Dynamic Balancing Leveraged ETF Investment Strategy

Author: ChaoZhang, Date: 2024-02-19 11:09:29Tags:

Overview

This strategy takes Hong Kong Hang Seng Index ETF (00631L) as the investment target and dynamically adjusts the cash position and position ratio to balance the return and risk of the investment portfolio in real time. The strategy is simple and easy to implement without the need to judge market trends and is suitable for investors who cannot frequently check the market.

Principles

Initially invest 50% of the total funds to purchase 00631L;

Monitor the ratio between unrealized profit and remaining cash;

Sell 5% of position when unrealized profit exceeds remaining cash by 10%;

Add 5% to position when remaining cash exceeds unrealized profit by 10%;

- Dynamically adjust position and cash ratio to control portfolio return and risk.

Advantage Analysis

Simple and easy to operate without the need to judge market conditions;

Dynamically adjusting positions effectively manages investment risk;

Two-way tracking to timely stop loss or take profit;

Suitable for investors who cannot frequently check the market.

Risks and Mitigations

- Leveraged ETFs have higher volatility;

Adopt gradual position building and spaced investments.

- Unable to timely stop loss;

Set stop loss line to control maximum loss.

- Higher trading costs;

Relax balancing range to reduce position adjustments.

Optimization Ideas

Optimize position and cash ratio;

Test return effectiveness across different ETF products;

Incorporate trend indicators to improve capital utilization efficiency.

Conclusion

By constructing a dynamic balancing portfolio, this strategy controls investment risks without the need to judge market trends. Simple to operate, it is a highly practical quantitative investment strategy suitable for investors who cannot frequently check the market.

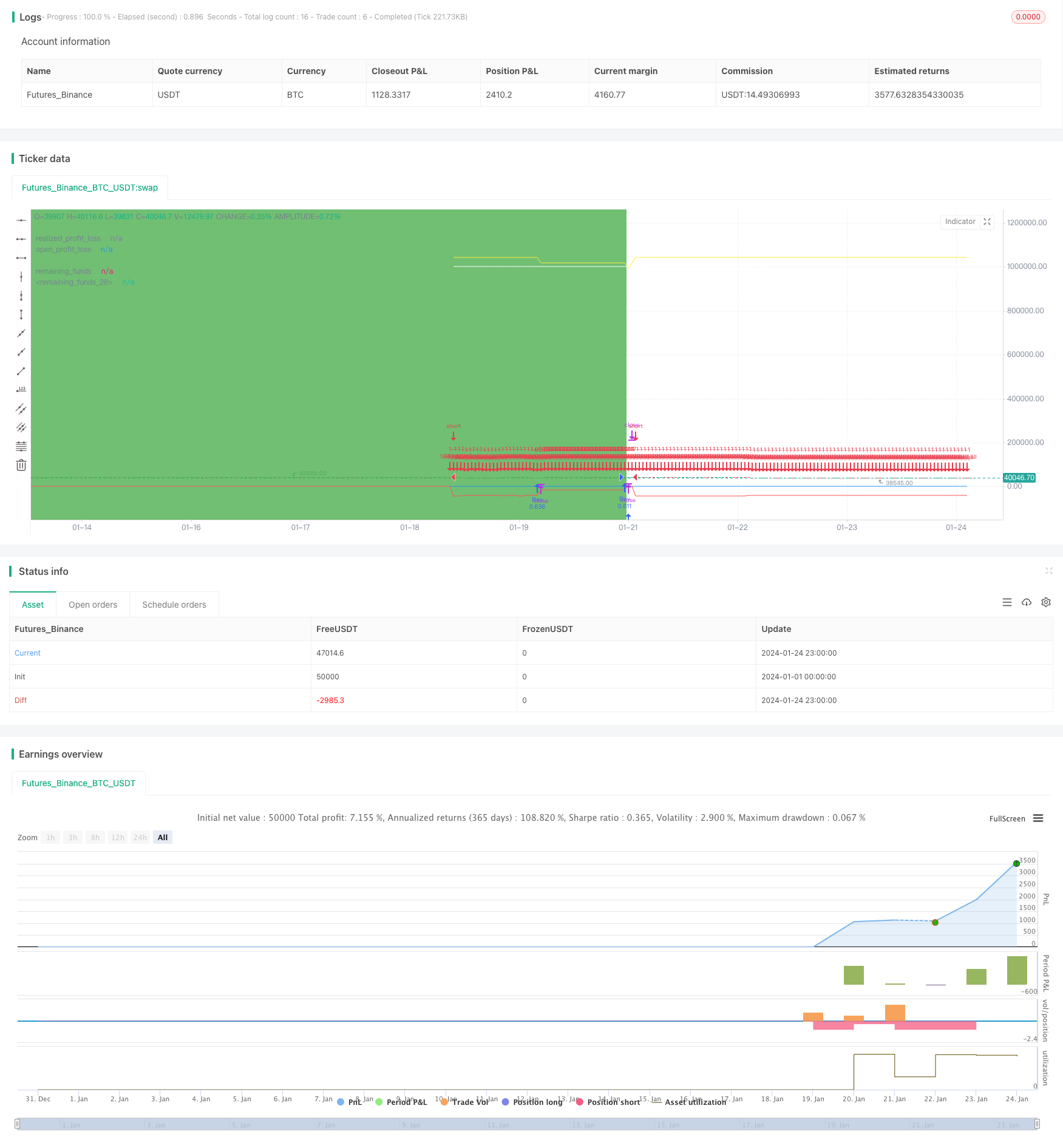

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("00631L Trading Simulation", shorttitle="Sim", overlay=true, initial_capital = 1000000)

// 设置本金

capital = 1000000

// 设置购买和出售日期范围

start_date = timestamp(2022, 10, 6)

next_date = timestamp(2022, 10, 7) // 較好的開始日

//start_date = timestamp(2022, 3, 8)

//next_date = timestamp(2022, 3, 9) // 較差的的開始日

sell_date = timestamp(2024, 1, 19)

end_date = timestamp(2024, 1, 21) // 结束日期为2024年01月21日

// 判断是否在交易期间

in_trade_period = time >= start_date and time <= end_date

// 实现的盈亏

realized_profit_loss = strategy.netprofit

plot(realized_profit_loss, title="realized_profit_loss", color=color.blue)

// 未实现的盈亏

open_profit_loss = strategy.position_size * open

plot(open_profit_loss, title="open_profit_loss", color=color.red)

// 剩余资金

remaining_funds = capital + realized_profit_loss - (strategy.position_size * strategy.position_avg_price)

plot(remaining_funds, title="remaining_funds", color=color.yellow)

// 總權益

total_price = remaining_funds + open_profit_loss

plot(total_price, title="remaining_funds", color=color.white)

// 购买逻辑:在交易期间的每个交易日买入 daily_investment 金额的产品

first_buy = time >= start_date and time <= next_date

buy_condition = in_trade_period and dayofmonth != dayofmonth[1]

// 出售邏輯 : 在交易期间的截止日出售所有商品。

sell_all = time >= sell_date

// 在交易期間的第一日買入50%本金

if first_buy

strategy.order("First", strategy.long, qty = capital/2/open)

// 在每个K线的开盘时进行买入

// 加碼邏輯 : 剩余资金 > 未实现的盈亏 * 1.05

add_logic = remaining_funds > open_profit_loss * 1.05

if buy_condition

strategy.order("Buy", strategy.long, when = add_logic, qty = remaining_funds * 0.025 / open)

//

// 減碼邏輯 : 剩余资金 > 未实现的盈亏 * 1.05

sub_logic = open_profit_loss > remaining_funds * 1.05

if buy_condition

strategy.order("Sell", strategy.short, when = sub_logic, qty = open_profit_loss * 0.025/open)

//

strategy.order("Sell_all", strategy.short, when = sell_all, qty = strategy.position_size)

// 绘制交易期间的矩形区域

bgcolor(in_trade_period ? color.green : na, transp=90)

- Absolute Momentum Indicator Strategy

- Supertrend and Moving Average Crossover Strategy

- Dual Trend Breakout Strategy

- SSL Channel and Wave Trend Quantitative Trading Strategy

- Super ATR Trend Following Strategy

- Trading-oriented Ichimoku Cloud Nine Strategy

- LPB Microcycles Adaptive Oscillation Contour Tracking Strategy

- Best ABCD Pattern Trading Strategy with Stop Loss and Take Profit Tracking

- Major Trend Indicator Long

- Multi Timeframe Strategy

- Multi-timeframe MACD Indicator Crossover Trading Strategy

- Gem Forest 1 Minute Breakout Strategy

- Three High Candle Reversal Strategy

- MACD Moving Average Combination Cross-Period Dynamic Trend Strategy

- Gem Forest One Minute Scalping Strategy

- Signal Smoothing Ehlers Cyber Cycle Strategy

- EMA Crossover Trend Following Trading Strategy

- Trend Following Strategy Based on Candlestick Direction

- Dual Confirmation MACD and RSI Strategy

- Williams Double Exponential Moving Average and Ichimoku Kinkou Hyo Strategy