概述

多时间轴MACD指标交叉交易策略是一种趋势跟踪策略。它通过计算不同参数设置的MACD指标,在价格突破该指标时产生交易信号,实现股票、指数、外汇等金融产品的自动化交易。

策略原理

该策略同时计算3条移动平均线:一条加权移动平均线WMA以及两条指数移动平均线EMA。这三条移动平均线的参数设置不同,分别为25天、50天和100天。这样可以让移动平均线覆盖不同的价格走势周期。

在计算出移动平均线后,策略会监测价格是否突破或跌破某条移动平均线。如果价格同时突破或跌破所有3条移动平均线,那么就产生交易信号。

例如,当价格同时高于所有3条移动平均线时,产生买入信号;当价格同时低于所有3条移动平均线时,产生卖出信号。监测价格与移动平均线的关系可以判断价格走势的转折点。

通过多时间轴指标的交叉判断,可以过滤掉一些假信号,使交易信号更加可靠。

优势分析

- 利用多时间轴分析价格趋势,过滤假信号

- 参数容易优化,可以适应不同周期的行情

- 可用于股票、指数、外汇等多个品种,适用面广

风险分析

- 大周期指标判断存在滞后,可能错过短线机会

- 突破失败时存在亏损风险

- PARAMETERS 后期少量调整,以优化止损止盈

优化方向

该策略可以从以下几个方面进行优化:

- 优化移动平均线的周期参数,适应更多行情周期

- 增加其他技术指标过滤,例如RSI指标判断超买超卖

- 增加止损机制,可参考ATR指标设定止损距离

- 可扩展至期货等其他品种,优化参数

总结

多时间轴MACD指标交叉交易策略整体思路清晰,通过移动平均线多周期判断价格趋势,在价格出现显著转折时产生交易信号。策略优化空间大,可针对不同品种和行情周期调整参数,从而获得良好的交易效果。该策略适合对趋势型股票、指数和外汇进行程序化交易。

策略源码

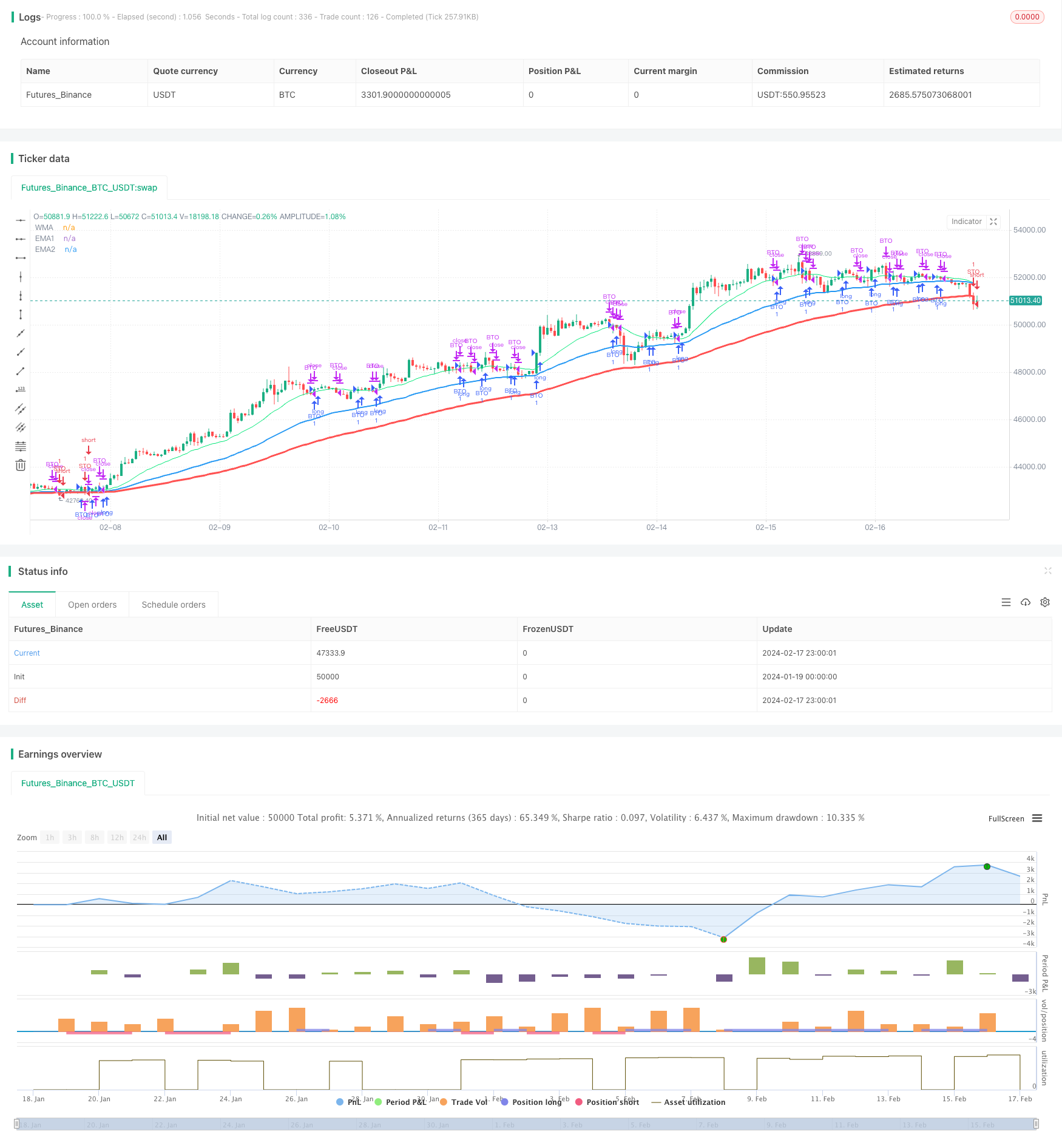

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("TC - MACDoscillator v2", overlay=true)

// ___________ .__ _________ .__ __ .__

// \__ ___/____ | | ____ ____ \_ ___ \_____ ______ |__|/ |______ | |

// | | \__ \ | | / ___\ / _ \ / \ \/\__ \ \____ \| \ __\__ \ | |

// | | / __ \| |__/ /_/ > <_> ) \ \____/ __ \| |_> > || | / __ \| |__

// |____| (____ /____/\___ / \____/ \______ (____ / __/|__||__| (____ /____/

// \/ /_____/ \/ \/|__| \/

//

// MACDoscillator Strategy v2

// Josh Breitfeld 2016

//

/// INPUTS START ///

//tradeSize = input(title="Shares Per Trade", defval=2500, step=1)

WMALength = input(title="WMA Length", defval=25, step=1)

EMA1Length = input(title="EMA1 Length", defval=50, step=1)

EMA2Length = input(title="EMA2 Length", defval=100, step=1)

//security = input(title="Alternate Security", type=string, defval="SPX500")

//inverse = input(title="Inverse Signals", type=bool, defval=true)

/// INPUTS END ///

/// ALGORITHM START ///

/// Define calculations

WMA = wma(close,WMALength)

EMA1 = ema(close,EMA1Length)

EMA2 = ema(close,EMA2Length)

/// Grab values from alternate security

dWMA = WMA

dEMA1 = EMA1

dEMA2 = EMA2

aClose = close

/// Crossover signal system

/// Long crosses

lc1 = aClose > dWMA ? true : false

lc2 = aClose > dEMA1 ? true : false

lc3 = aClose > dEMA2 ? true: false

/// Short crosses

sc1 = aClose < dWMA ? true : false

sc2 = aClose < dEMA1 ? true : false

sc3 = aClose < dEMA2 ? true : false

//plot(lc1,color=green)

//plot(lc2,color=green)

//plot(lc3,color=green)

//plot(sc1,color=red)

//plot(sc2,color=red)

//plot(sc3,color=red)

/// ALGO ORDER CONDITIONS START ///

pBuyToOpen = (lc1 and lc2 and lc3 ? true : false)

pSellToOpen = (sc1 and sc2 and sc3 ? true : false)

pSellToClose = (lc1 ? true : false) and not pBuyToOpen

pBuyToClose = (sc1 ? true : false) and not pSellToOpen

//plot(pBuyToOpen,color=lime)

//plot(pBuyToClose,color=lime)

//plot(pSellToOpen,color=red)

//plot(pSellToClose,color=red)

/// INVERT SIGNALS

//buyToOpen = inverse ? -pBuyToOpen : pBuyToOpen

//sellToOpen = inverse ? -pBuyToOpen : pSellToOpen

//sellToClose = inverse ? -pSellToClose : pSellToClose

//buyToClose = inverse ? -pBuyToClose : pBuyToClose

/// ALGO ORDER CONDITIONS END ///

/// ALGORITHM END ///

/// DEFINE PLOTS ///

plot(dWMA,"WMA",lime,1,line)

plot(dEMA1,"EMA1",blue,2,line)

plot(dEMA2,"EMA2",red,3,line)

//plot(aClose,"Close",orange,4,line)

/// PLOTS END ///

/// ORDER BLOCK ///

//strategy.entry("My Long Entry Id", strategy.long)

/// OPENING ORDERS START ///

if(pBuyToOpen)

strategy.entry("BTO", strategy.long, comment="BTO")

if(pSellToOpen)

strategy.entry("STO", strategy.short, comment="STO")

/// OPENING ORDERS END ///

/// CLOSING ORDERS START ///

strategy.close("BTO", pBuyToClose)

strategy.close("STO", pSellToClose)

/// CLOSING ORDERS END ///

/// END ORDER BLOCK ///

// Josh Breitfeld - Talgo Capital 2016

/// STRATEGY END ///