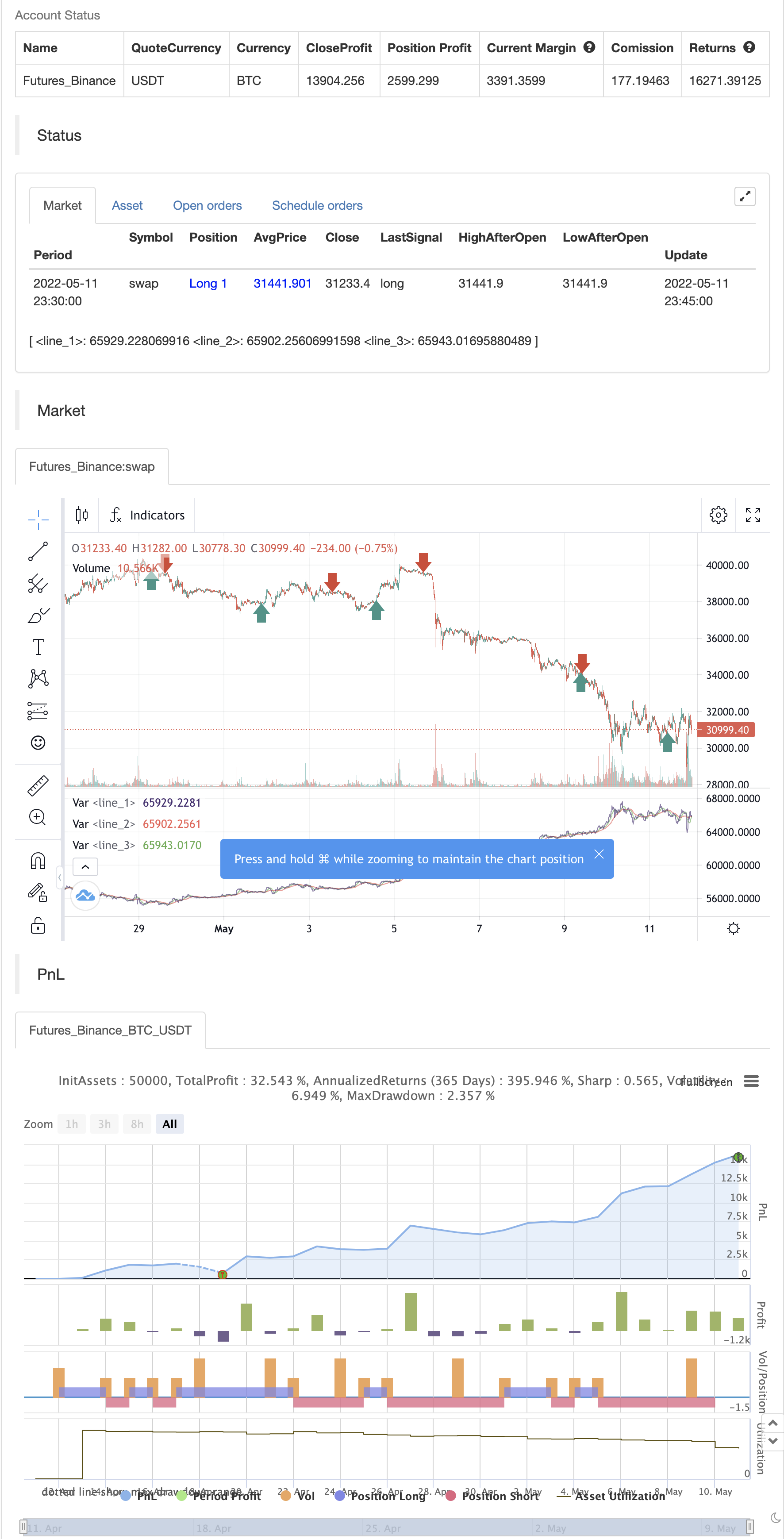

Exemple de dimensionnement des positions de négociation de la courbe des actions

Auteur:ChaoZhang est là., Date: 2022-05-13 22h25 et 44 minLes étiquettes:OCMSMA

Le but de la gestion de la courbe des actions est de minimiser le risque dans le trading lorsque la courbe des actions est en baisse. Cette stratégie a deux modes pour déterminer la tendance à la baisse de la courbe des actions: en créant deux moyennes mobiles simples de la courbe des actions d'un portefeuille - une à court terme et une à long terme - et en agissant sur leurs croisements. Si la SMA rapide est inférieure à la SMA lente, une tendance à la baisse des actions est détectée (smafastequity < smaslowequity). La deuxième méthode consiste à utiliser les croisements entre les capitaux propres eux-mêmes et la SMA à plus longue période (capital propre < smasloweequity).

Lorsque le trading avec la courbe des actions est actif, la taille de la position sera réduite d'un pourcentage spécifié si le capital est "sous l'eau" selon une règle sélectionnée.

test de retour

/*backtest

start: 2022-04-12 00:00:00

end: 2022-05-11 23:59:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shardison

//@version=5

//EXPLANATION

//"Trading the equity curve" as a risk management method is the

//process of acting on trade signals depending on whether a system’s performance

//is indicating the strategy is in a profitable or losing phase.

//The point of managing equity curve is to minimize risk in trading when the equity curve is in a downtrend.

//This strategy has two modes to determine the equity curve downtrend:

//By creating two simple moving averages of a portfolio's equity curve - a short-term

//and a longer-term one - and acting on their crossings. If the fast SMA is below

//the slow SMA, equity downtrend is detected (smafastequity < smaslowequity).

//The second method is by using the crossings of equity itself with the longer-period SMA (equity < smasloweequity).

//When "Reduce size by %" is active, the position size will be reduced by a specified percentage

//if the equity is "under water" according to a selected rule. If you're a risk seeker, select "Increase size by %"

//- for some robust systems, it could help overcome their small drawdowns quicker.

//strategy("Use Trading the Equity Curve Postion Sizing", shorttitle="TEC", default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital = 100000)

//TRADING THE EQUITY CURVE INPUTS

useTEC = input.bool(true, title="Use Trading the Equity Curve Position Sizing")

defulttraderule = useTEC ? false: true

initialsize = input.float(defval=10.0, title="Initial % Equity")

slowequitylength = input.int(25, title="Slow SMA Period")

fastequitylength = input.int(9, title="Fast SMA Period")

seedequity = 100000 * .10

if strategy.equity == 0

seedequity

else

strategy.equity

slowequityseed = strategy.equity > seedequity ? strategy.equity : seedequity

fastequityseed = strategy.equity > seedequity ? strategy.equity : seedequity

smaslowequity = ta.sma(slowequityseed, slowequitylength)

smafastequity = ta.sma(fastequityseed, fastequitylength)

equitycalc = input.bool(true, title="Use Fast/Slow Avg", tooltip="Fast Equity Avg is below Slow---otherwise if unchecked uses Slow Equity Avg below Equity")

sizeadjstring = input.string("Reduce size by (%)", title="Position Size Adjustment", options=["Reduce size by (%)","Increase size by (%)"])

sizeadjint = input.int(50, title="Increase/Decrease % Equity by:")

equitydowntrendavgs = smafastequity < smaslowequity

slowequitylessequity = strategy.equity < smaslowequity

equitymethod = equitycalc ? equitydowntrendavgs : slowequitylessequity

if sizeadjstring == ("Reduce size by (%)")

sizeadjdown = initialsize * (1 - (sizeadjint/100))

else

sizeadjup = initialsize * (1 + (sizeadjint/100))

c = close

qty = 100000 * (initialsize / 100) / c

if useTEC and equitymethod

if sizeadjstring == "Reduce size by (%)"

qty := (strategy.equity * (initialsize / 100) * (1 - (sizeadjint/100))) / c

else

qty := (strategy.equity * (initialsize / 100) * (1 + (sizeadjint/100))) / c

//EXAMPLE TRADING STRATEGY INPUTS

CMO_Length = input.int(defval=9, minval=1, title='Chande Momentum Length')

CMO_Signal = input.int(defval=10, minval=1, title='Chande Momentum Signal')

chandeMO = ta.cmo(close, CMO_Length)

cmosignal = ta.sma(chandeMO, CMO_Signal)

SuperTrend_atrPeriod = input.int(10, "SuperTrend ATR Length")

SuperTrend_Factor = input.float(3.0, "SuperTrend Factor", step = 0.01)

Momentum_Length = input.int(12, "Momentum Length")

price = close

mom0 = ta.mom(price, Momentum_Length)

mom1 = ta.mom( mom0, 1)

[supertrend, direction] = ta.supertrend(SuperTrend_Factor, SuperTrend_atrPeriod)

stupind = (direction < 0 ? supertrend : na)

stdownind = (direction < 0? na : supertrend)

//TRADING CONDITIONS

longConditiondefault = ta.crossover(chandeMO, cmosignal) and (mom0 > 0 and mom1 > 0 and close > stupind) and defulttraderule

if (longConditiondefault)

strategy.entry("DefLong", strategy.long)

shortConditiondefault = ta.crossunder(chandeMO, cmosignal) and (mom0 < 0 and mom1 < 0 and close < stdownind) and defulttraderule

if (shortConditiondefault)

strategy.entry("DefShort", strategy.short)

longCondition = ta.crossover(chandeMO, cmosignal) and (mom0 > 0 and mom1 > 0 and close > stupind) and useTEC

if (longCondition)

strategy.entry("AdjLong", strategy.long)

shortCondition = ta.crossunder(chandeMO, cmosignal) and (mom0 < 0 and mom1 < 0 and close < stdownind) and useTEC

if (shortCondition)

strategy.entry("AdjShort", strategy.short)

plot(strategy.equity)

plot(smaslowequity, color=color.new(color.red, 0))

plot(smafastequity, color=color.new(color.green, 0))

- Indicateur de volatilité dynamique (VIDYA) combiné à la stratégie de suivi des tendances ATR

- Stratégie de trading de retour à la moyenne d'adaptation basée sur l'oscillateur de dynamique de Chande

- Stratégie d'identification de l'état dynamique du marché basée sur une pente de régression linéaire

- Groupe MAHL

- Z Score avec des signaux

- Stratégie de négociation quantitative pour une percée dans plusieurs zones SMA et un gain dynamique

- Stratégie de dynamique à double échelle temporelle

- Le prix dépasse la stratégie d'achat

- Tendance de la SMA

- Stratégie d'arrêt-perte dynamique d'adaptation croisée entre le SMA et le filtrage des transactions

- Le montant de l'impôt sur les sociétés est calculé à partir de l'impôt sur les sociétés.

- Le MACD est plus intelligent

- Stratégie R5.1 du CCO

- Bienvenue sur le marché aux ours.

- Le chef de file

- Points de pivotement haut bas multi-temps

- Une base de données de stratégies de suivi de la tendance fantôme

- Les phantômes suivent les stratégies de l'entreprise

- Les stratégies de suivi de la tendance fantôme

- Oscillateur arc-en-ciel

- Une démonstration de KLineChart

- Stratégie de super-tendance à pivot dynamique

- La super tendance de Crodl

- RSI par zdmre

- FTL - Filtre de portée X2 + EMA + UO

- Le BRAHMASTRA

- Bandes de Mobo

- SAR + 3SMMA avec SL et TP

- Résultats

- Modèle d'alerte de lancement lunaire [indicateur]