Walnut Trend Following Strategy Based on Distance from 200 EMA

Author: ChaoZhang, Date: 2024-03-01 10:50:03Tags:

This article will analyze in detail a trend following strategy based on the distance between price and 200-day moving average, called “Walnut Trend Following Strategy Based on Distance from 200 EMA”. This strategy establishes positions when the price exceeds a preset threshold from the 200-day moving average and closes positions when reaching the profit target.

I. Strategy Logic

The core indicator of this strategy is the 200-day exponential moving average (200 EMA). The strategy judges if the price deviates from the 200-day line by a set percentage threshold. Long positions are established when the last candlestick is a green candle and short positions are established when the last candlestick is a red candle. The long entry conditions are price below 200 EMA and price percentage deviation above threshold. The short entry conditions are price above 200 EMA and price percentage deviation above threshold.

The exit conditions are when price reverts to 200 EMA or reaches 1.5 times the entry price as profit target. The stop loss is set at 20% of the option premium.

The detailed entry and exit conditions are:

Long Entry: Close < 200 EMA && Percentage Distance ≥ Threshold && Last Candle Green

Short Entry: Close > 200 EMA && Percentage Distance ≥ Threshold && Last Candle Red

Long Exit: Close ≥ 200 EMA || Reaches Profit Target || End of Day

Short Exit: Close <= 200 EMA || Reaches Profit Target || End of Day

The stop loss is 20% of the option premium.

II. Advantages

The main advantages of this strategy are:

- Using 200-day moving average to determine medium-long term trend, avoiding short-term market noise

- Establishing trend following mechanism to track medium-long term price trend

- Optimizing entry timing when last candle direction aligns with major trend

- Reasonable stop loss and take profit to avoid larger losses

III. Risks

The main risks of this strategy are:

- Multiple losses may occur during market consolidation around moving average

- Sudden trend reversal triggers stop loss

- Inappropriate parameter selection like moving average period leads to inaccurate trend judgment

The following aspects can be optimized to reduce the above risks:

- Adjust moving average parameters or add other indicators to determine major trend

- Optimize stop loss mechanism like adjusting stop distance based on price change

- Optimize entry conditions with more judgment indicators

IV. Optimization Directions

The main optimization directions for this strategy are:

- Optimize moving average parameters, test impacts of different period parameters

- Add other indicators like Bollinger Bands, KDJ to determine major trend

- Adjust stop loss strategy to trail price dynamically

- Optimize entry conditions to avoid wrong entries due to short-term corrections

V. Conclusion

This article analyzed in detail the logic, strengths, weaknesses and optimization directions of the trend following strategy based on the distance between price and 200-day moving average. This strategy judges medium-long term trend by tracking the price deviation from long-term moving average. Positions are established when the deviation exceeds a threshold and closed when hitting stop loss or take profit targets. This strategy can track medium-long term trend well but still has some parameter optimization space. Future improvements can be made from multiple perspectives to make the strategy more robust across different market conditions.

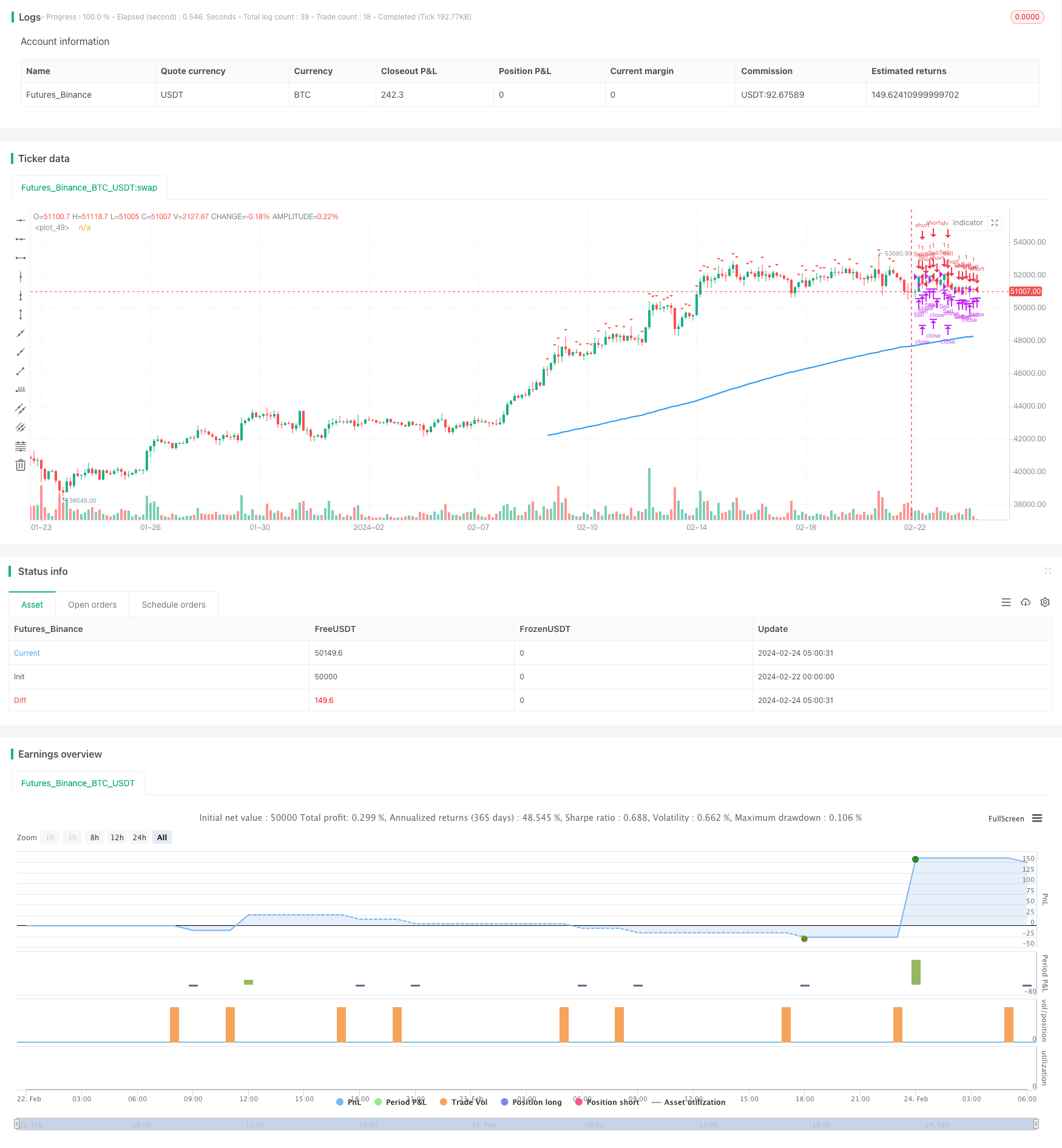

/*backtest

start: 2024-02-22 00:00:00

end: 2024-02-24 06:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Intraday Price Away from 200 EMA Strategy", overlay=true)

// Define inputs

emaPeriod = input(200, title="EMA Period")

thresholdPercent = input(0.75, title="Threshold Percent", minval=0) // Define the threshold percentage

// Calculate 200 EMA

ema = ema(close, emaPeriod)

// Calculate distance from 200 EMA as a percentage

distance_percent = ((close - ema) / ema) * 100

// Track average entry price

var float avgEntryPrice = na

// Buy conditions

buy_condition = close < ema and abs(distance_percent) >= thresholdPercent and close[1] < close[2]

// Exit conditions for buy

exit_buy_condition = close >= ema or time_close(timeframe.period) or (avgEntryPrice * 1.5) <= close

// Sell conditions

sell_condition = close > ema and abs(distance_percent) >= thresholdPercent and close[1] > close[2]

// Exit conditions for sell

exit_sell_condition = close <= ema or time_close(timeframe.period) or (avgEntryPrice * 1.5) >= close

// Execute buy and sell orders only if there are no open trades

if strategy.opentrades == 0

strategy.entry("Buy", strategy.long, when=buy_condition)

strategy.entry("Sell", strategy.short, when=sell_condition)

// Update average entry price for buy condition

if buy_condition

avgEntryPrice := close

// Update average entry price for sell condition

if sell_condition

avgEntryPrice := close

// Close buy position if exit condition is met

strategy.close("Buy", when=exit_buy_condition)

// Close sell position if exit condition is met

strategy.close("Sell", when=exit_sell_condition)

// Plot 200 EMA

plot(ema, color=color.blue, linewidth=2)

// Plot buy and sell signals

plotshape(buy_condition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(sell_condition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

- Trend Following Moving Average Strategy

- Quant Trading Strategy Based on HullMA Percentage Bands

- RSI and smoothed RSI bullish divergence strategy

- Dual-directional Trailing Stop Moving Average Trend Strategy

- The Breakout Regression Strategy

- Fast RSI Reversal Trading Strategy

- The Momentum Burst Tracking Strategy

- Elevated Touch Short Triangle Strategy

- Moving Average Crossover Trend Following Strategy

- Double Confirmation Breakthrough Strategy

- VWAP Trend Following Strategy

- Turtle Trend Strategy

- Market Reversal Momentum Strategy

- Triple BB Bands Breakout with RSI Strategy

- Dual Moving Average Channel Trading Strategy

- Adaptive Channel Breakout Strategy

- An Advanced EMA Trend Following Strategy with Relaxed RSI and ATR Filters

- Triple Confirmation Trend Tracking Strategy

- Multiple Moving Average Trading Strategy

- Turtle Trading Decision System