Estrategia clave para la reversión de las pruebas de retroceso

El autor:¿ Qué pasa?Las etiquetas:

Resumen general

Principio de la estrategia

La lógica central de la estrategia de prueba de retroceso de inversión clave es identificar el día de inversión clave. De acuerdo con el movimiento del precio de la acción, podemos juzgar la dirección de la tendencia actual. La aparición de una señal de inversión clave indica que la tendencia puede revertirse.

Análisis de ventajas

Análisis de riesgos

Direcciones de optimización

Resumen de las actividades

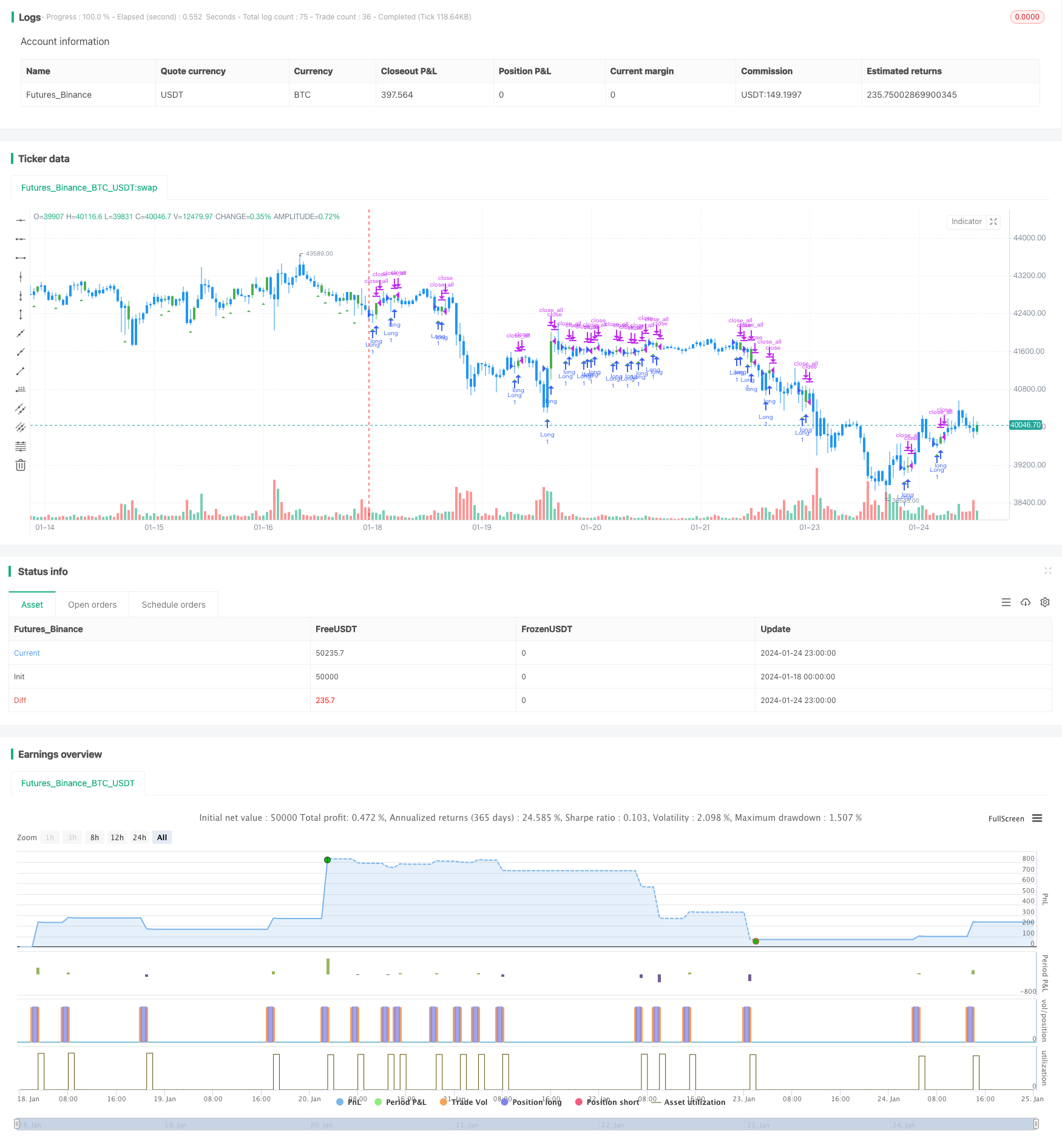

/*backtest

start: 2024-01-18 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/01/2020

//

// A key reversal is a one-day trading pattern that may signal the reversal of a trend.

// Other frequently-used names for key reversal include "one-day reversal" and "reversal day."

// How Does a Key Reversal Work?

// Depending on which way the stock is trending, a key reversal day occurs when:

// In an uptrend -- prices hit a new high and then close near the previous day's lows.

// In a downtrend -- prices hit a new low, but close near the previous day's highs

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Key Reversal Up Backtest", shorttitle="KRU Backtest", overlay = true)

nLength = input(1, minval=1, title="Enter the number of bars over which to look for a new low in prices.")

input_takeprofit = input(20, title="Take Profit pip", step=0.01)

input_stoploss = input(10, title="Stop Loss pip", step=0.01)

xLL = lowest(low[1], nLength)

C1 = iff(low < xLL and close > close[1], true, false)

plotshape(C1, style=shape.triangleup, size = size.small, color=color.green, location = location.belowbar )

posprice = 0.0

pos = 0

barcolor(nz(pos[1], 0) == -1 ? color.red: nz(pos[1], 0) == 1 ? color.green : color.blue )

posprice := iff(C1== true, close, nz(posprice[1], 0))

pos := iff(posprice > 0, 1, 0)

if (pos == 0)

strategy.close_all()

if (pos == 1)

strategy.entry("Long", strategy.long)

posprice := iff(low <= posprice - input_stoploss and posprice > 0, 0 , nz(posprice, 0))

posprice := iff(high >= posprice + input_takeprofit and posprice > 0, 0 , nz(posprice, 0))

Más.

- Estrategia de negociación a corto plazo de la EMA cruzada

- Tendencia de seguir una estrategia basada en la suspensión dinámica de pérdidas del cruce de dos EMA

- Estrategia de compra de la caja de Darvas

- La estrategia de impulso relativo

- Tendencia de onda y tendencia basada en la VWMA siguiendo la estrategia cuántica

- Estrategia de cruce de la media móvil

- Estrategia de prueba de retroceso de candeleros de inversión

- Estrategia de negociación de reversión de impulso

- Estrategia de canal de regresión lineal adaptativa

- Estrategia cruzada de diferencia de media móvil cero

- Los indicadores múltiples siguen la estrategia

- Tendencia sólida siguiendo una estrategia

- Cruce de la tendencia de la media móvil de precios siguiendo la estrategia