Stratégies de trading quantitatives à facteurs multiples

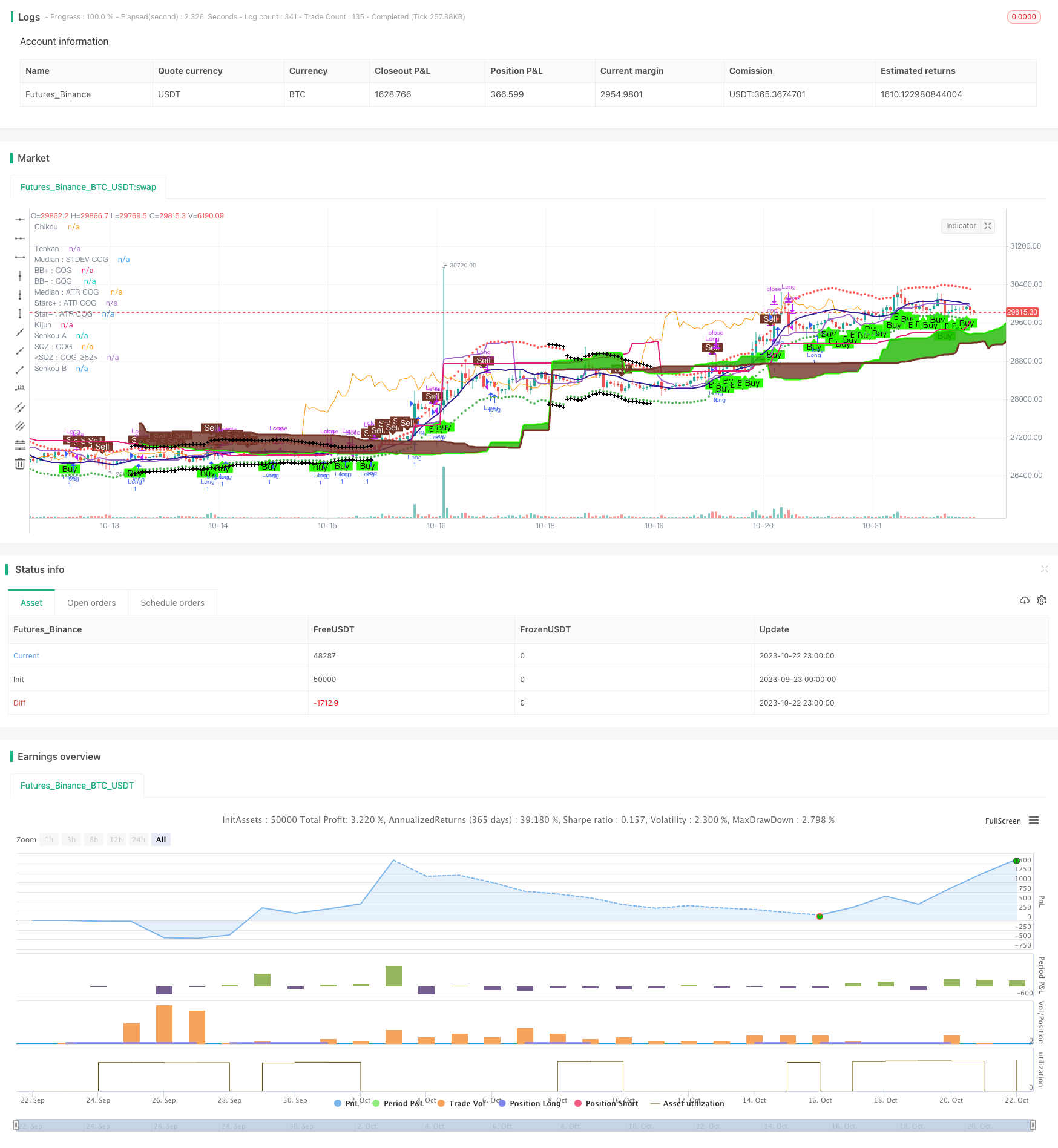

Il s’agit d’une stratégie de trading quantitatif qui combine plusieurs indicateurs techniques pour faire des jugements de marge. La stratégie prend en compte plusieurs facteurs, tels que les indicateurs de dynamique, les indicateurs de tendance et le diagramme de nuage d’Ichimoku, pour former un jugement d’achat et de vente final. La stratégie a une forte stabilité et une résistance au risque.

L’analyse des principes

La stratégie est principalement composée des éléments suivants:

Indicateur de dynamique: Parabolic SAR, indice de force Leledc, moyenne mobile adaptative de Kaufman, etc.

Les indicateurs de tendance sont les suivants: Vibrateur Rahul Mohindar, Trend Magic, etc.

Les nuages d’Ichimoku: incluant les lignes Tenkan, Kijun et autres

Indicateur de flux de volume

L’indicateur de fluctuation est le Wave Trend Oscillator

Séquence TD

Ces indicateurs déterminent la tendance et la force du marché actuel sous différents angles. Le SAR parabolique détermine le point de retournement de la tendance, l’indicateur de force Ledc détermine le momentum et le diagramme de nuage Ichimoku détermine la pression de soutien.

La stratégie impose également des conditions de filtrage pour les transactions effectuées uniquement dans la fourchette des dates de chaque mois et de chaque jour, réduisant ainsi le nombre de transactions invalides.

Analyse des avantages

Jurisprudence intégrée multifactorielle, plus de précision, plus de résistance aux risques

Utilisez différents types d’indicateurs pour effectuer une vérification croisée afin d’éviter le risque d’une seule défaillance

Configurer des conditions de filtrage afin d’éviter des transactions invalides pendant une période inappropriée

Il est écrit en Pine Script et peut être utilisé directement sur la plateforme TradingView, ce qui est pratique et rapide.

Les paramètres de l’indicateur peuvent être ajustés et optimisés pour différents marchés

Affichage visuel des signaux d’indicateurs et jugement intuitif de la structure du marché

Analyse des risques

Les combinaisons multifactorielles nécessitent un ajustement des poids et des paramètres, avec une certaine difficulté à optimiser

L’indicateur unique peut être inefficace dans certaines conditions de marché

Les conditions de filtrage mal définies peuvent vous faire manquer une occasion

Attention à ne pas optimiser trop

Les traders doivent être attentifs au risque de défaillance des indicateurs et adapter leur stratégie en temps opportun.

La réponse:

Optimiser les paramètres d’ajustement de l’indicateur pour le rendre plus efficace pour le marché actuel

Ajuster le poids pour augmenter le rôle des indicateurs efficaces et réduire celui des indicateurs inefficaces

Adapter les conditions de filtration en temps opportun pour saisir les opportunités et éviter les risques

Optimiser les idées

Ajout d’algorithmes d’apprentissage automatique pour ajuster automatiquement le poids des indicateurs

Des facteurs supplémentaires comme l’augmentation des indicateurs d’humeur et des flux de capitaux

Tester les variétés et les périodes de négociation pour définir les paramètres optimaux

Tester l’efficacité de différentes périodes de détention

Les statistiques de l’industrie de l’électricité, de l’électricité et de l’électricité, ainsi que les données de l’industrie de l’électricité et de l’électricité.

Ajout d’une stratégie de stop loss

Résumer

Cette stratégie a l’avantage d’intégrer plusieurs indicateurs pour formuler un jugement final et d’être résistant au risque. Il est également nécessaire de prêter attention au risque de défaillance d’un indicateur unique, d’optimiser et d’ajuster en permanence les paramètres.

//@version=2

persistent_bull = nz(persistent_bull[1],0)

persistent_bear = nz(persistent_bear[1],0)

strategy("Strategy for The Bitcoin Buy/Sell Indicator", overlay=true, calc_on_every_tick=true)

// ****************************************Inputs***************************************************************

//@fixme if there is a buy and sell signal on the same bar, then it displays the first one and skips the second one. Fix this issue

buySellSignal = true // Make this false if you do not want to show Buy/Sell signal

inputIndividualSiganlPlot = true // = input (false, "Do you want to display each individual indicator's signal on the chart?")

sp = input (false, "Do you want to display Parabolic SAR?")

spLines = input (false, "Do you want to display Parabolic SAR on the chart?")

sCloud = input(false, "Do you want to display the Tenkan and Kijun lines of Ichimoku lines on the chart?")

sL = input (false, "Do you want to display Leledec Exhausion - Leledc on the chart?")

sTD = false

sRMO = input(false, "Do you want to display Rahul Mohindar Oscillator - RMO on the chart?")

inputAma = input(false, title="Do you want to display Kaufman AMA wave - AMA on the chart?")

tm = input (false, "Do you want to display Trend Magic signals on the chart?")

wtoLB = input (false, "Do you want to display WaveTrend Oscillator - WTO on the chart?")

vfiLB = input (false, "Do you want to display Volume Flow Indicator - VFI on the chart?")

cogRegionFillTransp = 100 // input(false, "Do you want to display COG Region Fill and ATR Starc+/-")

inputNeutralMinorSignals = input (false, title="Do you want to not display the minor or the not so strong signals from Ichimoku")

maj=true // input(true,title="Show Major Leledc Exhausion Bar signal")

min=input(false,title="Show Minor Leledc Exhausion Bar signal")

tenkanPeriods = input(20, minval=9, title="Tenkan Period - Ichimoku [9 or 10 or 20]")

kijunPeriods = input(60, minval=26, title="Kijun Period - Ichimoku [26 or 30 or 60]")

chikouPeriods = input(120, minval=52, title="Chikou - Ichimoku [52 or 60 or 120]")

displacement = input(30, minval=26, title="Displacement - Ichimoku [26 or 30]")

// ****************************************General Color Variables***************************************************************

colorLime = #006400 // Warning sign for long trade

colorBuy= #2DFF03 // Good sign for long trade

colorSell = #733629 // Good sign for short trade

colorMaroon =#8b0000 // Warning sign for short trade

colorBlue =#0000ff // No clear sign

colorGray = #a9a9a9 // Gray Color (For Squeeze momentum indicator)

colorBlack = #000000 // Black

colorWhite = #ffffff // White

colorTenkanViolet = #800000 // Tenkan-sen line color

colorKijun = #0000A6 // Kijun-sen line color

// TD Sequential bar colors

tdSell = #ff6666

tdSellOvershoot = #ff1a1a

tdSellOvershoot1 = #cc0000

tdSellOverShoot2 = #990000

tdSellOverShoot3 = #732626

tdBuy = #80ff80

tdBuyOverShoot = #33ff33

tdBuyOvershoot1 = #00cc00

tdBuyOverShoot2 = #008000

tdBuyOvershoot3 = #004d00

// ****************************************Icons***************************************************************

upSign = '↑' // indicates the indicator shows uptrend

downSign = '↓' // incicates the indicator showing downtrend

exitSign ='x' //indicates the indicator uptrend/downtrend ending

// diamond signals weakBullishSignal or weakBearishsignal

// flag signals neutralBullishSignal or neutralBearishSignal

// ****************************************Parabolic SAR code***************************************************************

start = 2

increment = 2

maximum = 2

sus = true

sds = true

disc = false

startCalc = start * .01

incrementCalc = increment * .01

maximumCalc = maximum * .10

sarUp = sar(startCalc, incrementCalc, maximumCalc)

sarDown = sar(startCalc, incrementCalc, maximumCalc)

colUp = spLines and close >= sarDown ? colorLime : na

colDown = spLines and close <= sarUp ? colorSell : na

//@fixme Does not display the correct values for up and down pSAR

plot(sp and sus and sarUp ? sarUp : na, title="↓ SAR", style=cross, linewidth=3,color=colUp)

plot(sp and sds and sarDown ? sarDown : na, title="↑ SAR", style=circles, linewidth=3,color=colDown)

startSAR = 0.02

incrementSAR = 0.02

maximumSAR = 0.2

psar = sar(startSAR, incrementSAR, maximumSAR)

bullishPSAR = psar < high and psar[1] > low

bearishPSAR= psar > low and psar[1] < high

//***********************Leledc Exhausion Bar***********************************************

maj_qual=6

maj_len=30

min_qual=5

min_len=5

lele(qual,len)=>

bindex=nz(bindex[1],0)

sindex=nz(sindex[1],0)

ret=0

if (close>close[4])

bindex:=bindex + 1

if(close<close[4])

sindex:=sindex + 1

if (bindex>qual) and (close<open) and high>=highest(high,len)

bindex:=0

ret:=-1

if ((sindex>qual) and (close>open) and (low<= lowest(low,len)))

sindex:=0

ret:=1

return=ret

major=lele(maj_qual,maj_len)

minor=lele(min_qual,min_len)

leledecMajorBullish = maj ? (major==1?low:na) : na

leledecMajorBearish = maj ? (major==-1?high:na) : na

//****************Ichimoku ************************************

donchian(len) => avg(lowest(len), highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement]

displacedSenkouB = senkouB[displacement]

bullishSignal = crossover(tenkan, kijun)

bearishSignal = crossunder(tenkan, kijun)

bullishSignalValues = iff(bullishSignal, tenkan, na)

bearishSignalValues = iff(bearishSignal, tenkan, na)

strongBullishSignal = crossover(tenkan, kijun) and bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB and low > tenkan and displacedSenkouA > displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB and high < tenkan and displacedSenkouA < displacedSenkouB

neutralBullishSignal = (bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB)

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

neutralBearishSignal = (bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB)

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

//*********************Kaufman AMA wave*********************//

src=close

lengthAMA=20

filterp = 10

d=abs(src-src[1])

s=abs(src-src[lengthAMA])

noise=sum(d, lengthAMA)

efratio=s/noise

fastsc=0.6022

slowsc=0.0645

smooth=pow(efratio*fastsc+slowsc, 2)

ama=nz(ama[1], close)+smooth*(src-nz(ama[1], close))

filter=filterp/100 * stdev(ama-nz(ama), lengthAMA)

amalow=ama < nz(ama[1]) ? ama : nz(amalow[1])

amahigh=ama > nz(ama[1]) ? ama : nz(amahigh[1])

bw=(ama-amalow) > filter ? 1 : (amahigh-ama > filter ? -1 : 0)

s_color=bw > 0 ? colorBuy : (bw < 0) ? colorSell : colorBlue

amaLongConditionEntry = s_color==colorBuy and s_color[1]!=colorBuy

amaShortConditionEntry = s_color==colorSell and s_color[1]!=colorSell

//***********************Rahul Mohindar Oscillator ******************************//

C=close

cm2(x) => sma(x,2)

ma1=cm2(C)

ma2=cm2(ma1)

ma3=cm2(ma2)

ma4=cm2(ma3)

ma5=cm2(ma4)

ma6=cm2(ma5)

ma7=cm2(ma6)

ma8=cm2(ma7)

ma9=cm2(ma8)

ma10=cm2(ma9)

SwingTrd1 = 100 * (close - (ma1+ma2+ma3+ma4+ma5+ma6+ma7+ma8+ma9+ma10)/10)/(highest(C,10)-lowest(C,10))

SwingTrd2=ema(SwingTrd1,30)

SwingTrd3=ema(SwingTrd2,30)

RMO= ema(SwingTrd1,81)

Buy=cross(SwingTrd2,SwingTrd3)

Sell=cross(SwingTrd3,SwingTrd2)

Bull_Trend=ema(SwingTrd1,81)>0

Bear_Trend=ema(SwingTrd1,81)<0

Ribbon_kol=Bull_Trend ? colorBuy : (Bear_Trend ? colorSell : colorBlue)

Impulse_UP= SwingTrd2 > 0

Impulse_Down= RMO < 0

bar_kol=Impulse_UP ? colorBuy : (Impulse_Down ? colorSell : (Bull_Trend ? colorBuy : colorBlue))

rahulMohindarOscilllatorLongEntry = Ribbon_kol==colorBuy and Ribbon_kol[1]!=colorBuy and Ribbon_kol[1]==colorSell and bar_kol==colorBuy

rahulMohindarOscilllatorShortEntry = Ribbon_kol==colorSell and Ribbon_kol[1]!=colorSell and Ribbon_kol[1]==colorBuy and bar_kol==colorSell

//***********************TD Sequential code ******************************//

transp=0

Numbers=false

SR=false

Barcolor=true

TD = close > close[4] ?nz(TD[1])+1:0

TS = close < close[4] ?nz(TS[1])+1:0

TDUp = TD - valuewhen(TD < TD[1], TD , 1 )

TDDn = TS - valuewhen(TS < TS[1], TS , 1 )

priceflip = barssince(close<close[4])

sellsetup = close>close[4] and priceflip

sell = sellsetup and barssince(priceflip!=9)

sellovershoot = sellsetup and barssince(priceflip!=13)

sellovershoot1 = sellsetup and barssince(priceflip!=14)

sellovershoot2 = sellsetup and barssince(priceflip!=15)

sellovershoot3 = sellsetup and barssince(priceflip!=16)

priceflip1 = barssince(close>close[4])

buysetup = close<close[4] and priceflip1

buy = buysetup and barssince(priceflip1!=9)

buyovershoot = barssince(priceflip1!=13) and buysetup

buyovershoot1 = barssince(priceflip1!=14) and buysetup

buyovershoot2 = barssince(priceflip1!=15) and buysetup

buyovershoot3 = barssince(priceflip1!=16) and buysetup

TDbuyh = valuewhen(buy,high,0)

TDbuyl = valuewhen(buy,low,0)

TDsellh = valuewhen(sell,high,0)

TDselll = valuewhen(sell,low,0)

//***********************Volume Flow Indicator [LazyBear] ******************************//

lengthVFI = 130

coefVFI = 0.2

vcoefVFI = 2.5

signalLength= 5

smoothVFI=true

ma(x,y) => smoothVFI ? sma(x,y) : x

typical=hlc3

inter = log( typical ) - log( typical[1] )

vinter = stdev(inter, 30 )

cutoff = coefVFI * vinter * close

vave = sma( volume, lengthVFI )[1]

vmax = vave * vcoefVFI

vc = iff(volume < vmax, volume, vmax)

mf = typical - typical[1]

vcp = iff( mf > cutoff, vc, iff ( mf < -cutoff, -vc, 0 ) )

vfi = ma(sum( vcp , lengthVFI )/vave, 3)

vfima=ema( vfi, signalLength )

dVFI=vfi-vfima

bullishVFI = vfi > 0 and vfi[1] <=0

bearishVFI = vfi < 0 and vfi[1] >=0

//***********************WaveTrend Oscillator [WT] ******************************//

n1 = 10

n2 = 21

obLevel1 = 60

obLevel2 = 53

osLevel1 = -60

osLevel2 = -53

ap = hlc3

esa = ema(ap, n1)

dWTI = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * dWTI)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

wtiSignal = wt1-wt2

bullishWTI = wt1 > osLevel1 and wt1[1] <= osLevel1 and wtiSignal > 0

bearishWTI = wt1 < obLevel1 and wt1[1] >= obLevel1 and wtiSignal < 0

// **************** Trend Magic code adapted from Glaz ********************* /

CCI = 20 // input(20)

ATR = 5 // input(5)

Multiplier=1 // input(1,title='ATR Multiplier')

original=true // input(true,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x=thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

swap=x>x[1]?1:x<x[1]?-1:swap[1]

swap2=swap==1?lime:red

swap3=thisCCI >=0 ?lime:red

swap4=original?swap3:swap2

bullTrendMagic = swap4 == lime and swap4[1] == red

bearTrendMagic = swap4 == red and swap4[1] == lime

// ************ Indicator: Custom COG channel by Lazy Bear **************** //

srcCOG = close

lengthCOG = 34

median=0

multCOG= 2.5 // input(2.5)

offset = 20 //input(20)

tr_custom() =>

x1=high-low

x2=abs(high-close[1])

x3=abs(low-close[1])

max(x1, max(x2,x3))

atr_custom(x,y) =>

sma(x,y)

dev = (multCOG * stdev(srcCOG, lengthCOG))

basis=linreg(srcCOG, lengthCOG, median)

ul = (basis + dev)

ll = (basis - dev)

tr_v = tr_custom()

acustom=(2*atr_custom(tr_v, lengthCOG))

uls=basis+acustom

lls=basis-acustom

// Plot STDEV channel

plot(basis, linewidth=1, color=navy, style=line, linewidth=1, title="Median : STDEV COG")

lb=plot(ul, color=red, linewidth=1, title="BB+ : COG", style=hline.style_dashed)

tb=plot(ll, color=green, linewidth=1, title="BB- : COG ", style=hline.style_dashed)

fill(tb,lb, silver, title="Region fill: STDEV COG", transp=cogRegionFillTransp)

// Plot ATR channel

plot(basis, linewidth=2, color=navy, style=line, linewidth=2, title="Median : ATR COG ")

ls=plot(uls, color=red, linewidth=1, title="Starc+ : ATR COG", style=circles, transp=cogRegionFillTransp)

ts=plot(lls, color=green, linewidth=1, title="Star- : ATR COG", style=circles, transp=cogRegionFillTransp)

fill(ts,tb, green, title="Region fill : ATR COG", transp=cogRegionFillTransp)

fill(ls,lb, red, title="Region fill : ATR COG", transp=cogRegionFillTransp)

// Mark SQZ

plot_offs_high=0.002

plot_offs_low=0.002

sqz_f=(uls>ul) and (lls<ll)

b_color=sqz_f ? colorBlack : na

plot(sqz_f ? lls - (lls * plot_offs_low) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

plot(sqz_f ? uls + (uls * plot_offs_high) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

// ****************************************All the plots and coloring of bars***************************************************************

// Trend Magic

plotchar(tm and bullTrendMagic, title="TM", char=upSign, location=location.belowbar, color=colorBuy, transp=0, text="TM", textcolor=colorBuy, size=size.auto)

plotchar(tm and bearTrendMagic, title="TM", char=downSign, location=location.abovebar, color=colorSell, transp=0, text="TM", textcolor=colorSell, size=size.auto)

// WaveTrend Oscillator

plotshape(wtoLB and bullishWTI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="WTI", location=location.belowbar, transp=0)

plotshape(wtoLB and bearishWTI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="WTI", location=location.abovebar, transp=0)

// VFI

plotshape(vfiLB and bullishVFI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="VFI", location=location.belowbar, transp=0)

plotshape(vfiLB and bearishVFI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="VFI", location=location.abovebar, transp=0)

// PSAR

plotshape(inputIndividualSiganlPlot and sp and bullishPSAR, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Sar", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sp and bearishPSAR, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Sar", location=location.abovebar, transp=0)

// Leledec

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBearish, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Leledec", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBullish, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Leledec", location=location.belowbar, transp=0)

plotshape(min ? (minor==1?low:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Leledec", color=colorLime)

plotshape(min ? (minor==-1?high:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Leleded", color=colorSell)

// Ichimoku

plot(tenkan, color=iff(sCloud, colorTenkanViolet, na), title="Tenkan", linewidth=2, transp=0)

plot(kijun, color=iff(sCloud, colorKijun, na), title="Kijun", linewidth=2, transp=0)

plot(close, offset = -displacement, color=iff(sCloud, colorLime, na), title="Chikou", linewidth=1)

p1 = plot(senkouA, offset=displacement, color=colorBuy, title="Senkou A", linewidth=3, transp=0)

p2 = plot(senkouB, offset=displacement, color=colorSell, title="Senkou B", linewidth=3, transp=0)

fill(p1, p2, color = senkouA > senkouB ? #1eb600 : colorSell)

plotshape(inputIndividualSiganlPlot and strongBearishSignal, color=colorSell, style=shape.labelup, textcolor=#000000, text="Ichimoku", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and strongBullishSignal, color=colorBuy, style=shape.labeldown, textcolor=#ffffff, text="Ichimoku", location=location.belowbar, transp=0)

plotshape(inputNeutralMinorSignals and neutralBullishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.belowbar, title="Neutral Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and weakBullishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and neutralBearishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.abovebar, title="Neutral Bearish Signals - Ichimoku", color=colorMaroon)

plotshape(inputNeutralMinorSignals and weakBearishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Ichimoku", color=colorMaroon)

// AMA

plotshape(inputIndividualSiganlPlot and inputAma and amaLongConditionEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="AMA", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and inputAma and amaShortConditionEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="AMA", location=location.abovebar, transp=0)

// RMO

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorLongEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="RMO", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorShortEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="RMO", location=location.abovebar, transp=0)

// TD

plot(sTD and SR?(TDbuyh ? TDbuyl: na):na,style=circles, linewidth=1, color=red)

plot(sTD and SR?(TDselll ? TDsellh : na):na,style=circles, linewidth=1, color=lime)

barColour = sell? tdSell : buy? tdBuy : sellovershoot? tdSellOvershoot : sellovershoot1? tdSellOvershoot1 : sellovershoot2?tdSellOverShoot2 : sellovershoot3? tdSellOverShoot3 : buyovershoot? tdBuyOverShoot : buyovershoot1? tdBuyOvershoot1 : buyovershoot2? tdBuyOverShoot2 : buyovershoot3? tdBuyOvershoot3 : na

barcolor(color=barColour, title ="TD Sequential Bar Colour")

// ****************************************BUY/SELL Signal ***************************************************************

bull = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

bear = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

if bull

persistent_bull := 1

persistent_bear := 0

if bear

persistent_bull := 0

persistent_bear := 1

plotshape(bull and persistent_bull[1] != 1, style=shape.labelup, location=location.belowbar, color=colorBuy, text="Buy", textcolor=#000000, transp=0)

plotshape(bear and persistent_bear[1] != 1, style=shape.labeldown, color=colorSell, text="Sell", location=location.abovebar, textcolor =#ffffff, transp=0)

// ****************************************Alerts***************************************************************

// For global buy/sell

alertcondition(bull and persistent_bull[1] != 1, title='Buy', message='Buy')

alertcondition(bear and persistent_bear[1] != 1, title='Sell', message='Sell')

// Strategy

longCondition = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

closeLongCondition = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

monthfrom =input(1)

monthuntil =input(12)

dayfrom=input(1)

dayuntil=input(31)

yearfrom=input(2017)

yearuntil=input(2020)

leverage=input(1)

if (longCondition )

strategy.entry("Long", strategy.long, leverage, comment="Enter Long")

else

strategy.close("Long", when=closeLongCondition)

//if (closeLongCondition and month>=monthfrom and month <=monthuntil and dayofmonth>=dayfrom and dayofmonth <= dayuntil and year <= yearuntil and year>=yearfrom)

// strategy.entry("Short", strategy.short, leverage, comment="Enter Short")

//else

// strategy.close("Short", when=longCondition)