The Dual Quant Trading System

Author: ChaoZhang, Date: 2024-02-26 14:30:54Tags:

This strategy combines the CCI indicator, RSI indicator and two moving averages into a compound trading system. It can capture conventional trends while using RSI crossovers to add confirmation for entries to filter out some noise.

Strategy Principle

The strategy mainly uses the CCI indicator to determine the trend direction. CCI readings above 100 indicate a bullish market, while those below -100 indicate a bearish market. The system uses two moving average crossovers to assist in determining the trend direction. When the fast moving average crosses above the slow moving average, it is a buy signal, and vice versa for sell signals.

After determining the bullish or bearish trend, the system then uses the crossover of two RSIs with different parameter lengths as entry verification. For example, in a bull market, if the short-period RSI crosses above the long-period RSI, it is the final buy signal. This design mainly filters out noise to avoid wrong trades triggered by short-term corrections during trends.

The strategy only opens positions during the specified trading session, actively closing all positions 15 minutes before the close to avoid overnight risk. After opening positions, trailing stops are used to lock in profits.

Advantage Analysis

- Combining trend judgment and indicator crossovers can effectively identify trends and filter out noise for precise entries

- Using trailing stops to actively control risks avoids being stopped out due to flash crashes

- Only opening positions during specified trading sessions avoids overnight gap risk

- Adjustable RSI parameters can flexibly adapt to different market environments

Risk Analysis

- CCI shows poor performance in unusually volatile markets

- Dual RSI cross conditions are relatively strict, potentially missing some opportunities

- Trailing stops could be overly subjective, requiring parameter optimization

- Specified trading sessions may miss major overnight news gaps

Optimization Suggestions

- Test different CCI parameter combinations to find optimal settings

- Test removing the RSI crossover condition and directly entering based on CCI

- Backtest and optimize trailing stop parameters to find optimal settings

- Test removing forced position closing logic and instead track profits with trailing stops during positions to maximize profits

Summary

This strategy comprehensively considers trend determination and indicator crossover validation to ensure signal validity while controlling risk. Through parameter optimization and logic adjustments, the strategy has further potential to expand profit opportunities and reduce missed chances. This is a very promising trading concept.

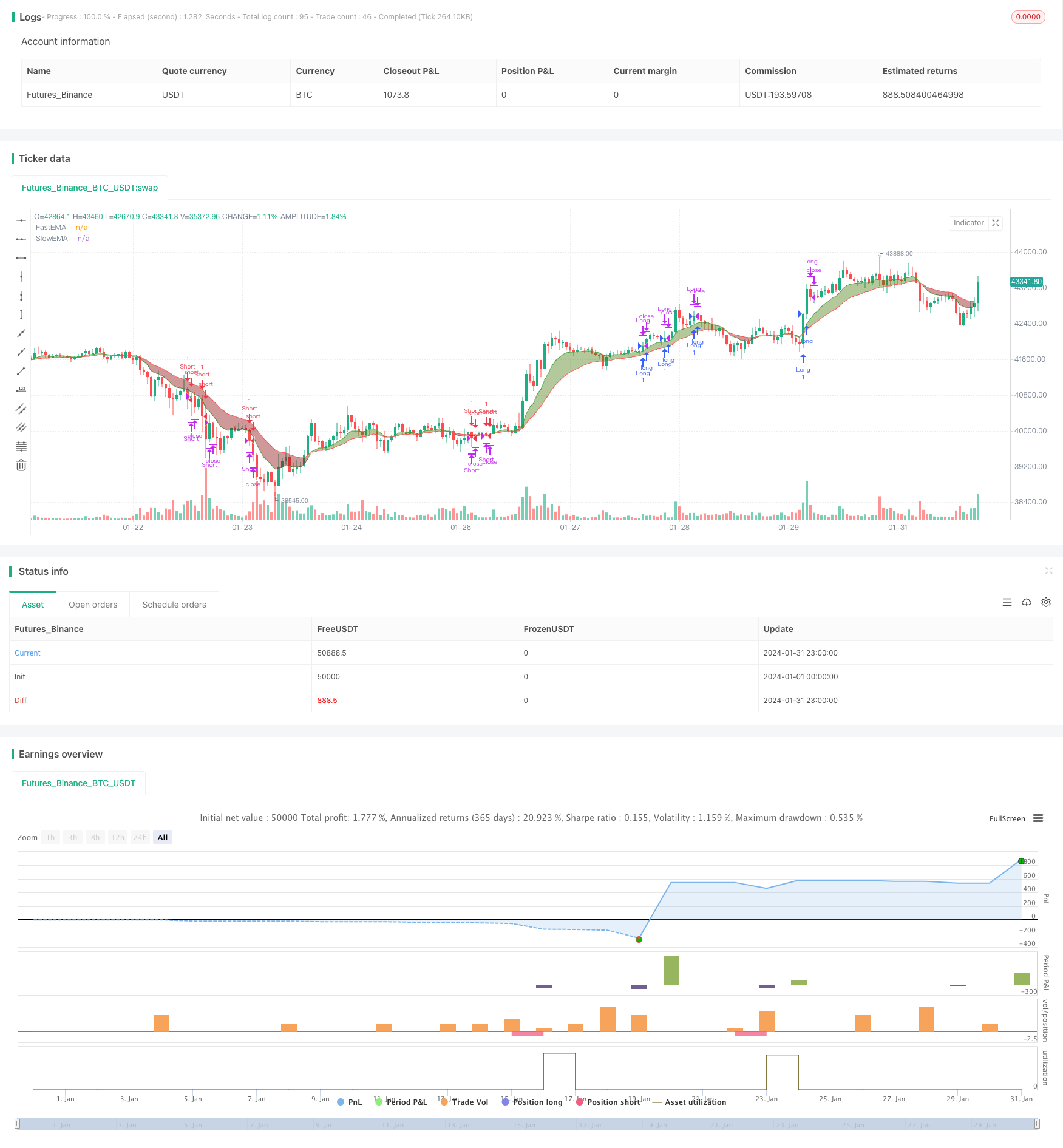

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rwestbrookjr

//@version=5

strategy("EMA with RSI Cross Strategy", overlay=true)

//EMA

fastLen = input(title='Fast EMA Length', defval=9)

slowLen = input(title='Slow EMA Length', defval=20)

fastEMA = ta.ema(close, fastLen)

slowEMA = ta.ema(close, slowLen)

fema = plot(fastEMA, title='FastEMA', color=color.new(color.green, 0), linewidth=1, style=plot.style_line)

sema = plot(slowEMA, title='SlowEMA', color=color.new(color.red, 0), linewidth=1, style=plot.style_line)

fill(fema, sema, color=fastEMA > slowEMA ? color.new(#417505, 50) : color.new(#890101, 50), title='Cloud')

// Bull and Bear Alerts

//Bull = ta.crossover(fastEMA, slowEMA)

Bull = fastEMA > slowEMA

//Bear = ta.crossunder(fastEMA, slowEMA)

Bear = fastEMA < slowEMA

//RSIs

rsiLength1Input = input.int(9, minval=1, title="RSI Length", group="RSI Settings")

rsiSource1Input = input.source(close, "Source", group="RSI Settings")

rsiLength2Input = input.int(20, minval=1, title="RSI Length", group="RSI Settings")

rsiSource2Input = input.source(close, "Source", group="RSI Settings")

up1 = ta.rma(math.max(ta.change(rsiSource1Input), 0), rsiLength1Input)

down1 = ta.rma(-math.min(ta.change(rsiSource1Input), 0), rsiLength1Input)

rsi = down1 == 0 ? 100 : up1 == 0 ? 0 : 100 - (100 / (1 + up1 / down1))

up2 = ta.rma(math.max(ta.change(rsiSource2Input), 0), rsiLength2Input)

down2 = ta.rma(-math.min(ta.change(rsiSource2Input), 0), rsiLength2Input)

rsi2 = down2 == 0 ? 100 : up2 == 0 ? 0 : 100 - (100 / (1 + up2 / down2))

//CCI

cciLength = input.int(20, minval=1)

src = input(hlc3, title="Source")

ma = ta.sma(src, cciLength)

cci = (src - ma) / (0.015 * ta.dev(src, cciLength))

//Trail Stop Setup

trstp = input.float(title="Trail Loss($)", minval = 0.0, step = 0.01, defval = 0.5)

longStop = 0.0, shortStop = 0.0

longStop := if Bull

stopValue = close - trstp

math.max(stopValue, longStop[1])

else

0.0

shortStop := if Bear

stopValue = close + trstp

math.min(stopValue, shortStop[1])

else

999999

//Session Setup

open_session=input(defval="0930-1545")

session = time("1", open_session)

validSession=(na(session) ? 0 : 1)

//Trade Signals

longCondition = Bull and cci > 100 and ta.crossover(rsi,rsi2) and validSession

if (longCondition)

strategy.entry("Long", strategy.long, 1)

//longExit = close > strategy.opentrades.entry_price(0) + 1.5 or close < strategy.opentrades.entry_price(0) - 0.75

longExit = close < longStop or not validSession

if (longExit)

strategy.close("Long")

shortCondition = Bear and cci < 100 and ta.crossunder(rsi,rsi2) and validSession

if (shortCondition)

strategy.entry("Short", strategy.short, 1)

//shortExit = close < strategy.opentrades.entry_price(0) - 1.5 or close > strategy.opentrades.entry_price(0) + 0.75

shortExit = close > shortStop or not validSession

if (shortExit)

strategy.close("Short")

- Momentum Crossover Bollinger Band Trend Tracking Strategy

- Vortex Trend Reversal Strategy

- Momentum Tracking Dual-EMA Crossover Strategy

- Dynamic Self-Adaptive Kaufman Moving Average Trend Tracking Strategy

- Three Factors Model for Price Oscillation Detection

- Momentum Breakthrough EMA 34 Crossover Strategy

- Average True Range Breakout Strategy with Golden Ratio

- Adaptive Exponential Moving Average Range Strategy

- Donchian Channel Breakout Strategy

- Turtle Trading Strategy Based on Donchian Channels

- StochRSI Reversal Trading Strategy

- Four DEMA Multi Timeframe Trend Strategy

- Follow The Bear Strategy

- Intelligent Accumulator Buy Strategy

- The Dual EMA Price Swing Strategy

- RSI Indicator Long Short Separation Trading Strategy

- Trend Following Quant Trading Strategy Based on Moving Average

- Inside Bar Breakout Strategy

- Gold Standard Quantitative Trading Strategy

- The Dual Reversal Strategy