Multi-Moving Average Trend Following and Reversal Pattern Recognition Strategy

Author: ChaoZhang, Date: 2024-07-30 16:30:26Tags: SMASMMAEMA

Overview

This strategy is a comprehensive technical analysis tool that combines multiple Smoothed Moving Averages (SMMAs), trend identification, candlestick pattern recognition, and trading session analysis. It aims to help traders identify market trends, detect potential reversal points, and execute trades within specific trading sessions. The core of the strategy lies in using SMMAs of different periods to determine market direction, while utilizing “3 Line Strike” and “Engulfing” candlestick patterns to generate trading signals.

Strategy Principle

-

Multiple Smoothed Moving Averages (SMMAs): The strategy employs 4 SMMAs (21-period, 50-period, 100-period, and 200-period) to assess market trends across different timeframes. These moving averages help traders understand short-term, medium-term, and long-term market trends.

-

Trend Fill: The strategy visually displays the current trend by color-filling the background based on the relationship between short-term prices (2-period EMA) and the 200-period SMMA. Green background indicates a bullish trend, while red indicates a bearish trend.

-

Candlestick Pattern Recognition:

- “3 Line Strike” pattern: Identifies a reversal candle appearing after three consecutive candles in the same direction, potentially signaling a trend reversal.

- Engulfing pattern: Identifies large candles that completely engulf the previous candle, also potentially signaling a trend reversal.

-

Trading Session Analysis: Allows users to define specific trading sessions and highlight these periods on the chart. This helps traders focus on the most active trading times.

-

Trade Signal Generation:

- Long signal: Triggered when a bullish “3 Line Strike” or bullish engulfing pattern appears.

- Short signal: Triggered when a bearish “3 Line Strike” or bearish engulfing pattern appears.

Strategy Advantages

-

Multi-dimensional Analysis: By combining multiple technical indicators and analytical methods, it provides a comprehensive market perspective, facilitating more informed trading decisions.

-

Trend Confirmation: Using SMMAs across multiple timeframes allows for more accurate trend confirmation, reducing false signals.

-

Reversal Identification: By recognizing specific candlestick patterns, it can capture potential market reversals early, providing traders with entry and exit opportunities.

-

Visual Intuitiveness: The use of color fills and graphical markers makes market states and potential signals easily discernible, facilitating quick analysis.

-

Flexibility: Allows users to customize various parameters, such as moving average periods and trading sessions, to adapt to different trading styles and market conditions.

-

Time Management: By highlighting specific trading sessions, it helps traders better manage their trading time, focusing on the most potential market periods.

Strategy Risks

-

Lagging Nature: Moving averages are inherently lagging indicators and may not capture turning points timely in rapidly changing markets.

-

Over-reliance on Patterns: Excessive dependence on candlestick patterns may lead to misjudgments, as not all patterns accurately predict market reversals.

-

False Breakout Risk: In ranging markets, prices may frequently cross moving averages, generating false signals.

-

Parameter Sensitivity: The strategy’s performance largely depends on chosen parameters, which may require frequent adjustments under different market conditions.

-

Neglect of Fundamentals: Pure technical analysis methods may overlook important fundamental factors, leading to incorrect judgments during significant news or events.

-

Overtrading: In highly volatile markets, the strategy may generate too many trading signals, increasing transaction costs and potentially leading to overtrading.

To mitigate these risks, it is recommended to:

- Combine other technical indicators and fundamental analysis to confirm signals.

- Use appropriate stop-loss and profit targets to manage risk.

- Back-test the strategy under different market conditions to find optimal parameters.

- Consider implementing signal filters to reduce false signals.

- Pay close attention to important economic data releases and market events.

Strategy Optimization Directions

-

Dynamic Parameter Adjustment: Implement adaptive moving average periods that automatically adjust based on market volatility to suit different market conditions.

-

Signal Confirmation Mechanism: Introduce additional technical indicators (such as RSI, MACD) to confirm trading signals, enhancing signal reliability.

-

Volatility Filter: Incorporate an ATR (Average True Range) indicator to filter out weak signals during low volatility periods, trading only when the market has sufficient momentum.

-

Market State Classification: Develop an algorithm to classify current market states (trending, ranging, high volatility, etc.) and adopt different trading strategies for different states.

-

Stop-Loss Optimization: Implement dynamic stop-losses, such as using ATR or recent support/resistance levels to set stop-loss points, for better risk management.

-

Volume Analysis: Integrate volume data, executing trade signals only when confirmed by volume, to improve signal reliability.

-

Time Weighting: Analyze historical data to determine success rates at different time periods, assigning different weights to signals at different times.

-

Machine Learning Integration: Use machine learning algorithms to optimize parameter selection and signal generation processes, improving strategy adaptability and performance.

-

Multi-timeframe Analysis: Extend the strategy to consider signals from multiple timeframes, ensuring trade direction aligns with larger market trends.

-

Capital Management Optimization: Implement dynamic position sizing adjustments based on market volatility and account risk to determine the size of each trade.

These optimization directions aim to enhance the strategy’s stability, adaptability, and overall performance. Through these improvements, the strategy can better cope with different market environments, increase profitability, and reduce risk.

Conclusion

The “Multi-Moving Average Trend Following and Reversal Pattern Recognition Strategy” is a comprehensive technical analysis tool that combines several advanced trading techniques. By utilizing multiple smoothed moving averages, trend identification, candlestick pattern analysis, and trading session management, this strategy provides traders with a comprehensive framework for market analysis. It not only helps identify overall market trends but also captures potential reversal points, offering valuable reference for trading decisions.

The main advantages of the strategy lie in its multi-dimensional analysis approach and visually intuitive presentation, allowing traders to quickly understand market conditions and make informed decisions. However, like all trading strategies, it also faces some inherent risks, such as lagging indicators and over-reliance on technical indicators.

To further improve the strategy’s effectiveness, several optimization directions can be considered, including dynamic parameter adjustment, introduction of additional confirmation mechanisms, and integration of more advanced techniques such as machine learning. These optimizations can help the strategy better adapt to different market environments, enhancing its stability and profitability.

Finally, it’s important to remember that no strategy is infallible. Successful trading depends not only on a good strategy but also on strict risk management, continuous market learning, and constant refinement of the strategy. Traders should use this strategy as part of their overall trading system, combining it with other analytical methods and personal market insights to make final trading decisions.

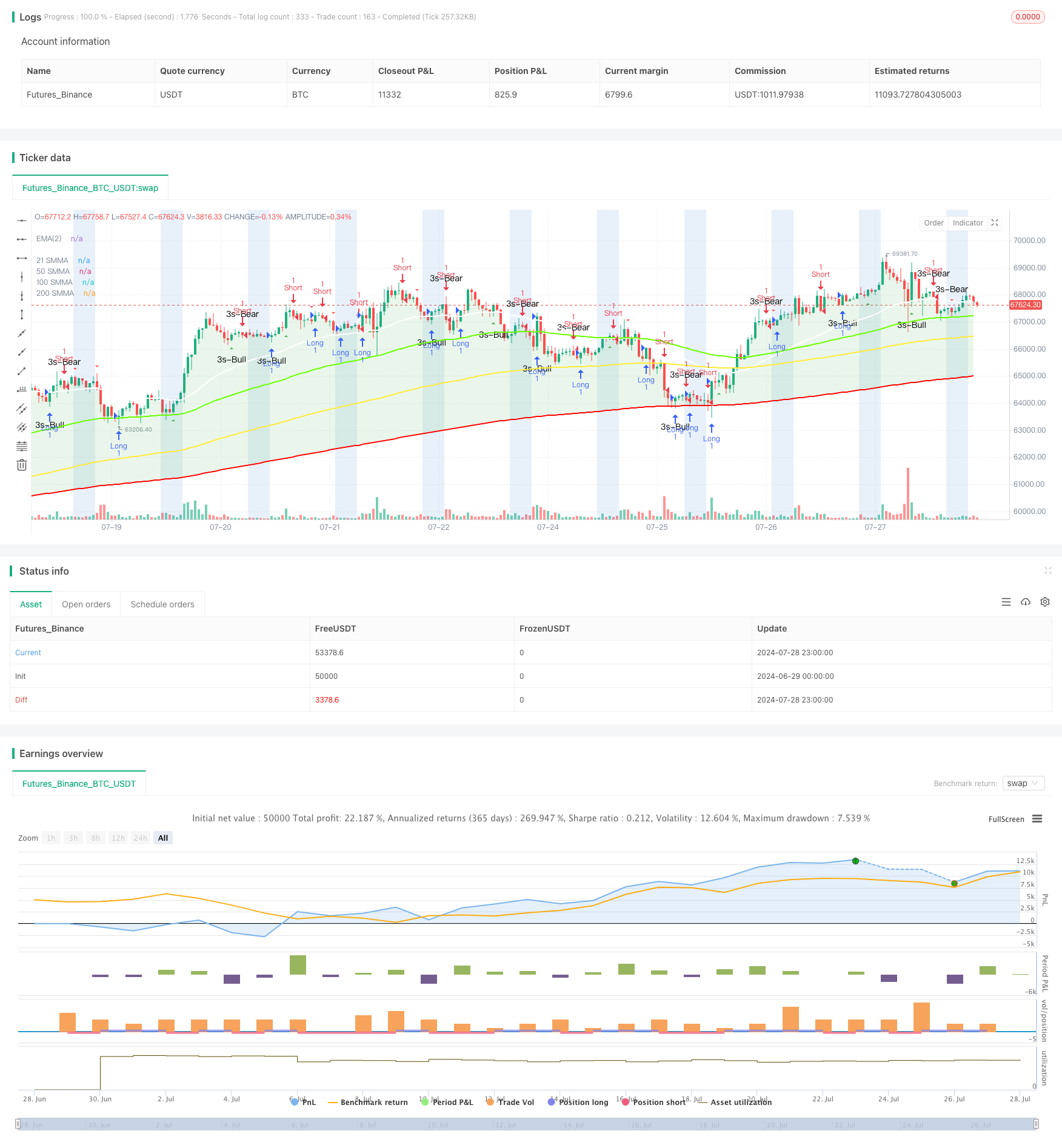

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="TMA Overlay Strategy", shorttitle="TMA Overlay", overlay=true)

// ### Four Smoothed Moving Averages

len1 = input.int(21, minval=1, title="Length 1", group="Smoothed MA Inputs")

src1 = close

smma1 = 0.0

sma_1 = ta.sma(src1, len1)

smma1 := na(smma1[1]) ? sma_1 : (smma1[1] * (len1 - 1) + src1) / len1

plot(smma1, color=color.white, linewidth=2, title="21 SMMA")

len2 = input.int(50, minval=1, title="Length 2", group="Smoothed MA Inputs")

src2 = close

smma2 = 0.0

sma_2 = ta.sma(src2, len2)

smma2 := na(smma2[1]) ? sma_2 : (smma2[1] * (len2 - 1) + src2) / len2

plot(smma2, color=color.new(#6aff00, 0), linewidth=2, title="50 SMMA")

h100 = input.bool(true, title="Show 100 Line", group="Smoothed MA Inputs")

len3 = input.int(100, minval=1, title="Length 3", group="Smoothed MA Inputs")

src3 = close

smma3 = 0.0

sma_3 = ta.sma(src3, len3)

smma3 := na(smma3[1]) ? sma_3 : (smma3[1] * (len3 - 1) + src3) / len3

sma3plot = plot(h100 ? smma3 : na, color=color.new(color.yellow, 0), linewidth=2, title="100 SMMA")

len4 = input.int(200, minval=1, title="Length 4", group="Smoothed MA Inputs")

src4 = close

smma4 = 0.0

sma_4 = ta.sma(src4, len4)

smma4 := na(smma4[1]) ? sma_4 : (smma4[1] * (len4 - 1) + src4) / len4

sma4plot = plot(smma4, color=color.new(#ff0500, 0), linewidth=2, title="200 SMMA")

// Trend Fill

trendFill = input.bool(true, title="Show Trend Fill", group="Smoothed MA Inputs")

ema2 = ta.ema(close, 2)

ema2plot = plot(ema2, color=color.new(#2ecc71, 100), linewidth=1, title="EMA(2)", editable=false)

fill(ema2plot, sma4plot, color=color.new(ema2 > smma4 and trendFill ? color.green : color.red, 85), title="Trend Fill")

// End ###

// ### 3 Line Strike

bearS = input.bool(true, title="Show Bearish 3 Line Strike", group="3 Line Strike")

bullS = input.bool(true, title="Show Bullish 3 Line Strike", group="3 Line Strike")

bearSig = close[3] > open[3] and close[2] > open[2] and close[1] > open[1] and close < open[1]

bullSig = close[3] < open[3] and close[2] < open[2] and close[1] < open[1] and close > open[1]

plotshape(bullS ? bullSig : na, style=shape.triangleup, color=color.green, location=location.belowbar, size=size.small, text="3s-Bull", title="3 Line Strike Up")

plotshape(bearS ? bearSig : na, style=shape.triangledown, color=color.red, location=location.abovebar, size=size.small, text="3s-Bear", title="3 Line Strike Down")

// End ###

//### Engulfing Candles

bearE = input.bool(true, title="Show Bearish Big A$$ Candles", group="Big A$$ Candles")

bullE = input.bool(true, title="Show Bullish Big A$$ Candles", group="Big A$$ Candles")

openBarPrevious = open[1]

closeBarPrevious = close[1]

openBarCurrent = open

closeBarCurrent = close

bullishEngulfing = openBarCurrent <= closeBarPrevious and openBarCurrent < openBarPrevious and closeBarCurrent > openBarPrevious

bearishEngulfing = openBarCurrent >= closeBarPrevious and openBarCurrent > openBarPrevious and closeBarCurrent < openBarPrevious

plotshape(bullE ? bullishEngulfing : na, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny, title="Big Ass Candle Up")

plotshape(bearE ? bearishEngulfing : na, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny, title="Big Ass Candle Down")

alertcondition(bullishEngulfing, title="Bullish Engulfing", message="[CurrencyPair] [TimeFrame], Bullish candle engulfing previous candle")

alertcondition(bearishEngulfing, title="Bearish Engulfing", message="[CurrencyPair] [TimeFrame], Bearish candle engulfing previous candle")

// End ###

// ### Trading Session

ts = input.bool(true, title="Show Trade Session", group="Trade Session")

tzOffset = input.int(0, title="Timezone Offset (hours from UTC)", group="Trade Session")

label = input.string("CME Open", title="Label", tooltip="For easy identification", group="Trade Session")

startHour = input.int(7, title="Analysis Start Hour", minval=0, maxval=23, group="Trade Session")

startMinute = input.int(0, title="Analysis Start Minute", minval=0, maxval=59, group="Trade Session")

startHour2 = input.int(8, title="Session Start Hour", minval=0, maxval=23, group="Trade Session")

startMinute2 = input.int(30, title="Session Start Minute", minval=0, maxval=59, group="Trade Session")

endHour2 = input.int(12, title="Session End Hour", minval=0, maxval=23, group="Trade Session")

endMinute2 = input.int(0, title="Session End Minute", minval=0, maxval=59, group="Trade Session")

rangeColor = input.color(#1976d21f, title="Color", group="Trade Session")

showMon = input.bool(true, title="Monday", group="Trade Session")

showTue = input.bool(true, title="Tuesday", group="Trade Session")

showWed = input.bool(true, title="Wednesday", group="Trade Session")

showThu = input.bool(true, title="Thursday", group="Trade Session")

showFri = input.bool(true, title="Friday", group="Trade Session")

showSat = input.bool(false, title="Saturday", group="Trade Session")

showSun = input.bool(false, title="Sunday", group="Trade Session")

startTime = timestamp("UTC", year(time), month(time), dayofmonth(time), startHour - tzOffset, startMinute)

endTime = timestamp("UTC", year(time), month(time), dayofmonth(time), endHour2 - tzOffset, endMinute2)

active = (startTime <= time and time <= endTime and ts) and ((dayofweek == dayofweek.monday and showMon) or (dayofweek == dayofweek.tuesday and showTue) or (dayofweek == dayofweek.wednesday and showWed) or (dayofweek == dayofweek.thursday and showThu) or (dayofweek == dayofweek.friday and showFri) or (dayofweek == dayofweek.saturday and showSat) or (dayofweek == dayofweek.sunday and showSun))

bgcolor(color=active ? rangeColor : na, title="Session Background")

startTime2 = timestamp("UTC", year(time), month(time), dayofmonth(time), startHour2 - tzOffset, startMinute2)

endTime2 = timestamp("UTC", year(time), month(time), dayofmonth(time), endHour2 - tzOffset, endMinute2)

active2 = (startTime2 <= time and time <= endTime2 and ts) and ((dayofweek == dayofweek.monday and showMon) or (dayofweek == dayofweek.tuesday and showTue) or (dayofweek == dayofweek.wednesday and showWed) or (dayofweek == dayofweek.thursday and showThu) or (dayofweek == dayofweek.friday and showFri) or (dayofweek == dayofweek.saturday and showSat) or (dayofweek == dayofweek.sunday and showSun))

bgcolor(color=active2 ? rangeColor : na, title="Session Background")

// End ###

// Trading Strategy

longCondition = bullSig or bullishEngulfing

shortCondition = bearSig or bearishEngulfing

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// eof

- SSS

- Crodl's Supertrend

- Advanced Flexible Multi-Period Moving Average Crossover Strategy

- Multi-Layer Volatility Band Trading Strategy

- RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- Multi-timeframe Trend Tracking Strategy Based on Impulse MACD and Dual Moving Average Crossover

- Adaptive Moving Average Crossover Strategy

- Multi-Moving Average Crossover Trend Following Strategy with Volatility Filter

- Multi-Period Moving Average Crossover Trend Following Strategy

- Dual Moving Average Momentum Tracking Quantitative Strategy

- Multi-Indicator Intelligent Pyramiding Strategy

- Multi-EMA Crossover Momentum Strategy

- Multi-Order Breakout Trend Following Strategy

- Multi-EMA Crossover with Time Interval Integration Strategy

- Dual Moving Average Crossover Confirmation Strategy with Volume-Price Integration Optimization Model

- Dual Dynamic Indicator Optimization Strategy

- VWAP Crossover Dynamic Profit Target Trading Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Fibonacci Extension and Retracement Channel Breakout Strategy

- Multi-Dimensional Order Flow Analysis and Trading Strategy

- Advanced Composite Moving Average and Market Momentum Trend Capture Strategy

- Advanced Fibonacci Retracement and Volume-Weighted Price Action Trading Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dynamic Position Dual Moving Average Crossover Strategy

- Dynamic Signal Line Trend Following Strategy Combining ATR and Volume

- Multi-Indicator Dynamic Volatility Alert Trading System

- Dynamic Trend-Following Trading Strategy Based on Gann Angles

- VWAP-ATR Trend Following and Price Reversal Strategy

- Bollinger Bands RSI Neutral Market Quantitative Trading Strategy

- Multi-Level Oversold Oscillator Buy Strategy