The Momentum Tracking and Trend Strategy

Author: ChaoZhang, Date: 2024-02-22 17:27:18Tags:

Overview

The core idea of this strategy is to combine the Super Trend indicator and the Average Directional Movement Index (ADX) to judge and track trends. The Super Trend indicator is used to identify the current price trend direction, and the ADX is used to determine the trend strength. Trades are only made under strong trend conditions. In addition, the strategy also uses candlestick body color, trading volume and other indicators for confirmation, forming a relatively complete set of trading rules.

Overall, this strategy belongs to the trend tracking strategy, aiming to capture medium and long term clear trends while avoiding interference from consolidation and oscillation periods.

Strategy Principles

Use the Super Trend indicator to determine the price trend direction. When the price stands above the Super Trend it is a long signal, and when it stands below the Super Trend it is a short signal.

Use the ADX to judge the strength of the trend. Trading signals are generated only when the ADX is greater than the threshold, so that periods with unclear consolidation can be filtered out.

The candlestick body color is used to judge whether it is currently in an upward or downward pattern, combined with the Super Trend indicator to form confirmation.

Expanding trading volume serves as a confirmation signal. Positions are only established when trading volume rises.

Set stop loss and take profit to lock in profits and control risks.

Close all positions before the set end of day time.

Advantages of the Strategy

Track medium and long term clear trends, avoid oscillation, and achieve high profitability.

The strategy has few parameters and is easy to understand and implement.

Risks are well controlled with stop loss and take profit in place.

The use of multiple indicators for confirmation can reduce false signals.

Risks of the Strategy

May suffer large losses during major market-wide corrections.

Individual stocks may have sharp reversals due to changes in fundamentals.

Black swan events from major policy changes.

Solutions:

Appropriately adjust ADX parameters to ensure trading only under strong trends.

Increase stop loss percentage to control single loss amount.

Closely monitor policies and important events, actively cut loss if necessary.

Directions for Optimization

Test different combinations of Super Trend parameters to find the one that generates the most stable signals.

Test different ADX parameter combinations to determine the optimal settings.

Add other confirmation indicators like volatility and Bollinger Bands to further reduce false signals.

Combine with breakout strategies to cut losses in a timely manner when trends break down.

Summary

The overall logic of this strategy is clear, using the Super Trend to judge price trend direction, the ADX to determine trend strength, and trading along strong trends. Stop loss and take profit are set to control risks. The strategy has few parameters and is easy to optimize. It can serve as a good example for learning simple and effective trend tracking strategies. Further improvements can be made through parameter optimization, signal filtering etc.

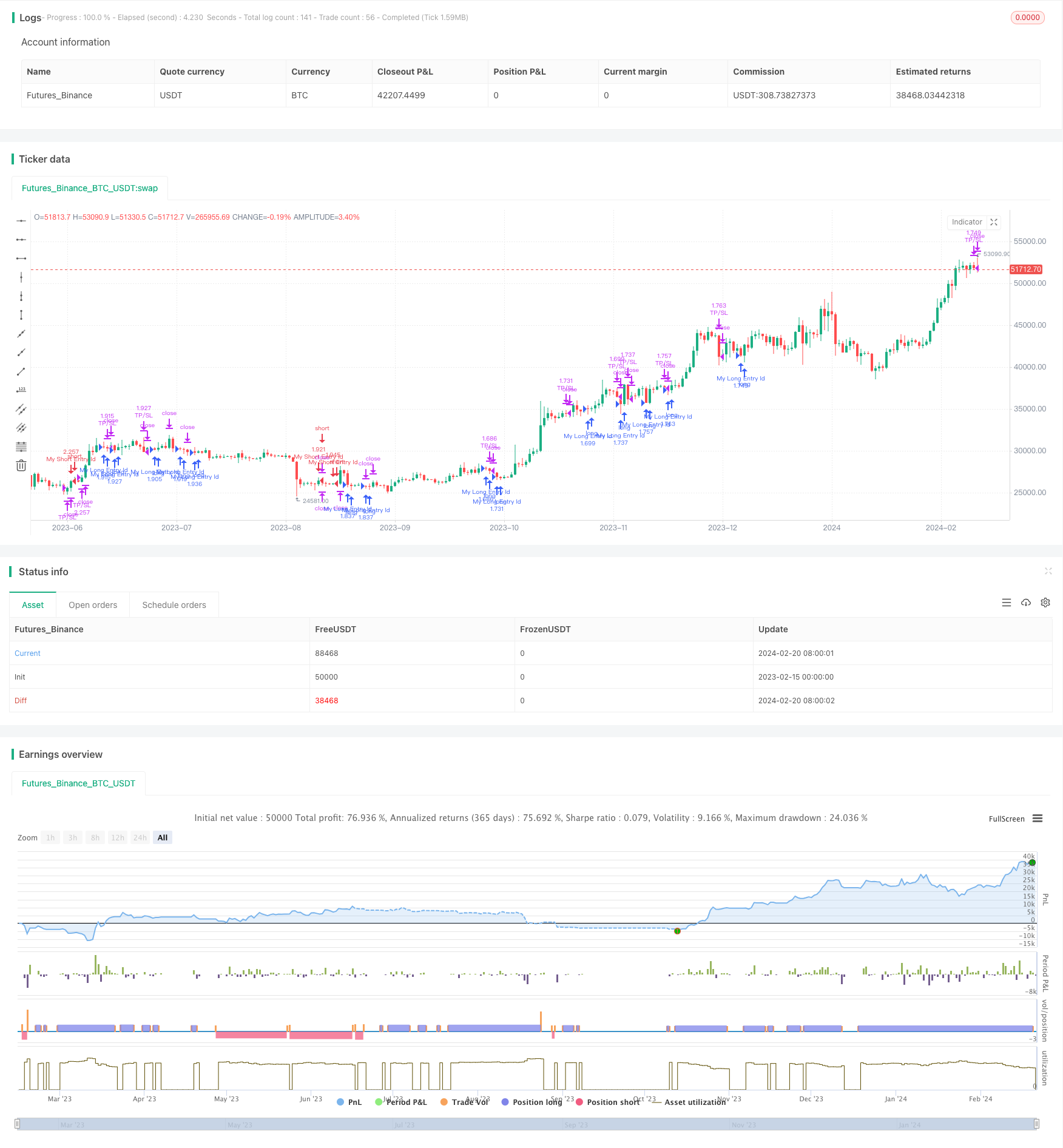

/*backtest

start: 2023-02-15 00:00:00

end: 2024-02-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Intraday Strategy Template

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vikris

//@version=4

strategy("[VJ]Hulk Smash Intra", overlay=true, calc_on_every_tick = false, pyramiding=0,default_qty_type=strategy.percent_of_equity, default_qty_value=100,initial_capital=2000)

// ********** Strategy inputs - Start **********

// Used for intraday handling

// Session value should be from market start to the time you want to square-off

// your intraday strategy

// Important: The end time should be at least 2 minutes before the intraday

// square-off time set by your broker

var i_marketSession = input(title="Market session", type=input.session,

defval="0915-1455", confirm=true)

// Make inputs that set the take profit % (optional)

longProfitPerc = input(title="Long Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

shortProfitPerc = input(title="Short Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

// Set stop loss level with input options (optional)

longLossPerc = input(title="Long Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5) * 0.01

shortLossPerc = input(title="Short Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5) * 0.01

var float i_multiplier = input(title = "ST Multiplier", type = input.float,

defval = 2, step = 0.1, confirm=true)

var int i_atrPeriod = input(title = "ST ATR Period", type = input.integer,

defval = 10, confirm=true)

len = input(title="ADX Length", type=input.integer, defval=14)

th = input(title="ADX Threshold", type=input.integer, defval=20)

adxval = input(title="ADX Momemtum Value", type=input.integer, defval=25)

// ********** Strategy inputs - End **********

// ********** Supporting functions - Start **********

// A function to check whether the bar or period is in intraday session

barInSession(sess) => time(timeframe.period, sess) != 0

// ********** Supporting functions - End **********

// ********** Strategy - Start **********

[superTrend, dir] = supertrend(i_multiplier, i_atrPeriod)

colResistance = dir == 1 and dir == dir[1] ? color.new(color.red, 0) : color.new(color.red, 100)

colSupport = dir == -1 and dir == dir[1] ? color.new(color.green, 0) : color.new(color.green, 100)

// Super Trend Long/short condition

stlong = close > superTrend

stshort = close < superTrend

// Figure out take profit price

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

// Determine stop loss price

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

//Vol Confirmation

vol = volume > volume[1]

//Candles colors

greenCandle = (close > open)

redCandle = (close < open)

// See if intraday session is active

bool intradaySession = barInSession(i_marketSession)

// Trade only if intraday session is active

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - nz(SmoothedTrueRange[1]) / len + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) -

nz(SmoothedDirectionalMovementPlus[1]) / len + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) -

nz(SmoothedDirectionalMovementMinus[1]) / len + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = sma(DX, len)

// a = plot(DIPlus, color=color.green, title="DI+", transp=100)

// b = plot(DIMinus, color=color.red, title="DI-", transp=100)

//Final Long/Short Condition

longCondition = stlong and redCandle and vol and ADX>adxval

shortCondition = stshort and greenCandle and vol and ADX >adxval

//Long Strategy - buy condition and exits with Take profit and SL

if (longCondition and intradaySession)

stop_level = longStopPrice

profit_level = longExitPrice

strategy.entry("My Long Entry Id", strategy.long)

strategy.exit("TP/SL", "My Long Entry Id",stop=stop_level, limit=profit_level)

//Short Strategy - sell condition and exits with Take profit and SL

if (shortCondition and intradaySession)

stop_level = shortStopPrice

profit_level = shortExitPrice

strategy.entry("My Short Entry Id", strategy.short)

strategy.exit("TP/SL", "My Short Entry Id", stop=stop_level, limit=profit_level)

// Square-off position (when session is over and position is open)

squareOff = (not intradaySession) and (strategy.position_size != 0)

strategy.close_all(when = squareOff, comment = "Square-off")

// ********** Strategy - End **********

- Dynamic Regression Channel Strategy

- Reversal Momentum Breakout Strategy

- Triple Dynamic Moving Average Trend Tracking Strategy

- Momentum Breakout EMA Crossover Strategy

- Trading Dynamic Trend Tracking Strategy

- MACD Momentum with MA Strategy

- EMA Crossover Trading Strategy

- Simple Cryptocurrency Trading Strategy Based on RSI

- Quantitative Trading Strategy Based on Price Crossover with SMA

- Dual Moving Average Crossover Strategy with Stop Loss and Take Profit

- Trend Following Strategy Based on MA Lines

- Trend Following Strategy Based on Bollinger Bands

- The Oscillating Breakthrough Strategy

- Adaptive Moving Average Trading Strategy

- RSI Golden Cross Short Strategy

- Dual Moving Average and Bollinger Band Combination Trend Tracking Strategy

- Adaptive Fluctuation Strategy Based on Quantitative Range Breakthrough

- Bull Flag Breakout Strategy

- The Moving Average Crossover Trading Strategy

- Moving Average Crossover Gold Trading Strategy