概述

本策略是一个结合了斐波那契回调水平、价格行为模式和成交量分析的高级交易系统。它利用斐波那契回调水平来确定关键支撑和阻力区域,使用蜡烛图模式如针式蜡烛和吞噬形态来识别潜在的反转点,并通过成交量确认来增强交易信号的可靠性。该策略旨在捕捉市场趋势中的高概率交易机会,同时通过多重确认机制来管理风险。

策略原理

斐波那契回调:策略使用20个周期的高低点来计算斐波那契回调水平(0%, 23.6%, 38.2%, 61.8%, 100%)。这些水平用于识别潜在的支撑和阻力区域。

价格行为模式:

- 针式蜡烛:通过比较蜡烛实体和影线长度来识别。当影线长度大于实体长度的两倍时,被认为是有效的针式蜡烛。

- 吞噬形态:通过比较相邻两根蜡烛的开盘价和收盘价来识别。

成交量分析:策略计算20周期的成交量移动平均线,并要求当前成交量超过该均线的1.5倍,以确认交易信号的强度。

交易逻辑:

- 做多条件:出现看涨针式蜡烛或看涨吞噬形态,价格位于38.2%斐波那契回调水平以上,且满足成交量条件。

- 做空条件:出现看跌针式蜡烛或看跌吞噬形态,价格位于38.2%斐波那契回调水平以下,且满足成交量条件。

策略优势

多重确认机制:结合了技术分析中的多个重要概念(斐波那契、价格行为、成交量),提高了交易信号的可靠性。

适应性强:斐波那契水平会根据市场波动动态调整,使策略能够适应不同市场环境。

风险管理:通过要求价格位于关键斐波那契水平之上或之下,以及成交量确认,降低了假突破的风险。

趋势跟踪与反转结合:策略既可以捕捉趋势延续的机会(价格在关键水平之上或之下),也可以识别潜在的反转点(通过价格行为模式)。

可视化:策略提供了清晰的图表标记,包括斐波那契水平、交易信号和成交量移动平均线,便于交易者直观理解市场状况。

策略风险

过度交易:在波动剧烈的市场中,可能会产生过多的交易信号,增加交易成本并可能导致过度交易。

滞后性:使用移动平均线计算成交量阈值可能导致信号滞后,在快速变化的市场中错过机会。

假信号:尽管有多重确认,但在横盘市场或低波动环境中仍可能产生假信号。

参数敏感性:策略性能可能对斐波那契长度、成交量MA长度和成交量阈值等参数设置敏感。

缺乏止损机制:当前策略未包含明确的止损逻辑,可能导致在不利行情中承受过大损失。

策略优化方向

动态参数调整:实现斐波那契长度、成交量MA长度和成交量阈值的自适应调整,以适应不同的市场条件。

增加趋势过滤器:引入额外的趋势指标(如移动平均线或ADX),以避免在强劲趋势中逆势交易。

完善风险管理:加入止损和止盈逻辑,如基于ATR的动态止损或利用斐波那契水平设置止损点。

优化入场时机:考虑在关键斐波那契水平附近设置限价单,以获得更优的入场价格。

增加时间框架分析:结合更高时间框架的分析,以提高交易方向的准确性。

加入波动性过滤:在低波动性时期减少交易频率,避免在不适合的市场条件下交易。

优化成交量分析:考虑使用更复杂的成交量指标,如OBV或Chaikin Money Flow,以更准确地评估成交量趋势。

总结

该高级斐波那契回调与成交量加权价格行为交易策略展现了量化交易中多因素分析的强大潜力。通过结合斐波那契回调、价格行为模式和成交量分析,策略能够在技术分析的基础上提供更可靠的交易信号。其适应性和多重确认机制是其主要优势,有助于在不同市场环境中识别高概率交易机会。

然而,策略仍存在一些潜在风险,如过度交易和参数敏感性等问题。通过实施建议的优化措施,如动态参数调整、增加趋势过滤器和完善风险管理等,可以进一步提升策略的稳健性和性能。

总的来说,这是一个设计良好的策略框架,具有广阔的应用前景和优化空间。对于寻求在技术分析基础上构建更复杂、更可靠交易系统的交易者来说,这个策略提供了一个极具价值的起点。通过持续的回测、优化和实盘验证,它有潜力成为一个强大的交易工具。

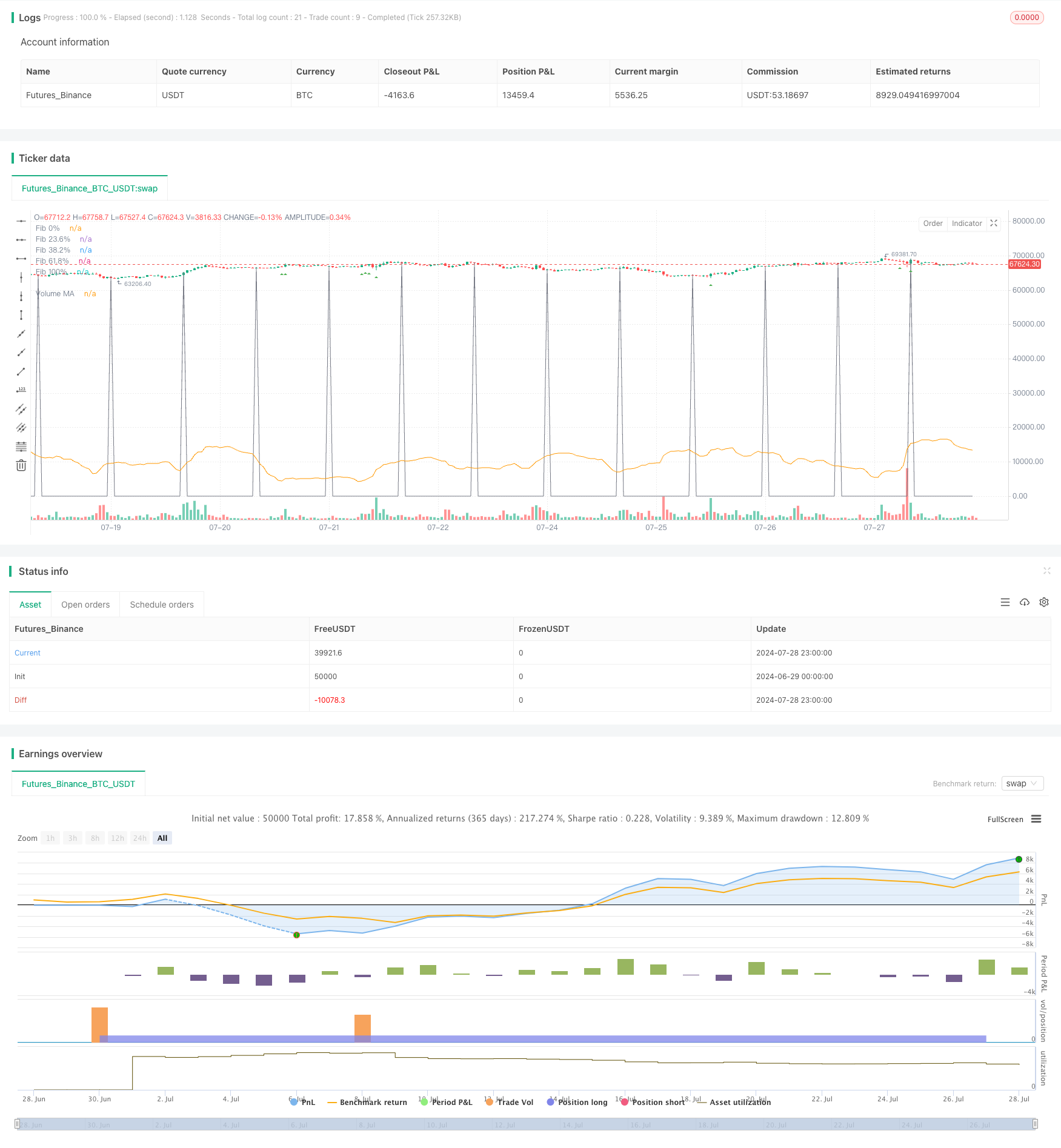

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fibonacci and Price Action with Volume Strategy", overlay=true)

// Inputs for Fibonacci levels

fibLength = input.int(20, title="Fibonacci Length")

fibonacciLevels = array.new_float(5, 0)

var float fibHigh = na

var float fibLow = na

// Inputs for Volume

volumeMA_length = input.int(20, title="Volume MA Length") // Moving average length for volume

volumeThreshold = input.float(1.5, title="Volume Threshold Multiplier") // Multiplier for volume condition

// Calculate Fibonacci retracement levels

if (na(fibHigh) or na(fibLow))

fibHigh := high

fibLow := low

if (high > fibHigh)

fibHigh := high

if (low < fibLow)

fibLow := low

if (bar_index % fibLength == 0)

fibHigh := high

fibLow := low

array.set(fibonacciLevels, 0, fibHigh)

array.set(fibonacciLevels, 1, fibHigh - 0.236 * (fibHigh - fibLow))

array.set(fibonacciLevels, 2, fibHigh - 0.382 * (fibHigh - fibLow))

array.set(fibonacciLevels, 3, fibHigh - 0.618 * (fibHigh - fibLow))

array.set(fibonacciLevels, 4, fibLow)

// Plot Fibonacci levels

plot(array.get(fibonacciLevels, 0), color=color.gray, linewidth=1, title="Fib 0%")

plot(array.get(fibonacciLevels, 1), color=color.gray, linewidth=1, title="Fib 23.6%")

plot(array.get(fibonacciLevels, 2), color=color.gray, linewidth=1, title="Fib 38.2%")

plot(array.get(fibonacciLevels, 3), color=color.gray, linewidth=1, title="Fib 61.8%")

plot(array.get(fibonacciLevels, 4), color=color.gray, linewidth=1, title="Fib 100%")

// Price Action Patterns

isPinBar(bullish) =>

wickSize = bullish ? high - math.max(open, close) : math.min(open, close) - low

bodySize = math.abs(close - open)

wickSize > bodySize * 2

isBullishEngulfing() =>

open[1] > close[1] and close > open and open <= close[1] and close >= open[1]

isBearishEngulfing() =>

close[1] > open[1] and open > close and open >= close[1] and close <= open[1]

// Calculate Volume Moving Average

volumeMA = ta.sma(volume, volumeMA_length)

volumeCondition = volume > volumeThreshold * volumeMA

// Buy and Sell Conditions with Volume

longEntry = (isPinBar(true) or isBullishEngulfing()) and close > array.get(fibonacciLevels, 2) and volumeCondition

shortEntry = (isPinBar(false) or isBearishEngulfing()) and close < array.get(fibonacciLevels, 2) and volumeCondition

// Execute Trades

if (longEntry)

strategy.entry("Buy", strategy.long)

if (shortEntry)

strategy.entry("Sell", strategy.short)

// Plot buy and sell signals

plotshape(series=longEntry, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortEntry, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Plot Volume MA

plot(volumeMA, title="Volume MA", color=color.orange, linewidth=1, style=plot.style_line)

// Plot Performance Metrics

// if (strategy.closedtrades > 0)

// winRate = (strategy.wintrades / strategy.closedtrades) * 100

// profitFactor = strategy.grossprofit / strategy.grossloss

// label.new(bar_index, high, "Win Rate: " + str.tostring(winRate, "#.##") + "%\nProfit Factor: " + str.tostring(profitFactor, "#.##"),

// color=color.new(color.blue, 80), style=label.style_label_down, size=size.small)