Estrategia de negociación de tendencias de varios plazos basada en indicadores comprimidos

El autor:¿ Qué pasa?, fecha: 2024-02-27 17:40:03Las etiquetas:

Resumen general

Esta estrategia combina los indicadores Boom Hunter, Hull Suite y Volatility Oscillator para implementar una estrategia cuantitativa para el seguimiento de tendencias y el comercio de ruptura en múltiples marcos de tiempo.

Principios

La lógica central de esta estrategia se basa en los siguientes tres indicadores:

-

Cazador de Boom: Un oscilador que utiliza técnicas de compresión de indicadores para generar señales de negociación a partir de cruces entre dos coeficientes (Quotient1 y Quotient2).

-

Suite del casco: Un conjunto de líneas de media móvil suavizadas que determinan la dirección de la tendencia en función de la relación entre la línea media y las bandas superior/inferior.

-

Ocilador de volatilidad: Indicador de oscilador que cuantifica la volatilidad de los precios.

La lógica de entrada de esta estrategia es cuando los dos indicadores del Quotiente del Boom Hunter se cruzan hacia arriba o hacia abajo, el precio rompe la línea media de Hull y se desvía de la banda superior o inferior, mientras que el Oscilador de Volatilidad está en el área de sobrecompra / sobreventa. Esto filtra algunas señales falsas de ruptura y mejora la precisión de entrada.

El stop loss se establece encontrando el valle más bajo o el pico más alto durante un determinado período (default 20 bar), y el take profit se obtiene multiplicando el porcentaje de stop loss por un factor de ganancia configurado (default 3x).

Ventajas

- Extrae señales comerciales clave del precio utilizando técnicas de compresión de indicadores, mejorando la rentabilidad

- La combinación de múltiples indicadores evita falsas rupturas y determina con precisión la dirección de la tendencia

- La configuración dinámica de stop loss y take profit permite seguir una tendencia controlada por el riesgo

- Asegura la negociación en entornos de alta volatilidad utilizando el oscilador de volatilidad

- Mejora de la estabilidad de la estrategia mediante análisis de marcos de tiempo múltiples

Los riesgos

- Los indicadores de Boom Hunter pueden tener distorsiones de compresión, generando señales incorrectas

- La línea media del casco puede retrasarse y no poder rastrear los cambios de precios en tiempo real

- Oportunidades comerciales perdidas o liquidaciones forzadas durante la contracción de la volatilidad

Soluciones:

- Ajustar los parámetros del indicador de compresión para equilibrar la sensibilidad

- Prueba promedios móviles exponenciales en lugar de la línea media

- Añadir otros indicadores de evaluación para evitar la desorientación de la volatilidad

Optimización

Esta estrategia puede optimizarse en los siguientes aspectos:

-

Optimización de parámetros: Obtener las mejores combinaciones de parámetros ajustando la configuración del indicador como el período y el coeficiente de compresión

-

Optimización del marco temporal: Prueba diferentes períodos (1min, 5min, 30min, etc.) para encontrar el marco de tiempo de negociación óptimo

-

Optimización del tamaño de la posición: Cambio por posición de negociación de tamaño y relación para encontrar el plan de utilización del capital ideal

-

Optimización de pérdidas: Ajustar la colocación de stop loss basándose en diferentes instrumentos de negociación para lograr una relación riesgo-recompensa óptima

-

Optimización de las condiciones: Añadir/reducir filtros de indicadores para obtener señales de entrada más precisas

Conclusión

Esta estrategia combina Boom Hunter, Hull Suite y Volatility Oscillator para implementar el comercio de seguimiento de tendencias de múltiples marcos de tiempo, identificando efectivamente los comportamientos bruscos de precios adecuados para activos digitales altamente volátiles.

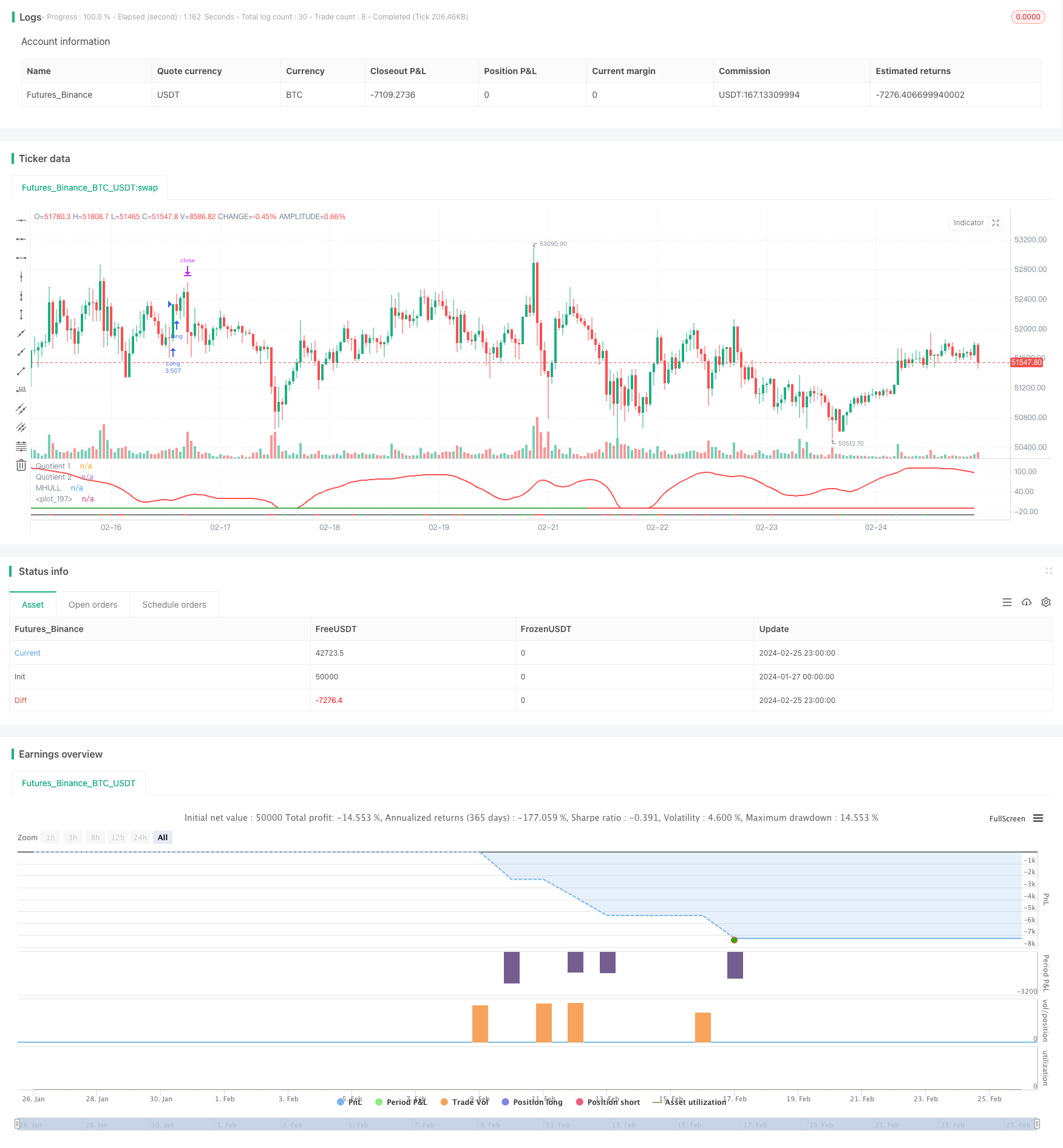

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - Boom Hunter Pro

// - Hull Suite

// - Volatility Oscillator

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - Boom Hunter Pro: veryfid (https://www.tradingview.com/u/veryfid/)

// - Hull Suite: InSilico (https://www.tradingview.com/u/InSilico/)

// - Volatility Oscillator: veryfid (https://www.tradingview.com/u/veryfid/)

//@version=5

strategy("Boom Hunter + Hull Suite + Volatility Oscillator Strategy", overlay=false, initial_capital=1000, currency=currency.NONE, max_labels_count=500, default_qty_type=strategy.cash, commission_type=strategy.commission.percent, commission_value=0.01)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(20, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(3, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

profitFactor = input.float(3, "Profit Factor (R:R Ratio)", step = 0.1, group='Strategy: Risk Management')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// ---------------

// Boom Hunter Pro

// ---------------

square = input.bool(true, title='Square Line?', group='Main Settings')

//Quotient

LPPeriod = input.int(6, title='Quotient | LPPeriod', inline='quotient', group='EOT 1 (Main Oscillator)')

K1 = input.int(0, title='K1', inline='quotient', group='EOT 1 (Main Oscillator)')

esize = 60 //, title = "Size", inline = "quotient2", group = "EOT 1 (Main Oscillator)")

ey = 50 //, title = "Y axis", inline = "quotient2", group = "EOT 1 (Main Oscillator)")

trigno = input.int(1, 'Trigger Length', group='EOT 1 (Main Oscillator)', inline='quotient2')

trigcol = input.color(color.white, title='Trigger Color:', group='EOT 1 (Main Oscillator)', inline='q2')

// EOT 2

//Inputs

LPPeriod2 = input.int(28, title='LPPeriod2', group='EOT 2 (Red Wave)', inline='q2')

K22 = input.float(0.3, title='K2', group='EOT 2 (Red Wave)', inline='q2')

//EOT 1

//Vars

alpha1 = 0.00

HP = 0.00

a1 = 0.00

b1 = 0.00

c1 = 0.00

c2 = 0.00

c3 = 0.00

Filt = 0.00

Peak = 0.00

X = 0.00

Quotient1 = 0.00

pi = 2 * math.asin(1)

//Highpass filter cyclic components

//whose periods are shorter than 100 bars

alpha1 := (math.cos(.707 * 2 * pi / 100) + math.sin(.707 * 2 * pi / 100) - 1) / math.cos(.707 * 2 * pi / 100)

HP := (1 - alpha1 / 2) * (1 - alpha1 / 2) * (close - 2 * nz(close[1]) + nz(close[2])) + 2 * (1 - alpha1) * nz(HP[1]) - (1 - alpha1) * (1 - alpha1) * nz(HP[2])

//SuperSmoother Filter

a1 := math.exp(-1.414 * pi / LPPeriod)

b1 := 2 * a1 * math.cos(1.414 * pi / LPPeriod)

c2 := b1

c3 := -a1 * a1

c1 := 1 - c2 - c3

Filt := c1 * (HP + nz(HP[1])) / 2 + c2 * nz(Filt[1]) + c3 * nz(Filt[2])

//Fast Attack - Slow Decay Algorithm

Peak := .991 * nz(Peak[1])

if math.abs(Filt) > Peak

Peak := math.abs(Filt)

Peak

//Normalized Roofing Filter

if Peak != 0

X := Filt / Peak

X

Quotient1 := (X + K1) / (K1 * X + 1)

// EOT 2

//Vars

alpha1222 = 0.00

HP2 = 0.00

a12 = 0.00

b12 = 0.00

c12 = 0.00

c22 = 0.00

c32 = 0.00

Filt2 = 0.00

Peak2 = 0.00

X2 = 0.00

Quotient4 = 0.00

alpha1222 := (math.cos(.707 * 2 * pi / 100) + math.sin(.707 * 2 * pi / 100) - 1) / math.cos(.707 * 2 * pi / 100)

HP2 := (1 - alpha1222 / 2) * (1 - alpha1222 / 2) * (close - 2 * nz(close[1]) + nz(close[2])) + 2 * (1 - alpha1222) * nz(HP2[1]) - (1 - alpha1222) * (1 - alpha1222) * nz(HP2[2])

//SuperSmoother Filter

a12 := math.exp(-1.414 * pi / LPPeriod2)

b12 := 2 * a12 * math.cos(1.414 * pi / LPPeriod2)

c22 := b12

c32 := -a12 * a12

c12 := 1 - c22 - c32

Filt2 := c12 * (HP2 + nz(HP2[1])) / 2 + c22 * nz(Filt2[1]) + c32 * nz(Filt2[2])

//Fast Attack - Slow Decay Algorithm

Peak2 := .991 * nz(Peak2[1])

if math.abs(Filt2) > Peak2

Peak2 := math.abs(Filt2)

Peak2

//Normalized Roofing Filter

if Peak2 != 0

X2 := Filt2 / Peak2

X2

Quotient4 := (X2 + K22) / (K22 * X2 + 1)

q4 = Quotient4 * esize + ey

//Plot EOT

q1 = Quotient1 * esize + ey

trigger = ta.sma(q1, trigno)

Plot3 = plot(trigger, color=trigcol, linewidth=2, title='Quotient 1')

Plot44 = plot(q4, color=color.new(color.red, 0), linewidth=2, title='Quotient 2')

// ----------

// HULL SUITE

// ----------

//INPUT

src = input(close, title='Source')

modeSwitch = input.string('Hma', title='Hull Variation', options=['Hma', 'Thma', 'Ehma'])

length = input(200, title='Length(180-200 for floating S/R , 55 for swing entry)')

lengthMult = input(2.4, title='Length multiplier (Used to view higher timeframes with straight band)')

useHtf = input(false, title='Show Hull MA from X timeframe? (good for scalping)')

htf = input.timeframe('240', title='Higher timeframe')

//FUNCTIONS

//HMA

HMA(_src, _length) =>

ta.wma(2 * ta.wma(_src, _length / 2) - ta.wma(_src, _length), math.round(math.sqrt(_length)))

//EHMA

EHMA(_src, _length) =>

ta.ema(2 * ta.ema(_src, _length / 2) - ta.ema(_src, _length), math.round(math.sqrt(_length)))

//THMA

THMA(_src, _length) =>

ta.wma(ta.wma(_src, _length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

//SWITCH

Mode(modeSwitch, src, len) =>

modeSwitch == 'Hma' ? HMA(src, len) : modeSwitch == 'Ehma' ? EHMA(src, len) : modeSwitch == 'Thma' ? THMA(src, len / 2) : na

//OUT

_hull = Mode(modeSwitch, src, int(length * lengthMult))

HULL = useHtf ? request.security(syminfo.ticker, htf, _hull) : _hull

MHULL = HULL[0]

SHULL = HULL[2]

//COLOR

hullColor = MHULL > SHULL ? color.green : color.red

//PLOT

///< Frame

Fi1 = plot(-10, title='MHULL', color=hullColor, linewidth=2)

// -----------------

// VOLUME OSCILLATOR

// -----------------

volLength = input(80)

spike = close - open

x = ta.stdev(spike, volLength)

y = ta.stdev(spike, volLength) * -1

volOscCol = spike > x ? color.green : spike < y ? color.red : color.gray

plot(-30, color=color.new(volOscCol, transp=0), linewidth=2)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// Boom Hunter Pro entry conditions

boomLong = ta.crossover(trigger, q4)

boomShort = ta.crossunder(trigger, q4)

// Hull Suite entry conditions

hullLong = MHULL > SHULL and close > MHULL

hullShort = MHULL < SHULL and close < SHULL

// Volatility Oscillator entry conditions

volLong = spike > x

volShort = spike < y

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = boomLong and hullLong and volLong and in_date_range

shortCondition = boomShort and hullShort and volShort and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

atr = ta.atr(14)

longSl = math.min(close - atr, swingLow)

shortSl = math.max(close + atr, swingHigh)

longStopPercent = math.abs((1 - (longSl / close)) * 100)

shortStopPercent = math.abs((1 - (shortSl / close)) * 100)

longTpPercent = longStopPercent * profitFactor

shortTpPercent = shortStopPercent * profitFactor

longTp = close + (close * (longTpPercent / 100))

shortTp = close - (close * (shortTpPercent / 100))

// Position sizing (default risk 3% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=longSl, limit=longTp, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=-40)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent) + " TP Percent: " + str.tostring(longTpPercent))

if (shortCondition and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=shortSl, limit=shortTp, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=-40)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent) + " TP Percent: " + str.tostring(shortTpPercent))

- Estrategia de tendencia cruzada de la media móvil

- Estrategia de caja blanca del robot del canal de precios

- Estrategia cuantitativa de tendencia de precios de media móvil simple

- Estrategia de compra de ATR sin pérdidas basada en el tiempo

- Estrategia de reversión de la ruptura de impulso binomial

- Estrategia de apertura de brechas

- Estrategia de ATR para detener el seguimiento con objetivos de retroceso de Fibonacci

- Estrategia de negociación de tendencia de ruptura de bandas de Bollinger

- Basado en la estrategia de inversión de la media móvil

- Estrategia de avance a corto plazo basada en el cruce de oro

- La línea de impulso cruzada de la EMA Nueve acciones Estrategia MACD

- Estrategia de combinación de indicadores de oscilación cuantitativa

- Tendencia de la nube de Ichimoku siguiendo la estrategia

- Estrategia de negociación de medias móviles dobles intradiarias

- Guía para la búsqueda del tesoro maya

- Estrategia de seguimiento de tendencias basada en la media móvil

- Tendencia transversal de la EMA siguiendo la estrategia

- Estrategia de cruce de dos medias móviles

- Estrategia de seguimiento de bandas de Bollinger

- Estrategia de cruce de medias móviles rápidas y lentas