Ejemplo de dimensionamiento de la posición de la curva de renta variable

El autor:¿ Qué pasa?, Fecha: 2022-05-13 22:25:44Las etiquetas:OCMLa SMA

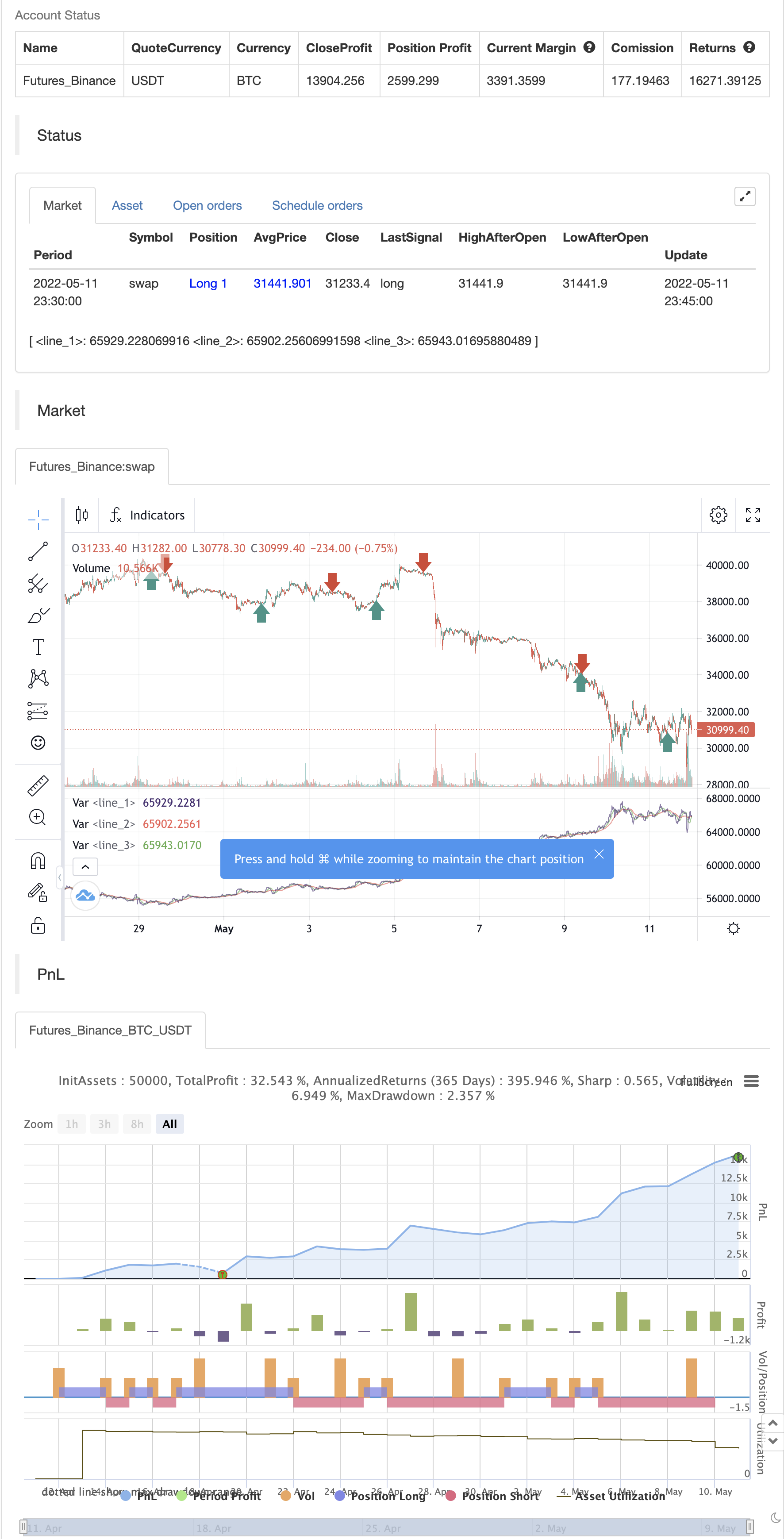

El objetivo de la gestión de la curva de renta variable es minimizar el riesgo en el comercio cuando la curva de renta variable está en una tendencia bajista. Esta estrategia tiene dos modos para determinar la tendencia bajista de la curva de renta variable: mediante la creación de dos promedios móviles simples de la curva de renta variable de una cartera - una a corto plazo y una a largo plazo - y actuando en sus cruces. Si la SMA rápida está por debajo de la SMA lenta, se detecta una tendencia bajista de la renta variable (smafastequity < smaslowequity). El segundo método consiste en utilizar los cruces del propio capital con el SMA de período más largo (equity < smasloweequity).

Si usted es un buscador de riesgo, seleccione

Prueba posterior

/*backtest

start: 2022-04-12 00:00:00

end: 2022-05-11 23:59:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shardison

//@version=5

//EXPLANATION

//"Trading the equity curve" as a risk management method is the

//process of acting on trade signals depending on whether a system’s performance

//is indicating the strategy is in a profitable or losing phase.

//The point of managing equity curve is to minimize risk in trading when the equity curve is in a downtrend.

//This strategy has two modes to determine the equity curve downtrend:

//By creating two simple moving averages of a portfolio's equity curve - a short-term

//and a longer-term one - and acting on their crossings. If the fast SMA is below

//the slow SMA, equity downtrend is detected (smafastequity < smaslowequity).

//The second method is by using the crossings of equity itself with the longer-period SMA (equity < smasloweequity).

//When "Reduce size by %" is active, the position size will be reduced by a specified percentage

//if the equity is "under water" according to a selected rule. If you're a risk seeker, select "Increase size by %"

//- for some robust systems, it could help overcome their small drawdowns quicker.

//strategy("Use Trading the Equity Curve Postion Sizing", shorttitle="TEC", default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital = 100000)

//TRADING THE EQUITY CURVE INPUTS

useTEC = input.bool(true, title="Use Trading the Equity Curve Position Sizing")

defulttraderule = useTEC ? false: true

initialsize = input.float(defval=10.0, title="Initial % Equity")

slowequitylength = input.int(25, title="Slow SMA Period")

fastequitylength = input.int(9, title="Fast SMA Period")

seedequity = 100000 * .10

if strategy.equity == 0

seedequity

else

strategy.equity

slowequityseed = strategy.equity > seedequity ? strategy.equity : seedequity

fastequityseed = strategy.equity > seedequity ? strategy.equity : seedequity

smaslowequity = ta.sma(slowequityseed, slowequitylength)

smafastequity = ta.sma(fastequityseed, fastequitylength)

equitycalc = input.bool(true, title="Use Fast/Slow Avg", tooltip="Fast Equity Avg is below Slow---otherwise if unchecked uses Slow Equity Avg below Equity")

sizeadjstring = input.string("Reduce size by (%)", title="Position Size Adjustment", options=["Reduce size by (%)","Increase size by (%)"])

sizeadjint = input.int(50, title="Increase/Decrease % Equity by:")

equitydowntrendavgs = smafastequity < smaslowequity

slowequitylessequity = strategy.equity < smaslowequity

equitymethod = equitycalc ? equitydowntrendavgs : slowequitylessequity

if sizeadjstring == ("Reduce size by (%)")

sizeadjdown = initialsize * (1 - (sizeadjint/100))

else

sizeadjup = initialsize * (1 + (sizeadjint/100))

c = close

qty = 100000 * (initialsize / 100) / c

if useTEC and equitymethod

if sizeadjstring == "Reduce size by (%)"

qty := (strategy.equity * (initialsize / 100) * (1 - (sizeadjint/100))) / c

else

qty := (strategy.equity * (initialsize / 100) * (1 + (sizeadjint/100))) / c

//EXAMPLE TRADING STRATEGY INPUTS

CMO_Length = input.int(defval=9, minval=1, title='Chande Momentum Length')

CMO_Signal = input.int(defval=10, minval=1, title='Chande Momentum Signal')

chandeMO = ta.cmo(close, CMO_Length)

cmosignal = ta.sma(chandeMO, CMO_Signal)

SuperTrend_atrPeriod = input.int(10, "SuperTrend ATR Length")

SuperTrend_Factor = input.float(3.0, "SuperTrend Factor", step = 0.01)

Momentum_Length = input.int(12, "Momentum Length")

price = close

mom0 = ta.mom(price, Momentum_Length)

mom1 = ta.mom( mom0, 1)

[supertrend, direction] = ta.supertrend(SuperTrend_Factor, SuperTrend_atrPeriod)

stupind = (direction < 0 ? supertrend : na)

stdownind = (direction < 0? na : supertrend)

//TRADING CONDITIONS

longConditiondefault = ta.crossover(chandeMO, cmosignal) and (mom0 > 0 and mom1 > 0 and close > stupind) and defulttraderule

if (longConditiondefault)

strategy.entry("DefLong", strategy.long)

shortConditiondefault = ta.crossunder(chandeMO, cmosignal) and (mom0 < 0 and mom1 < 0 and close < stdownind) and defulttraderule

if (shortConditiondefault)

strategy.entry("DefShort", strategy.short)

longCondition = ta.crossover(chandeMO, cmosignal) and (mom0 > 0 and mom1 > 0 and close > stupind) and useTEC

if (longCondition)

strategy.entry("AdjLong", strategy.long)

shortCondition = ta.crossunder(chandeMO, cmosignal) and (mom0 < 0 and mom1 < 0 and close < stdownind) and useTEC

if (shortCondition)

strategy.entry("AdjShort", strategy.short)

plot(strategy.equity)

plot(smaslowequity, color=color.new(color.red, 0))

plot(smafastequity, color=color.new(color.green, 0))

- Indicador de volatilidad dinámica (VIDYA) combinado con la estrategia de reversión de seguimiento de tendencias ATR

- Estrategia de negociación de regreso a la media de adaptación basada en osciladores de potencia de Chande

- Estrategias de identificación de estado de mercado dinámico basadas en el gradiente de regresión lineal

- Banda MAHL

- Puntuación Z con señales

- Estrategias de negociación cuantificadas para la ruptura de múltiples zonas SMA y el bloqueo de beneficios dinámicos

- Estrategia de movimiento de doble escala de tiempo

- Los precios rompen con la estrategia de compra

- Tendencia de la SMA

- Una estrategia de frenado de pérdida dinámica adaptativa que cruza el SMA con el filtro de transacciones

- Las entidades de crédito de las entidades de crédito incluidas en el cuadro 1 deberán tener en cuenta los siguientes elementos:

- MACD más inteligente

- Estrategia R5.1 del OCC

- Bienvenido al mercado de osos.

- Jefe del lado

- Puntos de eje Alto Bajo Marco de tiempo Multi

- La base de datos de estrategias de seguimiento de tendencias fantasmas

- La trayectoria fantasma sigue la estrategia del archivo de negocios

- Las estrategias de seguimiento de tendencias fantasmales

- Oscilador de arco iris

- La demostración de KLineChart

- Estrategia de supertrend de pivote dinámico de Villa

- La súper tendencia de Crodl

- RSI por zdmre

- FTL - Filtro de rango X2 + EMA + UO

- BRAHMASTRA también

- Bandas de Mobo

- SAR + 3SMMA con SL y TP

- El SSS

- Plantilla de alertas de lanzamiento lunar [Indicador]