moving Average Crossover Combo Strategy

- Willy Wonka Breakout Strategy

- Exponential Moving Average and Relative Strength Index Combination Trend Following Strategy