Estrategia de negociación estacional híbrida del S&P500

El autor:¿ Qué pasa?, Fecha: 2024-01-22 11:59:58Las etiquetas:

Resumen general

La estrategia de negociación estacional híbrida del S&P500 es una estrategia cuantitativa que negocia acciones basadas en patrones estacionales. Combina un sistema mejorado de compra y retención, condiciones de indicadores técnicos e indicadores de flujo de volumen para rotar entre los mejores y peores meses del año.

Estrategia lógica

Las principales señales y reglas de negociación son:

- Ir largo en el abierto el primer día de negociación de octubre de cada año.

- Si el VIX es superior al 60% o el ATR de 15 días es superior al 90%, se pausa la negociación estacional hasta que la volatilidad disminuya más adelante en el mes o año.

- Exit long/short en el mercado abierto el primer día de negociación de agosto de cada año.

- Las operaciones de liquidación de activos en el mercado de valores se clasifican en el modelo de referencia de los instrumentos financieros.

- Venta corta opcional habilitada.

La estrategia capitaliza el rendimiento desigual del mercado de valores a lo largo del año, yendo largo durante octubre-abril que estadísticamente superó el rendimiento y obteniendo ganancias o compras cortas durante los meses de peor rendimiento de mayo-septiembre.

Análisis de ventajas

La estrategia de negociación estacional híbrida del S&P500 tiene las siguientes ventajas clave:

- Los apalancamientos establecieron patrones estables estacionales basados en el rendimiento mensual desigual del índice S&P500 observado empíricamente a lo largo del año.

- Incorpora múltiples condiciones de filtro como VIX, ATR y VFI para filtrar eficazmente el ruido y generar señales comerciales más confiables.

- Reglas de negociación configurables para períodos largos/cortos y personalizados para entradas y salidas estacionales que facilitan las pruebas y la optimización.

- Mecanismos integrados de evitación de riesgos mediante medidas de volatilidad como los umbrales VIX y ATR para eludir los efectos de las violentas oscilaciones del mercado.

- Entrada de señal suplementaria del indicador de flujo de volumen que refleje posibles cambios en la participación en el mercado.

Análisis de riesgos

Algunos riesgos potenciales incluyen:

- El riesgo de invalidación de los patrones históricos. Los mercados evolucionan estocásticamente por lo que las tendencias históricas no siempre pueden durar.

- El riesgo de señales erróneas de los indicadores técnicos: VIX, ATR y VFI también pueden generar señales falsas.

- El riesgo de parámetros subóptimos: es posible realizar más pruebas y ajustes de parámetros, ya que los valores actuales pueden no ser óptimos a nivel global.

- Riesgos adicionales como pérdidas ilimitadas.

Los riesgos pueden mitigarse mediante controles de riesgos más rigurosos, combinación de indicadores, ajuste de parámetros, aprendizaje automático, etc.

Oportunidades de mejora

Oportunidades de optimización posibles:

- Periodos de pruebas posteriores más largos para obtener más datos de formación.

- Introducir mecanismos de stop loss para controlar las pérdidas por operación.

- Ajuste fino de los parámetros de indicadores como VIX, ATR y VFI para encontrar las mejores combinaciones.

- Implementar modelos de aprendizaje automático para permitir la optimización adaptativa.

- Combinar estrategias para reducir el riesgo sistémico de mercado mediante la no correlación.

Conclusión

El S&P500 Hybrid Seasonal Trading Strategy sintetiza tendencias estacionales bien establecidas, indicadores técnicos de tiempo y medidas de flujo de dinero. Al evitar los peores meses del año y posicionarse en los meses con mejor desempeño estacionalmente complementados con una efectiva regulación de volatilidad, el marco puede producir un alfa consistente. La estructura adaptable también proporciona componentes modulares útiles para que los profesionales puedan probar, optimizar y aprovechar.

/*backtest

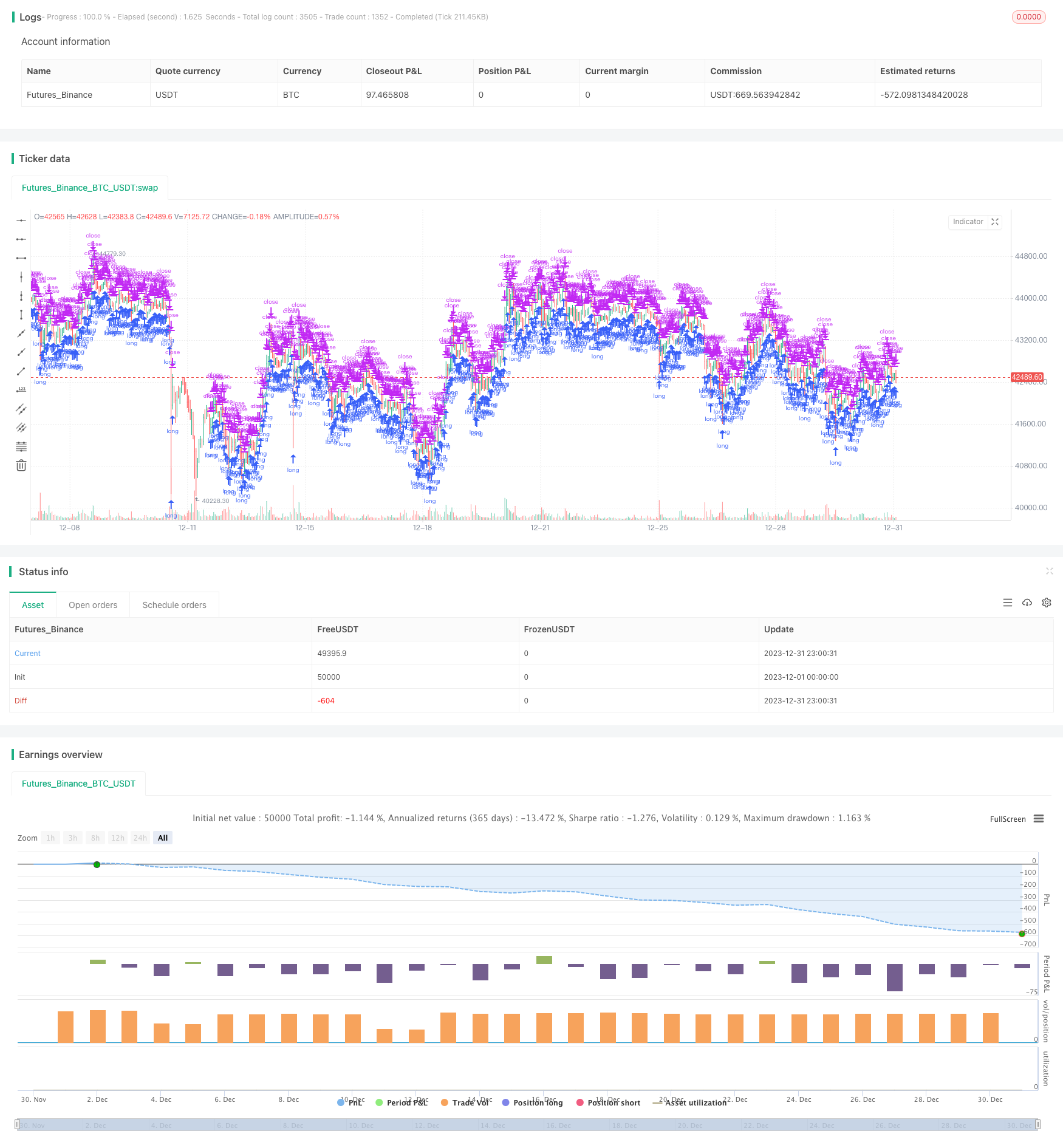

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// TASC Issue: April 2022 - Vol. 40, Issue 4

// Article: Sell In May? Stock Market Seasonality

// Article By: Markos Katsanos

// Language: TradingView's Pine Script v5

// Provided By: PineCoders, for tradingview.com

//@version=5

strategy(title = "TASC 2022.04 S&P500 Hybrid Seasonal System",

shorttitle = "HSS v2.0",

overlay = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

initial_capital = 100000,

currency = currency.USD,

commission_type = strategy.commission.percent,

commission_value = 0.01

)

// Helper Functions:

// @function Returns the ratio to max/min of a sample period

// @param src float, data source.

// @param length int, period of the sample.

// @returns [float, float] tuple.

volatility (float src, int length) =>

[(src / ta.highest(src, length)[1] - 1.0) * 100.0,

(src / ta.lowest (src, length)[1] - 1.0) * 100.0]

// @function Volume Flow Indicator.

// @param Period int, period of the data sample.

// @param VCoef float, Volume Volatility Coefficient.

// @param Coef float, Cutoff Coefficient.

// @returns float.

// ref: https://mkatsanos.com/volume-flow-vfi-indicator/

vfi (int Period = 130, float VCoef = 2.5, float Coef = 0.2) =>

lastHLC3 = nz(hlc3[1], hlc3)

MF = hlc3 - lastHLC3

Vinter = ta.stdev(math.log(hlc3) - math.log(lastHLC3), 30)

Vave = ta.sma(volume, Period)[1]

Cutoff = Coef * close * Vinter

VC = math.min(volume, Vave * VCoef)

VCP = MF > Cutoff ? VC :

MF < -Cutoff ? -VC : 0.0

VFI1 = nz(math.sum(VCP, Period) / Vave)

VFI = ta.ema(VFI1, 3)

// inputs:

// optional strategy obserservation window parameters:

string ig_ow = 'Observation Window:'

bool i_Sdate = input( title = 'Start date:',

defval = timestamp('2021-01-01'),

inline = 'Sdate',

group = ig_ow

) < time //

bool i_useSdate = input.bool( title = '',

defval = false,

group = ig_ow,

inline = 'Sdate',

tooltip = 'Optional start date to clamp strategy observation window.'

) //

bool i_Edate = input( title = 'End date:',

defval = timestamp('2022-01-01'),

inline = 'Edate',

group = ig_ow

) > time //

bool i_useEdate = input.bool( title = '',

defval = false,

group = ig_ow,

inline = 'Edate',

tooltip = 'Optional end date to clamp strategy observation window.'

) //

//

string ig_ro = 'Lookback Options:'

int i_lback = input.int( title = 'Lookback Shift:',

defval = 0, minval = 0,

group = ig_ro,

tooltip = 'Optional, inspect previous signal values.'

) //

//

string ig_so = 'Signal Options:'

bool i_onlyL = input.bool( title = 'Long Only:',

defval = true,

group = ig_so,

tooltip = 'If switched off, short entries are initiated by sell signals.'

) //

int i_sMonth = input.int( title = 'Sell Month:',

defval = 8, minval = 1, maxval = 12, step = 1,

group = ig_so,

tooltip = 'The worst performing month, originally clamped between months 5 and 8.'

) //

int i_maxVI = input.int( title = 'Max VIX up:',

defval = 60, minval = 50, maxval = 60, step = 5,

group = ig_so,

tooltip = 'Volatility maximum threshold.'

) //

int i_critVFI = input.int( title = 'Critical VFI Sell:',

defval = -20, minval = -20, maxval = -15, step = 5,

group = ig_so,

tooltip = 'Critical money float (VFI) threshold for sell signal.'

) //

float i_K = input.float( title = 'ATR/VIX Ratio:',

defval = 1.5, minval = 1.3, maxval = 1.7, step = 0.2,

group = ig_so,

tooltip = 'ATR to VIX ratio for sell signal.'

) //

//

string i_VIticker = input( title = 'Volatility Index:',

defval = 'VIX',

group = ig_so,

tooltip = 'Volatility Index Ticker.'

) //

string i_VItf = input.timeframe( title = '',

defval = 'D',

group = ig_so,

tooltip = 'Volatility Index Timeframe.'

) //

int i_VIiperiod = input.int( title = 'Implied Volatility period:',

defval = 25,

group = ig_so

) //

int i_VIhperiod = input.int( title = 'Historical Volatility period:',

defval = 15,

group = ig_so

) //

//

int i_VFIperiod = input.int( title = 'VFI period:',

defval = 130,

group = ig_so, inline = 'VFI1'

) //

int i_VFIMperiod = input.int( title = 'MA:',

defval = 10,

group = ig_so, inline = 'VFI1',

tooltip = 'VFI and Moving Average sampling period.'

) //

float i_VFIcoef = input.float( title = 'VFI Coef Cuttoff:',

defval = 0.2,

group = ig_so, inline = 'VFI2'

) //

float i_VFIvcoef = input.float( title = 'Volat.:',

defval = 2.5,

group = ig_so, inline = 'VFI2',

tooltip = 'VFI Cutoff and Volatility coefficient.'

) //

int i_ATRperiod = input.int( title = 'ATR length:',

defval = 15,

group = ig_so, inline = 'ATR',

tooltip = 'ATR length.'

) //

//

string ig_to = 'Table Options:'

bool i_showT = input.bool( title = 'Show Table:',

defval = false,

group = ig_to,

tooltip = 'Optional toggle.'

) //

string i_Tpos = input.string(title = 'Position:',

defval = position.middle_right,

options = [ position.top_left, position.top_center, position.top_right,

position.middle_left, position.middle_center, position.middle_right,

position.bottom_left, position.bottom_center, position.bottom_right ],

group = ig_to) //

int i_Ttransp = input.int( title = 'Transparency:',

defval = 0, minval = 1, maxval = 99,

group = ig_to

) //

//

color i_Tcframe = input.color( title = 'Table Colors:',

defval = #000000,

group = ig_to, inline = 'table color'

) //

color i_Tcrowe = input.color( title = '',

defval = #d6dae3,

group = ig_to, inline = 'table color'

) //

color i_Tcrowo = input.color( title = '',

defval = #cccccc,

group = ig_to, inline = 'table color',

tooltip = 'Table background colors, in order: frame, even row, odd row.'

) //

string i_Ttsize = input.string(title = 'Table Text:',

defval = size.small,

options = [size.auto, size.huge, size.large, size.normal, size.small, size.tiny],

group = ig_to, inline = 'table text'

) //

color i_Tcdeft = input.color( title = 'Text Colors:',

defval = #000000,

group = ig_to, inline = 'table text'

) //

color i_Tcsigt = input.color( title = '',

defval = color.red,

group = ig_to, inline = 'table text'

) //

color i_Tctitt = input.color( title = '',

defval = color.navy,

group = ig_to, inline = 'table text',

tooltip = 'Table text size and colors, in order: default, short signal, title.'

) //

// Comparison Index

float VIX = request.security(i_VIticker, i_VItf, close)

[VIdn, VIup] = volatility(VIX, i_VIiperiod) // Implied

[ATRdn, ATRup] = volatility(ta.atr(i_VIhperiod), i_VIiperiod) // Historical

float VFI = vfi(i_VFIperiod, i_VFIvcoef, i_VFIcoef)

float VFI10 = ta.sma(VFI, i_VFIMperiod)

//

bool VFIatCrit = VFI > i_critVFI

bool lowVolat = (VIup < i_maxVI) or (ATRup < (i_K * i_maxVI))

bool VolatC = VFIatCrit ? lowVolat : false

bool Long = ((month >= 10) or (month < i_sMonth)) and VolatC[1]

bool Sseasonal = month == i_sMonth // SEASONAL EXIT/SHORT

bool Svol = VIup > (2.0 * i_maxVI) // VOLATILITY EXIT/SHORT

bool Scrit = ta.cross(i_critVFI, VFI) and (VFI10 < VFI10[1]) // VFI EXIT/SHORT

bool Short = Sseasonal or Svol[1] or Scrit[1]

bool withinObsWindow = true

//

if withinObsWindow and strategy.equity > 0

_L = strategy.long

_S = strategy.short

strategy.entry('L' , direction = _L, when = Long )

if i_onlyL

strategy.close('L', comment = 'EXIT SEASONAL' , when = Sseasonal )

strategy.close('L', comment = 'EXIT VOLATILITY', when = Svol[1] )

strategy.close('L', comment = 'EXIT MF' , when = Scrit[1] )

else

strategy.entry('S Seasonal' , direction = _S, when = Sseasonal )

strategy.entry('S Volatility', direction = _S, when = Svol[1] )

strategy.entry('S MF Crit.' , direction = _S, when = Scrit[1] )

else

strategy.close_all()

string SIGNAL = switch

(Long) => 'Long Seasonal'

(Sseasonal and i_onlyL) => 'Exit Seasonal'

(Svol[1] and i_onlyL) => 'Exit Volatility'

(Scrit[1] and i_onlyL) => 'Exit Money Flow'

(Sseasonal and not i_onlyL) => 'Short Seasonal'

(Svol[1] and not i_onlyL) => 'Short Volatility'

(Scrit[1] and not i_onlyL) => 'Short Money Flow Bearish'

=> 'none'

string date = str.format(

'{0,number,0000}-{1,number,00}-{2,number,00}',

year, month, dayofmonth

)

var table dTable = table.new(position = i_Tpos,

columns = 2,

rows = 17,

frame_color = color.new(#000000, i_Ttransp),

frame_width = 4

) //

// @function Helper to populate the table rows.

tRow(tableId, idx, left, right, tcol=0) =>

color _bg = color.new(idx % 2 ? i_Tcrowo : i_Tcrowe, i_Ttransp)

color _tx = switch (tcol)

(1) => color.new(i_Tcsigt, i_Ttransp)

(2) => color.new(i_Tctitt, i_Ttransp)

=> color.new(i_Tcdeft, i_Ttransp)

// table.cell( table_id=tableId,

// column=0, row=idx,

// text=left, text_color=_tx, text_halign=text.align_right, text_size=i_Ttsize,

// bgcolor=_bg) //

// table.cell( table_id=tableId,

// column=1, row=idx,

// text=str.tostring(right), text_color=_tx, text_halign=text.align_left, text_size=i_Ttsize,

// bgcolor=_bg) //

if i_showT

float _atr10 = ta.atr(10)[i_lback]

string _nf = '0.00'

string _aru = '🔼 ', string _ard = '🔽 '

// id | idx | left label | right label | conditional color |

tRow(dTable, 00, 'S&P500 Hybrid Seasonal ' , '' , 2 )

tRow(dTable, 01, 'Created By: Markos Katsanos' , '' , 2 )

tRow(dTable, 02, 'Date:' , date[i_lback] )

tRow(dTable, 03, 'Signal:' , SIGNAL[i_lback] )

tRow(dTable, 04, 'Price:' , open[i_lback] )

tRow(dTable, 05, 'VIX:' , str.tostring( VIX[i_lback], _nf) )

tRow(dTable, 06, 'VFI:' , str.tostring( VFI[i_lback], _nf) , VFIatCrit ? 1 : 0 )

tRow(dTable, 07, 'ATR:' , str.tostring( _atr10, _nf) )

tRow(dTable, 08, 'VIup%:' , str.tostring( VIup[i_lback], _nf) , VIup > i_maxVI ? 1 : 0 )

tRow(dTable, 09, 'ATRup%:' , str.tostring(ATRup[i_lback], _nf) , ATRup > i_K * i_maxVI ? 1 : 0 )

tRow(dTable, 10, 'VIdn%:' , str.tostring( VIdn[i_lback], _nf) )

tRow(dTable, 11, 'ATRdn%:' , str.tostring(ATRdn[i_lback], _nf) )

tRow(dTable, 12, _aru + 'Long Seasonal:' , Long[i_lback] )

tmp = 12

if not i_onlyL

tmp := 13

tRow(dTable, 13, _ard + 'Short:' , Short[i_lback] , Short[i_lback] ? 1 : 0 )

tRow(dTable, tmp+1, _ard + 'Seasonal:' , Sseasonal[i_lback] , Sseasonal[i_lback] ? 1 : 0 )

tRow(dTable, tmp+2, _ard + 'Volatility:' , Svol[1+i_lback] , Svol[1 + i_lback] ? 1 : 0 )

tRow(dTable, tmp+3, _ard + 'Money Flow:' , Scrit[i_lback] , Scrit[i_lback] ? 1 : 0 )

- Seguimiento de tendencias y estrategia de negociación a corto plazo basada en el indicador ADX

- Estrategia de doble tendencia de impulso

- Estrategia dinámica de apoyo y resistencia de las CCI

- Estrategia de negociación de impulso de QQE

- La estrategia de pronóstico de ondas de Gauss

- Estrategia cuantitativa de combinación de EMA dinámicas móviles

- Tendencia del canal de Donchian siguiendo la estrategia

- Estrategia de la banda de la EMA

- Estrategia de cruce de tendencia de inversión de promedio móvil precisa

- Estrategia de tendencia alcista con múltiples EMA

- Estrategia de seguimiento de tendencias basada en desviaciones

- Estrategia de negociación de la divergencia RSI

- Estrategia de árbol de decisión de múltiples indicadores: IMACD, EMA e Ichimoku

- Estrategia de negociación de doble optimización MACD

- Estrategia de doble cruz de oro de la EMA

- Estrategia de negociación del RSI y de la media móvil de varios plazos

- Estrategia semanal de negociación de swing

- Estrategia de negociación MACD basada en EVWMA

- Estrategia de reversión media de las bandas de Bollinger para la ruptura del canal

- Estrategia cuantitativa de seguimiento de tendencias basada en múltiples indicadores técnicos