RSI Indicator Long Short Separation Trading Strategy

Author: ChaoZhang, Date: 2024-02-26 13:49:25Tags:

Overview

This strategy identifies long short separation phenomena through the RSI indicator to make trading decisions. The core idea is that when prices hit new lows but the RSI indicator hits new highs, a “bullish separation” signal is generated, indicating that the bottom has formed and going long. When prices hit new highs but the RSI indicator hits new lows, a “bearish separation” signal is generated, indicating that the top has formed and going short.

Strategy Principles

The strategy mainly uses the RSI indicator to identify the long short separation between prices and the RSI. The specific method is as follows:

- Use RSI indicator parameters of 13 and close prices as source data

- Define left lookback range for bullish separation as 14 days and right lookback range as 2 days

- Define left lookback range for bearish separation as 47 days and right lookback range as 1 day

- When prices hit lower lows but RSI hits higher lows, long separation condition is met to generate long signals

- When prices hit higher highs but RSI hits lower highs, short separation condition is met to generate short signals

By identifying the long short separation between prices and RSI, it can capture the inflection points of price trends in advance for trade decision making.

Advantages of the Strategy

The main advantages of this strategy are:

- Identifying price/RSI separation can judge trend inflections early to capture trading opportunities

- Use indicator analysis so less affected by emotions

- Use fixed lookback periods to identify separation, avoiding frequent parameter tuning

- Additional conditions like daily RSI reduce false signals

Risks and Solutions

There are still some risks:

RSI divergence does not necessarily mean immediate reversal, time lag may exist leading to stop loss risk. Solution is to allow wider stops to give time for divergence signal confirmation.

Prolonged separation also increases risk. Solution is to add longer-term daily or weekly RSI as filter conditions.

Small divergence may not confirm trend reversal, need to expand lookback periods to find more significant RSI divergence.

Optimization Directions

The strategy can be improved in the following aspects:

Optimize RSI parameters to find best parameter combinations

Try other technical indicators like MACD, KD to identify separation

Add oscillation filters to reduce false signals in choppy periods

Combine RSI from multiple timeframes to find best combination signals

Conclusion

The RSI long short separation trading strategy judges trend inflections by identifying divergence between price and RSI to generate trading signals. The strategy is simple and practical. Further improving parameters and adding filters can increase profitability. Overall an effective quantitative trading strategy.

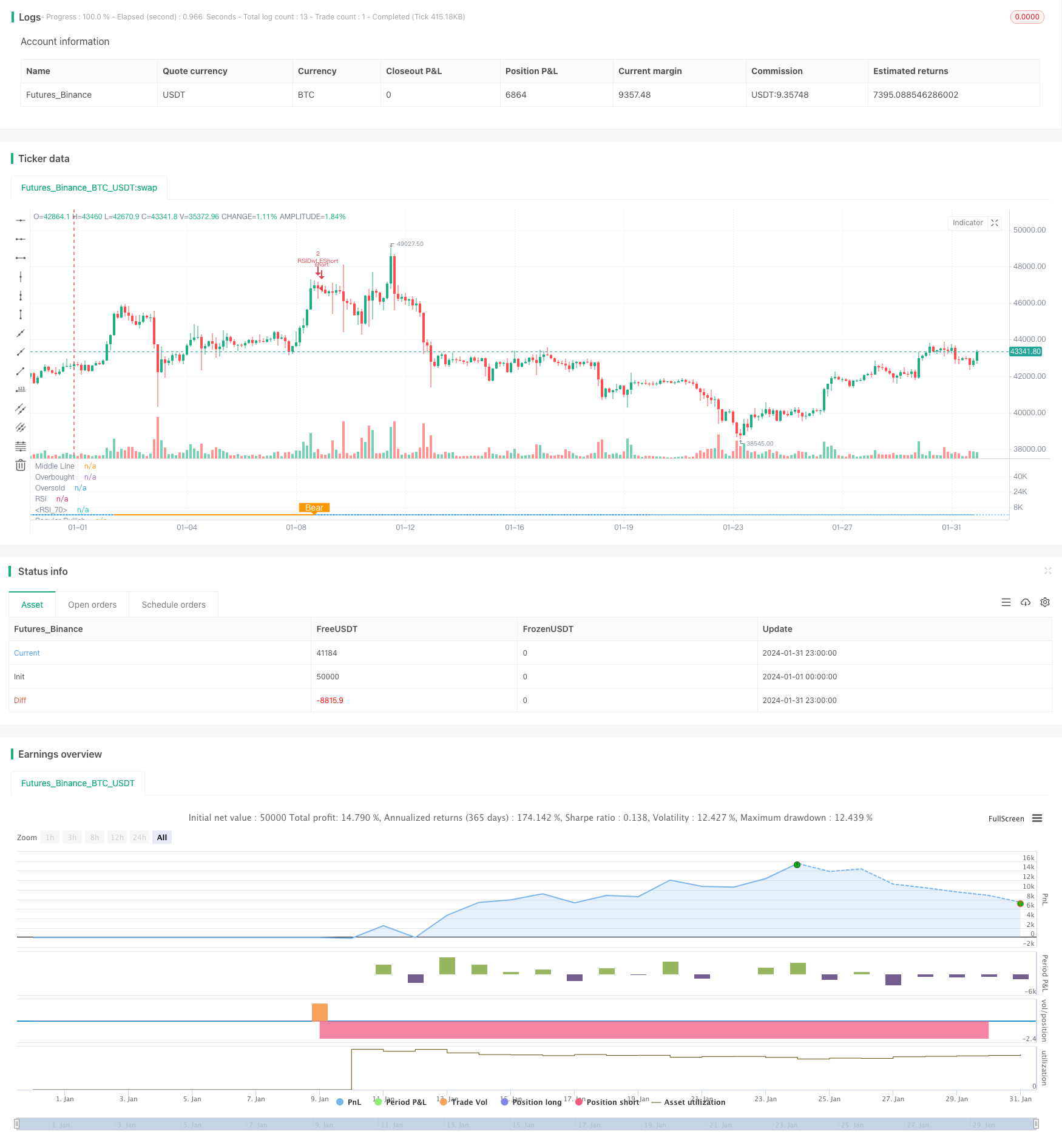

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Nextep

//@version=4

strategy(title="RSI top&bottom destroy ", overlay=false, pyramiding=4, default_qty_value=2, default_qty_type=strategy.fixed, initial_capital=10000, currency=currency.USD)

// INPUT Settings --------------------------------------------------------------------------------------------------------------------------------------------------

len = input(title="RSI Period", minval=1, defval=13)

src = input(title="RSI Source", defval=close)

// defining the lookback range for shorts

lbRshort = input(title="Short Lookback Right", defval=1)

lbLshort = input(title="Short Lookback Left", defval=47)

// defining the lookback range for longs

lbRlong = input(title="Long Lookback Right", defval=2)

lbLlong = input(title="Long Lookback Left", defval=14)

rangeUpper = input(title="Max of Lookback Range", defval=400)

rangeLower = input(title="Min of Lookback Range", defval=1)

// take profit levels

takeProfitLongRSILevel = input(title="Take Profit at RSI Level", minval=0, defval=75)

takeProfitShortRSILevel = input(title="Take Profit for Short at RSI Level", minval=0, defval=25)

// Stop loss settings

longStopLossType = input("PERC", title="Long Stop Loss Type", options=['ATR','PERC', 'FIB', 'NONE'])

shortStopLossType = input("PERC", title="Short Stop Loss Type", options=['ATR','PERC', 'FIB', 'NONE'])

longStopLossValue = input(title="Long Stop Loss Value", defval=14, minval=0)

shortStopLossValue = input(title="Short Stop Loss Value", defval=5, minval=-10)

// PLOTTING THE CHARTS --------------------------------------------------------------------------------------------------------------------------------------------------

// Plotting the Divergence

plotBull = input(title="Plot Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

bearColor = color.orange

bullColor = color.green

textColor = color.white

noneColor = color.new(color.white, 100)

// Adding the RSI oscillator

osc = rsi(src, len)

ma_len = 14 // Length for the moving average

rsi_ma = sma(osc, ma_len) // Calculate the moving average of RSI

plot(osc, title="RSI", linewidth=1, color=color.purple)

plot(rsi_ma, color=color.blue, title="RSI MA") // Plot the RSI MA

// Adding the lines of the RSI oscillator

plot(osc, title="RSI", linewidth=1, color=color.purple)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(75, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(25, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=color.purple, transp=80)

atrLength = input(14, title="ATR Length (for Trailing stop loss)")

atrMultiplier = input(3.5, title="ATR Multiplier (for Trailing stop loss)")

// RSI PIVOTS --------------------------------------------------------------------------------------------------------------------------------------------------

// Define a condition for RSI pivot low

isFirstPivotLowlong = not na(pivotlow(osc, lbLlong, lbRlong))

// Define a condition for RSI pivot high

isFirstPivotHighlong = not na(pivothigh(osc, lbLlong, lbRlong))

// Define a condition for the first RSI value

firstPivotRSIValuelong = isFirstPivotLowlong ? osc[lbRlong] : na

// Define a condition for the second RSI value

secondPivotRSIValuelong = isFirstPivotLowlong ? valuewhen(isFirstPivotLowlong, osc[lbRlong], 1) : na

// Define a condition for RSI pivot low

isFirstPivotLowshort = not na(pivotlow(osc, lbLshort, lbRshort))

// Define a condition for RSI pivot high

isFirstPivotHighshort = not na(pivothigh(osc, lbLshort, lbRshort))

// Define a condition for the first RSI value

firstPivotRSIValueshort = isFirstPivotLowshort ? osc[lbRshort] : na

// Define a condition for the second RSI value

secondPivotRSIValueshort = isFirstPivotLowshort ? valuewhen(isFirstPivotLowshort, osc[lbRshort], 1) : na

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

// ADDITIONAL ENTRY CRITERIA --------------------------------------------------------------------------------------------------------------------------------------------------

// RSI crosses RSI MA up by more than 2 points and subsequently down

rsiUpCross = crossover(osc, rsi_ma + 1)

rsiDownCross = crossunder(osc, rsi_ma - 1)

// Calculate the daily RSI

rsiDaily = security(syminfo.ticker, "D", rsi(src, 14))

// BULLISH CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// LOWER LOW PRICE & HIGHER LOW OSC

// Price: Lower Low

priceLL = na(isFirstPivotLowlong[1]) ? false : (low[lbRlong] < valuewhen(isFirstPivotLowlong, low[lbRlong], 1))

// Osc: Higher Low

oscHL = na(isFirstPivotLowlong[1]) ? false : (osc[lbRlong] > valuewhen(isFirstPivotLowlong, osc[lbRlong], 1) and _inRange(isFirstPivotLowlong[1]))

// BULLISH PLOT

bullCond = plotBull and priceLL and oscHL and isFirstPivotLowlong

plot(

isFirstPivotLowlong ? osc[lbRlong] : na,

offset=-lbRlong,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? osc[lbRlong] : na,

offset=-lbRlong,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

// BEARISH CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// HIGHER HIGH PRICE & LOWER LOW OSC

// Osc: Lower High

oscLH = na(isFirstPivotHighshort[1]) ? false : (osc[lbRshort] < valuewhen(isFirstPivotHighshort, osc[lbRshort], 1) and _inRange(isFirstPivotHighshort[1]))

// Price: Higher High

priceHH = na(isFirstPivotHighshort[1]) ? false : (high[lbRshort] > valuewhen(isFirstPivotHighshort, high[lbRshort], 1))

// BEARISH PLOT

bearCond = plotBear and priceHH and oscLH and isFirstPivotHighshort

plot(

isFirstPivotHighshort ? osc[lbRshort] : na,

offset=-lbRshort,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? osc[lbRshort] : na,

offset=-lbRshort,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

// ENTRY CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

longCondition = false

shortCondition = false

// Entry Conditions

longCondition := bullCond

shortCondition := bearCond

// Conditions to prevent entering trades based on daily RSI

longCondition := longCondition and rsiDaily >= 23

shortCondition := shortCondition and rsiDaily <= 80

// STOPLOSS CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// Stoploss Conditions

long_sl_val =

longStopLossType == "ATR" ? longStopLossValue * atr(atrLength)

: longStopLossType == "PERC" ? close * longStopLossValue / 100 : 0.00

long_trailing_sl = 0.0

long_trailing_sl := strategy.position_size >= 1 ? max(low - long_sl_val, nz(long_trailing_sl[1])) : na

// Calculate Trailing Stop Loss for Short Entries

short_sl_val =

shortStopLossType == "ATR" ? 1 - shortStopLossValue * atr(atrLength)

: shortStopLossType == "PERC" ? close * (shortStopLossValue / 100) : 0.00 //PERC = shortstoplossvalue = -21300 * 5 / 100 = -1065

short_trailing_sl = 0.0

short_trailing_sl := strategy.position_size <= -1 ? max(high + short_sl_val, nz(short_trailing_sl[1])) : na

// RSI STOP CONDITION

rsiStopShort = (strategy.position_avg_price != 0.0 and close <= strategy.position_avg_price * 0.90) or (strategy.position_avg_price != 0.0 and rsi(src, 14) >= 75)

rsiStopLong = (strategy.position_avg_price != 0.0 and close >= strategy.position_avg_price * 1.10) or (strategy.position_avg_price != 0.0 and rsi(src, 14) <= 25)

// LONG CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

strategy.entry(id="RSIDivLELong", long=true, when=longCondition)

strategy.entry(id="RSIDivLEShort", long=false, when=shortCondition)

// Close Conditions

shortCloseCondition = bullCond // or cross(osc, takeProfitShortRSILevel)

strategy.close(id="RSIDivLEShort", comment="Close All="+tostring(-close + strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) <= -1 and shortStopLossType == "NONE" and shortCloseCondition )

strategy.close(id="RSIDivLEShort", comment="TSL="+tostring(-close + strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= -1 and ((shortStopLossType == "PERC" or shortStopLossType == "ATR") and cross(short_trailing_sl,high))) // or rsiStopShort)// or rsiStopShort)

longCloseCondition = bearCond

strategy.close(id="RSIDivLELong", comment="Close All="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= 1 and longStopLossType == "NONE" and longCloseCondition)

strategy.close(id="RSIDivLELong", comment="TSL="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= 1 and ((longStopLossType == "PERC" or longStopLossType == "ATR") and cross(long_trailing_sl,low))) //or rsiStopLong

- Average True Range Breakout Strategy with Golden Ratio

- Adaptive Exponential Moving Average Range Strategy

- Donchian Channel Breakout Strategy

- Turtle Trading Strategy Based on Donchian Channels

- The Dual Quant Trading System

- StochRSI Reversal Trading Strategy

- Four DEMA Multi Timeframe Trend Strategy

- Follow The Bear Strategy

- Intelligent Accumulator Buy Strategy

- The Dual EMA Price Swing Strategy

- Trend Following Quant Trading Strategy Based on Moving Average

- Inside Bar Breakout Strategy

- Gold Standard Quantitative Trading Strategy

- The Dual Reversal Strategy

- The Order Block Momentum Breakout Strategy

- Dual EMA Intelligent Tracking Strategy

- Moving Average Trading Strategy

- Dual Moving Average HullMA Crossover Trend Strategy

- Dynamic Dual Moving Average Trailing Stop Strategy

- Moving Average Indicator Strategy