概述

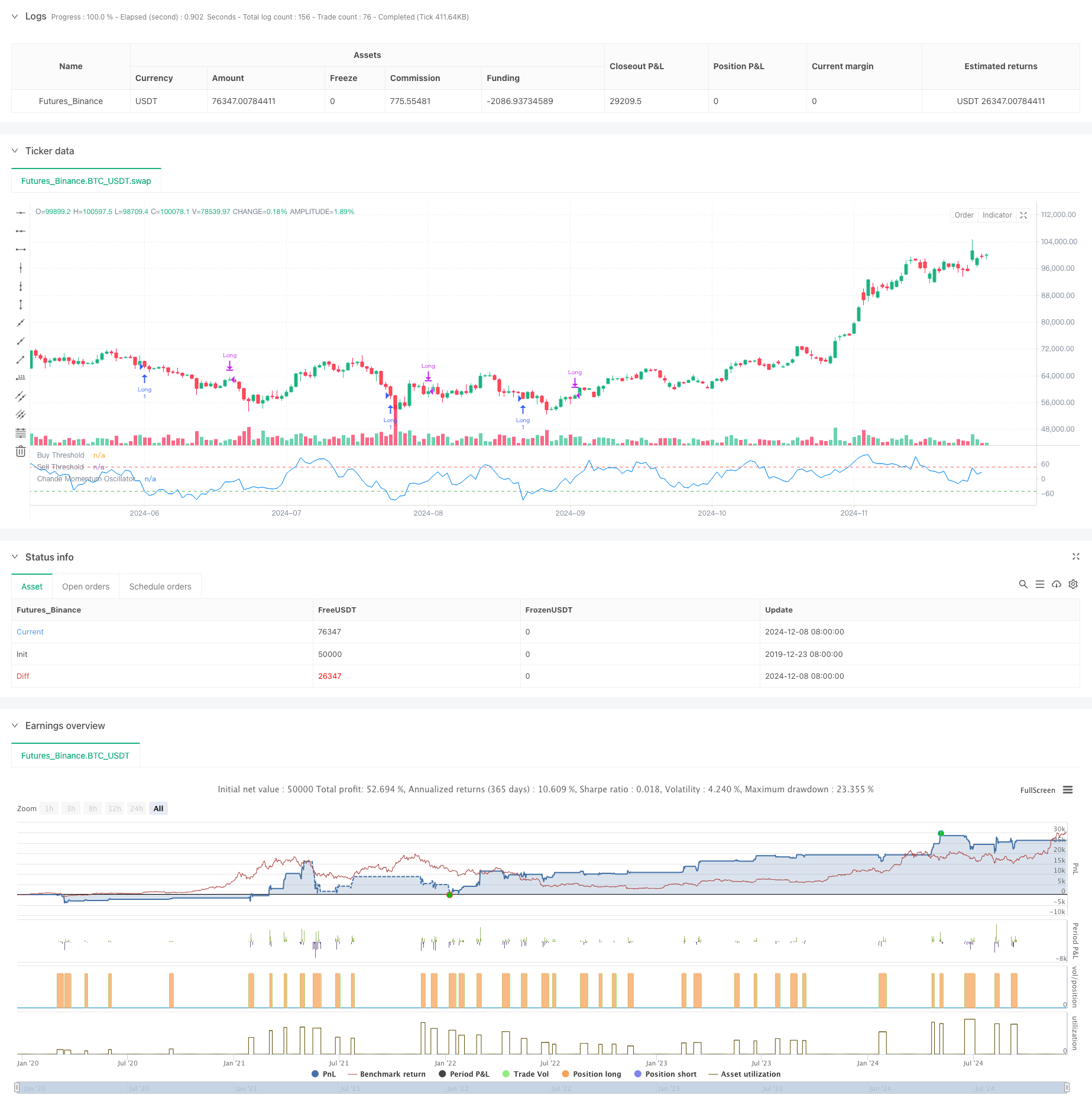

基于Chande动量振荡器(CMO)的均值回归交易策略是一种技术分析策略,通过计算一定时期内价格变动的动量来识别超买超卖区域。该策略主要通过监测资产价格的动量变化,在价格出现极端偏离时进行交易,以捕捉价格回归均值的机会。策略采用9天周期的CMO指标作为核心信号,在CMO低于-50时开仓做多,在CMO高于50或持仓时间超过5天时平仓。

策略原理

策略的核心是CMO指标的计算和应用。CMO通过计算一定周期内上涨和下跌的差值与总和的比值来衡量动量。具体计算公式为: CMO = 100 × (上涨和 - 下跌和)/(上涨和 + 下跌和)

与传统RSI不同,CMO在分子中同时使用了涨跌数据,提供了更对称的动量测量。策略在CMO低于-50时认为市场超卖,预期价格会回升,因此开仓做多。当CMO升至50以上或开仓超过5天时,策略平仓止盈或止损。

策略优势

- 信号明确 - CMO提供了清晰的超买超卖判断标准,交易信号明确,不会产生模棱两可的情况

- 风险控制完善 - 通过设置最大持仓时间,避免了长期套牢的风险

- 适应性强 - 策略可以根据不同市场情况调整参数,具有良好的适应性

- 理论基础扎实 - 基于成熟的均值回归理论,具有可靠的学术支持

- 计算简单 - 指标计算方法简单直观,易于理解和实现

策略风险

- 趋势市场风险 - 在强趋势市场中,均值回归策略可能频繁亏损

- 参数敏感性 - CMO周期和阈值的选择对策略表现影响较大

- 假信号风险 - 在市场波动剧烈时可能产生虚假信号

- 时间风险 - 固定的平仓时间可能错过更好的获利机会

- 滑点风险 - 在流动性较差的市场中可能面临较大滑点

策略优化方向

- 引入趋势过滤 - 可以添加长期趋势指标,在顺势时才开仓

- 动态参数优化 - 根据市场波动率动态调整CMO周期和阈值

- 完善止损机制 - 增加动态止损,保护已有利润

- 优化持仓时间 - 可以根据波动率动态调整最大持仓时间

- 增加成交量确认 - 结合成交量指标提高信号可靠性

总结

该策略通过CMO指标捕捉市场超买超卖机会,结合固定时间止损,构建了一个稳健的均值回归交易系统。策略逻辑清晰,风险控制合理,具有良好的实用价值。通过进一步优化参数和增加辅助指标,策略的稳定性和盈利能力还可以进一步提升。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Chande Momentum Oscillator Strategy", overlay=false)

// Input for the CMO period

cmoPeriod = input.int(9, minval=1, title="CMO Period")

// Calculate price changes

priceChange = ta.change(close)

// Separate positive and negative changes

up = priceChange > 0 ? priceChange : 0

down = priceChange < 0 ? -priceChange : 0

// Calculate the sum of ups and downs using a rolling window

sumUp = ta.sma(up, cmoPeriod) * cmoPeriod

sumDown = ta.sma(down, cmoPeriod) * cmoPeriod

// Calculate the Chande Momentum Oscillator (CMO)

cmo = 100 * (sumUp - sumDown) / (sumUp + sumDown)

// Define the entry and exit conditions

buyCondition = cmo < -50

sellCondition1 = cmo > 50

sellCondition2 = ta.barssince(buyCondition) >= 5

// Track if we are in a long position

var bool inTrade = false

if (buyCondition and not inTrade)

strategy.entry("Long", strategy.long)

inTrade := true

if (sellCondition1 or sellCondition2)

strategy.close("Long")

inTrade := false

// Plot the Chande Momentum Oscillator

plot(cmo, title="Chande Momentum Oscillator", color=color.blue)

hline(-50, "Buy Threshold", color=color.green)

hline(50, "Sell Threshold", color=color.red)

相关推荐