概述

这是一种基于双均线的简单日内交易策略。它使用两个不同周期的简单移动均线,在均线交叉时进行买入或卖出。在信号改变时,使用双倍数量平仓再反向开仓。当日内交易时段结束时,如果仓位还未平仓,则全部平仓。

策略原理

该策略使用10日和40日两条简单移动均线。当短期均线上穿长期均线时,做多;当短期均线下穿长期均线时,做空。当信号发生变化时,使用双倍手数平仓再反向开仓。在定义的日内交易时段内,跟随均线信号进行交易。当日内交易时段结束,如果还有未平仓位,则全部平仓。

该策略主要利用了短期均线能更快捕捉价格变化的特点。当短期均线上穿长期均线时,表示短期价格开始上涨,做多能捕捉这一趋势;当短期均线下穿长期均线时,表示短期价格开始下跌,做空能捕捉这一趋势。双倍手数反向开仓的设计,则能够加大仓位,扩大获利空间。

策略优势

- 策略思路简单清晰,容易理解和实现。

- 利用双均线交叉原理,可以有效捕捉短期价格趋势。

- 采用日内时间段交易,可以避免过夜风险。

- 采用双倍手数反向开仓设计,可以扩大获利空间。

风险分析

- 作为短线策略,容易受到市场噪音的影响,出现错误信号。

- 双倍手数设计可能放大损失。

- 日内强制平仓设计可能导致不能持有較长线的赚钱交易。

对应风险的解决方法:

- 优化均线参数,降低错误信号率。

- 结合其他指标过滤信号。

- 优化双倍手数参数。

- 适当放宽日内交易时段。

策略优化方向

优化均线参数。可以测试更多组合,寻找最佳参数。

增加其他技术指标过滤。例如加上MACD指标确认,可以降低错误信号率。

优化反向开仓倍数。测试不同的倍数大小,找到最优参数。

测试不同的日内交易时段。适当延长时段可能获得更好回报。

总结

该策略整体思路简单,通过捕捉双均线交叉形成的短期趋势,配合双倍手数反向开仓扩大获利空间,最后配合日内时段交易规避过夜风险。是一种适合日内短线交易的有效策略。有进一步优化空间,通过调整参数以及增添其他技术指标过滤,可以获得更好的策略效果。

策略源码

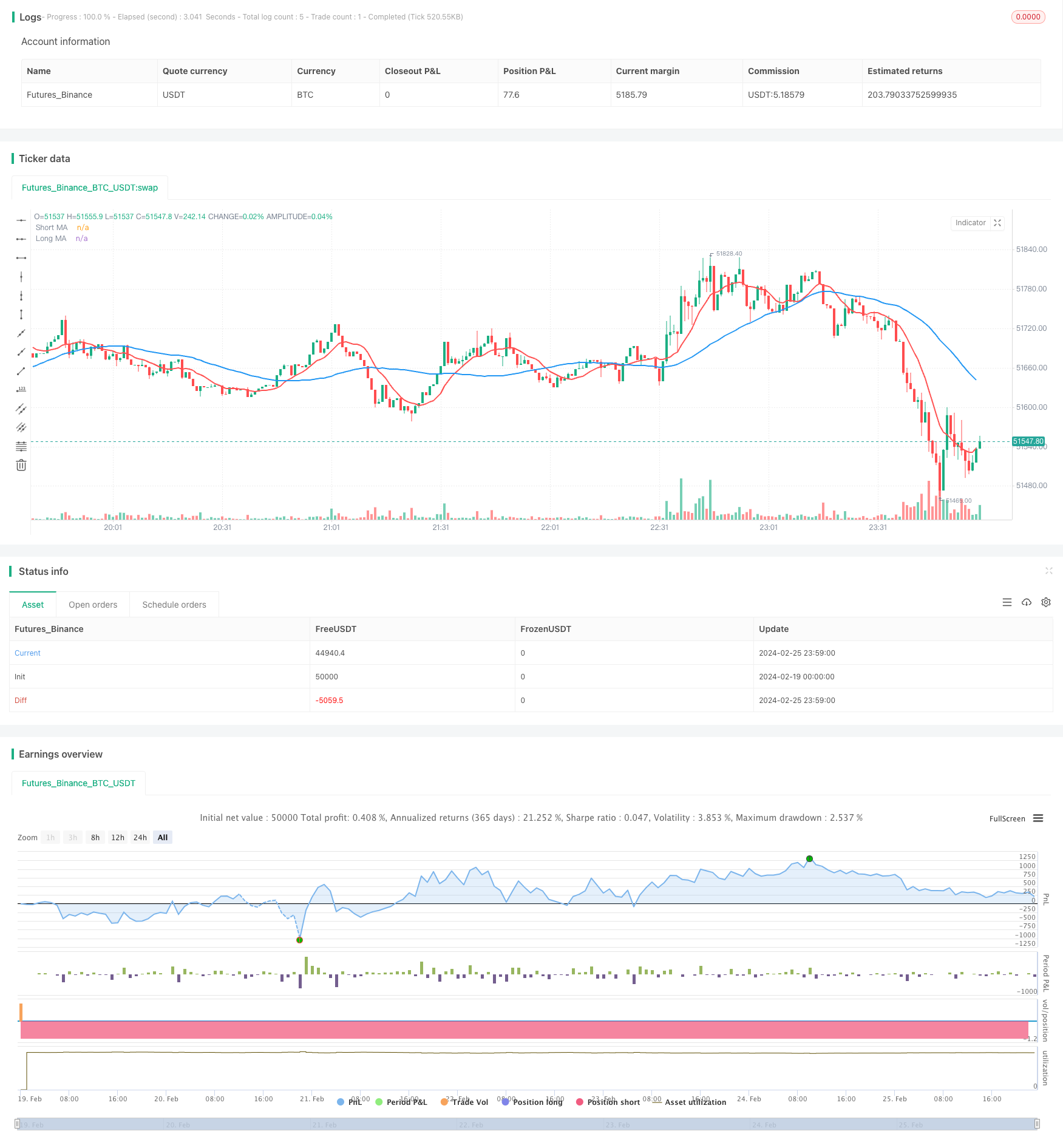

/*backtest

start: 2024-02-19 00:00:00

end: 2024-02-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pritesh-StocksDeveloper

//@version=4

strategy("Moving Average - Intraday", shorttitle = "MA - Intraday",

overlay=true, calc_on_every_tick = true)

// Used for intraday handling

// Session value should be from market start to the time you want to square-off

// your intraday strategy

var i_marketSession = input(title="Market session", type=input.session,

defval="0915-1455", confirm=true)

// Short & Long moving avg. period

var int i_shortPeriod = input(title = "Short MA Period", type = input.integer,

defval = 10, minval = 2, maxval = 20, confirm=true)

var int i_longPeriod = input(title = "Long MA Period", type = input.integer,

defval = 40, minval = 3, maxval = 120, confirm=true)

// A function to check whether the bar is in intraday session

barInSession(sess) => time(timeframe.period, sess) != 0

// Calculate moving averages

shortAvg = sma(close, i_shortPeriod)

longAvg = sma(close, i_longPeriod)

// Plot moving averages

plot(series = shortAvg, color = color.red, title = "Short MA",

linewidth = 2)

plot(series = longAvg, color = color.blue, title = "Long MA",

linewidth = 2)

// Long/short condition

longCondition = crossover(shortAvg, longAvg)

shortCondition = crossunder(shortAvg, longAvg)

// See if intraday session is active

bool intradaySession = barInSession(i_marketSession)

// Trade only if intraday session is active

// Long position

strategy.entry(id = "Long", long = strategy.long,

when = longCondition and intradaySession)

// Short position

strategy.entry(id = "Short", long = strategy.short,

when = shortCondition and intradaySession)

// Square-off position (when session is over and position is open)

squareOff = (not intradaySession) and (strategy.position_size != 0)

strategy.close_all(when = squareOff, comment = "Square-off")

更多内容