Estrategia de negociación de potencia en el rango de tiempo

Descripción general

La estrategia de compra y venta de fuerza de la franja horaria es una estrategia que utiliza el movimiento de los precios de las acciones en diferentes franjas horarias del día. Determina el mejor momento para hacer un descubierto en el intervalo de 48 horas y media del día.

Principio de estrategia

La lógica central de esta estrategia es que las acciones se mueven regularmente en diferentes intervalos horarios del día. La estrategia se desarrolla estableciendo un intervalo de tiempo de 48 horas y media, y en cada intervalo de tiempo se toman tres opciones: hacer más, hacer menos o no hacer nada. Cuando el tiempo entra en un intervalo, si se establece más, se abre una posición para hacer más; si se establece menos, se abre una posición para hacer menos. Al final del intervalo, se examina el tipo de operación en el siguiente intervalo de tiempo, y si es el mismo que el actual, se continúa con la posición; si es diferente, se abre una posición antes del final del intervalo.

Por ejemplo, si la estrategia está configurada para hacer más entre las 6:30 y las 7:30, la estrategia abrirá más a las 6:30; si la estrategia está configurada para hacer menos entre las 7:00 y las 7:30, la estrategia eliminará las ofertas anteriores antes de las 7:00 y abrirá más a las 7:00.

La ventaja de esta estrategia es que se puede capturar la ley de cambio de precio de las acciones en un día. El riesgo es que la ley de cambio de precio puede cambiar con el tiempo, lo que hace que la estrategia no funcione.

Análisis de las ventajas

La mayor ventaja de esta estrategia es que aprovecha la característica de que los precios son correctos, es decir, que los precios tienen diferentes medias y diferencias en diferentes intervalos de tiempo. Esto permite a la estrategia utilizar una estrategia de comercio de rango en momentos de mayor volatilidad, y una estrategia de tendencia en momentos de menor volatilidad, para responder con flexibilidad a los cambios en el mercado.

Otra ventaja es la flexibilidad en la configuración de los parámetros. Se puede elegir la combinación de parámetros óptima en función de las características de las diferentes acciones, para cubrir el riesgo de incertidumbre parcial.

Análisis de riesgos

El principal riesgo proviene de la inestabilidad de la hipótesis. Si los precios de las acciones cambian durante el día, la expectativa de ganancias de la estrategia se verá afectada. Este cambio puede provenir de los fundamentos de las acciones o de un evento de cisne negro en el entorno general.

Además, las transacciones demasiado frecuentes también conllevan riesgos en cuanto a las comisiones de transacción. Si no hay suficiente soporte de volumen de transacciones, la acumulación de comisiones de transacción también afectará a los ingresos finales.

Dirección de optimización

Se puede considerar la introducción de un modelo de aprendizaje automático para realizar un ajuste dinámico de los parámetros. Por ejemplo, el entrenamiento de un modelo LSTM para predecir el precio de las acciones en el siguiente intervalo de tiempo y ajustar los parámetros para hacer más blanqueo.

O bien, se puede intentar combinar los indicadores fundamentales de las acciones para determinar si es probable que haya cambios en las leyes de cambio de precios y así determinar el momento de inicio de la estrategia.

Resumir

La estrategia de compra y venta de fuerza de intervalo de tiempo analiza las leyes del cambio de precio de las acciones durante un día y toma las mejores acciones en diferentes intervalos de tiempo para obtener Alfa. Esta es una estrategia de negociación algorítmica eficiente que regula los parámetros con flexibilidad y control de riesgo. La dirección de optimización futura puede considerar la introducción de modelos de aprendizaje automático o combinar el juicio fundamental para que la estrategia tenga un mayor margen de ganancia y una mayor capacidad de resistencia al riesgo.

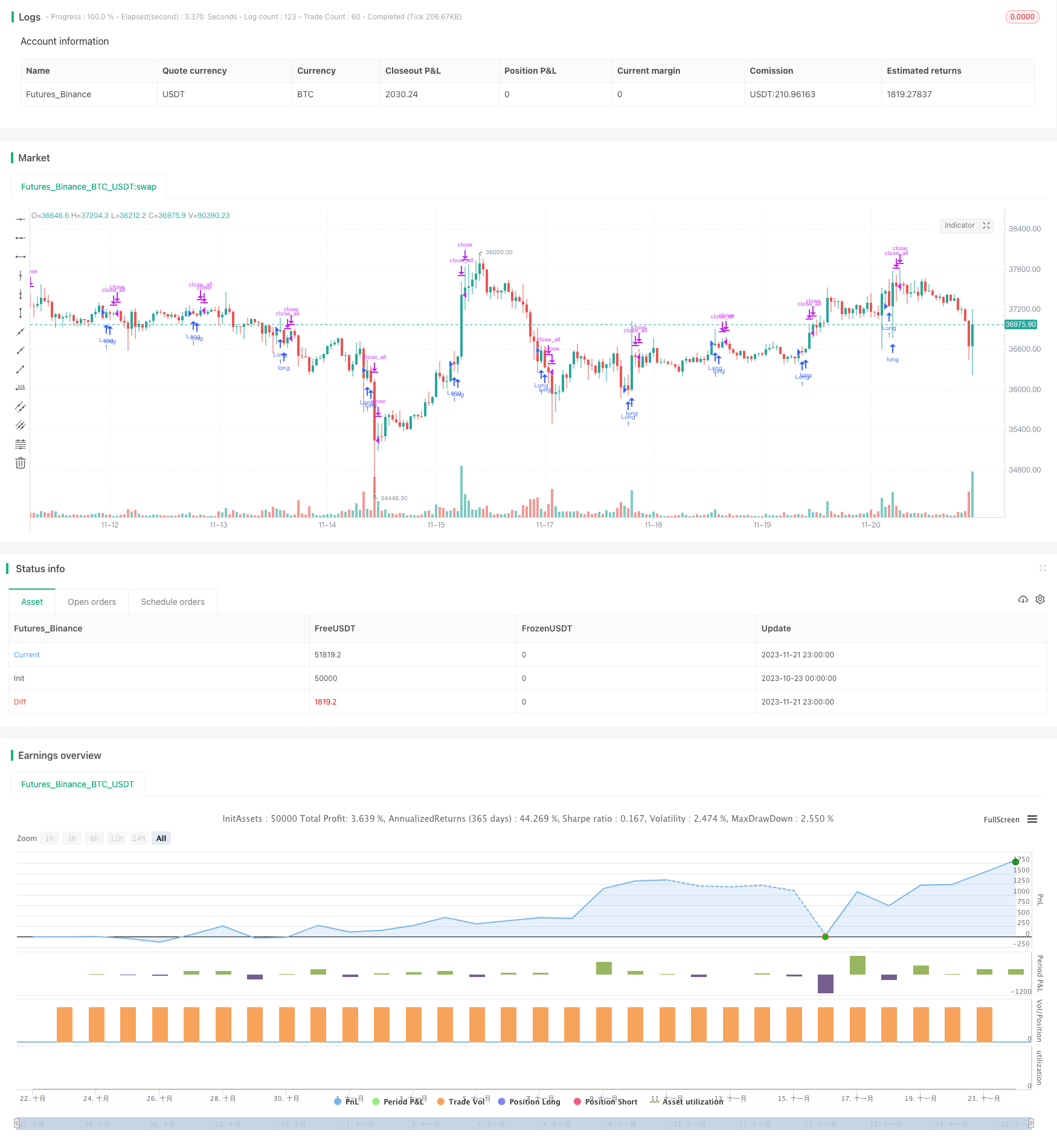

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy("Timeframe Time of Day Buying and Selling Strategy", overlay=true)

frommonth = input(defval = 6, minval = 01, maxval = 12, title = "From Month")

fromday = input(defval = 14, minval = 01, maxval = 31, title = "From day")

fromyear = input(defval = 2021, minval = 1900, maxval = 2100, title = "From Year")

tomonth = input(defval = 12, minval = 01, maxval = 12, title = "To Month")

today = input(defval = 31, minval = 01, maxval = 31, title = "To day")

toyear = input(defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

timeframes = array.new_string(48, '')

timeframes_options = array.new_string(49, 'None')

array.set(timeframes,0,'2330-0000')

array.set(timeframes_options,0, input(defval='None', options=['Long','Short','None'], title='0000-0030'))

array.set(timeframes,1,'0000-0030')

array.set(timeframes_options,1, input(defval='Long', options=['Long','Short','None'], title='0030-0100'))

array.set(timeframes,2,'0030-0100')

array.set(timeframes_options,2, input(defval='Long', options=['Long','Short','None'], title='0100-0130'))

array.set(timeframes,3,'0100-0130')

array.set(timeframes_options,3, input(defval='Long', options=['Long','Short','None'], title='0130-0200'))

array.set(timeframes,4,'0130-0200')

array.set(timeframes_options,4, input(defval='Long', options=['Long','Short','None'], title='0200-0230'))

array.set(timeframes,5,'0200-0230')

array.set(timeframes_options,5, input(defval='None', options=['Long','Short','None'], title='0230-0300'))

array.set(timeframes,6,'0230-0300')

array.set(timeframes_options,6, input(defval='None', options=['Long','Short','None'], title='0300-0330'))

array.set(timeframes,7,'0300-0330')

array.set(timeframes_options,7, input(defval='None', options=['Long','Short','None'], title='0330-0400'))

array.set(timeframes,8,'0330-0400')

array.set(timeframes_options,8, input(defval='None', options=['Long','Short','None'], title='0400-0430'))

array.set(timeframes,9,'0400-0430')

array.set(timeframes_options,9, input(defval='None', options=['Long','Short','None'], title='0430-0500'))

array.set(timeframes,10,'0430-0500')

array.set(timeframes_options,10, input(defval='None', options=['Long','Short','None'], title='0500-0530'))

array.set(timeframes,11,'0500-0530')

array.set(timeframes_options,11, input(defval='None', options=['Long','Short','None'], title='0530-0600'))

array.set(timeframes,12,'0530-0600')

array.set(timeframes_options,12, input(defval='None', options=['Long','Short','None'], title='0600-0630'))

array.set(timeframes,13,'0600-0630')

array.set(timeframes_options,13, input(defval='None', options=['Long','Short','None'], title='0630-0700'))

array.set(timeframes,14,'0630-0700')

array.set(timeframes_options,14, input(defval='None', options=['Long','Short','None'], title='0700-0730'))

array.set(timeframes,15,'0700-0730')

array.set(timeframes_options,15, input(defval='None', options=['Long','Short','None'], title='0730-0800'))

array.set(timeframes,16,'0730-0800')

array.set(timeframes_options,16, input(defval='None', options=['Long','Short','None'], title='0800-0830'))

array.set(timeframes,17,'0800-0830')

array.set(timeframes_options,17, input(defval='None', options=['Long','Short','None'], title='0830-0900'))

array.set(timeframes,18,'0830-0900')

array.set(timeframes_options,18, input(defval='None', options=['Long','Short','None'], title='0900-0930'))

array.set(timeframes,19,'0900-0930')

array.set(timeframes_options,19, input(defval='None', options=['Long','Short','None'], title='0930-1000'))

array.set(timeframes,20,'0930-1000')

array.set(timeframes_options,20, input(defval='None', options=['Long','Short','None'], title='1000-1030'))

array.set(timeframes,21,'1000-1030')

array.set(timeframes_options,21, input(defval='None', options=['Long','Short','None'], title='1030-1100'))

array.set(timeframes,22,'1030-1100')

array.set(timeframes_options,22, input(defval='None', options=['Long','Short','None'], title='1100-1130'))

array.set(timeframes,23,'1100-1130')

array.set(timeframes_options,23, input(defval='None', options=['Long','Short','None'], title='1130-1200'))

array.set(timeframes,24,'1130-1200')

array.set(timeframes_options,24, input(defval='None', options=['Long','Short','None'], title='1200-1230'))

array.set(timeframes,25,'1200-1230')

array.set(timeframes_options,25, input(defval='None', options=['Long','Short','None'], title='1230-1300'))

array.set(timeframes,26,'1230-1300')

array.set(timeframes_options,26, input(defval='None', options=['Long','Short','None'], title='1300-1330'))

array.set(timeframes,27,'1300-1330')

array.set(timeframes_options,27, input(defval='None', options=['Long','Short','None'], title='1330-1400'))

array.set(timeframes,28,'1330-1400')

array.set(timeframes_options,28, input(defval='None', options=['Long','Short','None'], title='1400-1430'))

array.set(timeframes,29,'1400-1430')

array.set(timeframes_options,29, input(defval='None', options=['Long','Short','None'], title='1430-1500'))

array.set(timeframes,30,'1430-1500')

array.set(timeframes_options,30, input(defval='None', options=['Long','Short','None'], title='1500-1530'))

array.set(timeframes,31,'1500-1530')

array.set(timeframes_options,31, input(defval='None', options=['Long','Short','None'], title='1530-1600'))

array.set(timeframes,32,'1530-1600')

array.set(timeframes_options,32, input(defval='None', options=['Long','Short','None'], title='1600-1630'))

array.set(timeframes,33,'1600-1630')

array.set(timeframes_options,33, input(defval='None', options=['Long','Short','None'], title='1630-1700'))

array.set(timeframes,34,'1630-1700')

array.set(timeframes_options,34, input(defval='None', options=['Long','Short','None'], title='1700-1730'))

array.set(timeframes,35,'1700-1730')

array.set(timeframes_options,35, input(defval='None', options=['Long','Short','None'], title='1730-1800'))

array.set(timeframes,36,'1730-1800')

array.set(timeframes_options,36, input(defval='None', options=['Long','Short','None'], title='1800-1830'))

array.set(timeframes,37,'1800-1830')

array.set(timeframes_options,37, input(defval='None', options=['Long','Short','None'], title='1830-1900'))

array.set(timeframes,38,'1830-1900')

array.set(timeframes_options,38, input(defval='None', options=['Long','Short','None'], title='1900-0930'))

array.set(timeframes,39,'1900-0930')

array.set(timeframes_options,39, input(defval='None', options=['Long','Short','None'], title='1930-2000'))

array.set(timeframes,40,'1930-2000')

array.set(timeframes_options,40, input(defval='None', options=['Long','Short','None'], title='2000-2030'))

array.set(timeframes,41,'2000-2030')

array.set(timeframes_options,41, input(defval='None', options=['Long','Short','None'], title='2030-2100'))

array.set(timeframes,42,'2030-2100')

array.set(timeframes_options,42, input(defval='None', options=['Long','Short','None'], title='2100-2130'))

array.set(timeframes,43,'2100-2130')

array.set(timeframes_options,43, input(defval='None', options=['Long','Short','None'], title='2130-2200'))

array.set(timeframes,44,'2130-2200')

array.set(timeframes_options,44, input(defval='None', options=['Long','Short','None'], title='2200-2230'))

array.set(timeframes,45,'2200-2230')

array.set(timeframes_options,45, input(defval='None', options=['Long','Short','None'], title='2230-2300'))

array.set(timeframes,46,'2230-2300')

array.set(timeframes_options,46, input(defval='None', options=['Long','Short','None'], title='2300-2330'))

array.set(timeframes,47,'2300-2330')

array.set(timeframes_options,47, input(defval='None', options=['Long','Short','None'], title='2330-0000'))

string_hour = hour<10?'0'+tostring(hour):tostring(hour)

string_minute = minute<10?'0'+tostring(minute):tostring(minute)

current_time = string_hour+string_minute

f_strLeft(_str, _n) =>

string[] _chars = str.split(_str, "")

int _len = array.size(_chars)

int _end = min(_len, max(0, _n))

string[] _substr = array.new_string(0)

if _end <= _len

_substr := array.slice(_chars, 0, _end)

string _return = array.join(_substr, "")

f_strRight(_str, _n) =>

string[] _chars = str.split(_str, "")

int _len = array.size(_chars)

int _beg = max(0, _len - _n)

string[] _substr = array.new_string(0)

if _beg < _len

_substr := array.slice(_chars, _beg, _len)

string _return = array.join(_substr, "")

for i = 0 to array.size(timeframes) - 1

start_time = f_strLeft(array.get(timeframes, i), 4)

end_time = f_strRight(array.get(timeframes, i), 4)

if current_time == end_time and array.get(timeframes_options, i)!='None' and array.get(timeframes_options, i) != array.get(timeframes_options, i==47?0:i+1) and timestamp(toyear, tomonth, today, 00, 00)

strategy.close_all()

if current_time == start_time and array.get(timeframes_options, i)!='None' and array.get(timeframes_options, i) != array.get(timeframes_options, i==0?47:i-1)

if array.get(timeframes_options, i) == 'Long'

strategy.entry("Long", strategy.long, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))

else if array.get(timeframes_options, i) == 'Short'

strategy.entry("Short", strategy.short, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))