Super Trend Following Strategy Based on Moving Averages

Author: ChaoZhang, Date: 2024-02-05 11:10:41Tags:

Overview

This strategy is a typical trend following strategy. It uses multiple sets of moving averages with different periods to determine the market trend. It enters the market when the trend is established and exits when the short-term trend reverses.

Strategy Principle

The strategy employs 4 groups of moving averages: 9-day, 21-day, 50-day and 200-day lines. They represent different timeframes respectively.

When the short-term moving average crosses over the long-term one upwards, it is determined that the market enters an uptrend. When it crosses downwards, the market is seen to be in a downtrend.

The strategy takes the 9-day MA as a reference to observe the alignment of the other MAs, thereby judging the overall trend direction. Specifically, the logic is:

Long entry conditions: Close > 9-day MA and 9-day MA > 21-day MA and 21-day MA > 50-day MA and 50-day MA > 200-day MA.

Short entry conditions: Close < 9-day MA and 9-day MA < 21-day MA and 21-day MA < 50-day MA and 50-day MA < 200-day MA.

Here the relationship between close price and 9-day MA determines the shortest-term trend, while that between 9-day and 21-day MA judges short-term trend, 21-day and 50-day medium-term trend, 50-day and 200-day long-term trend. Only when the relationships of all the four MA pairs conform can a valid trend be established to generate trading signals.

Exit conditions: close price crosses below 21-day MA, flatten all long positions; crosses above 21-day MA, flatten all short positions.

Advantages of the Strategy

-

Adopting multiple MAs to determine the trend can filter out market noises from non-mainstream moves and capture medium-to-long term trends.

-

Strict entry conditions require valid judgments across different timeframes, avoiding being trapped by short-term corrections.

-

Timely stop loss helps effectively control risks.

Risks and Solutions

-

In long-term rangebound markets, excessive false signals may occur and increase trading risks. This can be avoided by optimizing parameters and adjusting MA periods to filter out some noises.

-

During violent trends, MA crosses happen frequently. Other factors are needed then to determine real trend, e.g. combining indicators like RSI and MACD for confirmation, in case strong moves are missed.

Optimization Directions

-

Parameter optimization. Test different parameter combinations to find out the optimum. Such as adjusting MA periods, adding or modifying stop loss criteria etc.

-

Improve quality filter. For instance, check if volume surges on entry to avoid insufficient momentum, or examine volatility to avoid oscillations.

-

Introduce confirmation from more technical indicators to avoid wrong signals amid fierce market moves. Consider applying tools like RSI and MACD for multi-factor decision-making.

Summary

Overall this is a typical and practical trend following strategy. It adopts multiple MAs to determine trends, has strict entry rules to lock in medium-to-long term trends. Together with timely stop loss, it helps control risks. Further improvements on stability and profitability can be achieved through ways like parameter optimization and adding confirmation indicators. It suits investors who prefer following the trend for long-term trading.

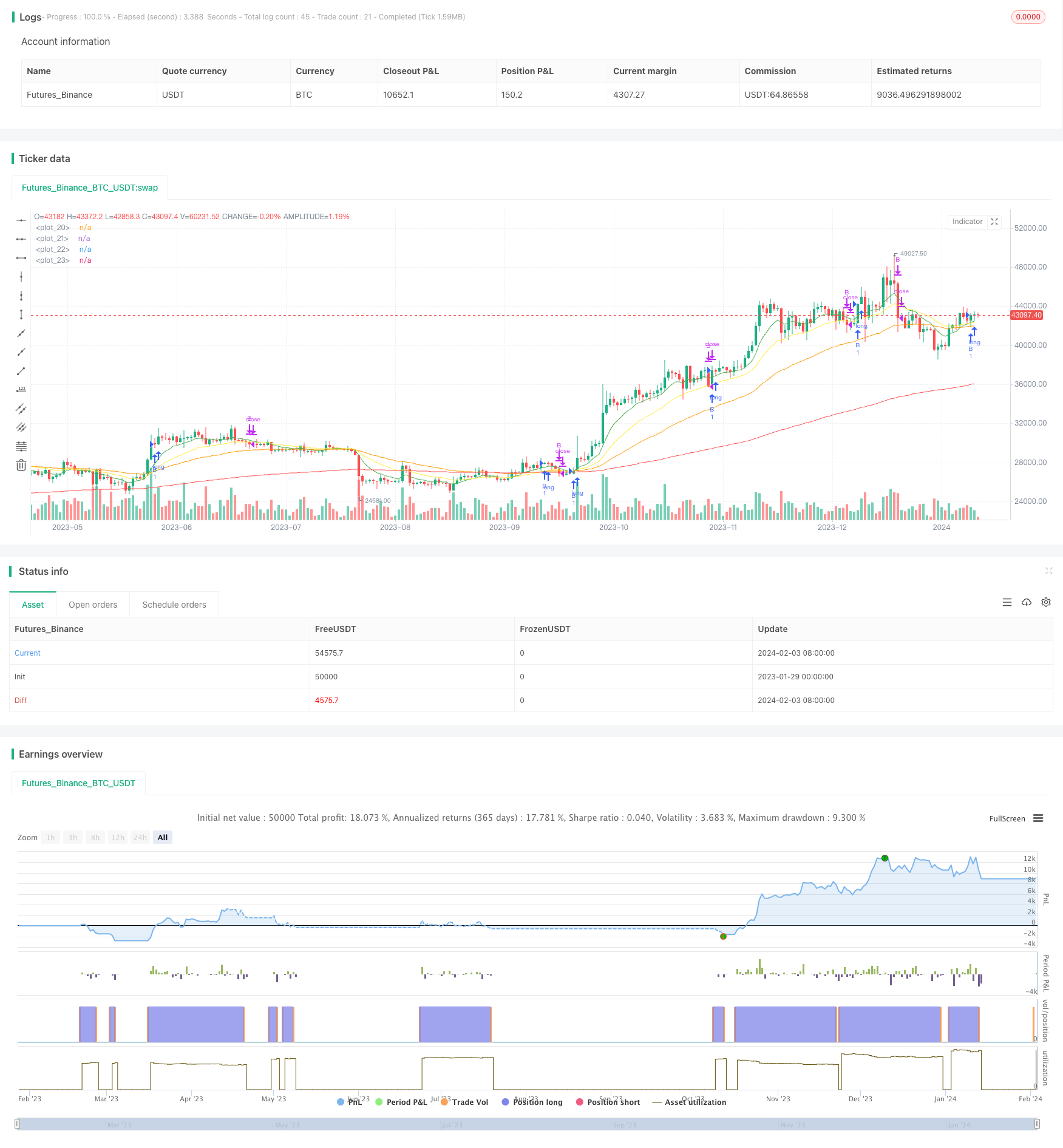

/*backtest

start: 2023-01-29 00:00:00

end: 2024-02-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shayak1

//@version=5

strategy('Super SR', overlay=true)

r = input.int(14,"rsi-length",1,100)

rsi = ta.rsi(close,r)

len1 = 9

len2 = 21

len3 = 50

len4 = 200

ema1 = ta.ema(close, len1)

ema2 = ta.ema(close, len2)

ema3 = ta.ema(close, len3)

ema4 = ta.ema(close, len4)

plot(ema1,color= color.green)

plot(ema2,color= color.yellow)

plot(ema3,color= color.orange)

plot(ema4,color= color.red)

// *** entries

Long1 = close > ema1

Long2 = ema1 > ema2

Long3 = ema2 > ema3

Long4 = ema3 > ema4

buy_condition = Long1 and Long2 and Long3 and Long4 and strategy.position_size == 0

if (buy_condition and strategy.position_size <= 1)

strategy.entry("B", strategy.long)

Short1 = close < ema1

Short2 = ema1< ema2

Short3 = ema2< ema3

Short4 = ema3< ema4

sell_condition = Short1 and Short2 and Short3 and Short4 and strategy.position_size == 0

//if (sell_condition)

// strategy.entry("S", strategy.short)

// trailing SL

//Long_sl = min(strategy.position_avg_price * 0.95, strategy.pos

//EXIT CONDITIONS

exit_long = ta.crossunder(close, ema2)

exit_short = ta.crossover(close, ema2)

if(exit_long)

strategy.close("B", "LE", qty_percent=100)

if(exit_short)

strategy.close("S", "SE", qty_percent=100)

//==============================================================================

//INSERT SECTION

//This section is where users will be required to insert the indicators they

//would like to use for their NNFX Strategy.

//==============================================================================

//INSERT - CONFIRMATION INDICATOR 1

//==============================================================================

//==============================================================================

//INSERT - CONFIRMATION INDICATOR 2

//==============================================================================

//==============================================================================

//INSERT - VOLUME INDICATOR

//==============================================================================

//==============================================================================

//INSERT - BASELINE INDICATOR

//==============================================================================

//==============================================================================

//INSERT - EXIT INDICATOR

//==============================================================================

//==============================================================================

//INSERT - CONTINUATION TRADES INDICATOR

//==============================================================================

//==============================================================================

//COMPLETED SECTION

//This section has been optimised to work with the above indicators the user

//has inserted above. The user does not require to change any code below and

//is completed and optimised for the full NNFX strategy. Users may wish to

//customise this section of code if they wish to alter the NNFX strategy.

//==============================================================================

//COMPLETE - BACKTEST DATE RANGE

//==============================================================================

// start_day = input.int(1,"start day",1,31)

// start_month = input.int(1,"start month",1,12)

// start_year = input.int(1,"start year",2010,2023)

//==============================================================================

//COMPLETE - CURRENCY CONVERSION

//==============================================================================

//==============================================================================

//COMPLETE - ATR MONEY MANAGEMENT

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - C1

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - C2

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - Vol

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - Bl

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - Exit

//==============================================================================

//==============================================================================

//COMPLETE - CONTINUATION TRADES

//==============================================================================

//==============================================================================

//COMPLETE - ONE CANDLE RULE

//==============================================================================

//==============================================================================

//COMPLETE - BRIDGE TOO FAR

//==============================================================================

//==============================================================================

//COMPLETE - BASELINE AND ATR RULE

//==============================================================================

//==============================================================================

//COMPLETE - ENTRY CONDITIONS

//==============================================================================

//==============================================================================

//COMPLETE - ENTRY ORDERS

//==============================================================================

//==============================================================================

//COMPLETE - TAKE PROFIT AND STOP LOSS CONDITIONS

//==============================================================================

//==============================================================================

//COMPLETE - EXIT ORDERS

//==============================================================================

//==============================================================================

//COMPLETE - CLOSE ORDERS

//==============================================================================

//==============================================================================

- Profit rate theory volatility index quantification strategy

- Relative Strength Index Long-term Quant Strategy

- Dual Moving Average Tracking Stop Loss Strategy

- RSI and WMA Crossover Strategy

- Dynamic SMA Cross Trend Strategy

- Dual MA Indicator Oscillating Price Tracking Strategy

- Dual Moving Average Supertrend Quantitative Trading Strategy

- Trend Following Quant Strategy Based on Hull and LSMA Indicators

- Moving Average and RSI Crossover Strategy

- Dual Range Filter Trend Tracking Strategy

- Engulfing Candle RSI Trading Strategy

- A Bollinger Band and Trend Tracking Strategy Based on RSI

- Robust Dual Moving Average Trading Strategy

- Bollinger Band Momentum Breakout Trading Strategy

- Quantitative Trading Strategy Based on 5-day Moving Average Band and GBS Buy/Sell Signals

- Dual Moving Average Oscillator Stock Strategy

- Momentum Swing Trading Strategy

- Dynamic PSAR Stock Fluctuation Tracking Strategy

- Closing Price Comparison Dual Moving Average Crossover Strategy

- Ichimoku Cloud, MACD and Stochastic Based Multi-Timeframe Trend Tracking Strategy